CML-T Trading Strategy

This post will introduce you to Crypto-ML’s CML-T crypto trading strategy, which applies big data and deep learning to technical analysis factors.

Crypto-ML Trade Strategies

With Auto Trade, you can select from multiple trading strategies. Here, we’ll focus on CML-T but you can also learn more about Crypto-ML Trading Strategies.

Strategy summary:

| Strategy | Description |

|---|---|

| Hold | Keeps a designated percentage of your portfolio held in cryptocurrency. |

| CML-A | Anomaly Detection: Measures the predictions from our neural networks to find anomalies in the market that indicate market manipulation that should be followed. Learn more. |

| CML-I | Investment: This strategy utilizes the CML-A machine learning foundation, but targets longer-term positions rather than swing trades. |

| CML-T | Technical: Applies deep learning to technical analysis data in order to generate a high-probability rules-based system. |

| CML-X | Experimental: Leading-edge strategies still in the research-and-development phase. Learn more. |

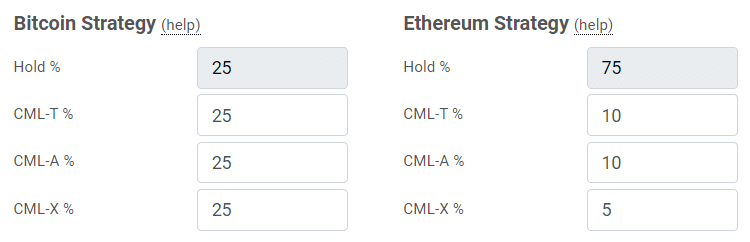

Choosing your strategies from your Auto Trade Dashboard:

CML-T Overview

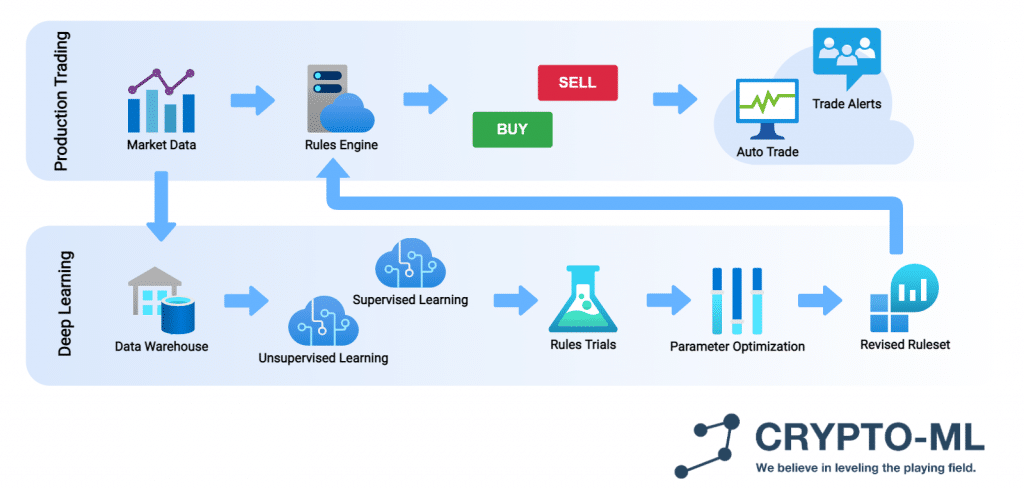

CML-T can best be described as an adaptive rules-based engine for trading. It takes inputs from technical analysis indicators, evaluates them, then issues a BUY or SELL signal.

What makes CML-T unique is how the rules are determined.

Whereas our other two strategies are dependent on Neural Network price change predictions, CML-T applies machine learning in an entirely different manner.

Note: CML-T is an enhanced version of our legacy “Matic” model, which you may find references to.

Deep Learning to Develop Crypto Trading Rules

Crypto-ML feeds large quantities of technical data into deep learning algorithms that find patterns in the data. These data sets are typically around 500 GB in size. Each given set consists of technical indicators deconstructed down to their individual components.

This is a huge amount of information that is ideal for a machine to analyze.

As humans, we can now ask questions such as:

- What does the market look like before upswings?

- What does the market look like before price drops?

Based on the findings, rules can be put in place to open and close trades as those patterns emerge in the market.

Once the core rules are determined, Crypto-ML applies machine learning optimization algorithms to tune parameters and maximize the potential outcome.

CML-T Workflow

Important Benefits

This approach to trading is exciting for three reasons:

- Unlike with our neural networks, we (humans) can understand the exact criteria used to make trade decisions. There is no layer of abstraction.

- Nearly all findings from deep learning are unorthodox. Machines don’t rely on textbooks and videos to learn technical analysis. Instead, they learn from the data itself. As a result, they use indicators differently than you typically expect.

- The processing is extremely fast. This reduces trade slippage when compared to methods that rely on a prediction pipeline.

Rule Sample

Since CML-T is computerized, it will consider hundreds of variables before determining whether or not to open a trade. Let’s look at one such rule derived from Relative Strength Index (RSI).

Human traders may learn to consider opening a trade when RSI is below 30. This indicates an oversold condition.

CML-T, on the other hand, gets to learn RSI from the ground-up. Our system will completely deconstruct RSI. During the learning phase, we may find that bullish conditions usually happen when the RS line is between 45 and 50 while also dropping by 5% per bar. It may also determine this matters on 4-hour bars, but not on 1-minute bars.

Taking this a step further, it might find this is only true when certain unorthodox conditions exist with other deconstructed indicators.

As you can see, this level of detail and intricacy would otherwise overwhelm human analysts.

Trade Expectations

CML-T seeks to capture quick moves in the market, therefore trades will typically be opened and closed within hours. However, some trades may be open for several days.

As with our other systems, the machines have determined it is best to capture profit quickly. There are two reasons for this:

- The longer a trade is open, the greater the chance of something going wrong.

- By rolling trade gains into the next trade, you can compound your results.

Another expectation to set is you may experience drawdowns in trades. If conditions are still bullish (despite the drawdown), CML-T will consider the drop as a temporary move. By doing so, it can avoid being whipsawed out.

CML-T Strengths

As a trader, you will see three key benefits from CML-T:

1. CML-T seeks to issue very high probability trades. Its goal is to rapidly compound your trading funds.

2. As noted, since CML-T doesn’t rely on neural networks for buy and sell decisions, it can execute trades extremely quickly, reducing trade slippage.

3. CML-T is can effectively navigate bull, bear, and sideways markets.

CML-T Weaknesses

The key downside to CML-T is that if rule conditions are not met, it will not issue a trade.

This means there may be extended periods of time without a trade.

Conclusion

CML-T adds tremendous strength to Crypto-ML’s already robust suite of machine learning-enabled trading systems.

Want to discuss CML-T with our community? Let us know in the comment below, discuss on our Community Forums, or join us on Telegram.