Cryptocurrency Fear and Greed Index

Crypto-ML’s Fear and Greed Index uses machine learning and big data to quantify the cryptocurrency market sentiment, helping you identify large-trend reversals. It pulls in technical, exchange, social, and search data to build a comprehensive picture of the market. This makes it one of the most powerful and important tools available on Crypto-ML. It is ideal for crypto investors with longer-term horizons.

This post will dive into the Fear and Greed Index and how you can use it in your trading and investing.

Key Assumptions for Crypto Investors

The Fear and Greed Index is primarily for people looking to invest long-term in various cryptocurrencies. Long-term typically means multiple years, ranging anywhere from 2 to 20+ years.

The Fear and Greed Index cannot tell you if a particular cryptocurrency will be successful in the long run. It’s possible any given crypto will go to zero.

However, if you have done your research and decided to invest, the Fear and Greed Index can help you determine when it’s an ideal time to invest aggressively and when it’s an ideal time to book some profits.

Here are some key assumptions to consider before diving into the details of the Fear and Greed Index.

1: You invest on a regular basis.

Investors typically take a portion of their monthly (or otherwise) pay and add to their investments. This means you have a choice to make every month. Which assets should your funds go to this month?

The Fear and Greed Index is designed to help you with this type of decision.

2: You believe in the long-term success of the investment.

When you invest in a cryptocurrency for the long run, it should be because you have done the research and believe in the fundamentals of it. You believe adoption and demand will rise over time. Ideally, you have an understanding of the use case, competition, leadership, technology, and evolving market dynamics.

3: Markets have cycles.

Most assets go through boom and bust cycles. By learning to identify and navigate these cycles, you should be able to optimize your investing. For example, if you buy houses heavily during housing crashes, you are optimizing your real estate investing. Many of today’s real estate millionaires went “all in” during the crash of 2008. That was a gutsy move at the time because everyone else was panicking.

The great thing about cryptocurrency is it has provided an accelerated course in market cycles. Whereas you may not experience these boom-and-bust cycles firsthand for decades in traditional markets, crypto has given us considerable real-world experience in just a few years. If you’ve lived through a few cycles yourself, you know the power they provide.

Unfortunately, most people buy during exuberant times and sell during times of panic. We hope the Fear and Greed Index can help you avoid that mistake.

4: Markets change but fundamentals don’t necessarily.

There are times when the price of an asset crashes, but its fundamental value hasn’t changed.

For example, in March of 2020, Bitcoin cratered to a low of $3,782 due to COVID concerns. But almost every other asset class also crashed. Did COVID change the long-term value proposition of Bitcoin? No. This was an ideal example of panic creating an opportunity.

5: Fortunes are made when big investments happen during times of panic.

There is never a guarantee a particular cryptocurrency, company, or idea will succeed in the long run. But one thing that is certain: people who make a large amount of money are the ones who pick great assets at a great price. If you believe an asset has long-term value, then you need to identify those times when people cannot sell it fast enough.

To be clear, that is scary and difficult for most people to do. Bitcoin is typically “on sale” when everyone is convinced it is a worthless asset going to zero. FUD (fear, uncertainty, and doubt) will dominate. Governments are going to outlaw it. Quantum computers will render it obsolete. Transactions are too slow and expensive.

It is very hard to buy during these times. But the same thing happens with stocks, housing, and every other type of investment. The world’s best investors identified great assets, stuck to their convictions, and bought when everyone else sold.

How the Fear and Greed Index Works

The Fear and Greed Index is designed to help you determine when the larger market trend will reverse. It is here to help you buy when everyone else is panicking. With cryptocurrency, these direction changes can be sudden and severe. So taking any action to lessen your positions at the end of a run and then reinvest them later may be hugely beneficial.

The end of a bull run tends to have these characteristics:

- Price extending quickly above recent levels.

- Exuberant press coverage.

- Fear of missing out (FOMO).

- Extreme optimism of market participants.

- Mass influx of retail traders.

- Highly speculative and leveraged trading.

These seemingly positive ingredients tend to signal the end of a bull market and the start of a bear market.

The end of a bear drop tends to have these characteristics:

- Price extending quickly below recent levels.

- Negative press coverage, with titles such as “Bitcoin is finally dead,” “Sell Your Bitcoin and Never Look Back,” and “The End is Here for Crypto.”

- Fear, uncertainty, and doubt (FUD).

- The exit of retail traders from the market. Only long-time holders remain.

- Reduction in speculative, leveraged trading.

As above, these negative ingredients tend to signal the end of a bear market and the start of a bull market.

The Fear and Greed Index seeks to ingest data points to identify when these extreme situations are forming.

