Insider Newsletter 11: November 2022

Crypto has given bad actors a gray area in which they can lie, cheat, and obfuscate their actions, causing billions of dollars in damage. This is destroying the financial lives of regular people and tarnishing the public’s perception of the industry.

As this bear market continues to expose these scams, you can expect low-quality companies and coins to follow suit, fade out, and die.

But if anything, what we’re seeing now only reinforces the value proposition of Bitcoin. And there is already a flight to quality.

With all of this in mind, there are 4 clear actions you can take now. These will protect you and help you capitalize on losses.

We’ll focus on those actions, while also providing our standard coverage of the macroeconomy, our indicators, on-chain data, and technical analysis.

The Value Proposition of Bitcoin: Stronger Than Ever

Bitcoin’s core value proposition is it takes human influence out of money.

Bitcoin emerged around the financial crisis of 2008-2009, which has many similarities to what we’re seeing now in the crypto space.

To be clear, the crypto mess we’re seeing is related to bad people using alternate blockchain technology and blockchain-related services to scam, mislead, and commit fraud for their own benefit.

By creating their own tokens and hiding behind the complexities of blockchain, these people have been able to get away with scams at scale.

This causes many of us to lose money.

Thanks to guilt-by-association, Bitcoin has been dragged off its growth trajectory.

This is all compounded by the money printing of governments and the war in Ukraine.

But these three items get back to the core of what makes Bitcoin great. As a result, you still see Bitcoin maintaining significant value. It is poised to rebound once the macro conditions are correct and liquidity is able to reenter the market.

Bitcoin:

- Doesn’t have a CEO or management.

- Has a fixed supply.

- Cannot be changed.

This helps it be resilient to the unfortunate human side of greed, incompetence, and malintent.

Learn more on our University Post Why Bitcoin Has Value and a 1 Trillion Dollar Market Cap.

4 Moves to Make Now

You don’t need to feel like a victim of the crypto current market conditions. Here are four actions you can take to best protect yourself and capitalize on losses.

1. Move loser-to-loser for positioning and tax benefits

If you are holding low-quality altcoins at a loss, you should consider selling them and moving those funds into high-quality coins, namely Bitcoin.

Both high-quality and low-quality coins have dropped dramatically, which gives you an opportunity to rebalance and also realize a loss for taxes.

This is a very common practice of hedge funds and investment banks.

Be better positioned for the next bull market.

When you have a position that is sitting at a loss, you don’t want to sell at a low and then buy a different asset that is at a high.

For example, real estate has not dropped as much as tech stocks. You wouldn’t want to sell tech stocks to buy real estate now.

But, you can drop one loser and move into another loser you expect to rebound stronger and faster.

Gain the tax advantage.

Not only will you be better positioned once the market reenters a bull phase, but you’ll gain a significant tax advantage.

When you realize a loss (sell), you can generally offset income tax by the amount of the loss.

For more, see our University Post Crypto Taxes: Why, Risks, and How.

Don’t limit to crypto losers.

You can swap loser-to-loser between asset classes and gain the same benefits.

If you are holding a 90% loss in Meta (Facebook) and believe Bitcoin will bounce back sooner and stronger, you can consider selling Meta to buy Bitcoin. You’ll also get the same tax write-off.

2. Move your coins to self custody

If you haven’t yet moved your coins to a self-custodial wallet, you really need to consider doing so now. The events in the crypto industry are going to put continued pressure on centralized firms. This cycle will expose more shady practices and bad actors.

Shop the Official Ledger store on Amazon

For more, see our University Post Non-Custodial Wallet Pros and Cons.

3. Dollar-cost-average

During times of panic, you want to invest regularly in high-quality assets. But, as we’ve repeated, don’t try to time the bottom. Instead, invest what you can afford and only as part of your larger, diversified, plan.

We are currently using Swan Bitcoin to automate regular purchases of Bitcoin and automate transferring it to our non-custodial wallets.

Learn more about Swan Bitcoin.

4. Stake via self custody

Earning interest is still a critical component of investing in crypto. You simply must put in the effort to earn on your holdings. Holding is not enough. Earning multiplies your investment over time.

Centralized businesses have unfortunately been taking excessive risks with customer funds in order to provide their returns.

The good news is you can still get solid returns under your own control. The best way to do this is to stake with your Ledger.

See our University Posts and Videos:

- How to Stake With a Ledger to Earn Crypto

- How to Stake Ethereum on Ledger (different approach from above)

Crypto-ML Data

Bitcoin has broken two major points of support. But sentiment-wise, it seems to be handling the crypto industry struggles quite well.

