Crypto Market Analysis + A Look at Uniswap: Dec 23, 2021

Despite many predictions of Bitcoin hitting $100,000 by yearend, it looks like we’re going to have to wait. This, however, is great news in disguise.

Bitcoin and the majority of the crypto markets have dropped around 28% since early November. Whenever something like this happens, it’s good to look at the big picture.

In this analysis post, we’ll take a look at the current crypto market state and also consider Uniswap as a long-term investment opportunity.

The broad-market picture

Is there a structural problem with crypto or is something else going on?

- Commodities, such as oil, also mostly saw double-digit drops.

- Stocks and indexes dropped significantly across US, Europe, and Asia.

As it turns out, this drop is not specific to cryptocurrency.

What this typically means is market participants are reevaluating risk. When this happens, it gives you an opportunity to buy long-term assets at low prices.

Here you see pretty extreme drops in the Dow and German Index. These have since rebounded better than cryptocurrency, but their uptrend was certainly disrupted.

The cryptocurrency markets tend to have more extreme reactions, as highly-leveraged positions, many speculators, and less-regulated markets combine to amplify sharp price changes.

Different market participants have different goals

An important principle to keep in mind during times like this is that other market participants likely have different goals and objectives than you.

Some examples:

- If you are relatively young, you may be okay holding an investment for the next 30 years. You may also be okay putting a portion of your funds in high-risk assets. You will be more likely to move to buy during times of uncertainty.

- If you are closer to retirement age, you have lower risk tolerance and a lower investment horizon. If you are a year away from retirement, you cannot weather a large drawdown. You will be more likely to move to sell during times of uncertainty.

- Institutional investors are much larger participants that also have a wide variety of goals, timelines, and objectives. Some funds may sustain a pension plan. Others may target aggressive growth but have a 5-year time horizon.

On top of this, participants have purchased at all sorts of price points. It is a mistake to assume the actions of someone who bought Bitcoin at $63,000 will be the same as a company that bought Bitcoin at $1,200.

In other words, just because many participants are selling doesn’t mean you need to sell.

In fact, if nothing has changed in your investment plan when others are selling, you have an incredible buying opportunity.

So what caused the market drop?

A few recent events have forced market participants to reevaluate their risk and, in some cases, seek assets that have lower risk profiles. When they exit the market, others can panic causing drops can cascade.

Here are some of the news items that likely caused concern:

1. Omicron

Yes, another COVID scare. The March 2020 COVID scare gave us an unbelievable buying opportunity. Omicron isn’t causing the same level of panic, but it does raise economic impact concerns. Being highly contagious, we could see impacts across productivity and consumer purchasing. For example, we’ve seen lockdowns hit Europe (Fortune) and many events across the globe be canceled. This impacts businesses and slows down the economy as a whole.

2. US Fed Interest Rate Hikes

After Omicron, the Fed announced its plans for three interest rate hikes in 2022. While ultimately good for a healthy economy, this will make money more expensive and will slow growth. This causes many participants to reduce exposure to higher-risk assets.

3. Triple Witching, Year-End, and More

We also had Triple Witching (The Street) on December 17. This means stocks options, index options, and index futures all expire on the same day, which causes a tremendous amount of money movement and volatility. This came at year-end, so funds use also it as an opportunity to close positions and lock in performance figures.

As another year-end event, many individuals, funds, and companies may also seek to close positions for tax reasons.

There are many more news items to toss into the hat. Regardless, the message is the same: money is shifting for reasons that seem to have very little to do with the fundamentals of cryptocurrency.

When news and events hit, money shifts around. Buyers with certain objectives exit. As price drops, eventually, other buyers enter. This is what causes markets to cycle.

What does this all mean for Bitcoin?

Probably not much. That markets are just going through natural cycles.

