Insider Newsletter 12: December 2022

The year is coming to a close and boy has it been tough on crypto. This newsletter will prepare you for 2023 with a deep dive into our new 30-day price prediction AI, a review of Crypto-ML indicators, macroeconomics, crypto news, on-chain analysis, technical analysis, and a wrap-up.

If you’re looking for the TLDR, jump down to our summary and recommendations.

30-Day Price Prediction Deep Dive

Since the 30-day prediction was newly introduced on our Member Dashboard, here’s a deep dive into how it works.

Our AI model uses data points covering influential global indexes, commodities, technical indicators, and sentiment. In building the model, we evaluated hundreds of data points but short-listed down to the 33 most impactful.

To be clear, these are the data points that influence the future price movement of Bitcoin. As these numbers move, they cause a downstream effect on Bitcoin price.

Predictive Performance

We post our AI’s prediction results publicly on the Bitcoin Price Prediction History.

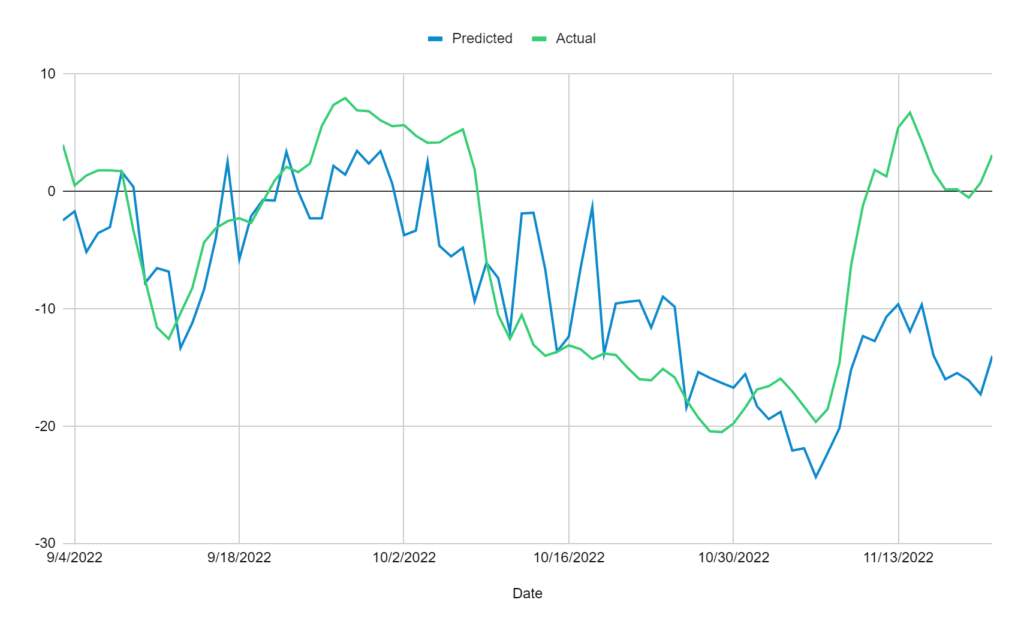

Here’s a graph comparing the predictions to reality.

Each predicted value really represents the most likely outcome based on available information. It’s all about probabilities. Given what the AI knows about the world, what is the most likely outcome for Bitcoin?

In mid-November, the AI signaled probabilities suggested December would be another down month and that we should currently be sitting at about Bitcoin $14,000.

This has not happened, which means one of two things:

- The predictions were wrong.

- The drop is lagging.

If the drop is lagging, Bitcoin may be artificially propped up at the moment. We could see a rug pull event ahead.

Given the economic news and FTX collapse, it is indeed a surprise Bitcoin has held steady. You’ll see below in the on-chain metrics section that large accounts are propping up the market. We’ll see if this continues or if we have a lagging drop in our near-term future.

It’s important to consider our model has been trained on the entire lifespan of Bitcoin, which has been overwhelmingly bullish. That means, statistically, the default assumption is Bitcoin will go up. It is less likely the model will generate negative predictions.

As such, we’re not taking these predictions lightly.

How the AI Works

A human analyst can look at many different data points and come to conclusions about where Bitcoin may be headed. This has been the basis for our Insider Newsletters. There are countless other analysts doing the same.

AI can do this job too. It can be given a swath of data, analyze it, and uncover statistically significant patterns. AI can theoretically do this job massively better and more efficiently than humans.

What differentiates AI models and their predictive power is the quality of the data presented. That means the role of the human is to ensure the best data is selected and that it is also properly transformed and structured. Raw numbers are relatively meaningless. But their relationships and how they move over time can be incredibly powerful.

Our current AI model is the result of our experience using machine learning over the last 5 years to predict Bitcoin price movement. It also includes all of the extra knowledge gained over the last year of deep diving into the economy, on-chain metrics, technical analysis, and more as part of our Insider Newsletters.

With that said, let’s look at our current model and what it’s telling us.

AI Model Top 10

These top 10 features that currently most influence the AI’s predictions:

| Feature | Data Influence | Description |

|---|---|---|

| vYieldCrv | 15% | Yield curve in the bond market. |

| v90Price | 9% | Bitcoin price vector over 90 days. |

| v30Crude | 7% | Crude oil price vector over 30 days. |

| vDOM | 7% | Day of the month. |

| v10YRT | 6% | 10-year treasury rate. |

| vBBup | 6% | Technical indicator upper Bollinger Band. |

| vDX | 5% | Dollar Index. |

| vVIX | 5% | CBOE Volatility Index. |

| v2YRT | 4% | 2-year treasury rate. |

| v30FTSE | 4% | London FTSE vector over 30 days. |

| 32% | Remaining 23 features. |

If you’ve been following our Insider Newsletters, these top influencers of Bitcoin price movement should not be a surprise.