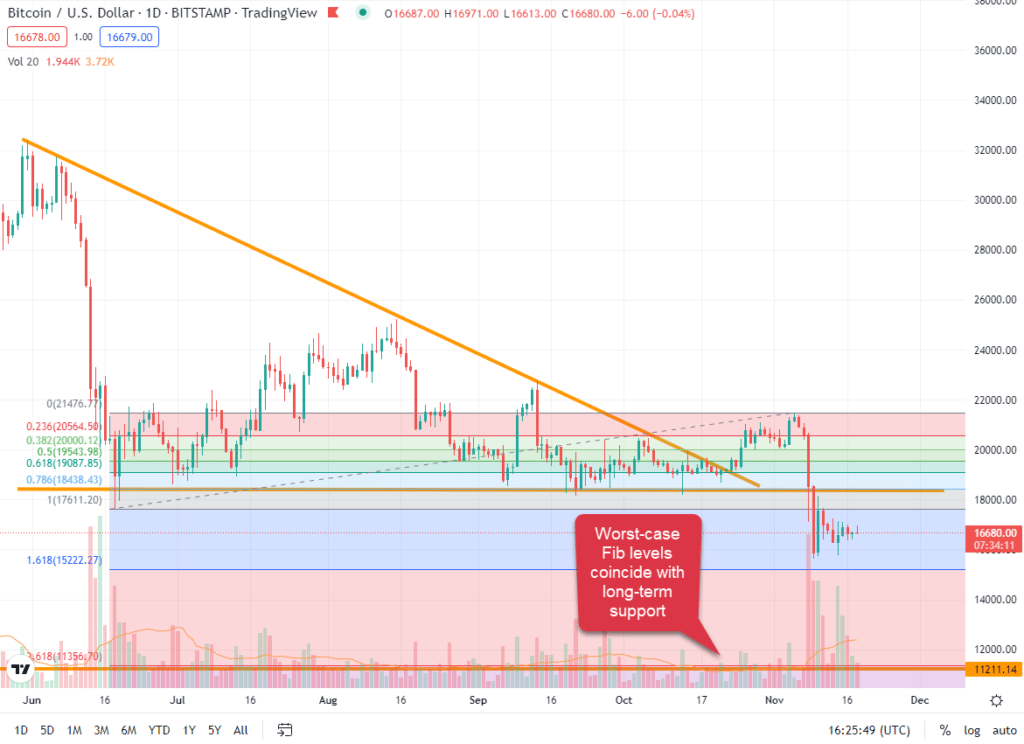

Price Channels

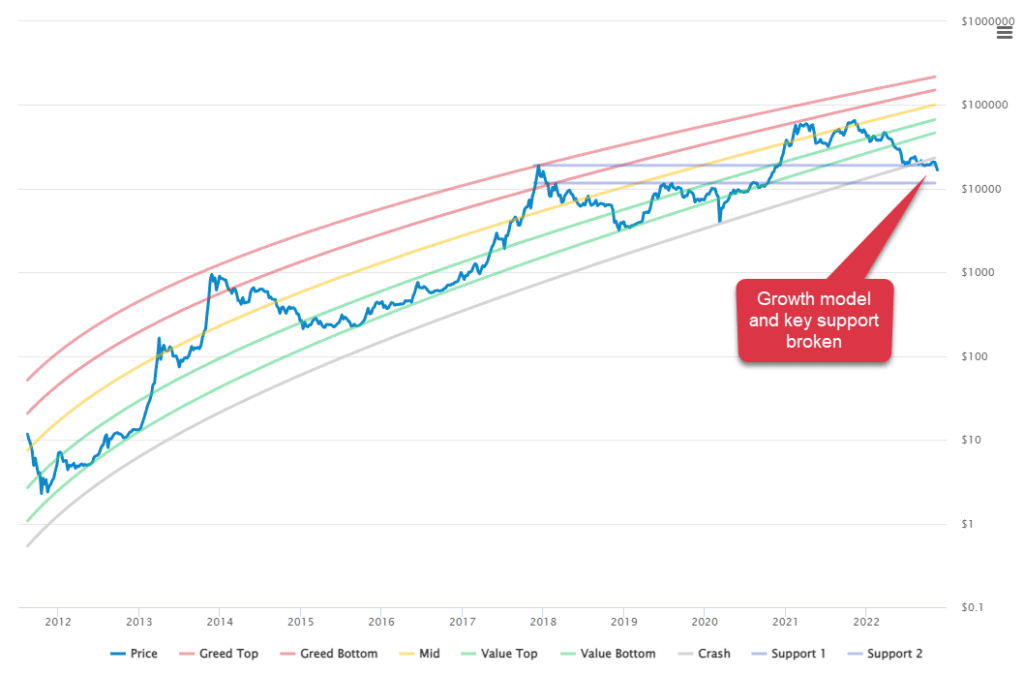

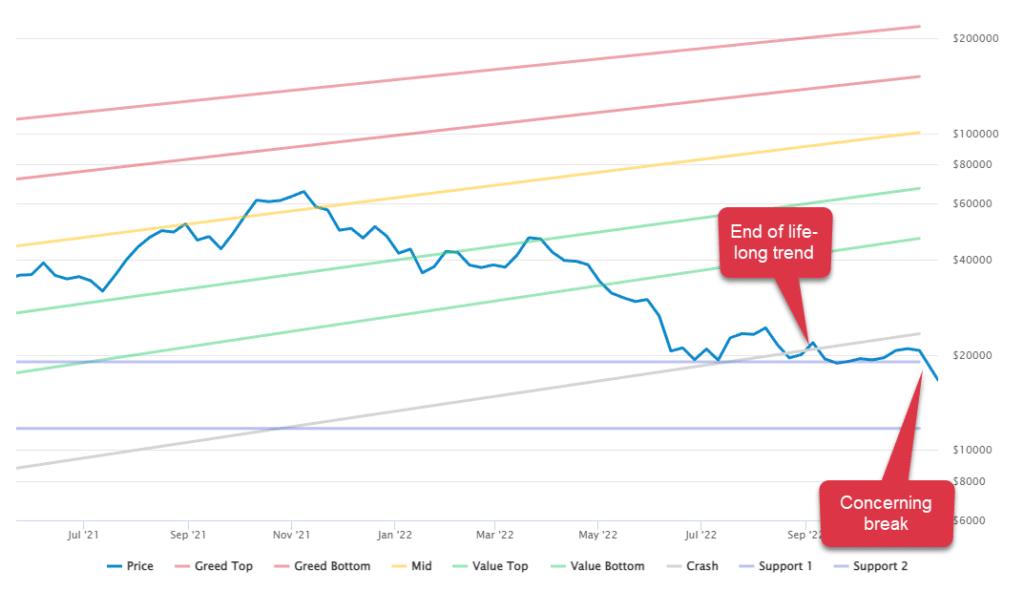

The Crypto-ML Price Channels use a regression model to plot the long-term growth pattern of Bitcoin. Like other models (that haven’t been continuously modified to fit), our price channels were breached mid-year.

Rather than modifying the model, we’ll monitor to see where Bitcoin will potentially snap back to once macro conditions improve.

Since the August breach, we’ve monitored two key support lines: $19,000 and $11,700. On the logarithmic scale, these are critical points.

The first line broke on the FTX news.

This suggests the next stop is $11,700 if we see another major negative event or economic double-dip. This level also regularly appears in other forms of analysis, which we’ll cover below.

Market Index

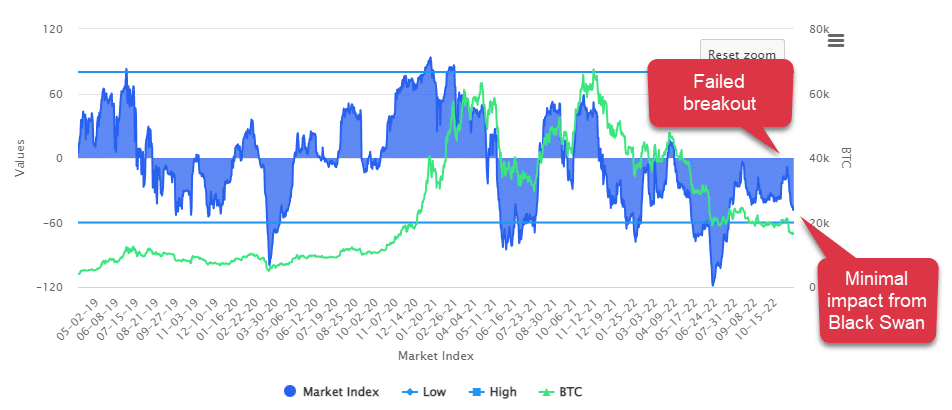

The Crypto-ML Market Index is much more bullish. Sentiment nearly turned bullish in early November, but the breakout failed on the FTX news.

Surprisingly, though, sentiment did not drop to an extreme level. As of now, the Market Index is -45. Moving below -60 would be considered extreme.

Though these sustained negative numbers seem bad, the reality is the Bitcoin community appears to only be flinching at the negativity surrounding the broader crypto space.

As we said above, the current situation only amplifies the need for Bitcoin. As more people become aware of its value proposition and how it differs from other cryptos, we can expect to see it diverge more and more from other assets.

Macroeconomy

We have targeted the end of 2023 as the likely point of economic turnaround, but the reality is we may hit a market bottom anywhere between now and the end of next year.

Inflation and recession

We’ve previously looked at nearly all recessions lasting two years.

