Optimize Your Crypto Bot Trading with Exchange Liquidity

Paired with the right intelligence, crypto bot trading is very effective. This post shows how to optimize your auto trading using liquidity to reduce slippage.

Bot trading helps remove emotion, replacing it with a systematic approach. It also is the true test of your strategy as you should have no human interference.

However, you may find that sometimes your actual trade results don’t match the raw results of the model or algorithm you’re following. Generally, the reason for this is “order slippage.”

Cutting to the chase: for Crypto-ML Auto Trade customers, the most liquid trading option is BTC/USDT on Binance. This is followed by BTC/USD on Coinbase Pro.

(Note: Based on this research, USDT will be added to our trading pairs in December.)

Read below for the details behind this that will be useful regardless of your crypto bot trading platform.

Bonus: do you want to try creating a machine learning trading model on your own? Check out our guide: Bitcoin Price Prediction with DIY Machine Learning in Excel.

Video Version

Prefer to consume this content by video?

Order execution slippage

If the system generates a “buy” at $62, but your order fills at $63, then you have $1 (or 1.6%) of slippage. While $1 doesn’t sound like much, it adds up quickly–especially if you are trading at a rapid frequency.

“Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market at a price reflecting its intrinsic value.”

Investopedia

You will experience this slippage regardless of the crypto bot trading platform you use. Even our Crypto-ML Auto Trader (see plans) customers experience slippage. That is, their results may not match our Trade History results exactly.

However, there are some greats ways to minimize this slippage.

Is all order slippage bad?

In the example above, the “buy” order was placed above the price the system wanted. That is clearly bad. But sometimes your order will fill at a better price. You may actually buy at a price lower than the system wanted.

While that second scenario is good, it still represents uncertainty. As a trader or investor, you want to minimize uncertainty. You want precision.

Additionally, most trade systems rely on movement to trigger an order. That means in order to get a “buy” signal on Bitcoin, the price will likely be moving up. Because of this, slippage is more likely to work against you than for you.

Uncertainty + bad odds = slippage should be managed.

Causes of bot trading order slippage

The top causes of undesirable order execution can be broken out into a few categories.

1. Large spreads (low liquidity)

The fewer people trading something, the less likely you are to get the price you want. You see this on exchanges by looking at the difference between the bid and ask prices (the spread). Spreads are wider with:

- Unpopular exchanges

- Unpopular trading pairs

2. Order types

The type of order that is entered matters.

- Market orders: These are entered with the exchange and will be filled at the current market price. If the market price has moved against you, then your order will be executed at an adverse price.

- Limit orders: These are entered and will only execute if you get the price requested or better. This sounds good, but the downside is your order may never be entered. If you’re trading longer timeframes, this could cause you to miss out on massive bull runs. And if you miss out on a sell order only to see price continue to move down, you could face an unacceptable loss.

You can learn more about the pros and cons of market vs limit orders for crypto trading on our blog post. It will also help you choose which to select for Crypto-ML Auto Trade.

3. Volatility

The faster an asset is moving, the less likely you are to get it for the price you want. As mentioned earlier, most crypto trading bots generate signals based on movement. So a quick movement up may trigger a “buy” call.

Since crypto can move incredibly quickly, you may find your execution is constantly chasing your trigger.

This is a bit of a double-edged sword situation, though. Part of the reason traders like crypto is because of its volatility.

Volatility is something you’ll have to live with. However, you can attempt to choose an asset that is more or less volatile based on your trading preferences.

4. Poor crypto trading bot technical infrastructure

Your crypto trading bot needs to go through many steps between identifying a trade and executing it. Any slowdown in this process separates the trade issuance from the trade execution.

- Code: You need to have extremely efficient code executing your scripts.

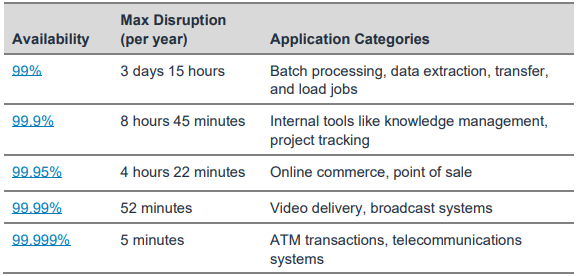

- Infrastructure: The systems that execute your code must be highly reliable (ideally five 9s) and sufficiently resourced.