Let’s take a look at why these are important.

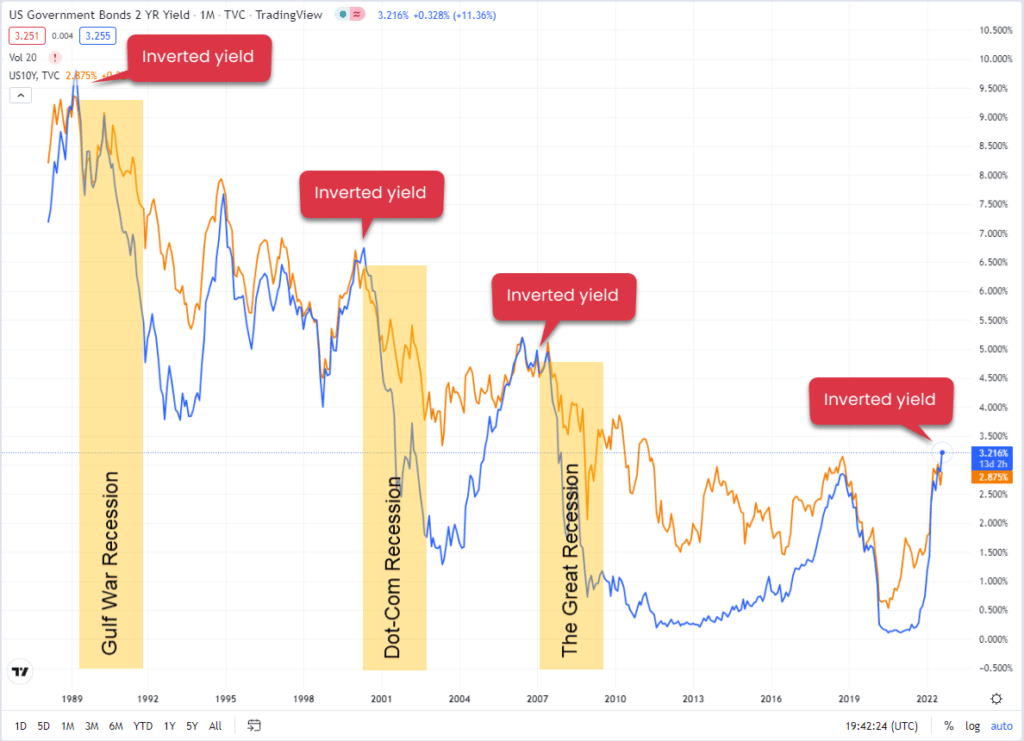

Yield Curve

The yield curve feature analyzes the relative movement of short and long-term bond rates. In Newsletter #8 (August), we dove into yield curve. It has been perhaps the most consistent indicator of economic health.

From 1940 to the present, every time there is an inverted yield, a recession follows.

Since this relationship is so correlated with broad economic performance, it’s not surprising it’s so predictive of Bitcoin price movement.

Bond rates are driven by actions the Fed takes to control the economy. They are a good indicator of not only where experts anticipate the economy will go but also the results of their actions.

90-Day Bitcoin Price Vector

Our features look at Bitcoin’s vector over several time frames, but the #2 influence on our model is the 90-day vector. This is likely getting at the old adage trends tend to continue.

Said another way, unless the other features are showing significant signs of change, the reasonable assumption is Bitcoin will continue on its bigger picture path (e.g. generally up or generally down).

30-Day Crude Oil Vector

It’s a bit of a surprise that changes in the price of oil capture the #3 spot in terms of influencing future Bitcoin price.

However, looking at our Insider Newsletters from March and June, oil does appear to be one of the earliest and fastest movers as the economy changes.

Oil price can be manipulated. Russia and OPEC alone can drive rapid, dramatic changes in worldwide supply. It makes sense that OPEC members monitor the economy and attempt to preempt expectations, thus making oil a leading indicator.

Other Variables

Beyond these top three, we see:

- Two more bond rate-related items. Together, bond yields make up a whopping 25% of the overall influence on future Bitcoin price. You can see why economists focus so heavily on them.

- The Dollar Index, Volatility Index, and FTSE represent the movement of other major financial markets. Numerous other global indexes are also represented but do not show in the top 10. The Dollar Index is particularly interesting as it sums up the pressure placed on small economies across the globe.

- The upper portion of Bollinger Bands is the only technical indicator that made it into the top 10. This is traditionally used to identify overly-bought markets though it’s not fully clear how the AI is using it.

Coupling with Human Analysis

Alright, now that you have a better understanding of how the model works, let’s take a look at the bigger picture to see if the predictions seem to line up.

Crypto-ML Data

Bitcoin remains in a good long-term accumulation zone, but we need to be prepared for another leg down.

