2021 Roadmap and 2020 Performance Report

Crypto-ML publishes annual performance reports to provide insight into research and development, share strategic direction, and maintain transparency and accountability. In this report, you will find:

- Goals for 2021.

- Feature and development roadmap for 2021.

- An analysis of the markets both in 2020 and ahead for 2021.

- Details on Crypto-ML’s 2020 crypto trading performance.

- A review of how Crypto-ML evolved over 2020.

Goals for 2021

Machine learning for crypto trading is still a leading-edge technology that is evolving. While it is not–and may never be–a “silver bullet” solution, it continues to show exceptional promise and the ability to outperform traditional trading approaches. This is especially true of its ability to adapt and pivot, which is the power we’re seeking to harness fully in 2021.

With that in mind, Crypto-ML has two simple goals for 2021:

Return

100%+

Win Rate

85%+

We want to provide optimal value to you, our customer. We will do so by delivering a consistent stream of winning trades.

Note on figures: Crypto-ML began publicly issuing BTC trades to customers on February 7, 2018. As such, BTC trade and benchmark data presented below covers February 7, 2018 through December 31, 2020. Measurements for the S&P500 benchmark also begin on this February 7, 2018 date. The first Crypto-ML ETH trade was issued on April 11, 2018, which is the beginning of its reporting period. These dates are referred to as “Reporting Period.”

