Risk Management for Crypto Trading with Machine Learning: Handling Sliding Markets and Bad Calls

With the release of Crypto-ML’s 5.30+ machine learning models, we have introduced two new risk management features. Managing risk in crypto trading is key to long-term success. While many of us enjoy occasional home runs, the real pros need to find ways to continuously tip the risk-to-reward ratio in their favor.

With this release, two new risk-management features have been added, giving the capabilities to:

- Exit a trade if the market begins slowly sliding down.

- Pause trading after being stopped out for a loss.

Both features have “smart parameters” that are optimized by our machine learning platform. These are in addition to our other risk-management features, including the recently-released Dynamic Trailing Stop Losses and Profit Targets.

This post will provide more detail on how these new features work.

Handling Slowly Fading Crypto Markets

Crypto-ML opens trades based on a prediction from our Neural Networks of where price will be 24 hours from now. Of course, sometimes these predictions are incorrect.

When this happens, the Neural Network may predict an upcoming reversal and close the trade. But sometimes, the reversal isn’t strong enough to trigger a close. In this case, price can slowly drift down and ultimately we’ll hit our stop loss. This is a slow death of the trade.

This can be frustrating, as it seemed there was plenty of time to exit the trade, but there just wasn’t a strong enough indication of where price was going.

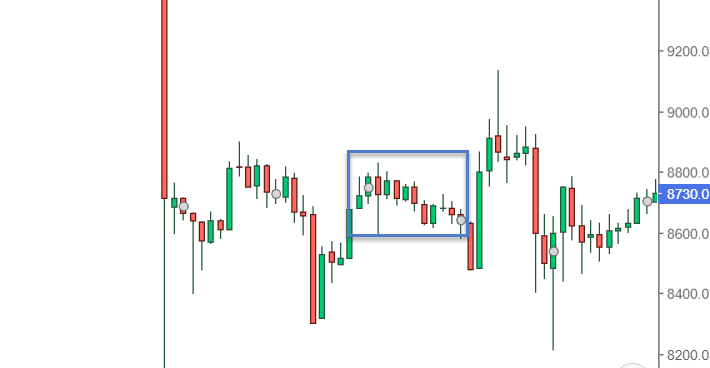

Here’s an example:

In the blue square, price action tightened up (smaller candles) and started drifting down toward the right edge of the blue box. Nothing was sudden, but the price action was definitely fading.

In this second example, you’ll see similar behavior:

Over the course 10 hours, price failed to move convincingly and generally faded down.

In either case, the movement may not have been enough to set off any alarms. But with our new “Slide” feature, we are actively detecting two patterns:

- A slow, consistent fade in price action.

- A slow, consistent fade in predictions from our neural networks (e.g. they are less and less bullish over time).

Ultimately, if either of those conditions is met, we see a low likelihood of hitting our profit target and therefore, the trade should be exited. We can instead wait for a trade with a better risk-to-reward ratio.

Functionally speaking, our optimizer machine learning models set parameters for these patterns. They identify when price and/or predictions have faded enough to generate a stop. This is one more layer of protection on top of our numerous other “stop” conditions.

Pausing Crypto Trades After a Loss

If you have traded for a long time yourself, you’ll likely know the worst time to start a new trade is immediately after a bad loss.

With humans, taking a loss leads to a flood of emotions and almost certainly clouds your judgment. Rather than following your trading plan, you may attempt to “win back” your losses and therefore act more aggressively than you should.

What you should do is take a break and cool down.

Even though Crypto-ML signals are entirely produced by machine learning, it’s still good to enforce a cool-down period. We’re not controlling for emotions, but instead, we’re controlling for blind spots in our models.

As an example, the current market conditions may match a bullish pattern that resolved successfully 95% of the time in the past. However, this is one of those times that it just isn’t working.

In this case, if the trade stops out, we want the model to take a forced pause, even if the prediction is still strong and would normally trigger a new “buy” signal. The pattern just isn’t right this time.

In the past, you may have seen our platform open a new trade right after closing out a losing trade. This will not happen in the future. Instead, our platform will cool down first.

Our machine learning optimizers determine how long the models should cool down before issuing their next trade. This is based on a combination of the Neural Network prediction strength and the severity of the loss.

Again, this feature simply helps shift the risk-to-reward ratio in our favor. Every little bit matters.

Conclusion

Over time, Crypto-ML will continue to build its library of patterns, functions, and tools. Especially since the release of our 5.x Neural Net platform, we’ve continued to chip away at edge cases and negative scenarios.

With all of these tools on hand, a human trader would get stuck in “analysis paralysis,” but fortunately, our platform is 100% built on machine learning and can readily consume these new inputs. There are certain risks we’ll never eliminate, but we can seek to manage unknowns and improve trading results for ourselves and our customers.

Questions, Comments, or Ideas?

Let us know in the comment below, discuss on our Community Forums, or join us on Telegram.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.