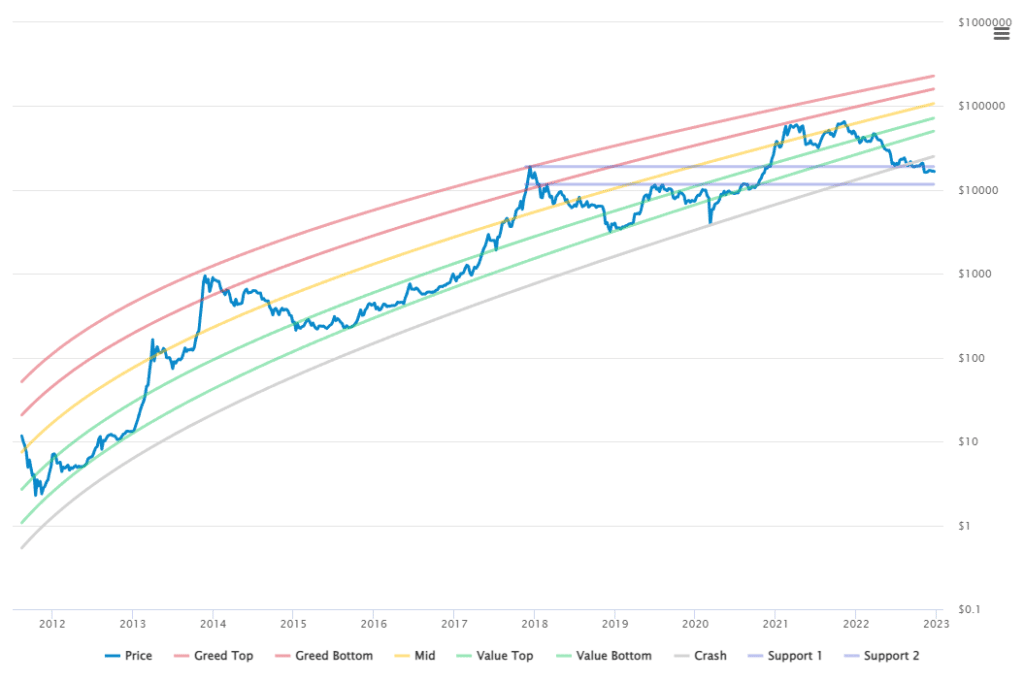

Price Channels

The Crypto-ML Price Channels use a regression model to plot the long-term growth pattern of Bitcoin.

Bitcoin broke the logarithmic growth charts back in June of this year. Most chartists simply changed their plotting to fit the new trend. But it’s important to have this perspective when making decisions.

It may mean:

- Bearishly, Bitcoin is no longer in the logarithmic growth portion of its lifecycle. It may now behave more like a mature investment instrument, providing more modest returns over time.

- Bullishly, it may mean once the weight of the larger economy is lifted and money starts flowing back into the markets, Bitcoin will slingshot back into the green or yellow zones.

From the logarithmic perspective, there are two key levels of support:

- $19,000 which was broken in November.

- $11,700 which may be a worse-case ahead. Our AI model has been predicting a drop to near this level will happen this month, or if not, in January.