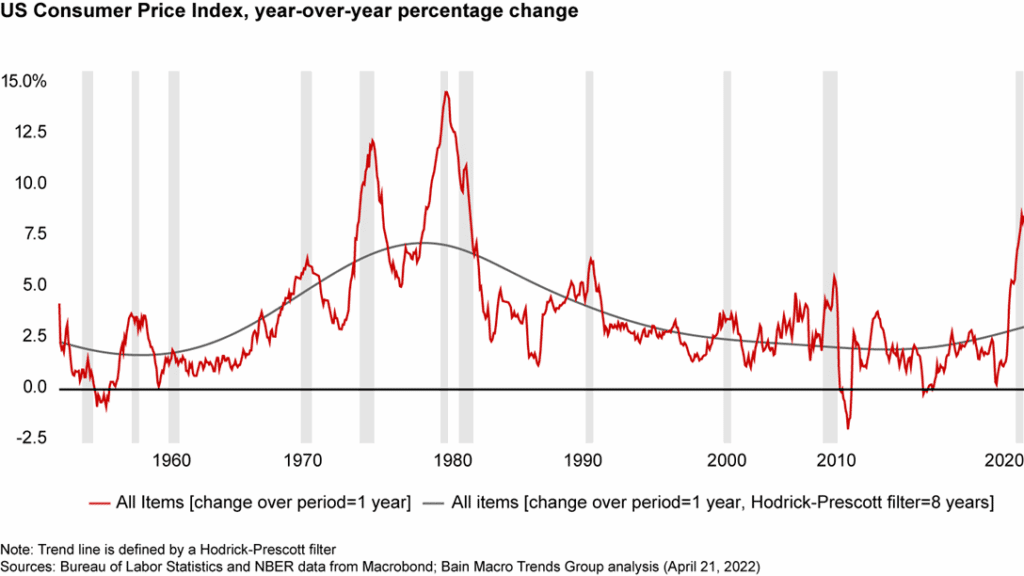

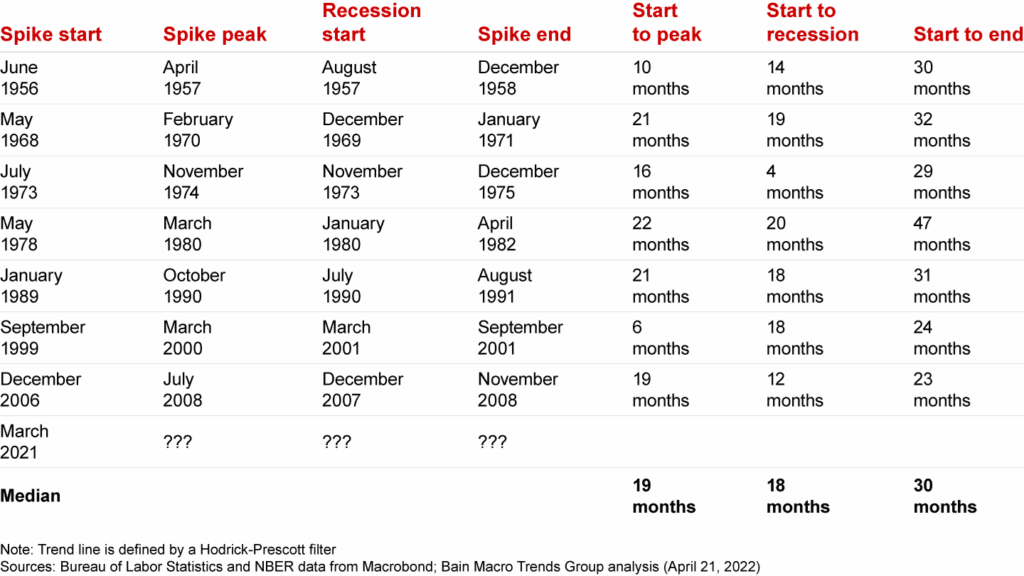

Another way to arrive at this is to analyze inflation spikes. This approach shows that we typically see a 30-month period from the start of an inflation spike to the end of the recession.

When inflation spikes, liquidity is literally sucked out of the markets.

Not surprisingly, this approach also puts our return to normal at the end of 2023, with the 30-month mark hitting in September of 2023.

This reinforces the data and information we’ve been providing in previous Insider Newsletters.

Economic headwinds

In addition to inflation, we have the following macro considerations:

- As the dollar value goes up, developing countries struggle to pay their debt.

- China is facing a housing crisis but has more than 3x the exposure of what the US had in 2008.

- Europe is facing an energy crisis and war.

- The US printed $3 trillion in 2020, but that created closer to $31 trillion in the financial system due to leverage and derivatives. That is higher than the $23 trillion GDP, which creates massive weakness and risk.

These are big, slow problems to unwind. However, if foundational progress is made on these, especially if faster than expected, we will see a rebound.

The business world is continuing to be impacted and take more defensive measures:

- ‘We will see spectacular failures’: CEOs and investors on what the end of cheap money means for tech (CNBC)

- Amazon CEO Andy Jassy says layoffs will continue into next year (CNBC)

- Target earnings miss by a mile amid ‘significant change in consumer shopping patterns’ (Yahoo Finance)

- Jeff Bezos’ top tips for managing the economic downturn (CNN)

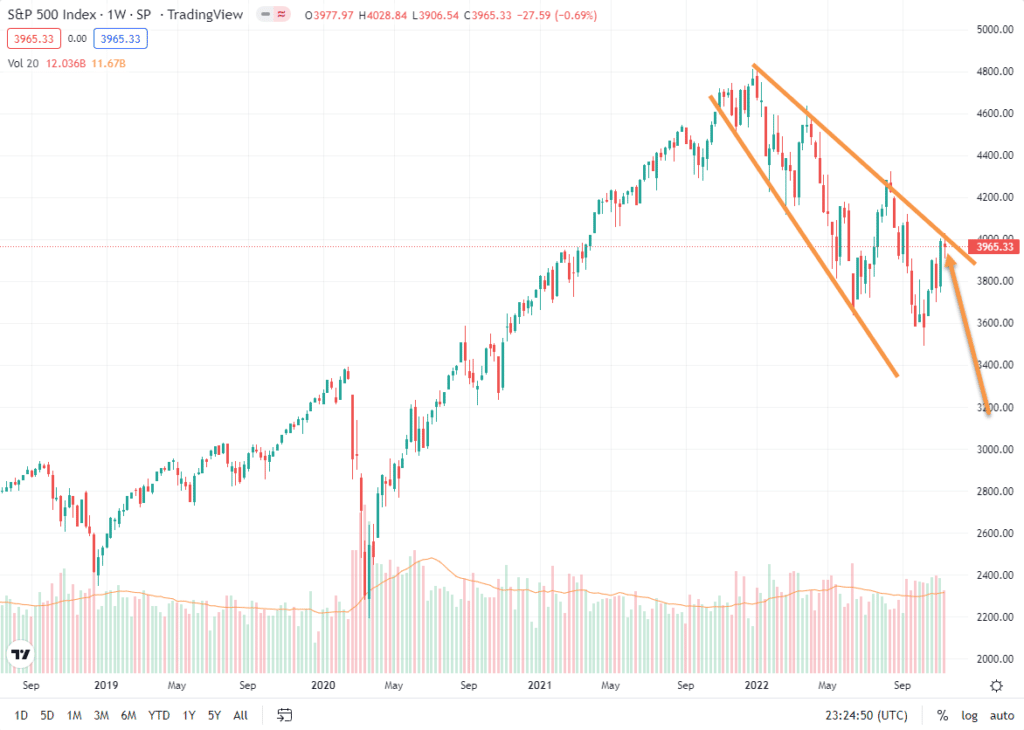

While the S&P 500 has shown a fair rebound, it’s possible we’re seeing a sucker’s rally right now. There is an indecisive candle sitting at significant resistance.

