Insider Newsletter 15: March 2023

Economic challenges and systemic risks. Crypto exchange and traditional bank collapse. Regulation crackdown. Yet Bitcoin is up 70% for 2023. What does that mean for Bitcoin as an asset and how should we position ourselves now?

Actions We’re Taking

Since actions speak louder than words, here are our current actions:

- Continuing to dollar-cost-average into BTC.

- Staying prepared to invest lump sums into BTC if the market takes another leg down.

- Keeping all funds off exchanges.

We bought continuously and aggressively during the second half of 2022, so we’re also ready to sit back and enjoy the ride-up if the market does go on a run. Our Market Index helped us invest while others were fearful.

If the market stagnates or drops, we’ll continue to buy more. In the meantime, we’re dollar-cost averaging into Bitcoin at a moderate pace.

Crypto-ML Data

Our indicators show bullish momentum and a run to $30,000 by late April is probable.

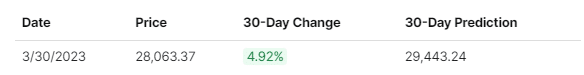

30-Day Price Prediction

Our predictions have been calling for Bitcoin to hit the $30K level in late April.

The predictions have consistently targeted that level for the last 12 days. As Bitcoin has gone up in value, the predictions have softened down to what you see above. $30K will undoubtedly be a psychological level and area of support and resistance. This seems like a reasonable target.

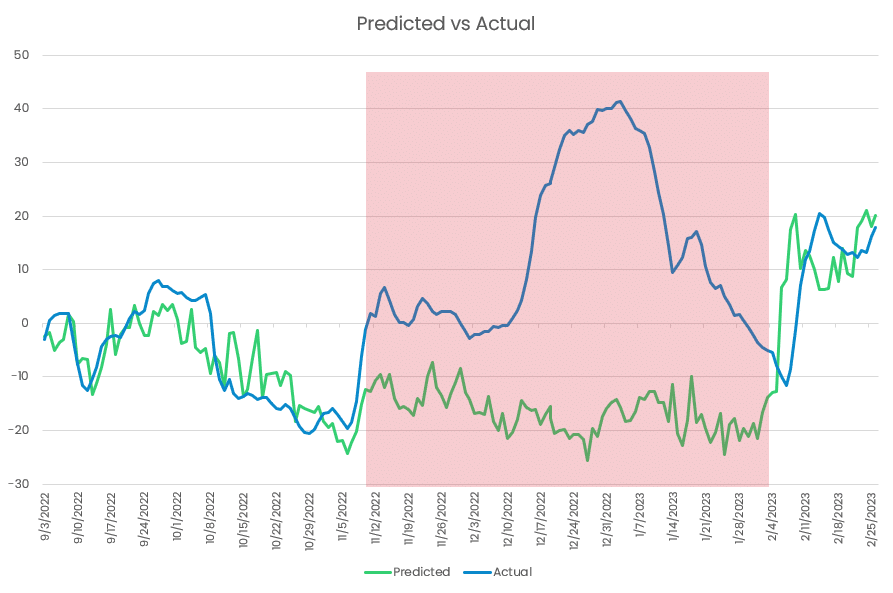

Starting in November, we began noticing a divergence in predicted versus actual changes for Bitcoin, as you’ll see in the red section below.

Ultimately, we discovered the interest rate values from our data provider were reported incorrectly, which caused the issue. We switched to a different data provider in January and have since seen the predictions for February forward track against reality much better.

While this looks like a long window, it takes 30 days to validate predictions. It also took time to then diagnose the problem, identify the root cause, and switch data providers. We now have new validation processes in place, but even subtle issues with the underlying data can cause significant changes in predictions.

Regardless, predictions are back on track.