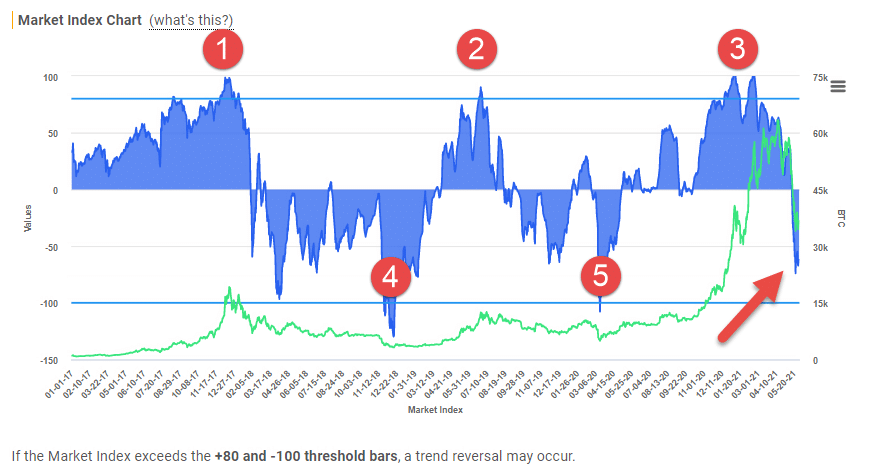

Looking at the example points in the image above, you can see the Fear and Greed Index would have you selling at extremely high points (1, 2, and 3) and buying at low points (4 and 5).

Data Used for the Fear and Greed Index

The Fear and Greed Index consumes a large variety of data points to determine its score:

- Exchange data: such as price and volume

- Technical data: such as momentum and moving averages

- Social media data: such as Twitter sentiment and volume of discussion

- Search trend data: such as quantity and type of search queries

- Dominance data: how Bitcoin compares to altcoin market capitalization

These factors come together to paint a picture of just how extreme the market may be.

How is Crypto-ML’s Fear and Greed Index Different?

There are multiple crypto fear and greed indexes out there. They generally operate in a similar way, taking a basket of data to generate a value. But how they combine data and optionally learn will vary greatly.

Crypto-ML’s Fear and Greed Index does not just combine numbers to come up with an arbitrary value. We actually simulate investment decisions based on our generated value and then let machine learning optimize and tune it so the index not only captures market sentiment but also optimizes for ideal investment timing.

Fear and Greed Index Components

You’ll find the Fear and Greed Index on the Member Dashboard.

Here’s how to interpret it.

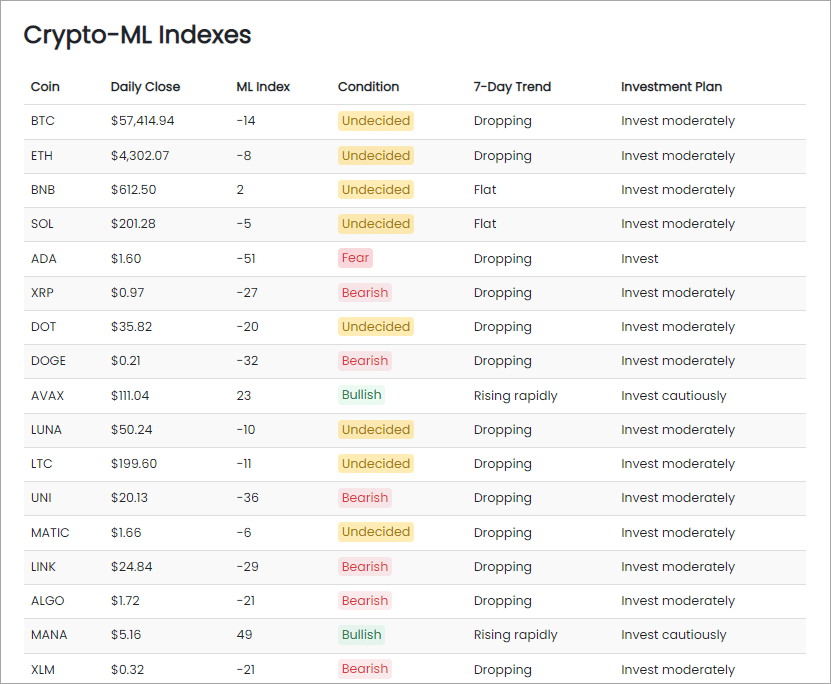

- ML Index is the composite, raw value determined by our systems.

- Trend shows the general direction of the ML Index value over the last seven days. It may help you determine which condition we’re moving into next.

- Condition and Plan is a text summary of the value, broken down as below.

| ML Index | Condition | Plan | Detail |

|---|---|---|---|

| 80+ | Extreme Greed | Book Profits | The market is very likely overextended. Consider reducing your positions and investing back in at a future time. |

| 60-79 | Greed | Book Some Profits | The market is very hot. Consider taking some profit to reinvest at a future time. |

| 20 to 59 | Bullish | Invest Cautiously | The market is hot but will likely continue going up. You can hold your position and consider investing, but not as aggressively as normal. |

| 0 to 19 | Undecided | Invest Moderately | The market is being recalibrated as participants attempt to value the asset. Consider regular investing at this normal price. Depending on the trend, there may be a bullish bias. |

| -1 to -19 | Undecided | Invest Moderately | The market is being recalibrated as participants attempt to value the asset. Consider regular investing at this normal price. Depending on the trend, there may be a bearish bias. |

| -20 to -39 | Bearish | Invest Moderately | The market may continue dropping but is still at a low part of the overall cycle, providing relatively good prices. |

| -40 to -59 | Fear | Invest | This is likely a low part of the market cycle and a good time to invest for the long run. |

| -60 & lower | Extreme Fear | Invest Aggressively | If you believe in the long-term success of the asset, consider this a rare opportunity to invest heavily. |

Sample Monthly Investment Decision

Looking at the screenshot above, you’ll notice that most cryptocurrencies are in a similar condition. However, a few stand out:

- ADA is in the fear zone and has dropped much more than others. Perhaps the market is overreacting to a temporary setback.

