Crypto Bear Market is Official – How to Proceed

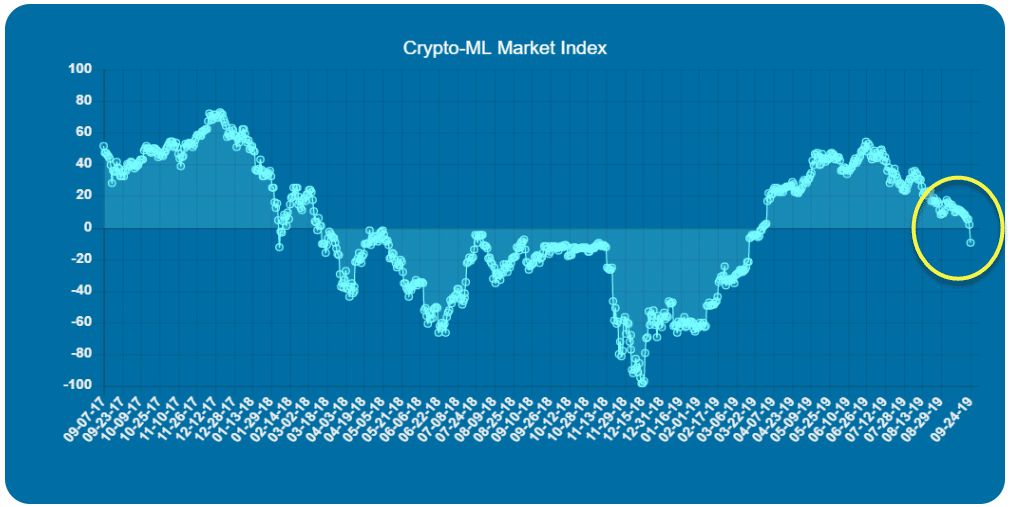

The Crypto-ML Fear and Greed Index indicates the Bitcoin and broader crypto markets are now officially in a bearish phase. On September 24, the Fear and Greed Index dropped convincingly past zero and into negative territory. This post will provide additional information on the current market conditions as well as guidance on how to handle your trades in this context.

Learn more about the Fear and Greed Index.

Forecasting the Bear Market

We like nothing more than exceptional bull markets. And we hope you do too. However, to be smart and protect our money, we need to constantly seek insights into when the tide may be turning.

Back on August 13, we posted Crypto Market Analysis – Bearish Indications, which highlighted bearish formations appearing in our signals. While we hadn’t crossed into bear territory yet, there were some early warning signs.

We followed this up with a post on August 29, with Strong Bearish Indicators for Crypto Market Continue, showing many of the trends were strengthening.

As of yesterday, we now have a hard break in the Fear and Greed Index through zero which confirms the bear market.

While it’s possible for this indicator to oscillate above and below zero, you can see the zero-line has historically held as a strong point of support and resistance.

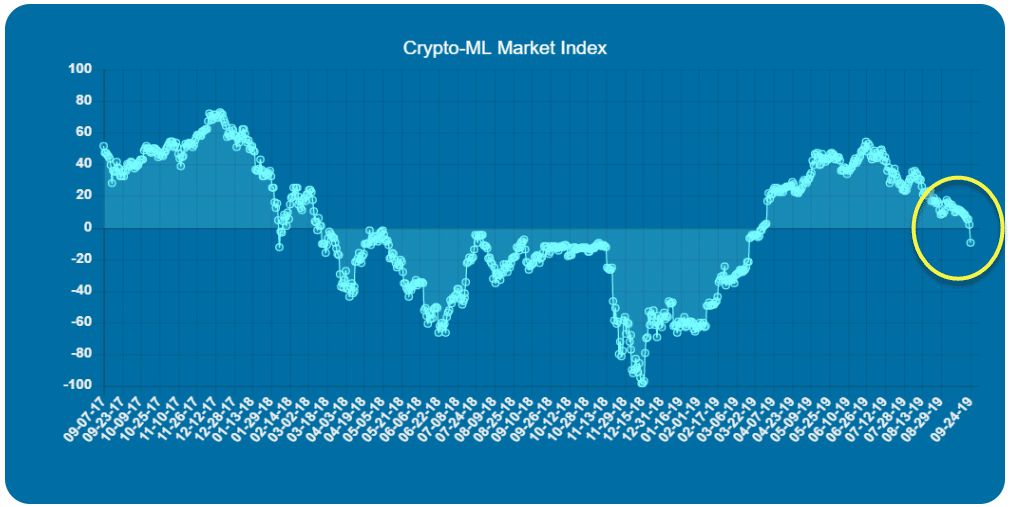

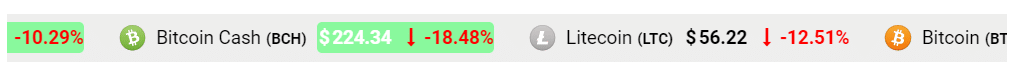

Here is a snapshot of the action (as of this writing) in case you’ve managed to miss it:

Back in March, Crypto-ML’s Fear and Greed Index called the bull market well in advance of most analysts, resulting in some excellent long trades:

- 2019 Bull Market Confirmed According to the Crypto-ML Fear and Greed Index

- Bull Market Review – How Machine Learning Predicted It Sooner

Here is a quick recap:

- Despite fairly horizontal price movement in the markets for 2019, the Fear and Greed Index began moving up sharply.