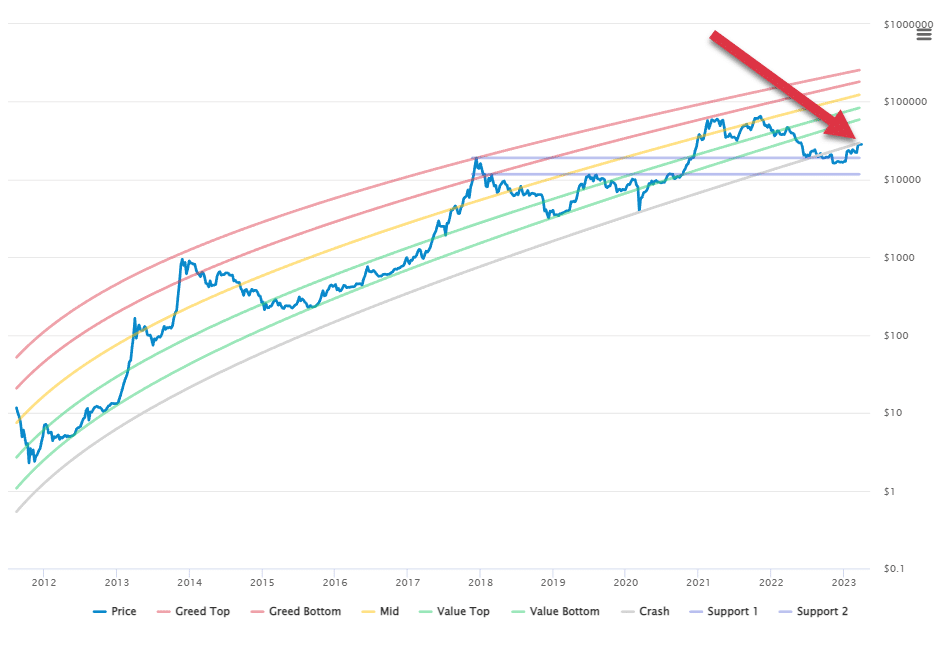

Price Channels

The Crypto-ML Price Channels use a regression model to plot the long-term growth pattern of Bitcoin.

It appears Bitcoin is on track to re-enter its growth model. We may look back at this in history and realize it took a massive economic slowdown and the brink of recession to shake Bitcoin out of its path.

If this holds, Bitcoin is still in an ideal zone for long-term accumulation.

However, we’ll continue to monitor this year. If we find Bitcoin is no longer tracking in this regression growth model, it will have significant implications for Bitcoin’s state of maturity and potential upside.

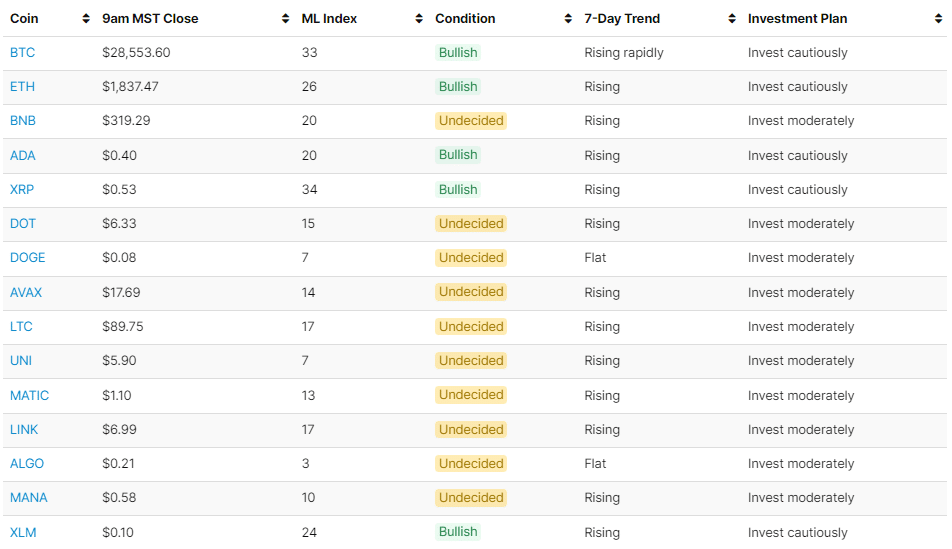

Market Index

Our Market Index looks at technical indicators and also social and search sentiment to determine overbought and oversold zones.

It helps you invest when others are fearful and then take profit when others are greedy.

With it, we see the market is in neither fear nor greed. It’s in somewhat of a middle point. Our action, in this case, is to continue our dollar-cost averaging at a measured pace.

If these values move to a state of Greed or Extreme Greed, it will be time for us to realize some profits and then reinvest those funds in the future. For now, we continue to invest moderately.