This all matters for crypto because until the larger economy resolves itself, there will not be enough liquidity available for people to invest in Bitcoin and other cryptos.

Take advantage by stacking what you can before liquidity rushes back into the markets.

Crypto News

Using crypto to obfuscate actions, tokens to inflate balance sheets, and loose regulation seems to be the common set of actions across these bad actors in the centralized space.

The FTX disaster has been covered extensively, so we won’t go into exhaustive detail here. But we once again have a human acting out of greed and incompetence, which will result in the loss of billions of dollars and financial ruin for everyday people.

To be clear, bad actors with malintent are at fault. The “mistakes” they made were getting caught.

- Alameda, FTX Executives Are Said to Have Known FTX Was Using Customer Funds (Wall Street Journal)

- SBF built bespoke ‘backdoor’ to outwit FTX compliance systems (Reuters, The Block)

Expect continued pressure on other exchanges, even legitimate ones. It will be hard for crypto companies to operate profitably during this economic downturn and negative environment.

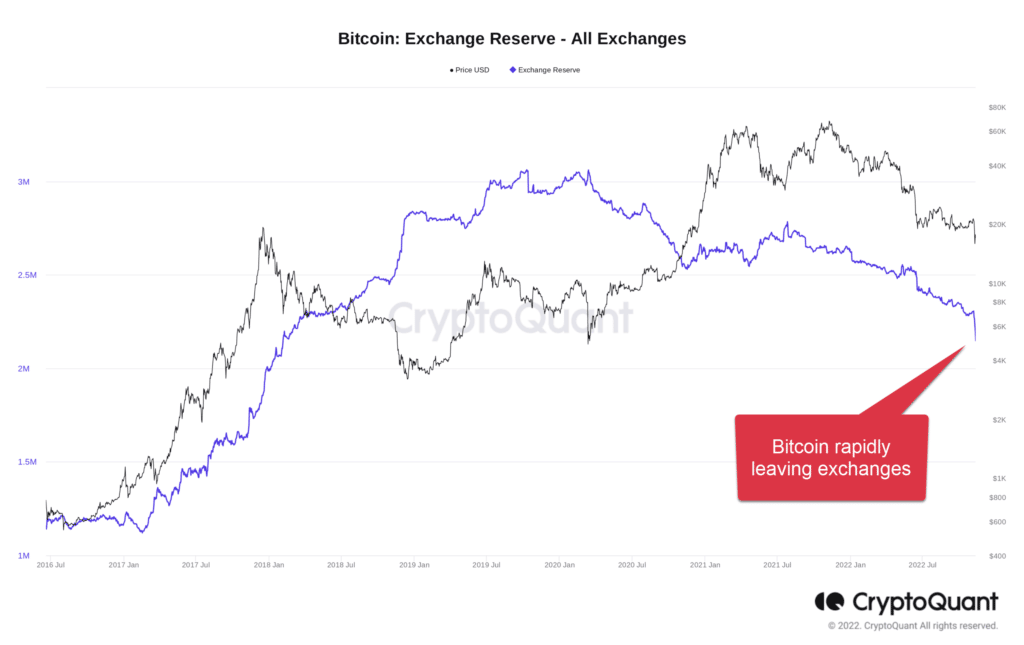

- Crypto Is Flowing Out of Exchanges: ‘Severe’ Outflows From Gemini, OKX and Crypto.com, Says JP Morgan (Decrypto.co)

- CZ (Binance) also hints at problems with other exchanges. If it wasn’t clear yet, get your crypto off of exchanges! (Reddit)

Despite all of this, Bitcoin appears to be largely shrugging off this news.

That said, ultimately, we need companies in the crypto space. Even centralized ones. Countries like the United States should seek to be innovation hubs. They should provide a progressive, clear, regulatory framework that allows for great companies and systems to be built while minimizing risk.

Trust yourself. While this gets sorted out, you need to be extremely cautious and consider our four recommendations above.

On-Chain Metrics

Holders are holding and moving off of centralized exchanges. Traders and other temporary money is staying away.

Unsurprisingly, Bitcoin is moving off-exchange at a record rate.

