Portfolio Auto Trade Announcement

Crypto-ML’s Auto Trade feature is receiving a massive upgrade that is designed to manage your crypto portfolio, simplify your experience, give you much more flexibility, and also reduce your risk. At a high level, Portfolio Auto Trade allows you to assign percentage allocations to different coins and strategies. It contains patent-pending technology to efficiently balance short and long-term approaches within a single account.

Portfolio Auto Trade also includes new and enhanced trading strategies that tackle key opportunities our machine learning has identified.

This post will capture everything you need to know about Portfolio Auto Trade and will be updated as we move through milestones:

- Upgrade begins: Thursday, June 3

- Validation completes: Friday, June 4

- Full launch: Monday, June 7

You can also expect upcoming video walkthroughs of some of the content here.

Important: existing Auto Trade customers will need to take an action once the upgrade completes. See Existing Auto Trade Customers below.

Video Guide

Full detail about this change is provided below in this article, but you can also watch this video to dive into a walkthrough of the new system:

Portfolio Auto Trade Overview

Portfolio Auto Trade is the start of a large shift in Crypto-ML’s approach that will move away from single trading strategies toward robust crypto portfolio management. The key features are:

- Connect to a single exchange API. Binance Subaccounts and Coinbase Portfolios are no longer required, but can still be used as desired.

- Assign a percentage allocation to multiple cryptocurrencies. Bitcoin and Ethereum are supported at launch.

- Assign a percentage allocation to multiple strategies for each cryptocurrency.

- Assign a percentage to hold each cryptocurrency.

- Assign a percentage of profit capture that will be set aside for separate, long-term holding.

The primary benefits are:

- Improved risk management with built-in exposure to multiple cryptocurrencies and multiple strategies. If one coin or strategy is underperforming, that may be offset by the performance of other coins and strategies.

- Profit capture to remove a portion of gains from the rebalance pool. Captured gains will be stored in cryptocurrency.

- The ability to hold (HODL) and actively trade within the same pool of funds, facilitating both short and long-term approaches.

- More trades will occur because you have exposure to multiple strategies, helping avoid long periods of time between trades.

As a current situation example, Matic has two positions that may remain open for an extended period of time as the market recovers. According to its internal calculations, it is not worth selling now. If you have 100% of your funds tied up in either of these trades, you will be unable to capture gains as the market moves back up. Rather, you are sitting on the sidelines.

With Portfolio Auto Trade, you could leave a subset of your funds in Matic. Another subset could be actively traded by the Manipulation Detection models, allowing you to avoid selling for a loss while also still taking advantage of any upswings.

Existing Auto Trade Customers

If you currently have Auto Trade active, you will need to take action and be aware of how Portfolio Auto Trade will work once you re-enable it.

You will receive notifications at each step.

Auto Trade will be stopped

In order to roll out this change, your Auto Trade will be stopped on Thursday, June 3. This will leave positions in their current state during the maintenance window. You can, of course, manually trade at any time before or after it is stopped.

Maintenance window of approximately 48 hours

Once Auto Trade is stopped, the Auto Trade Dashboard and Exchange Setup pages will be put in a maintenance mode.

As soon as the upgrade is complete and verified end-to-end, your access to those pages will be restored.

Your exchange will remain connected

Your existing exchange keys will not be removed. This means you will not have to generate new keys to start Portfolio Auto Trade unless you want to connect a different account.

Starting Portfolio Auto Trade after the upgrade

Once ready, you will receive a notice from Crypto-ML that you can restart Auto Trade using the upgraded Portfolio Auto Trade system.

Important: When you start Portfolio Auto Trade, a rebalance event will occur. It will move funds in your account to the buckets you have selected.

This means that once you make your allocation selections and hit “Start Auto Trade,” Crypto-ML will move funds between your selected market (e.g. USDT), Bitcoin, and Ethereum to your ideal allocations according to the current trade status of each strategy. As a result, it may buy or sell Bitcoin and Ethereum in order to properly sync with your selections.

It is important to emphasize that only funds in your selected market and cryptocurrencies will be considered for rebalancing. Any funds in other markets (fiat and fiat equivalents) and other cryptocurrencies will be left alone.

For example, if you select USDT, BTC, and ETH for Auto Trade, then a rebalance between those three will occur. Any balance you have in others, such as USDC, LTC, or LINK will be left alone.