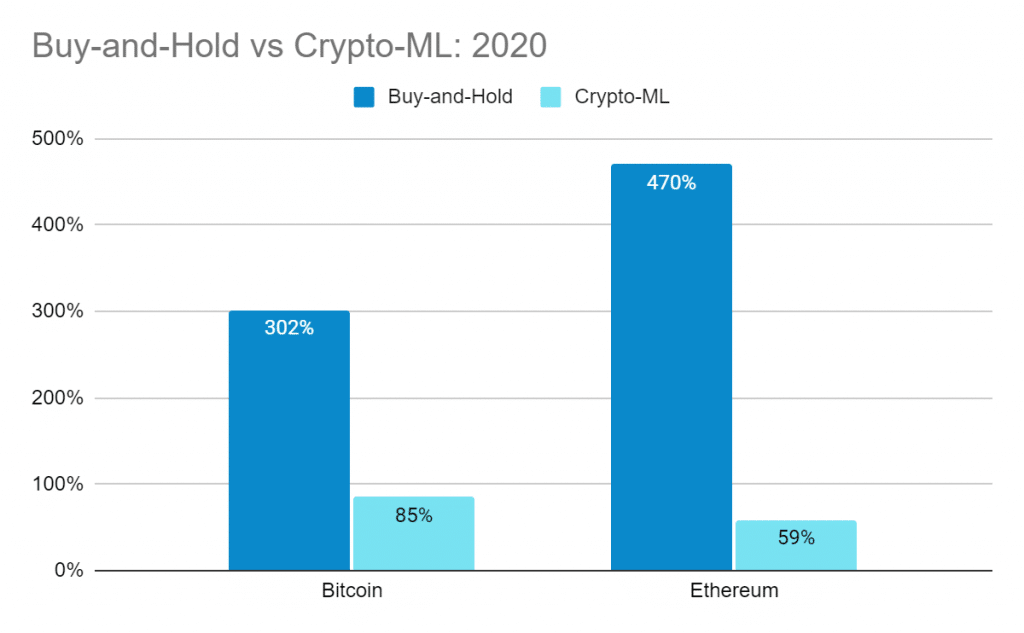

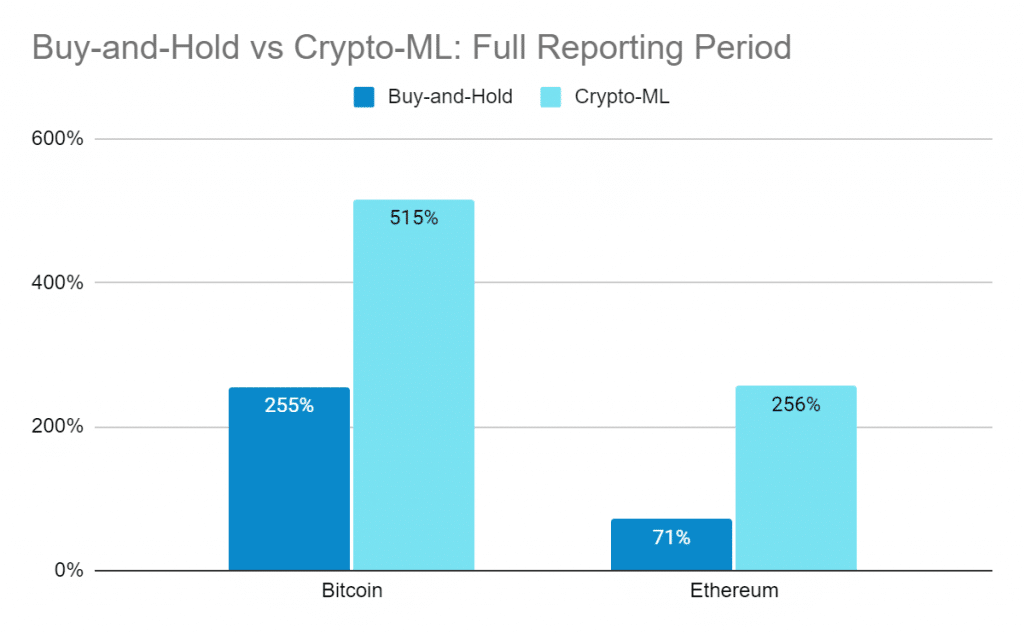

Value of Trading vs Holding

One of the largest reflections of 2020 comes in evaluating different approaches to addressing the crypto markets. Before diving into the data below, this summary will help set the context.

Both long-term holding and active trading have a place in your portfolio. But with trading, it’s never too late to hop into the markets.

“Holding” is a standard benchmark. It assumes you get in the asset at the start of a comparison period and that you exit at the end of that period. This makes it highly contextual.

Holding comes with a few challenges. When you hold an asset, you hope:

- You get in at a good time.

- The asset will continue going up.

- That you can get out at a good time.

During strong bull markets, holding will almost always outperform trading. But are you able to get in at the start of the rally? And are you also able to get out at the peak?

These practical questions lead many people to trading, which has a few key advantages:

- It’s never too late. It shouldn’t matter what the price of Bitcoin (or other crypto) is. You should be able to effectively trade Bitcoin $20,000 and Bitcoin $2,000.

- Market conditions are less important. It shouldn’t matter if crypto is in a bull market, bear market, or sideways market. As evidenced below, trading can be effective in many different conditions.

- Your funds are compounded. One of the key advantages of trading is your results are compounded with each trade. With the right system, your average trade size naturally grows over time, thereby more rapidly delivering results.

On the downside, trading comes with:

- Its own set of risks

- Different tax implications

- Trading and technology fees

These all need to be well understood and closely managed. Learn more about optimizing your fees.

Due to the pros and cons of each approach, it may be suitable for most investors to have a portion of their cryptocurrency in a trading account and another portion in a long-term holding account.

With all of this in mind, the following information will show you how both options have played out in the short and long term.

The 2020 Crypto Markets

While the cryptocurrency space is notorious for incredible bull and bear runs, 2020 still stands as an exceptional time.

Broader interest in Bitcoin helped propel an exceptional, yet more stable bull run that has continued beyond 2020.

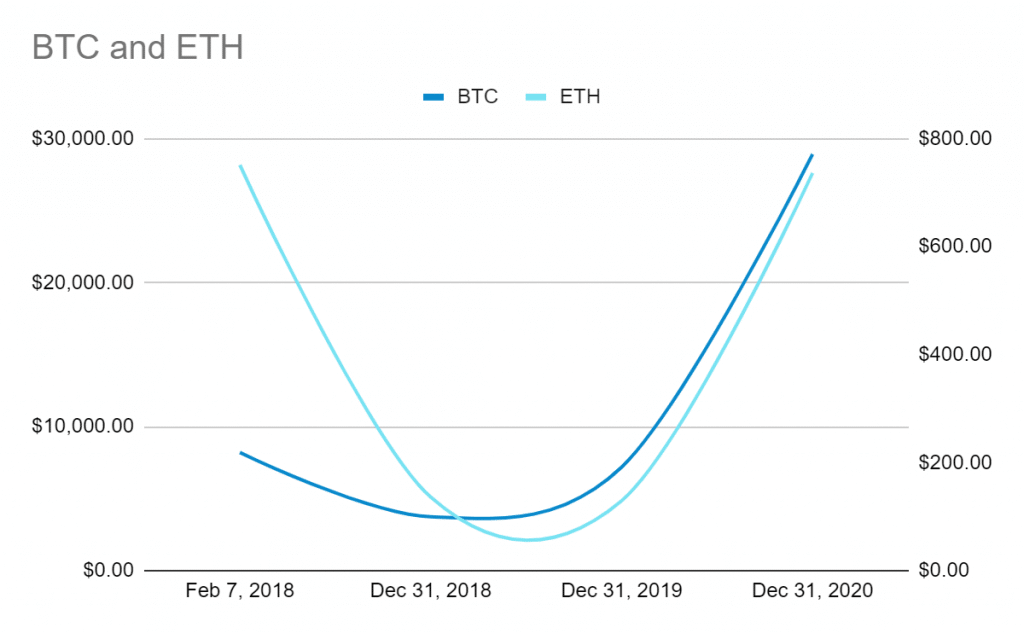

Bitcoin

Bitcoin began the year at $7,195, hit a low of $3,782, then closed out at $28,934.

