Insider Newsletter 2: February 2022

Thank you for being an Insider! In this month’s newsletter, we’ll walk through many data points, covering macro, technical, on-chain, and proprietary. We will assess current dynamics and attempt to determine if the market has bottomed out.

We will also show how to best use our tools to optimize entry points for long-term holdings.

Extreme Fear

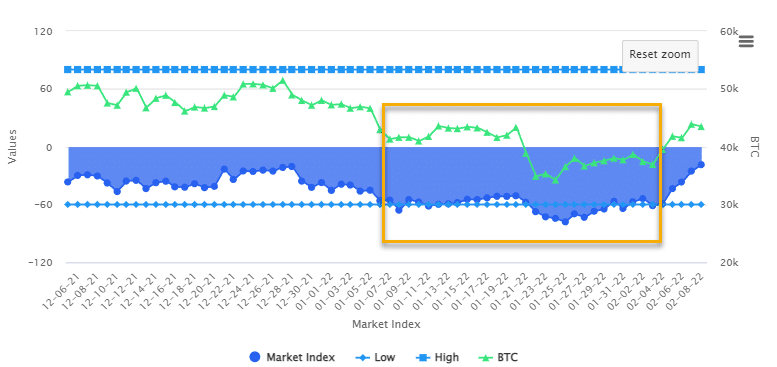

The Crypto-ML Fear and Greed Index for Bitcoin dipped below -60 into Extreme Fear on January 8 at $41,613.

It hit a low of -78 on January 25. The prior day, January 24, was this cycle’s low for Bitcoin (so far), at $32,951.