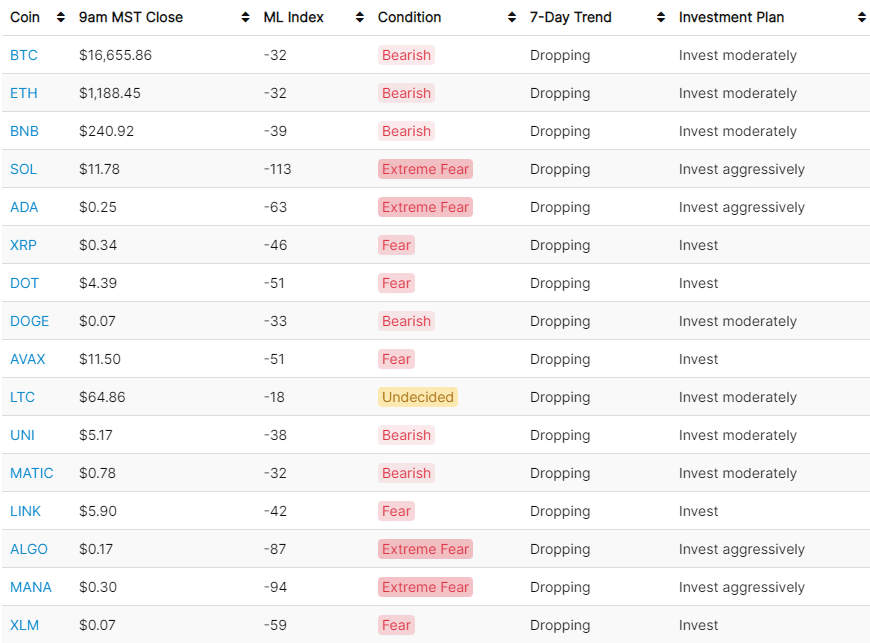

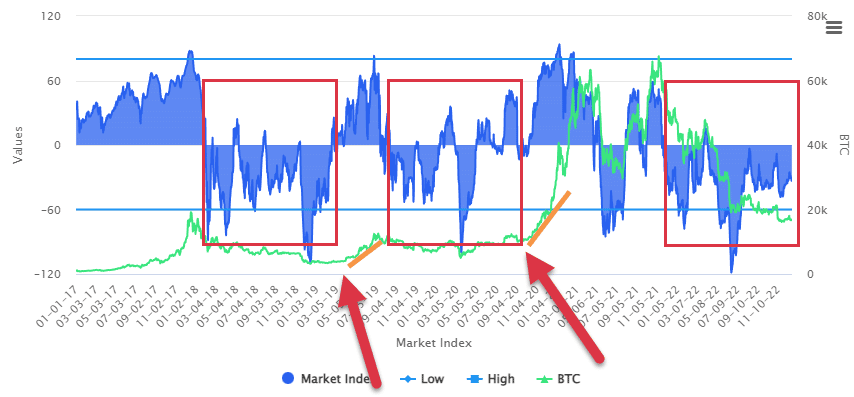

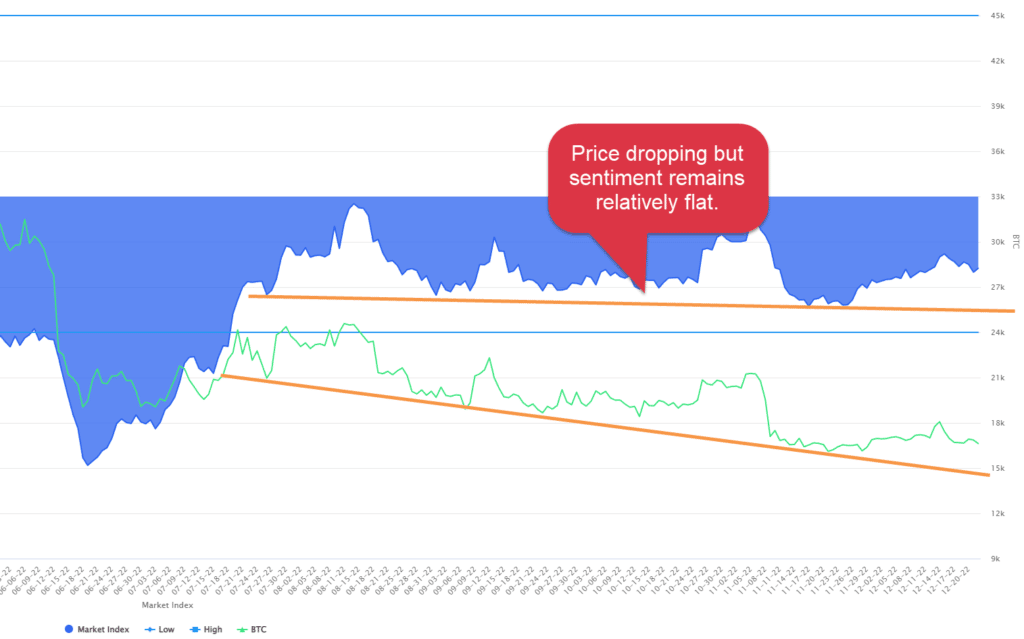

Market Index

Our Market Index sentiment indicators have remained in the negative for over one year now.

Bitcoin sentiment peaked in November of 2021, then quickly crossed negative in just 10 days. It has stayed in the bearish-to-extreme fear zone since.

Does this mean we may be nearing a turning point in the markets?

It’s possible, but there are broader forces at play this time.

Interestingly, price has been dropping faster than sentiment. This seems to indicate that despite all of the negative news surrounding the general crypto space, confidence in Bitcoin is not wavering.

As we said in last month’s newsletter, all of the crypto scams and altcoin messes truly strengthen the case for Bitcoin. Unfortunately, Bitcoin is guilty by association.

The value proposition for Bitcoin has never been stronger.

Macroeconomy

The economy is looking shakier and shakier. The markets may still hit a bottom in 2023 but be prepared for a sustained bear market that may last through 2025. If you can afford to invest during tough times, you’ll be positioned well during the next run.

We covered the economy a fair amount in the Price Prediction section above, so the following are highlights to reinforce the picture:

- 70% of economists are predicting further downturn in 2023, up from 65% last month (foxbusiness.com).

- The latest Fed report was gloomier than ancticpated, leading to a drop in financial markets, with all 11 major S&P 500 sectors falling (reuters.com).

- The Fed expects the jobless rate to remain elevated in 2024 and 2025 as steeper rates continue to take their toll by pushing up borrowing costs (foxbusiness.com).

- Wall Street banks from Morgan Stanley and Bank of America to Deutsche Bank have warned that US stocks could plunge by more than 20% in 2023 due to an economic downturn and liquidity risks fueled by the Federal Reserve’s interest-rate increases (finance.yahoo.com).

- Companies such as JPMorgan, General Motors, Walmart, United and Union Pacific, are conituing to prepare for further economic slowdown by taking conservative strategies in 2023 (cnbc.com).

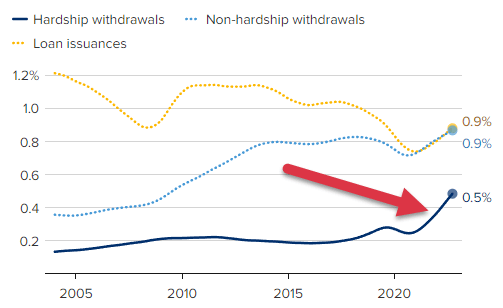

- Consumer loan delinquencies are on track to hit a 13-year high in 2023 (finance.yahoo.com). That’s meeting the peak that followed the 2008 financial crisis. Fundamentally, consumer behavior has not dramatically changed (people are still spending) but interest rates are climbing, make debt service a larger part the budget, which can ultimately be unsustainable.

- People are dipping into their 401Ks at record rates with “hardship” withdrawals (cnbc.com).

