Crypto Trading Crash Protection

Crypto-ML has released a “Crash Protection” feature that is designed to minimize losses during flash cryptocurrency market crashes. This feature can be configured on the Auto Trade Exchange Setup page.

Why Crash Protection is Needed in Crypto

In traditional finance, exchanges have a variety of controls to minimize the impact of sharp movements. These controls are referred to as Circuit Breakers and Trading Curbs. In addition to hard controls, numerous other factors help minimize extreme movements in traditional finance.

But the crypto world generally has fewer controls, less regulation, and less consistency across exchanges. Coupled with it being possible for a few players to dramatically move the markets, we tend to see crypto prices swing very rapidly. This can result in massive losses for many retail investors.

The 40% single-day Bitcoin drop from March of 2020:

In a crash situation, there simply aren’t enough buyers to meet the selling demand. That means if you have a stop loss or exit planned, you almost certainly won’t find a buyer at the price you want. Rather, your orders will be partially filled all the way down the drop.

Even if you have a stop loss sitting on the exchange, you are not guaranteed an exit at the price you want or at all.

This situation can catch bot-trading systems and individuals particularly off guard as any latency (reaction time) results in greater loss.

No solution can entirely protect open trades from crashes, but Crypto-ML now has a solution available that will help mitigate impact in such situations.

How Crash Protection Works

If you turn Crash Protection on, then an additional set of actions occur any time Crypto-ML opens a trade:

- A trigger point is set on the exchange at the current Stop Loss point established by Crypto-ML.

- A limit point is set on the exchange 1% below the trigger point.

In the background, Crypto-ML is constantly working to assess trade exits. If it decides to stop out of a trade, then it will issue a SELL order.

However, sometimes the market can drop suddenly before Crypto-ML or other systems can react. If price drops to the trigger point and Crypto-ML has not yet sold, the exchange will attempt to close your open trade for any value above the limit point.

In this case, one of three scenarios will occur:

- The exchange closes your entire position above the limit point.

- The exchange closes a portion of your position above the limit point. Any remaining quantity will be handled by Crypto-ML’s logic and likely sold as a market order.

- The exchange cannot sell any of your position above the limit point. Your entire position will be handled by Crypto-ML’s logic and likely sold as a market order.

This results in improved handling during crashes because the orders sit on the exchange. The orders do not need to wait for Crypto-ML’s machine learning processing pipeline to assess the market and react. During flash crashes, milliseconds matter.

That said, order slippage will inevitably occur during crashes. But this construct will minimize the impact on your trading positions as much as possible.

Monitoring Crash Protection

When Crypto-ML opens a trade, you will now see open orders on your Auto Trade Dashboard under your Current Portfolio.

When Crypto-ML closes a trade, it will clean up any orders associated with that trade. So you will not need to perform any additional actions.

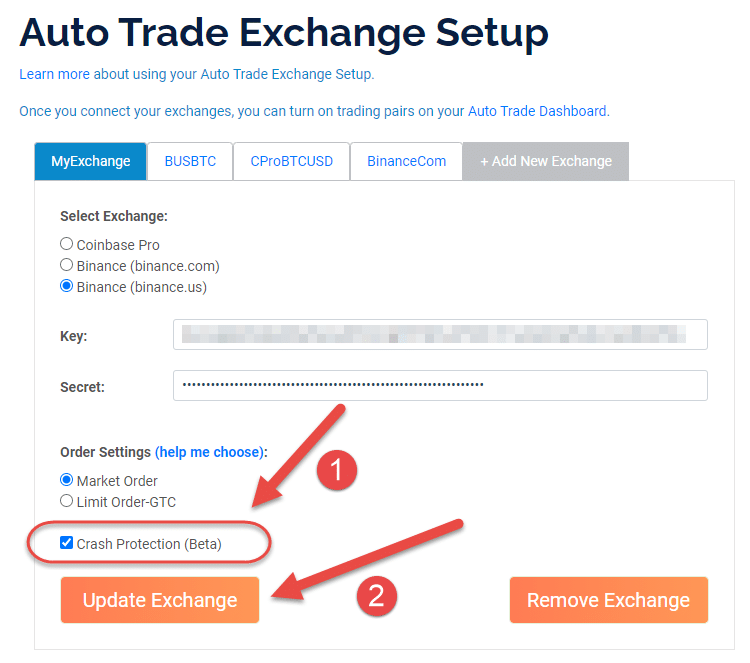

How to Configure Crash Protection

Crash protection can be turned on and off from the Auto Trade Exchange Setup page.

Note, this is only available for Market Orders.

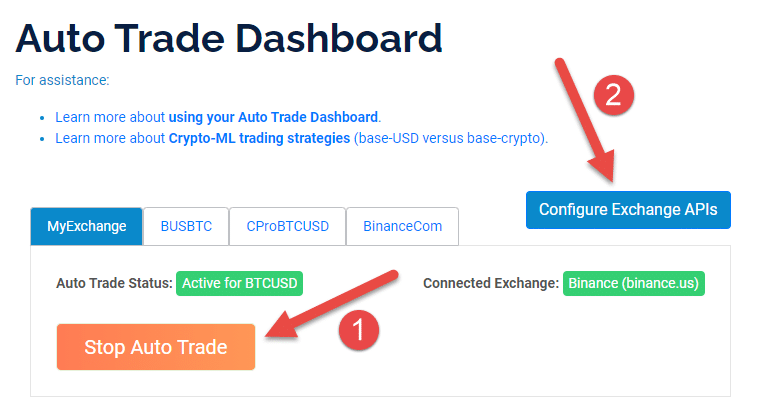

If you already have Auto Trade turned on, you will need to pause Auto Trade before making this change. To do so:

- Go to your Auto Trade Dashboard

- Click Stop Auto Trade

- Click Configure Exchange APIs

- Check Crash Protection

- Hit Update Exchange

- Go back to your Auto Trade Dashboard and Start Auto Trade again

Questions or Comments?

Let us know in the comment below, discuss on our Community Forums, or join us on Telegram.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.