- The Fear and Greed Index indicated we entered bull territory on March 29.

- On April 2, most cryptocurrencies saw huge 20-50%+ rallies in just two days.

This means we are likely going to see the reverse of this now that the Fear and Greed Index has crossed into negative territory. The Fear and Greed Index has continued to be a very effective tool, so we feel it is highly important to consider this in your day-to-day trading.

Additional Bearish Machine Learning Factors

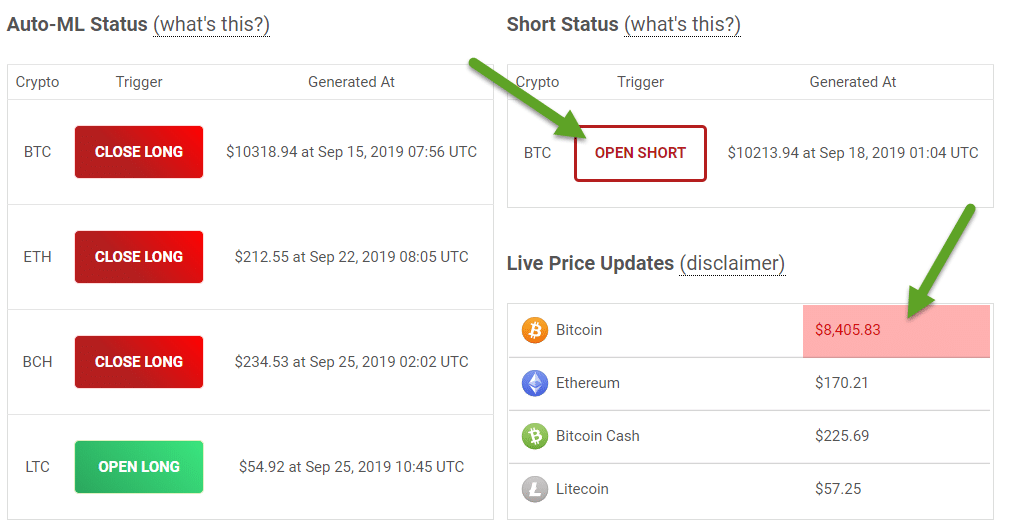

In addition to the Fear and Greed Index, we are seeing a convergence of the Trade Signals as shown here:

Interestingly, LTC seems to have opened a counter trade in anticipation of a bounce.

Adjusting Your Strategy

The consistent message we put forth is you should swim with the current. This means taking long trades during bull markets and short trades during bear markets. The reason for this is you will, mathematically, have probability on your side.

As a trader, we recommend discontinuing taking long trades or reducing your exposure to long trades. You can also explore short-selling cryptocurrency as described in our post How to Short Sell Bitcoin.

As an investor, a bear market represents a different opportunity. If you believe that cryptocurrency adoption will expand in the future, then we may be nearing a great time to accumulate more in your portfolio. While this may be a treacherous phase for short-term traders, it may be a desirable dip on the long-term charts. We would recommend allowing the Fear and Greed Index to drop further before accumulating, but the time is likely approaching.

Machine Learning Trades in Bear Markets

Currently, our platform segments short and long trades with our 3.5 machine learning models. These models largely follow trends in a “momentum trading” style. Though it should be noted that our LTC model seems to be counter trading recently.

That said, we have a very exciting approach in the works, which will culminate it the 4.0 release of our models.

This new approach incorporates anomaly detection, which has an exceptional ability to predict price reversals. On top of this, our models will become aware of the Fear and Greed Index itself. The Trade Alert models and the Fear and Greed Index models will have open communication and be able to influence one another.

With 4.0, you should see more trading opportunities in a variety of market conditions–including bear markets. These new models will be more adaptable and will continue to reduce the need for human consideration.

More to come!

Questions and Comments

As always, we want to hear your thoughts and questions. Our machine learning tools provide powerful insights, but it’s important to dissect their data and discuss openly to truly understand what they’re telling us. As a result, we should all be better traders. If you have anything to discuss, please hit us up on our Community Forums.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.