Crypto News

Crypto is clearly going through a phase of maturation and shakeout. Shady players and sham projects are being exposed, unfortunately at the expense of many of us. Keep your crypto in a non-custodial wallet until the dust settles.

The crypto markets have been greenfield for scammers. Hiding behind ideals like publicly-auditable blockchain and decentralization, what we’ve instead found is bad actors cashing in on the public’s greed.

The first portion of this interview does an amazing job of breaking down crypto scams. It will help educate you.

Fundamentally, nearly all altcoins are securities and should be regulated as such. This is where scamming is most prevalent. In our Altcoin Fundamental Analysis post, we strongly recommend analyzing altcoins like companies with management (e.g. humans). This is entirely different than how you’d analyze Bitcoin.

Regulation

There will be tremendous demand to clearly regulate the crypto industry in 2023.

Expect clarity for altcoins and exchanges (reuters.com).

“What does that mean? It means more transparency, it means segregated client funds, the role of the broker as a broker-dealer will be overseeing and the exchanges will be separated from the brokers. The settlement and clearing will be separated from the exchanges.”

ICE Chief Executive Jeffrey Sprecher

More shakeouts may be on the way, with the global chief investment officer of the $285 billion asset management firm Guggenheim Global predicting additional crypto fallout following the FTX collapse (bloomberg.com).

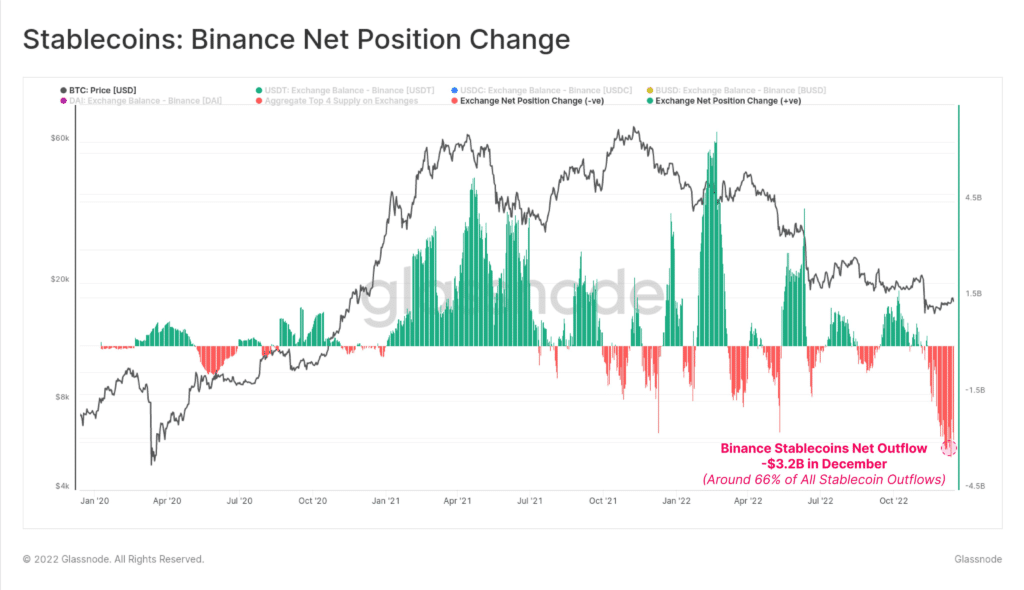

All eyes on Binance

The US Department of Justice is determining whether or not to charge Binance related to investigations that began in 2018 (reuters.com). The investigation is related to Binance’s compliance with anti-money laundering and sanction laws.

As you’ll see below, money has been flowing out of Binance at record rates.

Binance keeps its books closed, but undoubtedly a significant portion of its balance sheet is made up of its proprietary coins. The auditing firm, Mazars, was working to demonstrate “proof of reserves” for Binance, but suddenly ceased all work in the crypto space (ft.com),

Binance appears to be weathering the storm. But if this stress exposes issues or causes it to collapse, the repercussions to the crypto market could be unprecedented.

While it may be unlikely Binance will prove insolvent, it is still wise to move your crypto to a non-custodial wallet until the dust settles.