Commentary

Significant economic and regulatory hurdles will dampen crypto investment in the near term. Exercise caution and prioritize asset preservation, but consider investing available speculative cash in case Bitcoin continues its recovery, which will likely happen at a rapid pace once it starts.

Unfolding crypto news

The US is cracking down hard on the crypto industry, largely focused on altcoins and exchanges.

While some speculate on a conspiracy to kill the crypto industry, there may be a simpler explanation. Between failed exchanges and failing banks, it appears the SEC and others aren’t doing enough to protect consumers. It is, after all, their job to minimize these events. As such, it’s natural to step up and take a series of swift actions.

This puts pressure on exchanges and other crypto services. It also makes Bitcoin less attractive to the average person through guilt-by-association. Bad actors in the altcoin and exchange space get conflated with Bitcoin.

Many people have lost their crypto on an exchange that collapsed. With mounting pressure, don’t be one of them. Consider moving your crypto to your own non-custodial wallet at least while the dust settles.

The SEC has taken the following actions in recent weeks:

- Stated that all altcoins are securities, only Bitcoin is not

- Sued Kraken

- Issued warnings to Coinbase and stated plans to pursue enforcement actions

- Request additional funding to address the “Wild West of crypto markets which is rife with noncompliance”

For well-researched reading on this topic:

- Nasdaq.com: SEC’s Gensler Warns Crypto Investors, but Differentiates Bitcoin

- Time.com: The U.S. Crypto Crackdown Could Reshape the Industry

The CFTC has sued Binance and its CEO, CZ. The lawsuit stems from investigations that began in 2021. It mentions numerous significant issues:

- It concealed substantial ties to China for years, specifically instructing employees to hide its presence in China.

- Willfully ignoring registration and compliance laws.

- Hiding organization, ownership, and funds traceability through a maze of corporate entities.

- Intentionally allowed criminals on the platform by skirting anti-money laundering and KYC requirements.

- Violating derivative and trading rules, including trading against its customers. Consider that Binance staff members know user stop loss and target levels.

Read the news directly on the CFTC’s website: https://www.cftc.gov/PressRoom/PressReleases/8680-23. These are serious issues that may cause a global shock to the crypto space.

It’s possible the US is pushing too hard, but it’s tough to argue against the “wild west” statement. Hopefully, a sensible middle ground is established that protects consumers but still allows innovation to thrive.

Despite all of this, Bitcoin is largely shaking off the news and is holding its price.

Technical view

Rather than looking at technical indicators, we’ll focus on trends as well as support and resistance levels.

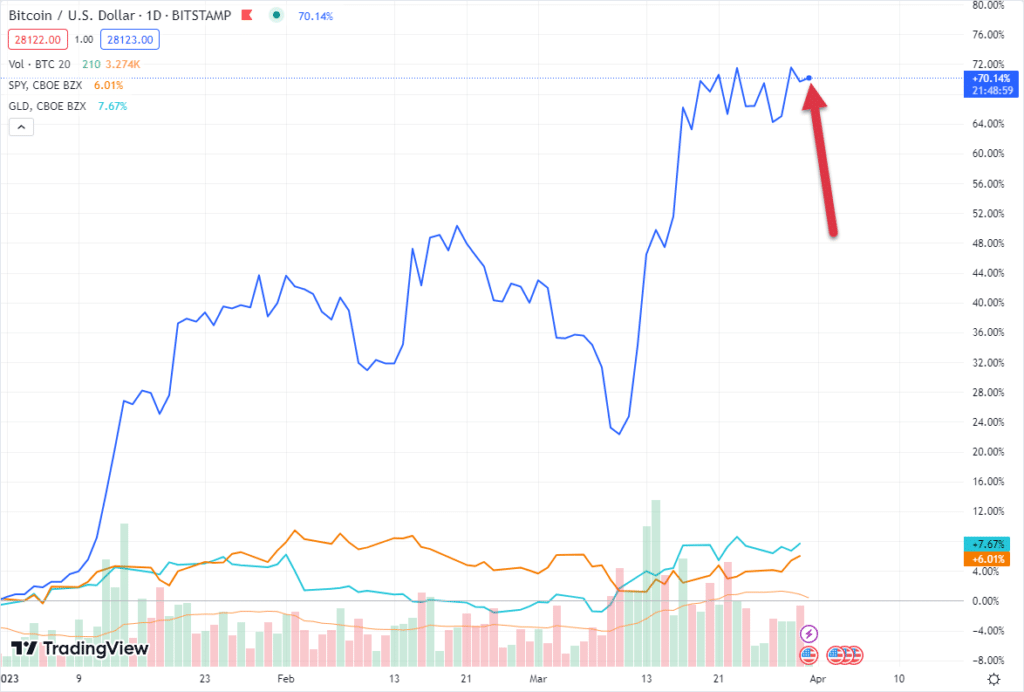

So far in 2023:

- Bitcoin is up 70%

- S&P 500 is up 6%

- Gold is up 7%

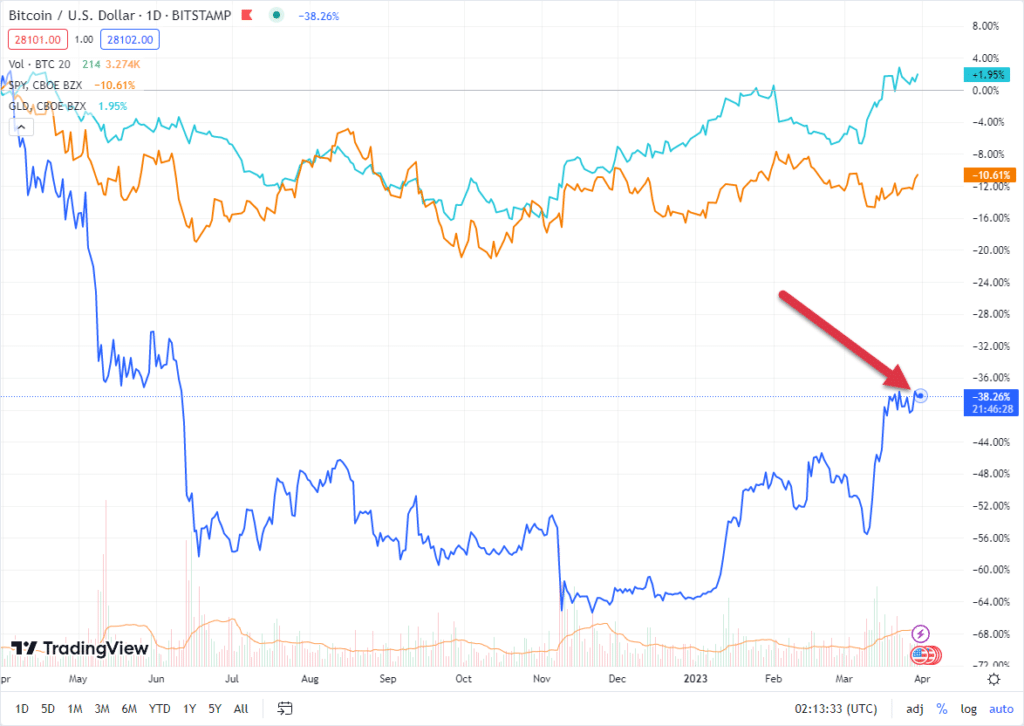

Looking year-over-year, though, it’s clear Bitcoin has not recovered as much as other assets.

Bitcoin tends to crash and recover sharply. This could be a bullish case for the rest of 2023. Bitcoin may have barely put together half of its recovery so far.