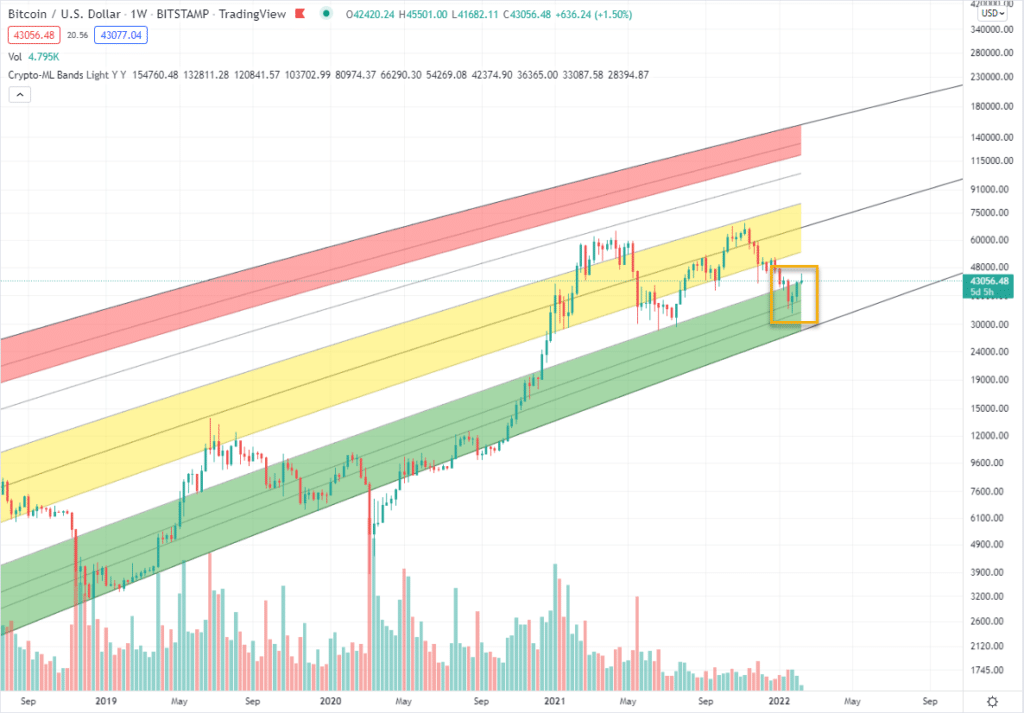

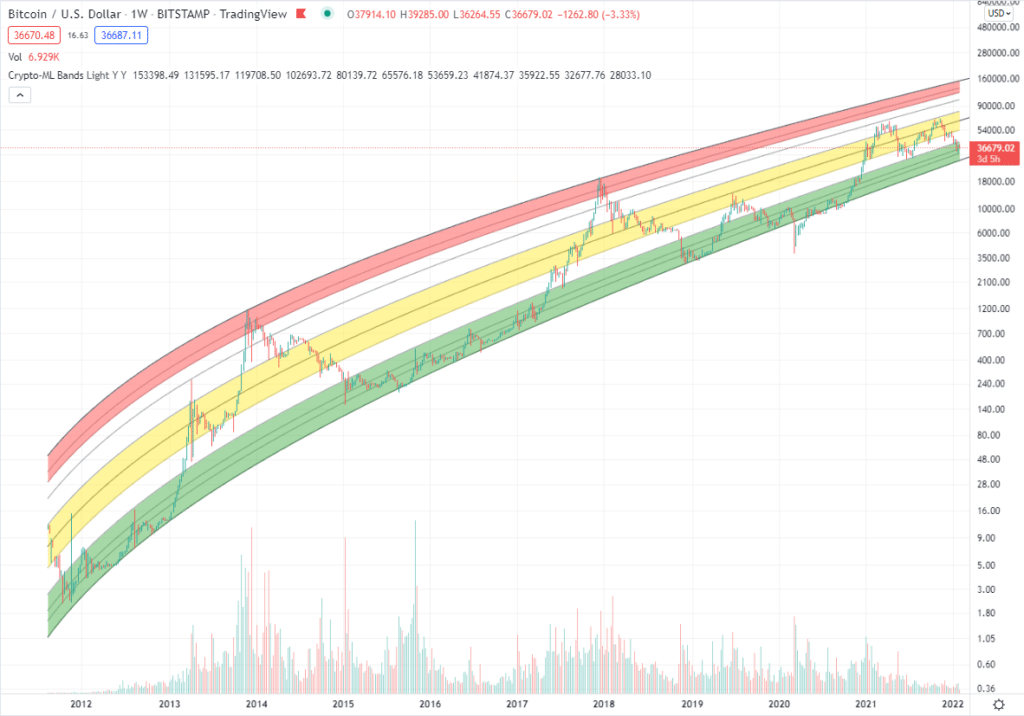

This drop into Extreme Fear corresponded directly with the Green Channel in the chart below, which simply applies a statistical distribution of all past Bitcoin price movement. The chart’s channels are not fed to the Fear and Greed Index, but the two tend to behave similarly.

Like the Extreme Fear zone of the Fear and Greed Index, the Green Channel tends to pick historically great times to buy Bitcoin for the long haul.

Crypto-ML is working to display these channels on the Member Dashboard so that you can have a validating reference point for the Fear and Greed Index.

To be clear, it is scary to buy when the Fear and Greed Index is extremely low and price is in the Green Channel. News is negative. Outlook is abysmal. Questionable regulation looms. People worry about fundamentals. Bitcoin has no future. It’s going to zero.

That feeling is exactly what the Fear and Greed Index is attempting to quantify. Once you’ve experienced enough market cycles, you’ll probably have an innate sense of what the next Fear and Greed Index update will be.

What Was Your Behavior?

During times like this, it is important to honestly assess your own behavior.

- Did you panic and sell at a low?

- Did you stay calm and hold?

- Did you see it as an opportunity and buy?

Being brutally honest with your emotions and behavior will make you a better investor over the long haul. We all need to make hard mistakes in order to sharpen our skillsets. Assessing your behavior will help you avoid repeating those mistakes.

Fortunes are started during market panics. And fortunes are booked during mania.

Has the Market Bottomed?

While the crypto markets have rebounded nicely out of these extreme states, it may be months before we know if the market has truly bottomed or not. But this dip into Extreme Fear did serve to provide a solid glimpse into the real-world value of the Fear and Greed Index.

Since it is impossible to predict with certainty, as a long-term investor, you should buy at a variety of price points and begin buying more and more aggressively as the market slips further into panic. This way, if the market continues to rebound, you will have bought around the lows. If the market continues to drop, you’ll have more opportunities to add to your long-term positions. At the bottom of this newsletter, you’ll see how we’re managing our portfolio.

Looking at the statistic distribution chart, we can see the Green Channel bottom is at $28,000. This means if the market does continue down, we could still realistically have 37% drop ahead.

Any move below that would be the result of a highly unique situation, such as the previous break during COVID in March of 2020.

Macro-Economic Perspective

Crypto is speculative and will drop when money becomes more expensive.

Cryptocurrencies continue to generally follow equities and other speculative assets. That means when large investors have less, they pull money out of riskier, more speculative investments, such as startups, businesses not generating a profit, and crypto. This is why tech stocks and crypto were hit the hardest during this recent drop.