To tackle this, Crypto-ML uses best-in-class microservices, web services, IaaS, and PaaS to deliver trade alerts and execute trades. This is particularly important because our machine learning models are resource-intensive.

But once the model ingests data and makes a decision, it then needs to notify users, enter traders, and process everything simultaneously, not sequentially.

To effectively manage, our systems are isolated and separate from any other resources. This ensures if one system has a problem, another isn’t impacted.

How to optimize your crypto trading bot order execution

Now that we understand the problem and some of the root causes, here are solutions.

1. Choose an exchange with excellent liquidity

The first step is to pick the right exchange. You need to do this based on many factors, including trust, reporting, track record, transparency, and more.

Crypto is fairly unregulated, so there are sketchy exchanges out there and people have lost their money. Be cautious.

Crypto-ML Auto Trade works with Coinbase Pro and Binance. This provides worldwide coverage with two of the best names in the business.

Once you have a shortlist of trustworthy exchanges, look at volume numbers to determine liquidity. Coinmarketcap provides the best data to do this: https://coinmarketcap.com/rankings/exchanges/

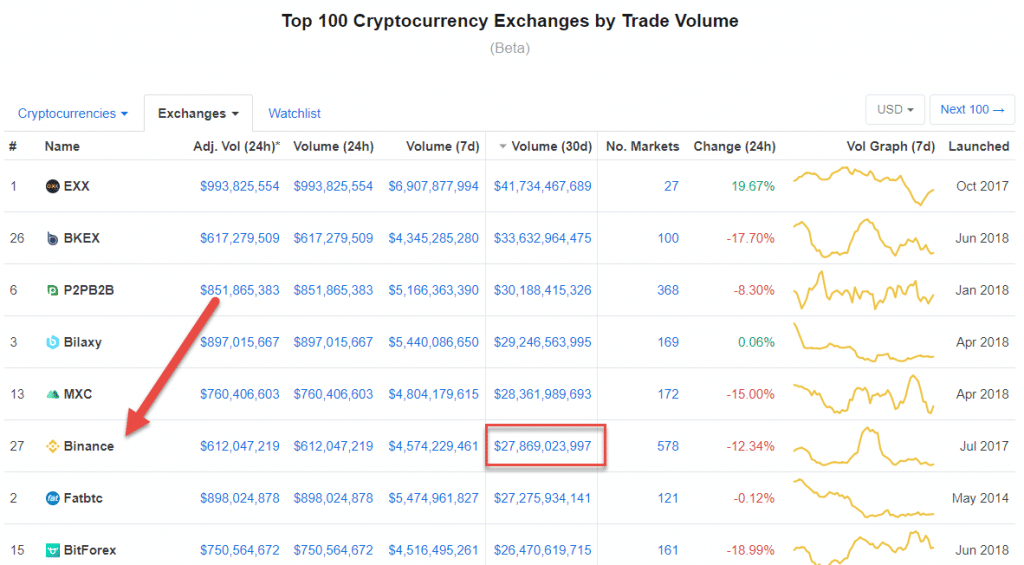

As we can see here, Binance ranks #6 in terms of trade volume over the last 30 days at $28 trillion.

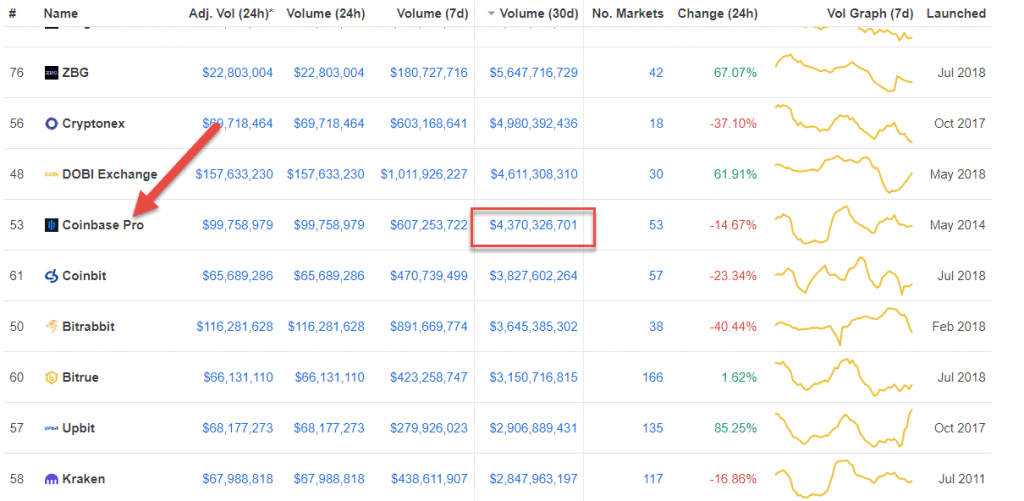

Coinbase Pro ranks further down at $4 trillion.