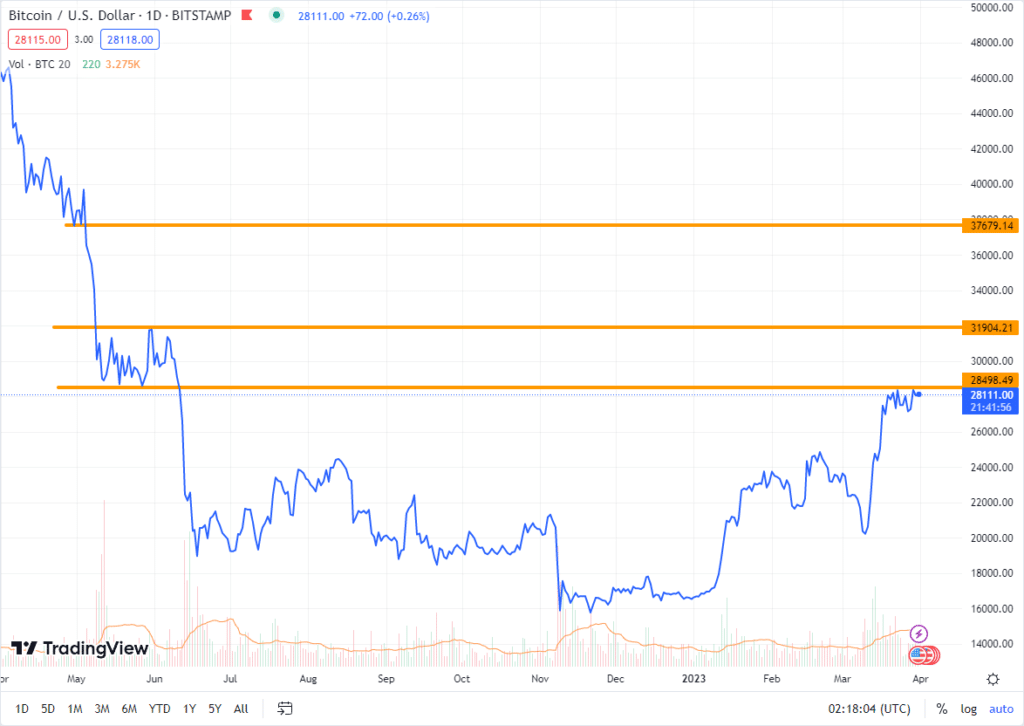

Looking at the next chart, we see the next major level up is at $31,900. That is where our AI is predicting Bitcoin will be in late April.

If Bitcoin breaks that level, there is virtually no resistance up to the $37,000 level.

If you zoom out even further, these levels hold significance all the way back to 2020.

Macroeconomic view

Looking at the broader, macroeconomic view, there is still considerable concern. When this is true, investors have less money to invest in crypto or any other asset. They specifically invest less in speculative assets.

As a result, macroeconomic instability will put downward pressure on the crypto markets, even if Bitcoin is technically a hedge against traditional monetary systems.

- Inflation still is not under target, causing the Fed to hike rates again in March.

- Rates are putting pressure on banks, causing Silicon Valley Bank to collapse.

- Layoffs in tech and finance are continuing, along with unemployment emerging in other sectors, such as healthcare.

- Commercial real estate is set to cause an unprecedented spike in loan defaults, impacting small and mid-sized banks.

- Substantial consumer credit risk continues to escalate, as individuals are saving less and racking up credit card balances at unprecedented speed, all while interest rates are climbing, making the debt less serviceable.

While the economic future can be debated, the one absolute is there is uncertainty. In times of uncertainty, people and institutions take less risk which puts pressure on crypto.

Putting It All Together

Bitcoin has done extremely well in 2023, but still hasn’t recovered as much as mainstream assets. It is largely treated as speculative. Once the macro and regulatory picture clear up, expect Bitcoin to rise rapidly.

Steps to consider:

- Watch our AI predictions as they appear to be tracking effectively.

- Move your crypto to your own non-custodial wallet at least while the industry dust settles.

- Minimize expenses.

- Determine a budget and diversified savings and investing plan. Bitcoin is a subset of this plan.

- Automate monthly Bitcoin investing so that you stick to your plan.

We are currently using Swan Bitcoin to automate regular purchases of Bitcoin and automate transferring it to our non-custodial wallets.

Learn more about Swan Bitcoin.

Current Crypto-ML Portfolio

Here’s the monthly view of our portfolio.

- During earlier periods of Extreme Greed, we slowly exited about 30% of our crypto positions to stablecoins.

- During Extreme Fear, we deployed out of stablecoins fully into crypto.

- We are actively dollar-cost-averaging into crypto every month.

- We have lump sums ready to deploy in case this is a bull trap and the market drops again.

- We are continuously working to ensure each position earns interest.

That last point is important. We are not relying on appreciation alone. Earning interest also means our investments are buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

Stablecoins: 0% (flat)

- This balance has been completely phased out during “Extreme Fear.” It originally consisted of profits that were booked during “Extreme Greed.”

BTC: 74% (+3%)

- Long-term hold

- Investing bi-weekly

ETH: 22% (-2%)

- Earning interest through staking

- Long-term hold

Other: 4% (-1%)

- This group consists of 17 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Questions and Comments

Do you have thoughts, comments, or criticisms of this analysis? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.