That’s a 47% drop followed by a 665% run.

Ethereum

Ethereum performed similarly, but returned to highs of previous years rather than surpassing them.

Ethereum began 2020 at $129, hit a low of $86, then closed out at $736.

That’s a 33% drop followed by a 756% run.

Rally Factors

While it’s difficult to say exactly what caused the strong bull market at the end of 2020, a few factors likely contributed:

Institutional interest. Customers of large investment firms are demanding a percentage of their assets be exposed to cryptocurrency. The list includes JP Morgan, Mass Mutual, Goldman Sachs, and more (notes). As this bucket grows, a larger, more stable demand may help permanently drive higher cryptocurrency valuation.

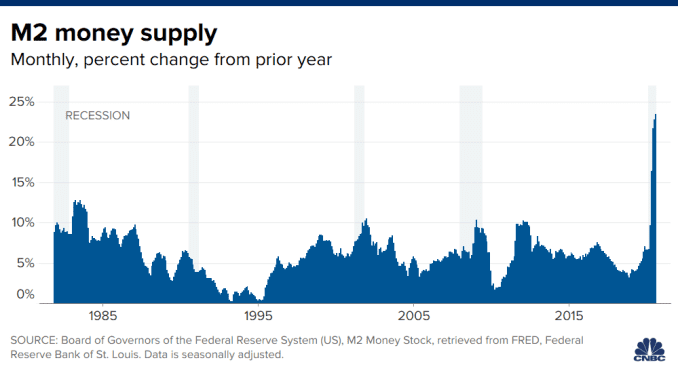

Devalued Dollar. Most people measure cryptocurrency against the US Dollar. For Bitcoin price to rise, either the demand for Bitcoin can go up or the supply of the US Dollar can go up. In response the COVID-19, the United States Government increased money supply by 23% year-over-year, which is a record increase.

Broader use cases. Crypto gained interest with numerous large companies, including PayPal (CNBC). Blockchain continues to gain traction (Forbes) with enterprise IT organizations. As well, decentralized finance (DeFi) matured considerably (see DeFi: The Hot New Crypto Trend of 2020 – Forbes).

Retail interest. As markets begin rising, retail investors fear missing out, helping cascade demand.

Crypto-ML’s 2020 Trade Performance

Crypto-ML delivered trade alerts as detailed in our Trade History with the summarized results following.

Crypto-ML’s performance over the years and across multiple market types shows the value of compounding your results via trading.

| Trading Pair Model | 2020 Performance | Overall Performance (through Dec 31, 2020) | Notes |

| BTC-USD | +85% | +515% | |

| ETH-USD | +59% | +256% | |

| USD-BTC | +10% | +10% | Started July 3, 2020 |

| USD-ETH | +5% | +5% | Started October 28, 2020 |

Despite the incredibly strong year for base cryptocurrency, the consistency of Crypto-ML has allowed it to continue to outperform benchmarks:

For Crypto-ML in 2020, the star performer was a new approach to interpreting the neural network’s predictions. This strategy is called Manipulation Detection (more info below).

This system was only live for the final two weeks of 2020, but was critical in accepting the rally and finishing the year off strongly.

| ML (Traditional) | Manipulation | |

| Days Live in 2020 | 349 | 16 |

| Trades | 80 | 10 |

| Win Rate | 63% | 70% |

| Return | 51% | 23% |

As another view, here is the performance for 2020:

While this view shows the results of consistency and compounding over time:

Crypto-ML’s Roadmap for 2021

Our core development focus will be on bringing multiple, intelligently selected AI crypto trading strategies to our customers. This will be paired with enhanced controls and dashboards.

Our top priority is always to drive improvement to our core, AI-driven trading system.

Multiple Strategies

Based on the strong markets in 2020, it became clear Crypto-ML needs multiple strategies to fully thrive in all market conditions.

As a result, the biggest difference Crypto-ML customers will see in 2021 is trading strategies will be intelligently selected throughout the year. This is how we plan to achieve our goals of 100%+ returns and an 85%+ win ratio.

Specifically, extreme market conditions, such as the bull run at the end of 2020 and start of 2021, push outside the boundaries of past patterns. If you interpret machine learning output in a traditional manner, your results will falter. But if you see these outliers as signs of market manipulation, you are able to capture exceptional moments.

If fact, in mid-December 2020, this first new strategy (Manipulation Detection) kicked in to capture much of the rally that carried into the start of 2021.

Additionally, our upcoming trading system (codename Matic), is expected to deliver next-level results and trade reliability. This system digests a very broad array of indicators, rapidly processes them, and then delivers extremely high-probability trades.

Matic leverages deep learning and ML-optimization to construct novel algorithms. Unlike our other two strategies, it doesn’t rely on a real-time neural network pipeline. This increases its response to market changes and drastically minimizes slippage.