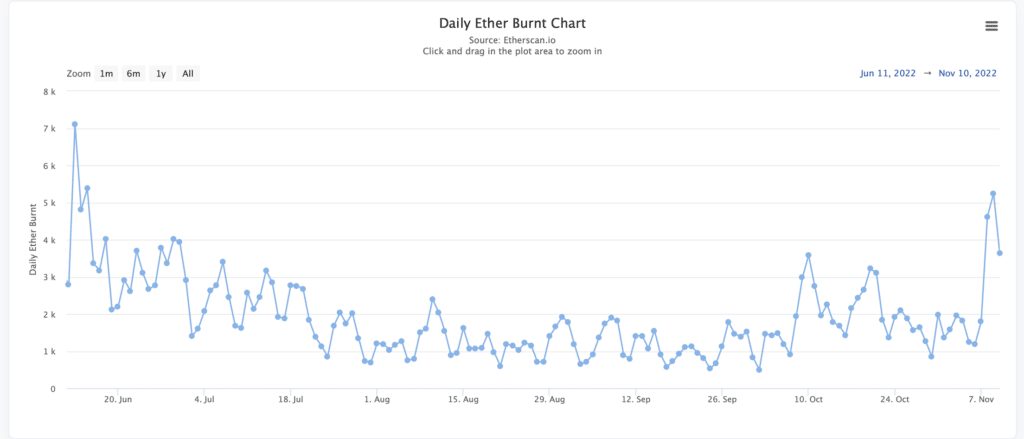

Ethereum has become deflationary for the first time since the Merge, with burn exceeding supply. This is good for long-term value and is helping drive staking rewards that have hit upward of 25%!

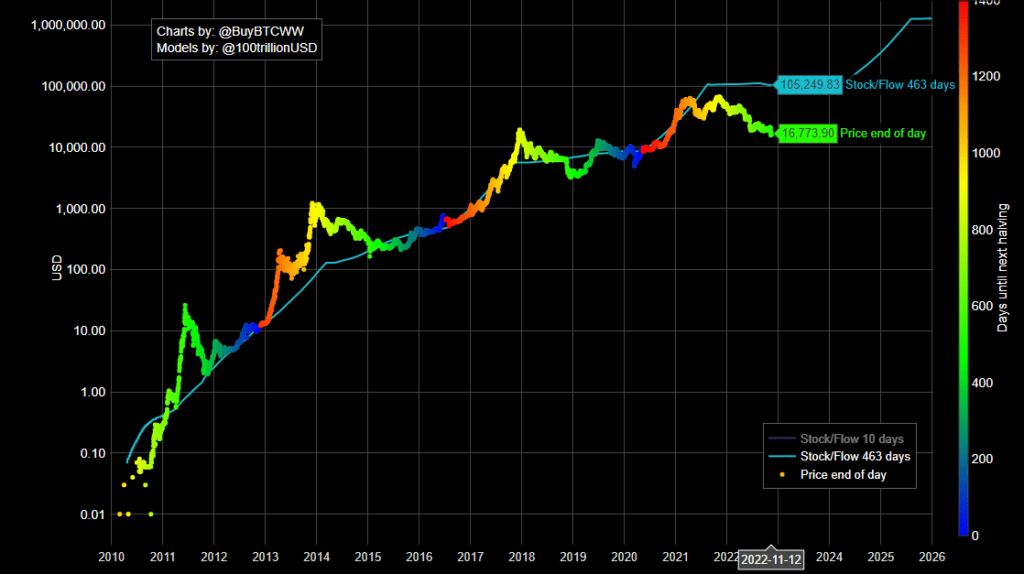

Bitcoin stock-to-flow is seeing by far the highest separation from the predicted value, currently 6.3x lower than expected.

Like other growth models, this could mean the historic growth trends have ended. Or it could mean we’ll see a rapid rise back to target once the macro issues resolve.

Technical Analysis

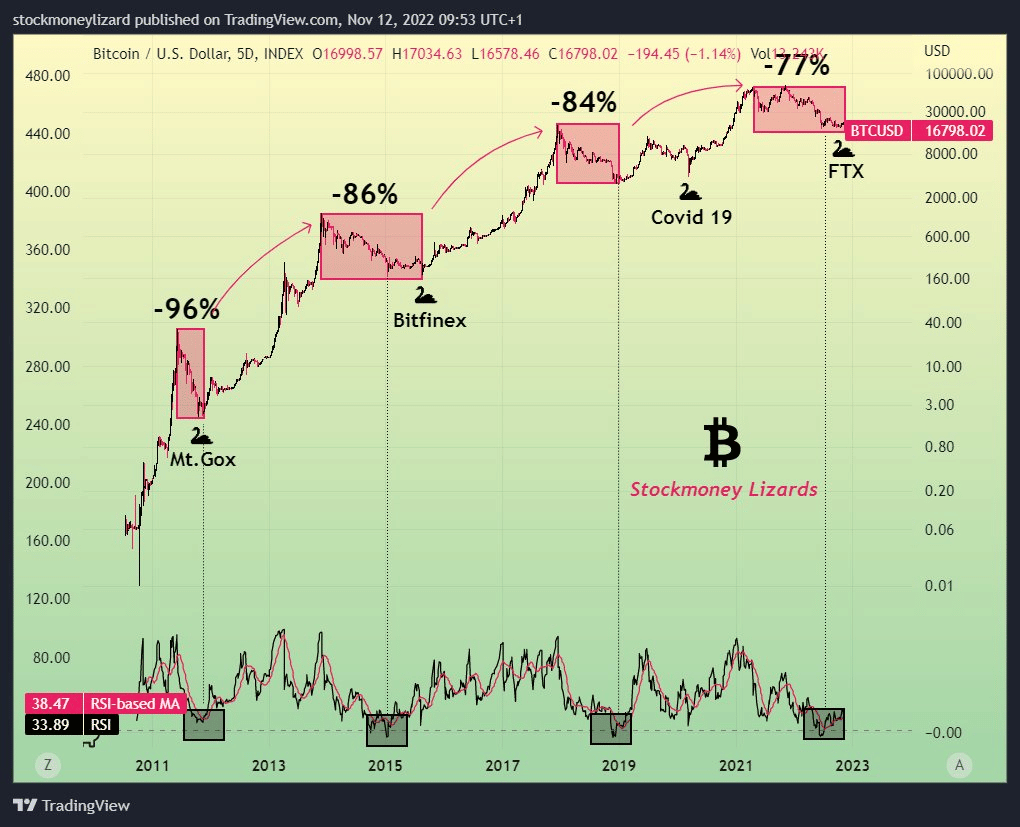

Overall, it appears we’re near a bottom but we continue to track $11,000 as a worst-case.

