Navigate Bitcoin's long-term potential with confidence.

Advanced, easy-to-understand analytics for strategic Bitcoin investment over 3-5 years.

We are a Bitcoin analytics firm that simplifies

Bitcoin investing for individual investors.

About us

Two decades of expertise in quantitative finance.

Since 2001, our team has been building robust quantitative financial models. Our experience over these two decades has equipped us with profound insights into the common challenges and errors investors face.

Initially, our models were built on statistical models, mathematics, and compute-intensive optimization algorithms. In 2015, we added machine learning and artificial intelligence, enhancing our ability to process and interpret extensive, diverse data sets.

The CML Index embodies our comprehensive understanding of financial systems, transformed into clear, actionable insights. It's designed for anyone seeking data-driven Bitcoin analytics, offering simplicity without sacrificing depth.

Results preview

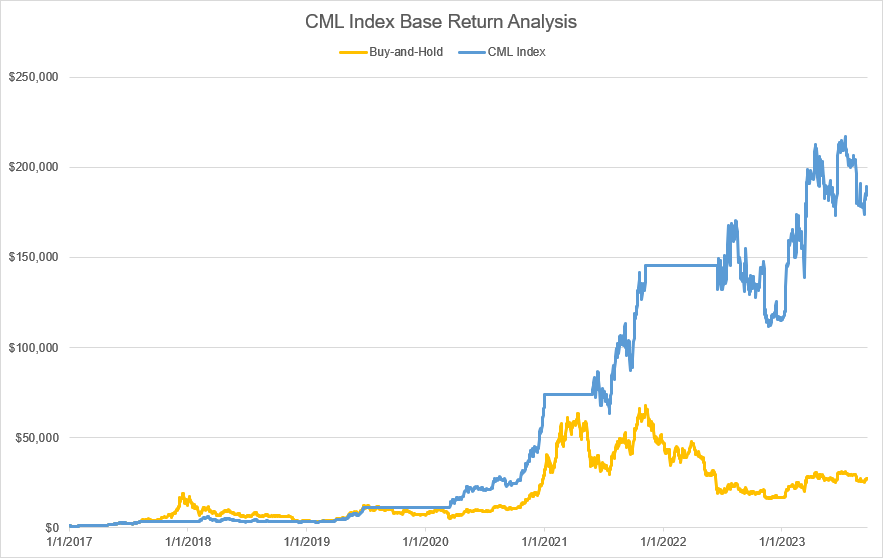

Running from January 1, 2017, through September 20, 2023, our approach achieved results that are 7.45x better than buy-and-hold while also minimizing drawdowns. This period was chosen for analysis due to its diverse market conditions, including bullish, bearish, and sideways trends, providing a comprehensive view of our approach's performance.

| Buy and Hold | CML Index | |

|---|---|---|

| Starting balance | $1,000 | $1,000 |

| Realized gain | $0 | $144,320 |

| Unrealized gain | $25,127 | $42,865 |

| Total gain | $25,127 | $187,185 |

This leaves final balances of $188,185 for Crypto-ML and $26,127 for buy and hold (including the original $1,000 deposited).

While buy-and-hold is the defacto benchmark, it’s worth highlighting a major issue: it never realizes a gain. There is no exit plan. Realizing gains while even matching buy-and-hold is considered an accomplishment. Beating it while realizing gains in a variety of market conditions is exceptional.

Not crypto. Bitcoin.

Why Bitcoin?

Bitcoin is unique. No altcoin or other financial instrument is this free from human manipulation.

- Decentralization: Enables a financial system with no central authority

- Store-of-value: Provides a hedge against fiat inflation

- Peer-to-peer: Facilitates global transactions without intermediaries

- Financial sovereignty: Empowers people outside traditional systems

- Transparency: Transactions are publicly verifiable

What We Believe In

✅ Educated investing

In the crypto world, over 80% of investors lose money by following hype instead of data. Our solution? Providing concise, data-driven insights to promote informed, analytical investing.✅ Timeless investing principles

While Bitcoin is a relatively new technology, its price still behaves like that of other scarce, tradeable investment instruments. Human psychology matters.✅ Only Bitcoin

There will only be 21 M Bitcoin, and the computing resources dedicated to Bitcoin are now in Exahashs (quintillion checks per second). This gives us confidence that Bitcoin will be there for the next 100 years.What We DON'T Believe In

🔴 Quick flips

We aren't a trading service selling you on a false reality. We believe in building wealth by navigating market cycles like the professionals. We're about arming you to confidently buy when others are fearful and sell when others are greedy.🔴 Gambling & gurus

Don't chase the latest hype and empty promises. Avoid the common psychological traps that cause 90%+ traders to lose money.🔴 Altcoin buzz

Most altcoins are young startups skirting regulation and designed to make the founders rich. Bitcoin survices because of its resistance to human manipulation and 650 exahashs/second of computer power to keep the system in check.Bitcoin's Diverse Use Cases for Investors

Retirement Diversification

Bitcoin in your investment portfolio

Integrate Bitcoin into your retirement planning for a diversified investment portfolio. As a non-correlated asset to traditional stocks and bonds, Bitcoin offers a unique opportunity to hedge against market volatility. Its historical upward trend, despite short-term fluctuations, positions it as a potentially lucrative addition to long-term retirement strategies. With Bitcoin, savvy investors can tap into the digital age's potential while mitigating risks through diversification.