Based on this metric, Binance does about 7 times the trading volume of Coinbase Pro.

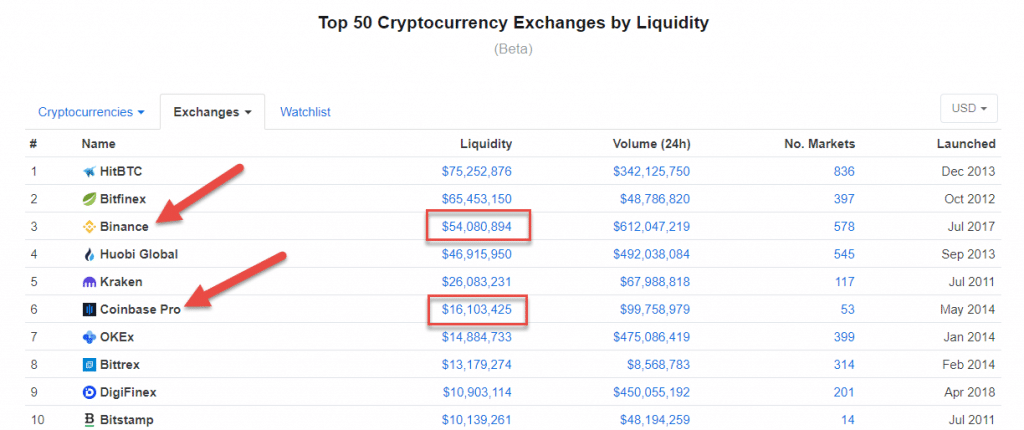

Coinmarketcap also has created its own Liquidity value. This is because it does not trust reported data from exchanges.

Looking at its Liquidity measure:

- Binance comes in #3 at $54 billion.

- Coinbase Pro comes in #6 at $16 billion.

They are both in the top 10. By this measure, Binance is about 3 times more liquid than Coinbase Pro.

Strictly speaking, more trades are happening at Binance but both exchanges perform well.

2. Choose the most liquid trading pair

Now that you have an exchange, it’s time to pick your trading pair. Just like with the last decision, there are more factors to consider than just liquidity.

You should choose an asset to trade that you believe will be moving in the direction you want. You should understand it and have a good feel for its history, news, and movements.

But assuming everything is equal between, say, Bitcoin and Litecoin–which should you auto trade?

Liquidity is the answer.