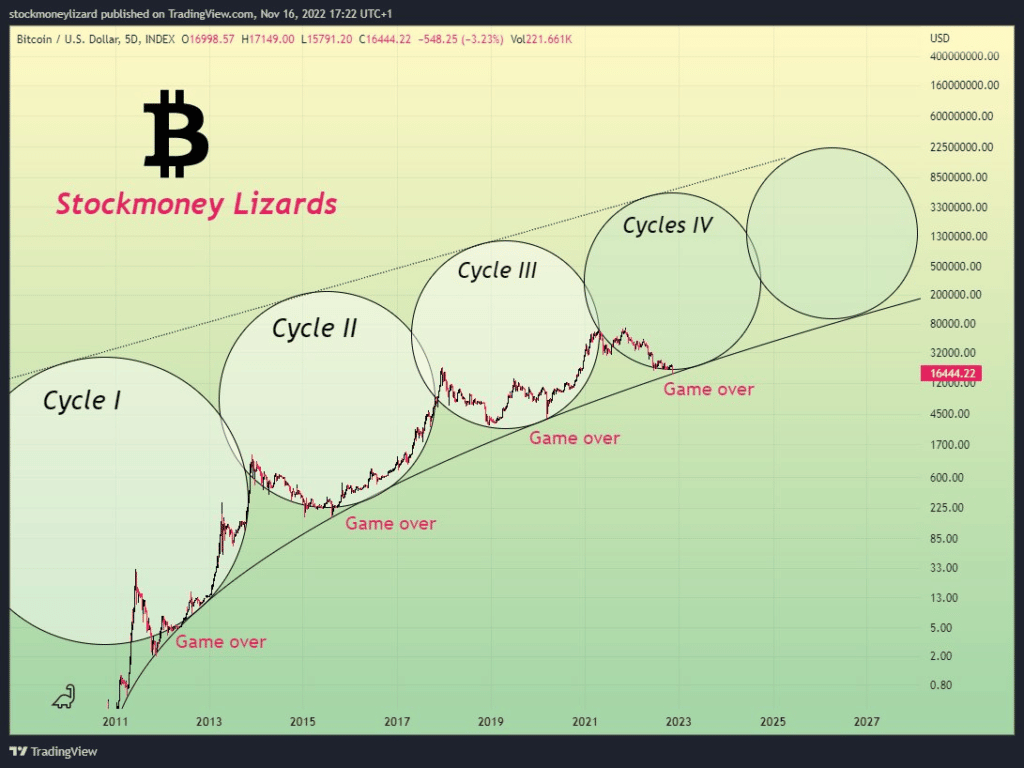

Growth cycle models have largely been revised to keep Bitcoin on track. Given all of the bad news and economic issues, it’s hard to argue that we aren’t in a “game over” or despair portion of the cycle.

It is reasonable to expect that once these issues subside, we’ll see a sharp rebound.

If this is the case, now is the time to accumulate.