After the initial rebalance is complete, you will not see additional activity in your account until a trade alert is issued. See How Rebalancing Works below for more information.

Handling the Open Matic Trades

Matic currently has positions open for BTC-USD and ETH-USD. These positions are in a drawdown. Currently, Matic’s calculations determine it is better to hold these positions rather than sell them. This may change at any time.

When you initially set up Portfolio Auto Trade, you may trigger a portion of those positions to sell. For example, if you are 100% in BTC and have selected USDT as your market, you may assign your strategy allocations as follows:

- 50% CML-T (Matic)

- 20% CML-A (Manipulation Detection)

- 30% Hold

This will leave 80% of your BTC in BTC (CML-T plus Hold). It will move 20% of your BTC to USDT so that it can be ready for the next CML-A trade alert. This may be desirable as it will allow you to use a portion of your funds to trade back up with the market as it recovers.

Will USD-BTC and USD-ETH (Crypto Optimizers) be supported?

Crypto-ML currently has pairs that seek to optimize the quantity of cryptocurrency you hold. These will not be supported with Portfolio Auto Trade. Rather, there are two options to use instead:

- The Hold strategy keeps a certain percentage of your portfolio in cryptocurrency at all times. Since it is a percentage, the value you hold will grow as your portfolio grows.

- The Profit Allocation takes a certain percentage of any profitable trade and sets it aside in cryptocurrency. Since this bucket is set aside, it won’t be adjusted as your portfolio is rebalanced. This bucket will simply continue to grow over time.

Portfolio Auto Trade Details

A video explanation of the new Auto Trade page is forthcoming, but this will describe how each of the options on the new Auto Trade Dashboard will work.

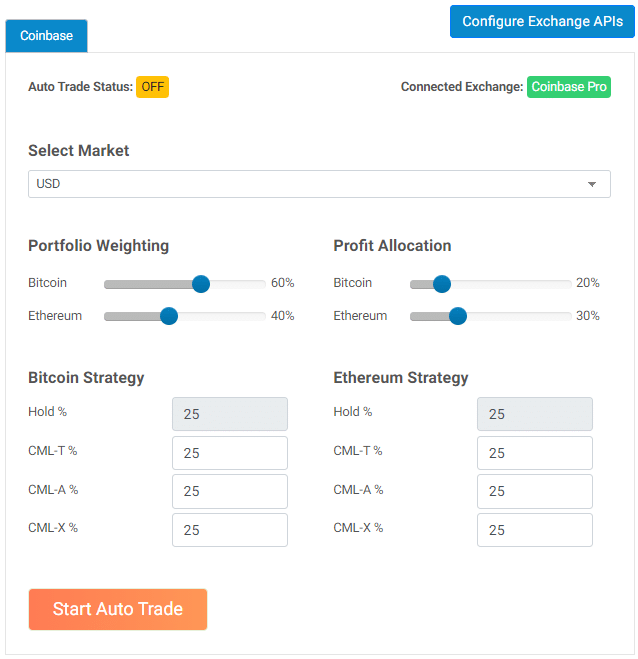

This preview of the alpha screen shows the options available:

- Select Market allows you to choose the fiat or stablecoin you will trade against. This list will be expanded to any options your exchange makes available to us for your account location.

- Portfolio Weighting lets you decide what portion of your funds will be allocated to Bitcoin and Ethereum Strategies.

- Profit Allocation sets what portion of a profitable trade you’d like to set aside in that particular cryptocurrency. Setting that to zero will keep all of your proceeds in the rebalance and trading pool. By increasing the number, you will establish a separate pool of BTC and ETH that will grow over time and not be factored into any future rebalances.

- Strategy lets you have multiple trading strategies work on your account simultaneously. This is the key to increasing opportunity and reducing risk. The strategies are detailed below.

Important: When you choose to Start Auto Trade, action will be taken to move your funds into the buckets you have selected.

The funds used for Portfolio Auto Trade and rebalancing will only consist of the funds you have currently existing in the Market you have selected and BTC and ETH. Any funds in other crypto, fiat, or stablecoins will be left alone.

How Rebalancing Works

Crypto-ML’s portfolio rebalancing method is patent-pending, designed to keep your portfolio in balance across many cryptocurrencies and many trading strategies without introducing excess exchange fees and excess taxes. Consider it to be efficient portfolio rebalancing.

