Coming Soon: Crypto-ML Portfolio Management

Crypto-ML will soon introduce Portfolio Management. This feature is an extensive overhaul of Auto Trade, giving you the ability to create a portfolio of coins and strategies managed by Crypto-ML’s machine learning.

Our experience trading with machine learning over the years has netted one key learning: in the world of crypto trading, there is no single silver bullet.

Continuously trying to craft the perfect single system is a flawed approach. Just like our Manipulation Detection strategy embraces specific limitations related to predicting real-world patterns, Portfolio Management embraces the “no single silver bullet” concept.

Portfolio Management Overview

Crypto-ML currently allows you to simultaneously trade four pairs (BTC-USD, ETH-USD, USD-BTC, and USD-ETH) by utilizing Binance Subaccounts or Coinbase Pro Portfolios.

While this is effective, it is complex.

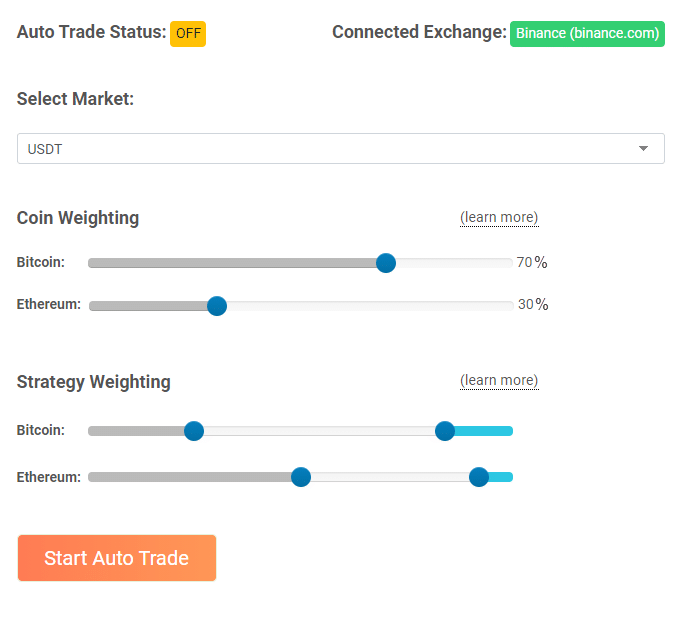

Crypto-ML Portfolio Management will simplify your experience greatly, only requiring a single connection. Within the Crypto-ML interface, you’ll be able to assign percentages to different coins and strategies, giving you the ability to:

- Determine how much of your account will be used for Bitcoin strategies and how much will be used for Ethereum strategies.

- Assign allocations to multiple strategies for each coin, broken down by Hold, Matic, and Manipulation Detection.

The screenshot above is a preliminary interface being used for testing. While this is not the final form, it gives you an idea of how you might allocate across coins and strategies.

Reducing Risk and Improving Performance

We’ve regularly discussed relying on one strategy or one coin increases risk:

- Risk a particular coin underperforms

- Risk a particular strategy underperforms

For example, there have been periods when our BTC models traded highly successfully while our ETH models stuttered. The opposite has also happened. Likewise, as an underlying asset, Bitcoin itself may significantly outperform Ethereum. The best way to manage these risks is to have exposure to multiple coins and multiple trading strategies.

While Crypto-ML has addressed this to an extent with Multi-Account Auto Trade, we have not addressed model-specific risk entirely.

While this makes sense at a principle level, it also proves out in the data. Running multiple strategies dramatically improves performance over the long term.

As an example, while Matic is technically the most advanced strategy we offer, it recently held an ETH trade for 41 days. During this time, it missed out on a considerable amount of volatility and movement. Manipulation Detection, however, did not. It made multiple several trades and outperformed Matic’s return by 6 times over this 41-day period.

The problem is, Crypto-ML currently only delivers signals from one strategy at a time. As a result, our customers held the Matic trade and missed out on the Manipulation Detection trades.

With Crypto-ML Portfolios, we will avoid this problem. You will be able to allocate across:

- Holding: always keep some percentage of your account in Bitcoin and Ethereum.

- Matic: allow Crypto-ML to trade some percentage of your portfolio value with Matic.

- Manipulation Detection: allow Crypto-ML to trade another percentage of your portfolio value with Manipulation Detection.

In short, Portfolio Management gives you the ability to take a more comprehensive, strategic, long-term approach with your cryptocurrency.

Bitcoin Trading with Machine Learning Anomaly Detection

Rebalance Details

By setting allocations for both coins and strategies, it will be necessary for Crypto-ML to rebalance your funds as you drift from your ideal allocations over time.

Most services tackle this by doing periodic rebalances. That is, they trade funds between buckets on a daily, weekly, or monthly basis in order to keep your ideal state. Some crypto bots even rebalance multiple times per day!

The problem is this results in extra transactions and extra exchange fees. It also becomes a tax nightmare.

Crypto-ML will rebalance without introducing any additional trades or exchange fees. Each time a trade is opened or closed, we will use that as an opportunity to leave the right amount in each bucket so that traditional rebalancing overhead is eliminated.

For example, imagine your ideal allocation for Bitcoin is to:

- Hold 30% of your total account value in Bitcoin.

- Trade 50% of your total account value following the Matic strategy.

- Trade 20% of your total account value following the Manipulation Detection strategy.

At rest, 30% of your account will be in Bitcoin and 70% in USDT.

If a Matic BUY signal is generated, it will use 50% of your available USDT to open a position. If that trade closes for a profit, each bucket needs to grow. To accomplish this, it will leave a subset of the gain in BTC and move the rest back to USDT. When complete, your 30/50/20 allocation will be maintained. No extra trades needed.

Said in plain English, because one strategy had a successful trade, all buckets grow. You now have more BTC and more USDT. All with zero overhead or extra expense.

Portfolio Management Conclusion

Crypto-ML’s Portfolio Management feature is currently in development but will be available soon. Once live, it will be an evolutionary step for Auto Trade, providing Crypto-ML customer’s a much more comprehensive and effective set of tools for managing their long-term cryptocurrency accounts. Please watch for additional updates as we get closer to release.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

2 thoughts on “Coming Soon: Crypto-ML Portfolio Management”

Leave a Comment

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.

HI.

how soon how much is left?

Hi David, yes–this is a much-needed feature. We are probably 1 month out.