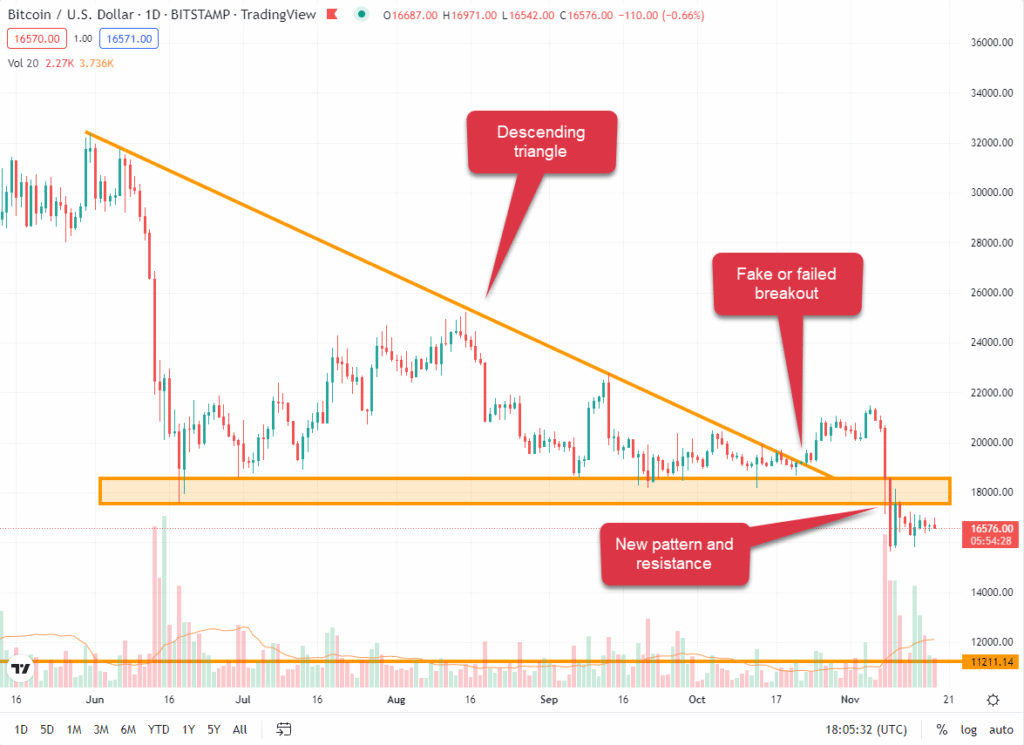

In terms of larger patterns, we watched the formation of a classic descending triangle. These typically break down.

This one appeared to break bullish mid-October, but ultimately that failed and price has now dropped back below.

The support level around $11,200 continues to appear as a worst-case support level. We may already be at a bottom, but be prepared mentally for Bitcoin to shake down into full despair. If you are accumulating now, consider that an opportunity to stack at even better levels.

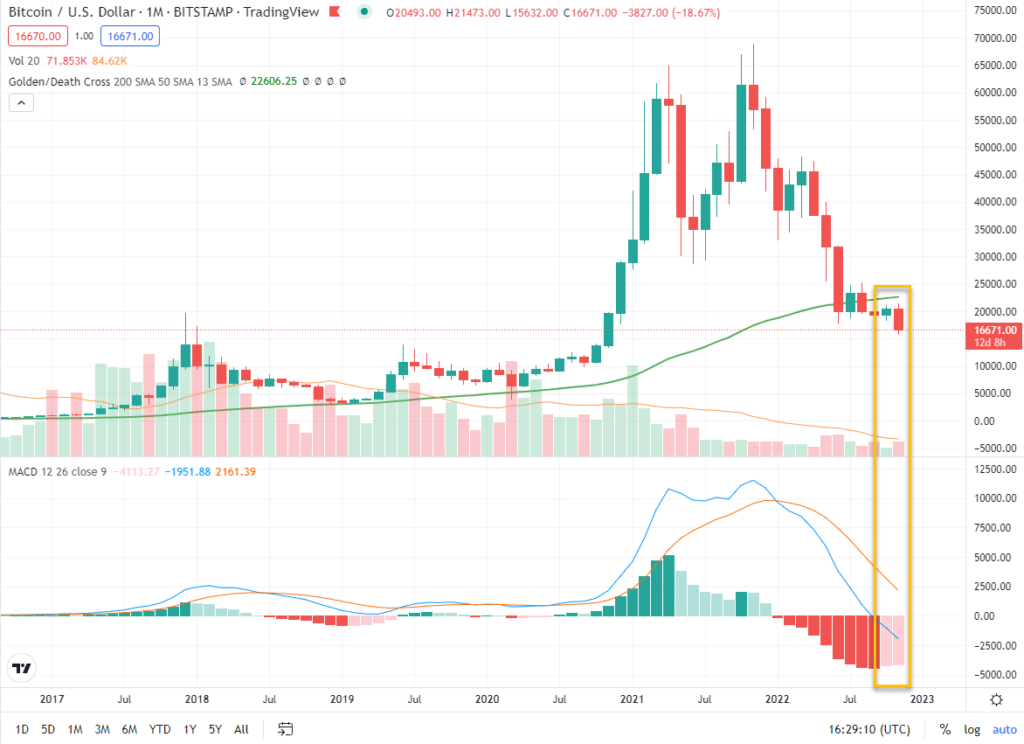

Zooming out, we see that $11,000 level as a heavy area of support and resistance, requiring significant volume to break.

On the positive side, we have the monthly MACD, which we reported on last month. Every time MACD turned light red in Bitcoin’s history, it marked the bottom of a bear trend.

This suggests November will actually close with a green candle, likely above $20,000.

Of course, this bear market seems to be breaking most past patterns, so we have yet to see.

Current Crypto-ML Portfolio

Here’s the monthly view of our portfolio.

- During earlier periods of Extreme Greed, we slowly exited about 30% of our crypto positions to stablecoins.

- Over the last few months (June through July mainly) during Extreme Fear, we deployed out of stablecoins fully into crypto.

- We are actively dollar-cost-averaging into crypto every month.

- We are continuously working to ensure each position earns interest.

That last point is important. We are not relying on appreciation alone. Earning interest also means our investments are buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

Stablecoins: 0% (flat)

- This balance has been completely phased out during “Extreme Fear.” It originally consisted of profits that were booked during “Extreme Greed.”

BTC: 40% (flat)

- Long-term hold

- Investing bi-weekly

BNB: 42% (flat)

- Earning interest through staking.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences.

ETH: 15% (flat)

- Earning interest through staking

- Long-term hold

Other: <3%

- This group consists of 17 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Putting It All Together

We continue to face serious headwinds. Until these conditions begin to improve, we won’t see liquidity available to return to the markets. Expect that to be toward the end of 2023, but no one knows for sure.

But once liquidity comes back, expect a sharp and fast rise in quality assets.

To avoid missing it, consider the four actions we mentioned at the start.

Questions and Comments

Do you have thoughts, comments, or criticisms of this analysis? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.