Read more about our Trade Strategies and look for more information to be published as these strategies and others are released.

Portfolio Allocation

Crypto-ML currently utilizes Binance Subaccounts and Coinbase Pro Portfolios to enable trading of multiple pairs.

Going forward, we seek to expand this vision to a percentage allocation system. This will allow you to easily select and weight the strategies and pairs that best match your personal approach.

You will be able to weight between different strategies (including holding a portion of your funds) and different crypto.

User Experience

Coupled with the above changes, you will see an improved dashboard and command center solution so that you can interact with and control Crypto-ML better than ever before.

Expanded Crypto Support

Crypto-ML has always focused on “doing a few things well” instead of “being mediocre at a lot of things.” However, one of our most common requests is to expand our cryptocurrency support.

Assuming each of the above pieces are delivered effectively, it will be possible to enable a select few additional cryptocurrencies.

This reduces your risk by helping expose your portfolio to a broader set of crypto classes.

Crypto Market Outlook for 2021

After the bull run of 2017, the markets crashed and then slumped, finally returning to those highs 3 years later.

While the market will likely experience several corrections, we anticipate a continued long-term value increase.

The 2020 rally holds some resemblance to the 2017 rally, there now appears to be much more stable interest in Bitcoin. This comes in terms of investment banks, corporate adoption, inflation, interest rates, and more mature adoption.

We will likely face a correction at some point, but it may be less severe, both in terms of size and duration, that after previous rallies.

Regardless of direction, we’ll be taking guidance from machine learning to navigate the markets.

For additional reading:

- The 2021 Outlook for Bitcoin Prices, Adoption, and Risks (Yahoo Finance)

- Goldman Sachs Explores Entering Crypto Markets (Bloomberg)

- Have I Already Missed My Time to Buy Bitcoin? (Nasdaq)

- As Bitcoin Smashes Through $40,000, Data Reveals What’s Behind The Huge 2021 Bitcoin Price Boom (Forbes)

Crypto-ML Development in 2020

During 2020, we primarily saw advancements in our core logic and machine learning capabilities.

Release 7 of Machine Learning Models

This release is perhaps the largest achievement yet for Crypto-ML. It is a novel approach that recognizes the limitations of machine learning and exploits those limitations.

It’s results have been incredible. It has been able to navigate the rally and propel us into 2021.

Unfortunately, this system was rolled out on December 18. Had it been rolled out earlier in the year, our overall results may have looked much different.

Read more: https://crypto-ml.com/blog/release-7-of-crypto-mls-machine-learning-trading-system/

Base Crypto Pairs

Traditionally, our trading pairs and models have been centered around the use case of using crypto to maximize your US Dollar (or other fiat) holdings.

However, many of our customers have been seeking a different strategy: they want to increase their crypto holdings over the long run. While this may sound similar on the surface, it requires a separate strategy.

Instead of measuring success against buy-and-hold, you measure against hold one crypto.

For example, you could buy 1 Bitcoin and hold it. But what if you traded into USD occasionally to increase your holdings to 1.2 BTC. Or even 5 BTC over time. That’s what these models seek to do.

Performance is as follows:

| Buy-and-Hold | Crypto-ML | |

| Bitcoin | 1 BTC | 1.10 BTC |

| Ethereum | 1 ETH | 1.05 ETH |

Release 6 of Models: Faster Reactions and More Data

Release 6 was an overhaul of Crypto-ML’s backend approach, allowing for a much higher throughput of data and machine learning processing.

This laid the necessary foundation for Release 7.

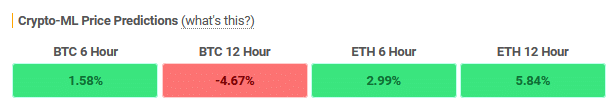

It also enabled us to display both 6-Hour and 12-Hour predictions on the Member Dashboard.

Risk Management Suite

2020 stress testing trading systems with numerous flash crashes.

To best protect profits, Crypto-ML enabled a variety of mechanisms that can be turned on and off as market conditions dictate.

- Real-time monitoring (outside of the machine learning workflow)

- Dynamic trailing stops

- Dynamic profit targets

- Crash protection

Telegram Group

To better enable real-time communication, we migrated most of our discussion from the Community Forums out to our Telegram Group. If you’re not part of the discussion yet, come join us!

Conclusion

2020 was an exceptional year for many reasons, and crypto was certainly one of them. Here’s to another great year ahead for both the crypto markets and Crypto-ML customers.

Want to discuss cryptocurrency and trading with our community? Let us know in the comment below, discuss on our Community Forums, or join us on Telegram.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

2 thoughts on “2021 Roadmap and 2020 Performance Report”

Leave a Comment

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.

Excellent report and job this year, keep going !

Thank you!