Inflation Hedge

Preserving purchasing power with Bitcoin

Protect your wealth from inflation's eroding effects with Bitcoin. Its limited supply and decentralized nature shield it from inflationary pressures that impact fiat currencies. As central banks continue to increase money supply, Bitcoin stands out as a digital store of value. Investors are increasingly turning to Bitcoin to maintain the purchasing power of their savings, making it an essential component of a balanced, forward-thinking investment strategy.Leveraging Market Sentiment

Strategic Bitcoin investing

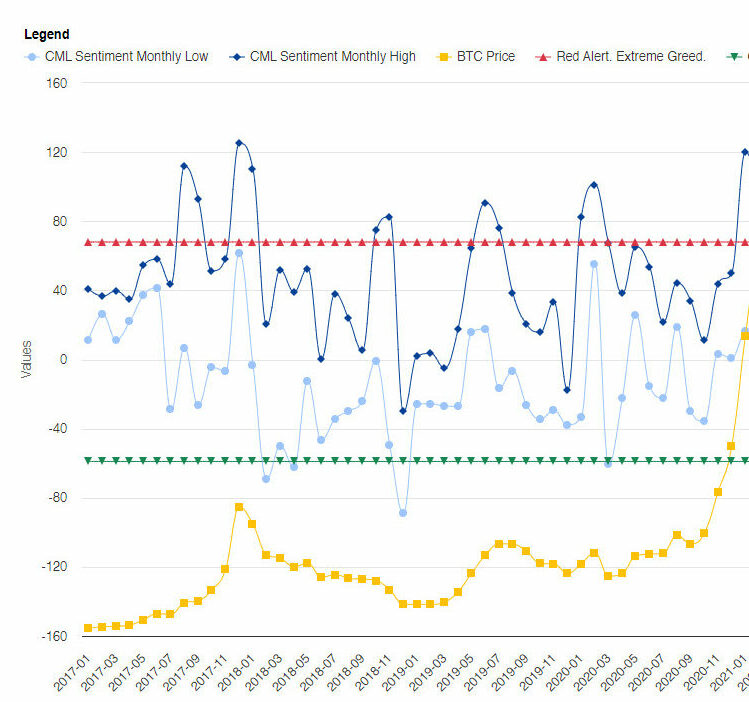

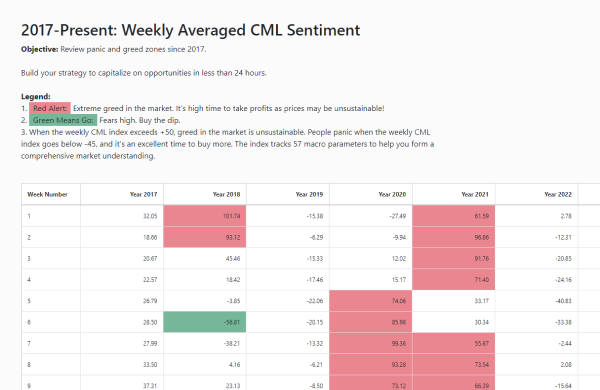

Enhance your Bitcoin investment strategy using the Crypto-ML Fear and Greed Index (CML Sentiment Index). This sophisticated tool analyzes over 57 macro parameters, including market trends and economic indicators, to guide investment decisions. By quantifying market sentiment, the CML Index helps investors identify zones to buy aggressively or take monthly profits, aiming for long-term growth rather than short-term speculation. This strategic approach empowers investors to maximize their Bitcoin holdings with informed, data-driven decisions.

Take a Closer Look

See How Our Product Can Work for You

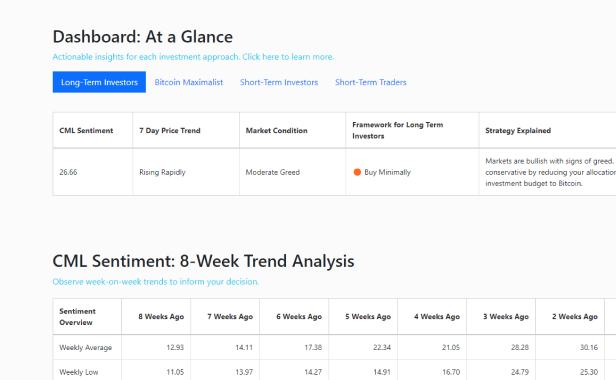

Actionable dashboard

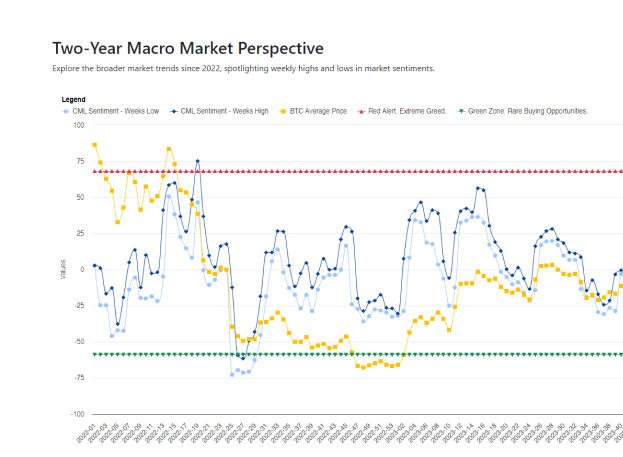

Historical CML sentiment and market volatility trends

Gauge sentiment and plan with precision