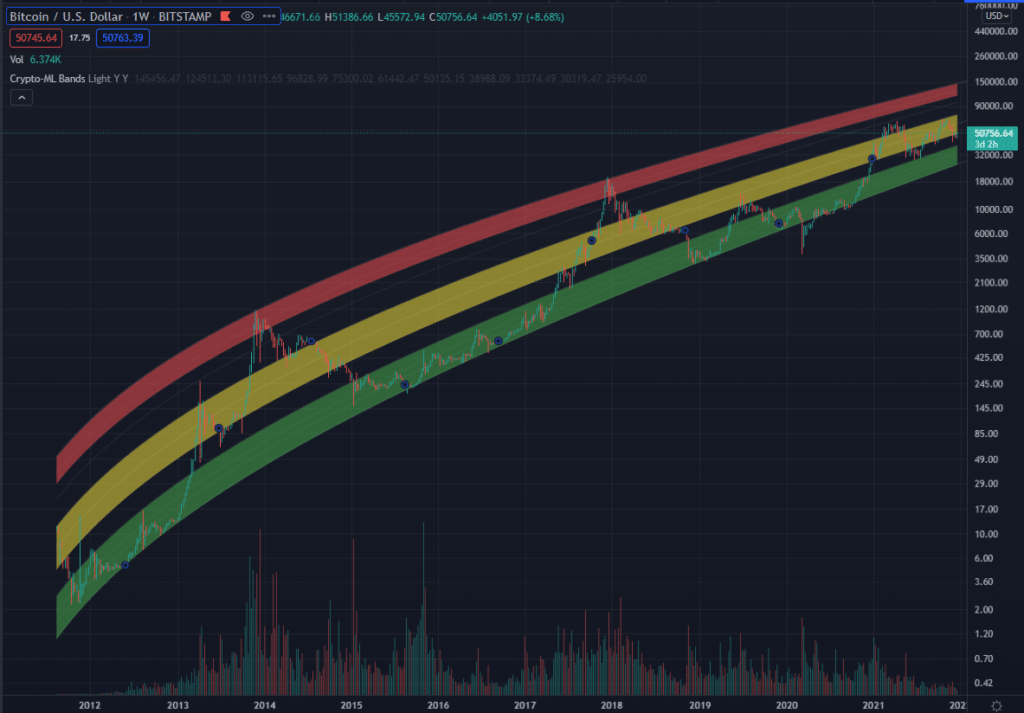

In fact, if you zoom out, Bitcoin seems to still be coasting along within its neutral channel. We are not at an extreme price point for Bitcoin. This means we could see bullish or bearish movement, but the bias is toward the upside.

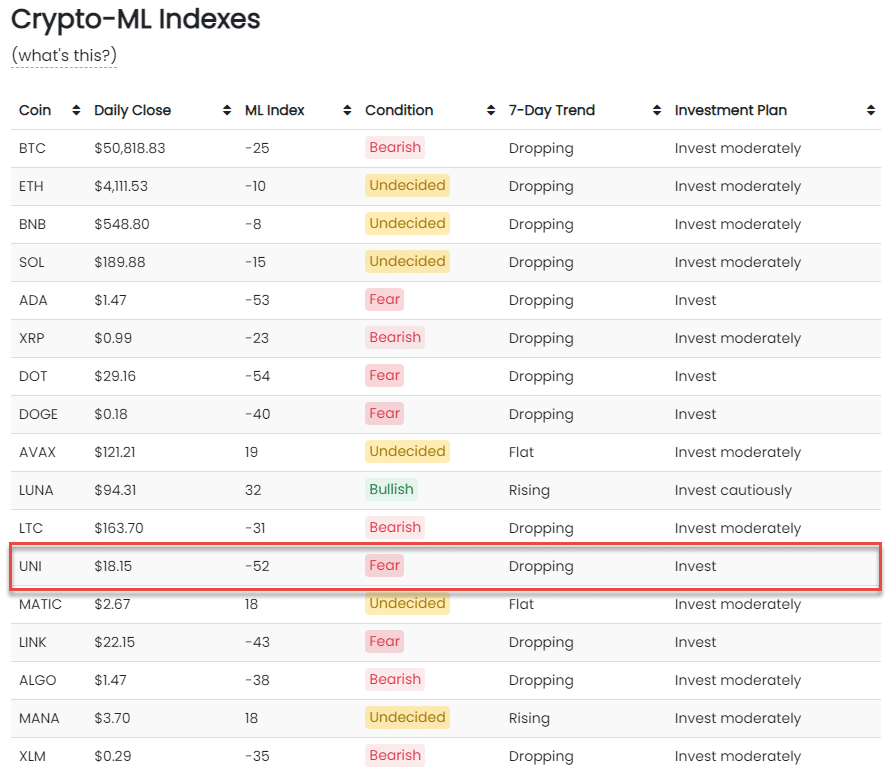

At -25, the Fear and Greed Index paints a similar picture. Bitcoin price is low, but not extremely low. We are not in Extreme Fear.

What cryptocurrencies are good investments right now?

Thanks to today’s rally, we don’t see anything in Extreme Fear, however, we do have several still in Fear, including:

- ADA

- DOT

- DOGE

- UNI

- LINK

If you’re looking for a long-term investment, evaluate the coins in negative conditions and see if any seem like a bargain.

Uniswap UNI as a long-term investment

Out of these, Uniswap’s UNI seems like a great long-term investment at this point. If you don’t know, Uniswap is an open-source, decentralized exchange built on Ethereum.

“The Uniswap Protocol is an open-source protocol for providing liquidity and trading ERC20 tokens on Ethereum. It eliminates trusted intermediaries and unnecessary forms of rent extraction, allowing for safe, accessible, and efficient exchange activity. The protocol is non-upgradable and designed to be censorship resistant.”

It allows you to:

- Swap crypto tokens

- Earn rewards by providing liquidity

The biggest problem with Uniswap is its fees. To swap tokens, you pay Ethereum Gas fees, which have grown significantly. The market has responded negatively to Uniswap as a result. It will never scale to the masses unless fees lower.

However, there are plenty of roadmap items to reduce these fees in the long term, meaning Uniswap will become more attractive in the future. It already has great technology, a great interface, and a great community. As fees lower, the user base should grow.

Uniswap also just went live on Polygon yesterday. This brings an entirely new DeFi ecosystem that also comes with lower transaction fees.

To learn more about Uniswap and to see if it’s a good investment for you:

- Try the app: https://app.uniswap.org/#/swap

- Earn by providing liquidity: https://app.uniswap.org/#/pool

- Read about the project: https://uniswap.org/

If you’re not quite ready to optimize your holdings via DeFi, you can earn interest on UNI at either BlockFi or Celcius as discussed in our Simple Ways to Earn Interest On Crypto Holdings post.

Conclusion

We are in the midst of the market cycling. It’s not clear if crypto will move up or down from here, but the bias is toward the positive. When money shuffles around, market inefficiencies happen. Take advantage of this by looking for coins with great long-term potential that may currently be a bargain.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.