On-Chain Metrics

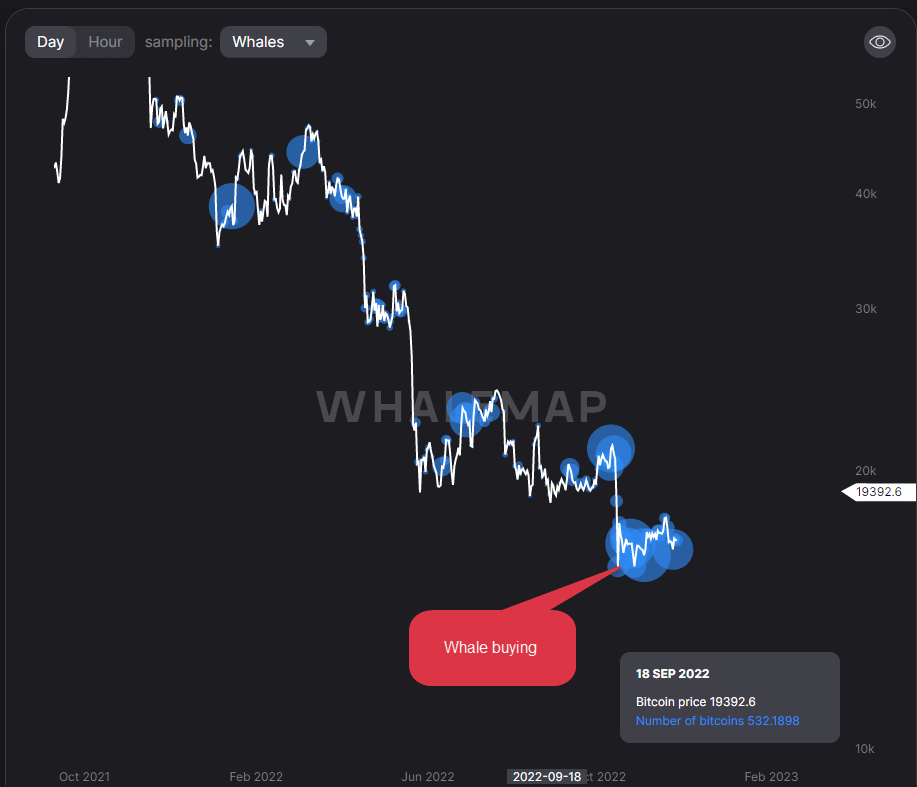

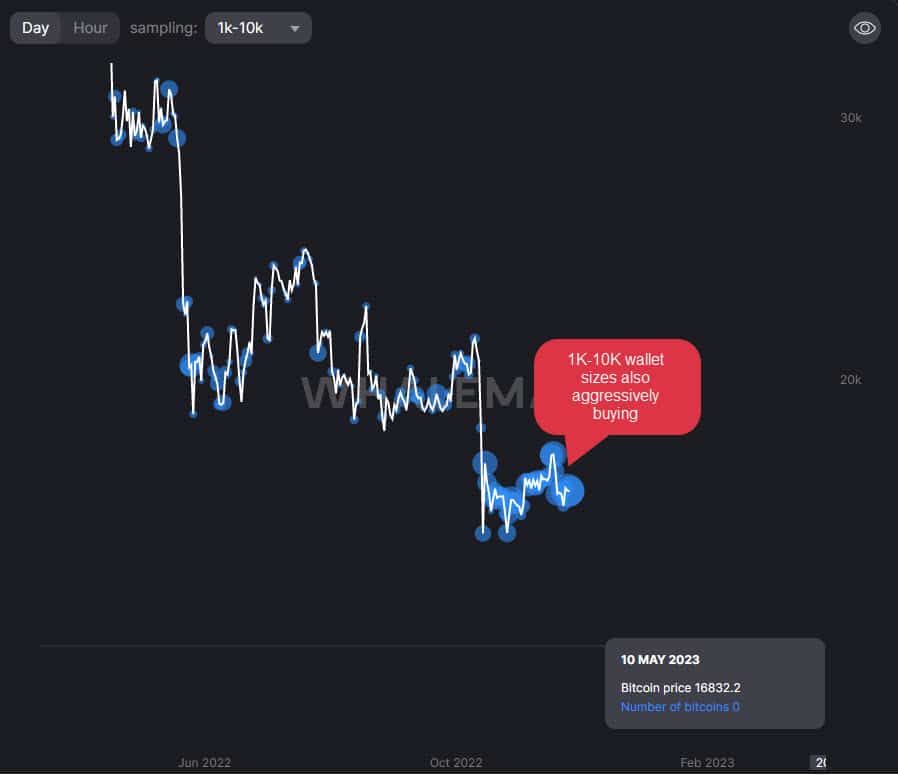

The big Bitcoin players are accumulating faster than at any time since this bear market started. This buying is propping up the market but may not be sustainable.

Glassnode showed $3,200,000,000 in stablecoins exited Binance in a 30-day period. This includes USDT, USDC, BUSD, and DAI.

Continuing to be the positive news, we have whales accumulating. They’re doing so at the highest rate in since the bear market started.

This indicates that even if prices break downward temporarily, whales are assuming this will be a good long-term entry price.

The next tier of holders (wallets with 1K to 10K Bitcoin) is buying aggressively at these levels too.