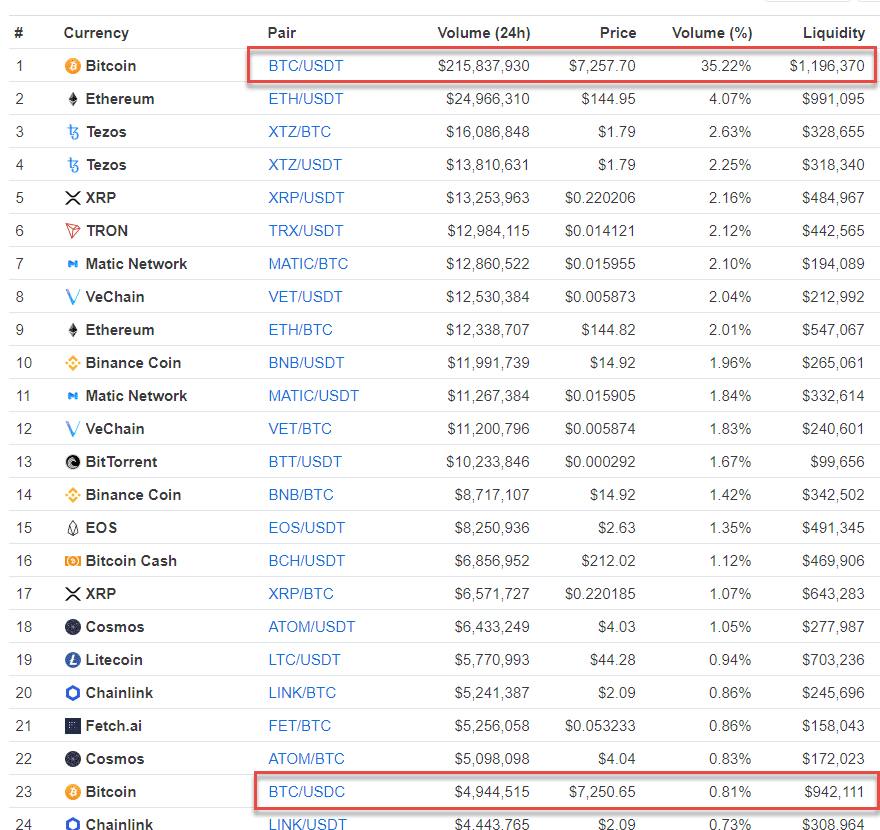

Here’s a look at trading pair volume at Binance:

As you can see, BTC/USDT trades at a massively higher volume than any other pair. There’s about 43x the volume of BTC/USDC. That is great to know.

With all else being equal, we can now recommend your crypto trading bot should work on BTC/USDT in order to minimize slippage.

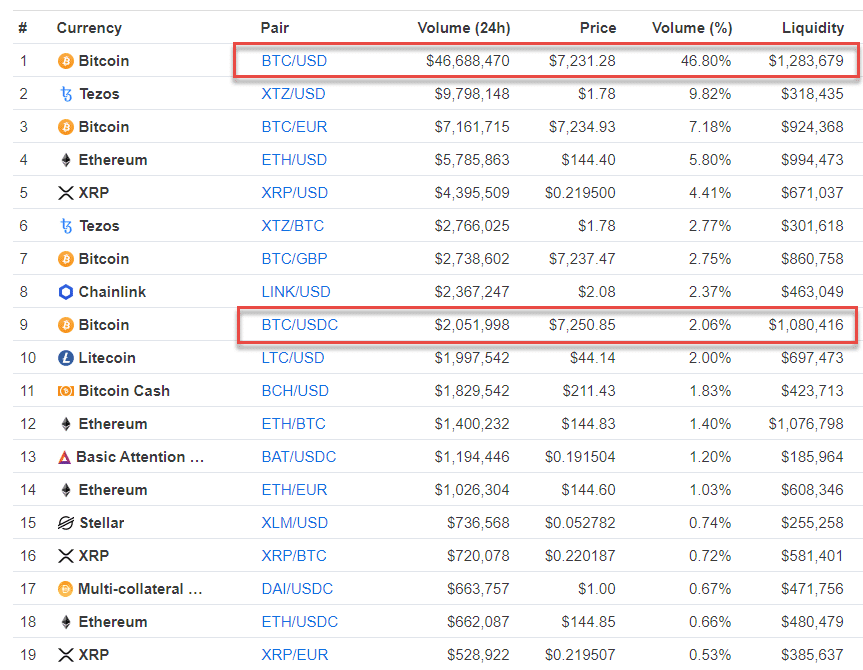

Here’s the same view of Coinbase Pro:

We have a similar story here. One pair accounts for a huge proportion of the trading. At Coinbase Pro, BTC/USD is the pair to trade. It gets about 14 times the volume of BTC/USDC.

The volume is also higher than the 2nd highest at Binance.

You really can’t go wrong with either exchange, but our order of preference for crypto trading bots would be:

- BTC/USDT on Binance

- BTC/USD on Coinbase Pro

Everything else has significantly lower liquidity.

3. Pick a crypto trading bot that delivers

You can’t control volatility, so the final step to optimize your order execution is to pick a bot that performs fast and well. You can go with reviews, but likely, you’ll need to experiment with different solutions yourself to see how they perform.

Crypto-ML has invested in the type of infrastructure needed for this, as have some of the other market leaders.

As with any trading solution, start small and slowly increase your funds as you gain more experience with it.

Conclusion

To optimize your auto trading, there are several key variables you can manage. By taking these steps, you will see better, more consistent results. Your actual performance will more closely match your model or algorithm’s recommendations.

Want to check out Crypto-ML? We have free accounts and free 30-day trials on any of our paid accounts. Check out Crypto-ML pricing and plans here.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.