When you start Portfolio Auto Trade, you are asking it to oversee your crypto portfolio and keep it in balance with the percentage selections you have made.

Maintaining a balanced portfolio is a common financial practice. It reduces your risk by exposing you to different assets. It also allows you to adjust your profile as your risk appetite changes over time.

As a common example, you may want your traditional retirement account to ideally consist of 80% stocks and 20% bonds. If the stocks grow faster over time, your actual balance will shift from ideal. Perhaps you have drifted to 85% stocks and 15% bonds. To correct this, a periodic rebalance event occurs to move you back to your ideal 80/20 allocation. In this case, stocks would be sold and bonds would be purchased.

The problem with periodic rebalancing is it introduces trades that would otherwise not be needed. This creates excess trading fees and taxes. Over time, these excess fees will dramatically reduce the performance of your portfolio.

In fact, many of the services similar to Crypto-ML trade your cryptocurrency by constantly rebalancing between a variety of crypto. One service we tested rebalanced every four hours across dozens of crypto. This quickly caused thousands of transactions to pile up in a very short time. This is not efficient from an expense perspective and it is a nightmare to deal with come tax time.

Apart from periodic rebalancing, there are a variety of other rebalancing methods, but each introduces additional transactions. Crypto-ML is different. We will instead perform rebalance calculations each time a trade is opened or closed. This means no additional transactions will be performed in order to rebalance.

As an example, if a BTC trade is closed profitably, a portion of that trade may be left in BTC in order to maintain your desired allocation in the “Hold” bucket. In this way, as one of your buckets grow, others can grow proportionately.

Rebalancing occurs between strategies and between cryptocurrency, always seeking to return you back to your ideal portfolio balance.

Important: There is only one time Crypto-ML will rebalance your account outside of trades. That is when you first start Auto Trade.

This means that each time you stop and start Auto Trade, rebalancing will occur. It is advisable to avoid starting and stopping the system excessively.

Strategy Descriptions

Along with this functional upgrade, our machine learning trading strategies are also being upgraded and renamed.

| New Name | Old Name | Description |

|---|---|---|

| Hold | n/a | Hold simply holds a portion of your overall portfolio value in the asset (aka HODL). |

| CML-T | Matic | CML-T is the result of deep learning applied to technical analysis. An enhanced version will be live as part of this upgrade. |

| CML-A | Manipulation Detection | CML-A uses neural networks to predict price movement and then identify anomalies in market movement. A major upgrade that will help avoid an expected 50% of losses will be live as part of this change. |

| CML-X | n/a | CML-X gives you preview access to upcoming strategies. All signal publications in this bucket will be reviewed and approved by a human. |

Going forward, the trade history of each strategy will be separately maintained. Look for more detail on each strategy in this upcoming week.

Except for Hold, these strategies all seek to compound your money over time by capturing numerous small wins. Our machine learning clearly proves out this is the best long-term approach. However, no single strategy works in all conditions. That is why it is advantageous to run multiple strategies.

We can provide three general recommendations:

- Balanced: Assign 25% to each of the four strategies.

- Trading Only: Assign 50% to CMT-T and 50% to CML-A.

- Aggressive Trading: Assign 33% to CML-T, 33% to CML-A, and 33% to CML-X

Frequently Asked Questions

Do I Need Binance Subaccounts or Coinbase Pro Portfolios?

No. You no longer need Binance Subaccounts or Coinbase Pro Portfolios to use multiple strategies.

Can I cancel the Multi-Account Addon?

Yes. If you want to manage only one portfolio, go to My Account > Subscription and cancel your Multi-Account Addon.

Can I manage multiple portfolios?

Yes. If you do want multiple portfolios, you can keep your Multi-Account Addon and connect multiple exchange APIs. Each will operate independently.

Will the subscription price change?

For existing customer, no. All existing Auto Trade customers will be grandfathered in. If you cancel the Multi-Account Addon, you may actually save money. Eventually, the Auto Trade price will increase for new customers.

What’s the difference between Hold and Profit Allocation?

Both options keep a portion of your funds in cryptocurrency; however, the amount in “Hold” is considered in rebalance equations, and “Profit Allocation” is not. That is whatever profit you allocate to be set aside will be outside of the pool of funds used for your trading strategies (including Hold).

Questions and Comments

This is a very significant change. Please let us know your questions in the comments below and we will update this post through launch.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.