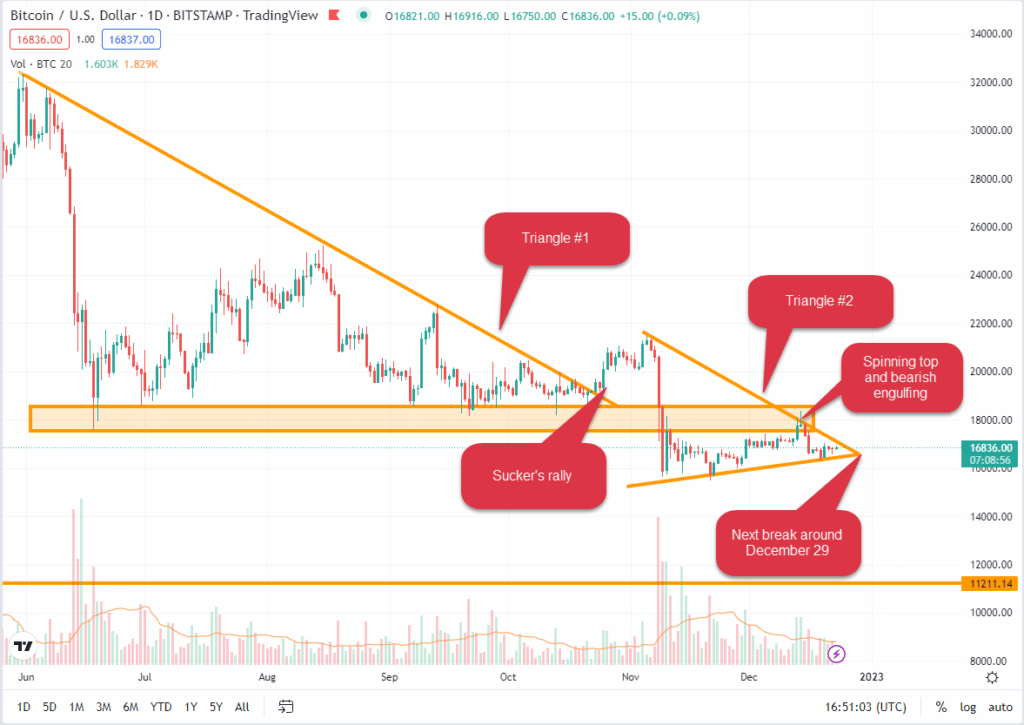

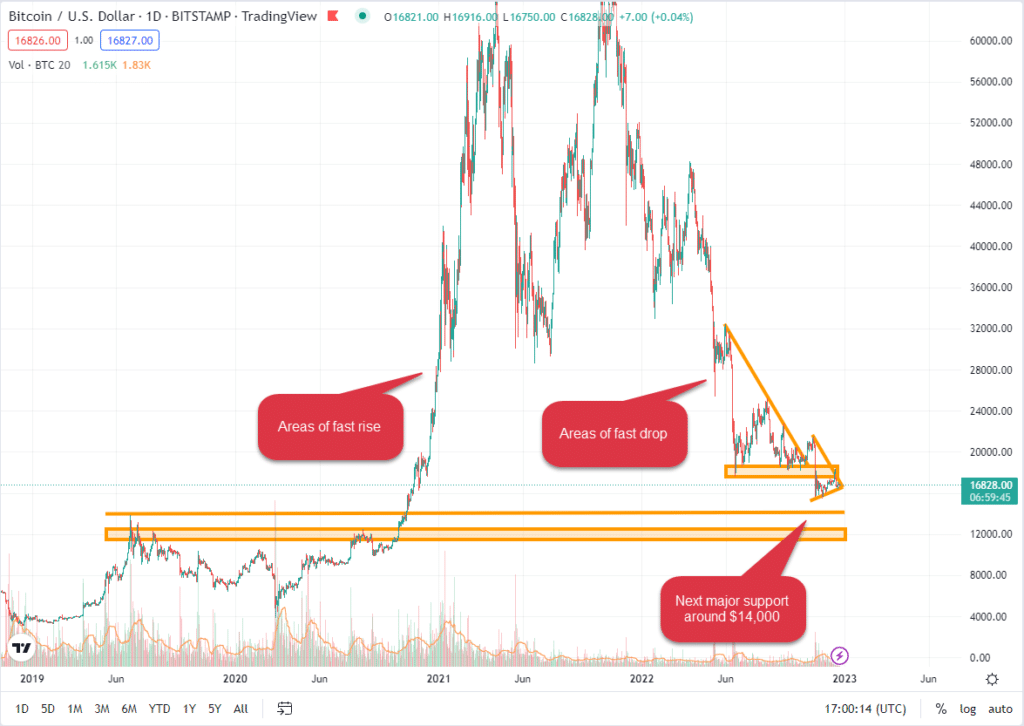

Technical Analysis

Looking at how behavior typically plays out in classic financial markets, we see an extremely bearish picture for Bitcoin. The next major move will like come around December 29.

Here’s a look at recent movements and patterns.