- AVAX and MANA are in bullish zones and rising rapidly. Perhaps the market is overreacting to recent good news. You may have missed this wave.

If you invest $1,000 monthly in BTC, ETH, ADA, AVAX, and MANA, you may consider the following approach this month:

- BTC: $200

- ETH: $200

- ADA: $500

- AVAX: $50

- MANA: $50

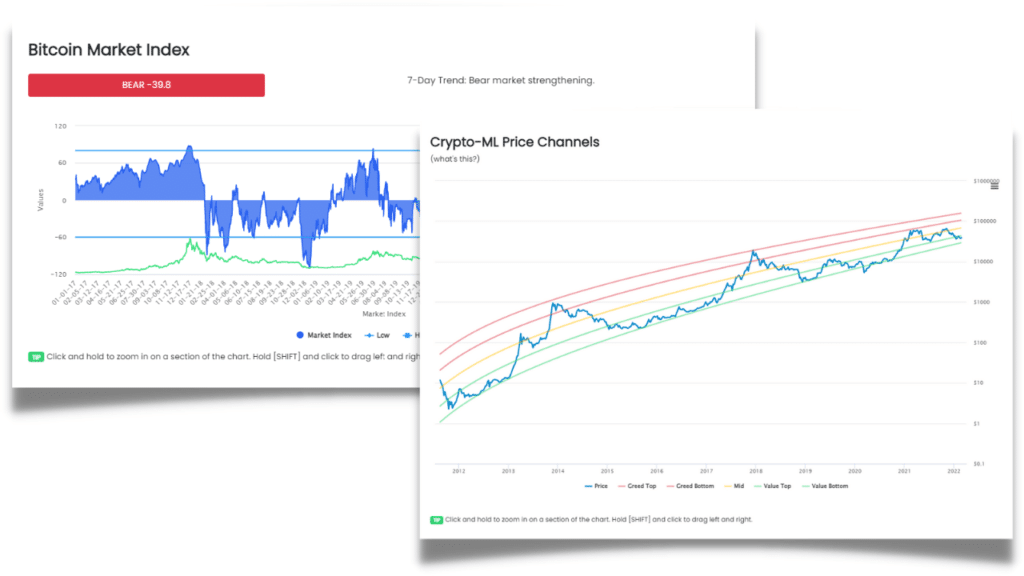

Better Together with Price Channels

The Crypto-ML Price Channels are a key complement to the Fear and Greed Index.

- The Price Channels utilize only one data point, which is price.

- The Fear and Greed Index is a sophisticated combination of many data points that attempt to quantify market sentiment.

While the Fear and Greed Index is a much more robust tool, the Price Channels help answer a different question. They provide a clear picture of statistically-likely reversal points.

When the information from both tools is combined, you can gain much more clarity into the overall market picture.

Risks of the Fear and Greed Index

In the history of cryptocurrency, there have only been a handful of large trend reversals. In machine learning and statistics, you prefer to have thousands of samples of events you try to predict in the future.

As such, we have a limited understanding of when the crypto markets will actually reverse. However, we can look at commonly accepted factors that have led to reversals in numerous other financial markets and use those as a guide.

That said, please consider the following:

1. The Fear and Greed Index may be above +80 but price will continue to go up.

2. The Fear and Greed Index may be below -100 but price will continue down, possibly to zero.

3. The trend may reverse without first crossing +80 or -60.

As such, the Fear and Greed Index should be a guide. Always take these steps before making any major decisions:

1. Reevaluate fundamentals.

2. Attempt to validate if the Fear and Greed Index is accurately representing the market conditions.

3. Always consider your personal strategy and risk tolerance.

Downloading Past Fear and Greed Index Data

If you want to run your own scenarios and tests with actual Fear and Greed Index data, you can download it directly from the Member Dashboard. Simply go to the Fear and Greed Index graph, click on the hamburger icon and choose one of the download options.

Historical data is currently only available for Bitcoin.

In the second half of this video (which is queued to start at the right point), we walk you through downloading data and running a simple scenario. Even with a couple of very basic rules, you’ll see the power of using cycles to your advantage.

Conclusion

The Fear and Greed Index provides Crypto-ML users a tool to gauge the overall market dynamic.

If you are a Crypto-ML Free Member, you can see the Fear and Greed Index on the Member Dashboard. If not, see our plans and pricing to register. Thanks for reading!