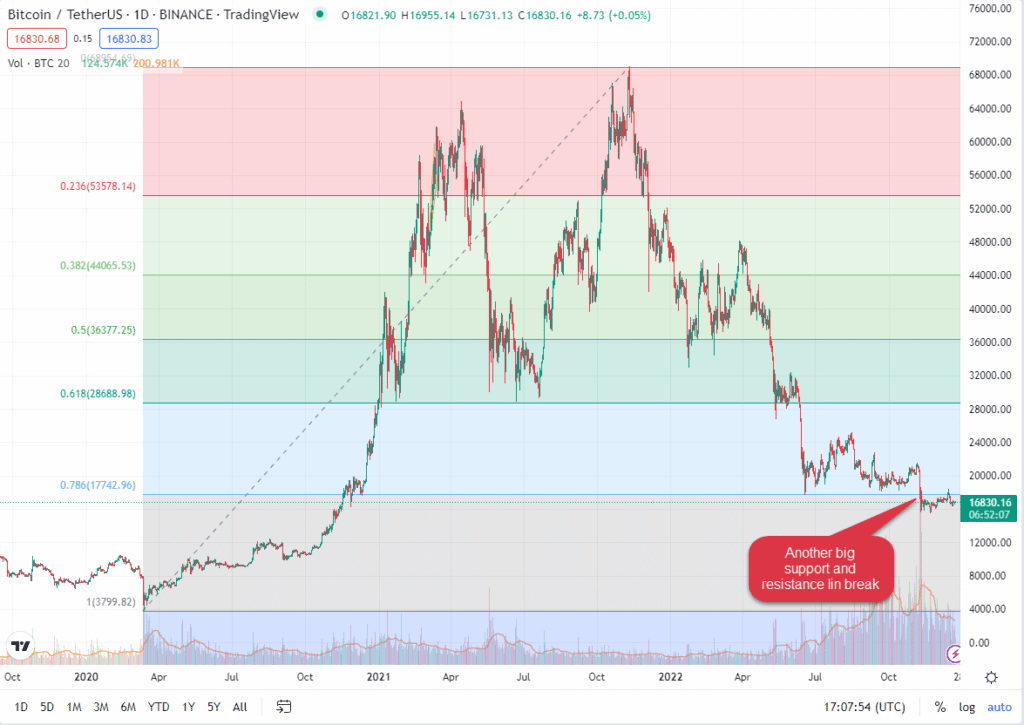

Bitcoin seems to obey support and resistance fairly well. If it has moved up rapidly through levels in the past, it moves back down through them rapidly too.

This may be a factor in the AI’s predictions.

As another view of support and resistance, Bitcoin has followed Fibonacci levels surprisingly well. Unfortunately, it went back into the bottom section in early November. We’re currently sitting at the top, which means there’s a long way to fall.

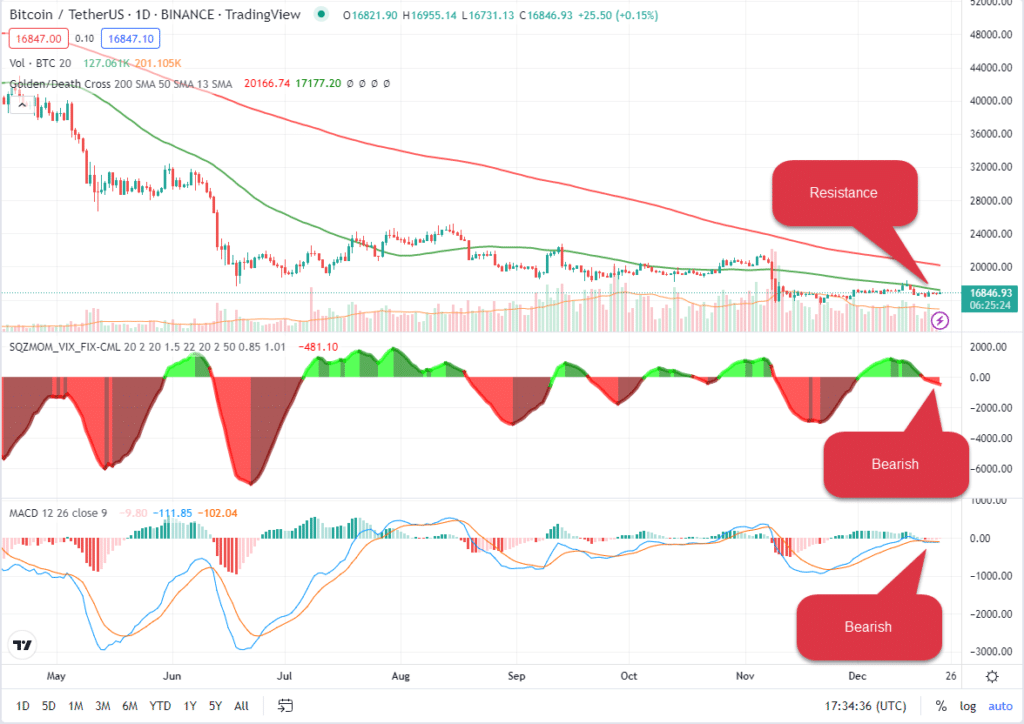

Momentum indicators also paint a bearish picture. The energy to maintain price is dropping and we are setting up for a new bearish wave.

Current Crypto-ML Portfolio

Here’s the monthly view of our portfolio.

- During earlier periods of Extreme Greed, we slowly exited about 30% of our crypto positions to stablecoins.

- Over the last few months (June through July mainly) during Extreme Fear, we deployed out of stablecoins fully into crypto.

- We are actively dollar-cost-averaging into crypto every month.

- We are continuously working to ensure each position earns interest.

That last point is important. We are not relying on appreciation alone. Earning interest also means our investments are buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

Stablecoins: 0% (flat)

- This balance has been completely phased out during “Extreme Fear.” It originally consisted of profits that were booked during “Extreme Greed.”

BTC: 40% (flat)

- Long-term hold

- Investing bi-weekly

BNB: 42% (flat)

- Initiated unstaking in order to move off exchange.

- May sell while the dust settles to avoid losing this balance.

ETH: 15% (flat)

- Earning interest through staking

- Long-term hold

Other: <3%

- This group consists of 17 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Putting It All Together

Bitcoin is proving it can survive harsh industry and economic conditions. We are in a massive time of fear, which is the classic time to buy.

However, we may not recover for a year or more. And you need to prepare for a recession and possible loss of income.

With that in mind, our recommendations:

- Move your crypto to your own non-custodial wallet at least while the industry dust settles.

- Minimize expenses.

- Don’t try to time the bottom or go all in.

- Determine a budget and diversified savings and investing plan. Bitcoin is a subset of this plan.

- Automate monthly Bitcoin investing so that you stick to your plan.

We are currently using Swan Bitcoin to automate regular purchases of Bitcoin and automate transferring it to our non-custodial wallets.

Learn more about Swan Bitcoin.

Questions and Comments

Do you have thoughts, comments, or criticisms of this analysis? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.