As noted in last month’s Insider Newsletter, the main driver for this risk reduction behavior is that the US and other countries are beginning to implement measures that make money more expensive. This comes in terms of higher interest rates and reduced quantitative easing.

This is needed to curb inflation. But with more expensive capital, large-scale investors tend to reduce exposure to risky investments.

There’s also always the chance that policymakers will overrotate and inadvertently cause economic pain rather than stabilization.

This all means there is still plenty of uncertainty.

The Bullish Case for Crypto

Strong economic forces are behind the long-term growth of blockchain and cryptocurrency.

Following are reasons to assume cryptocurrency will continue growing into the future:

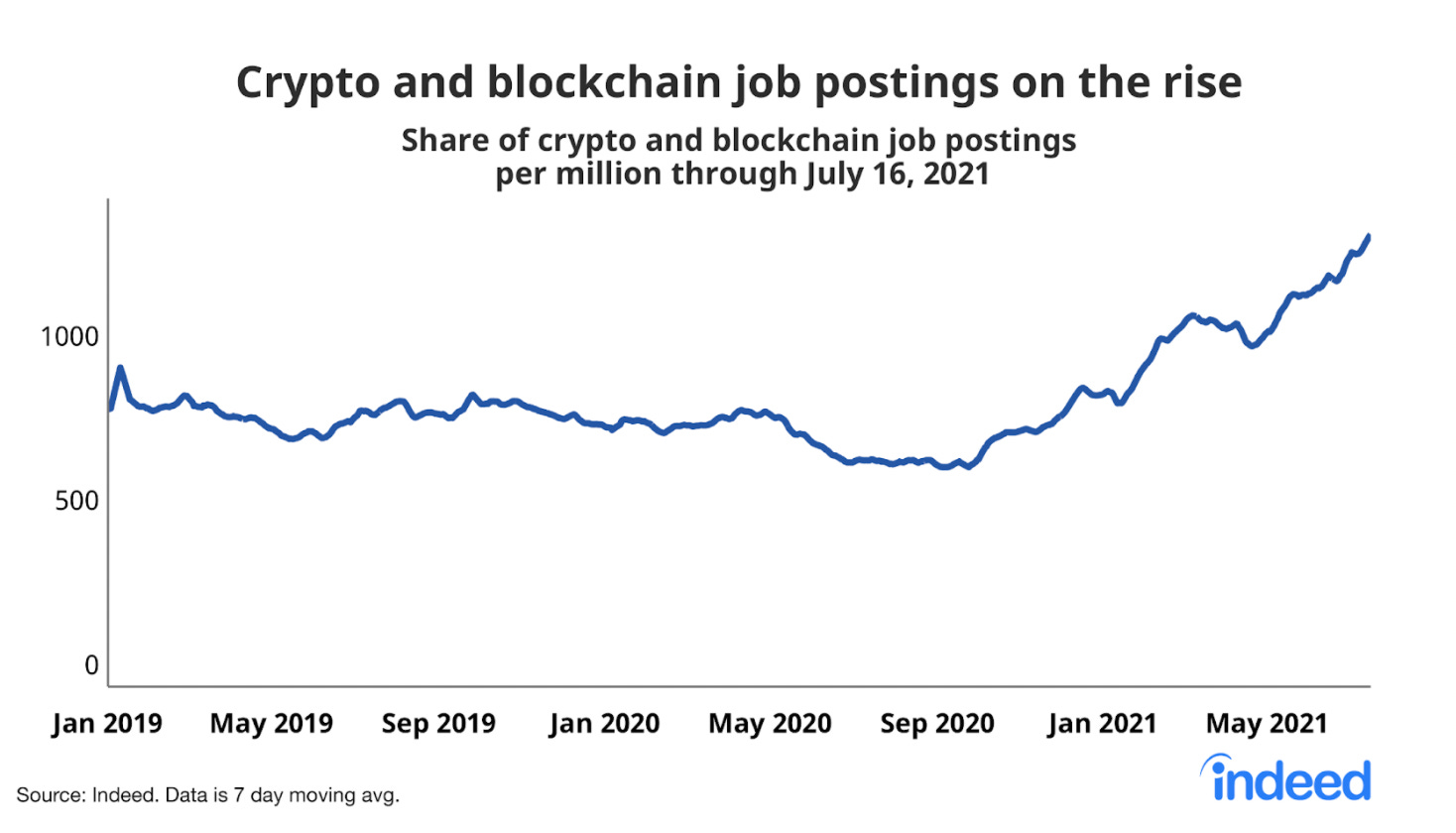

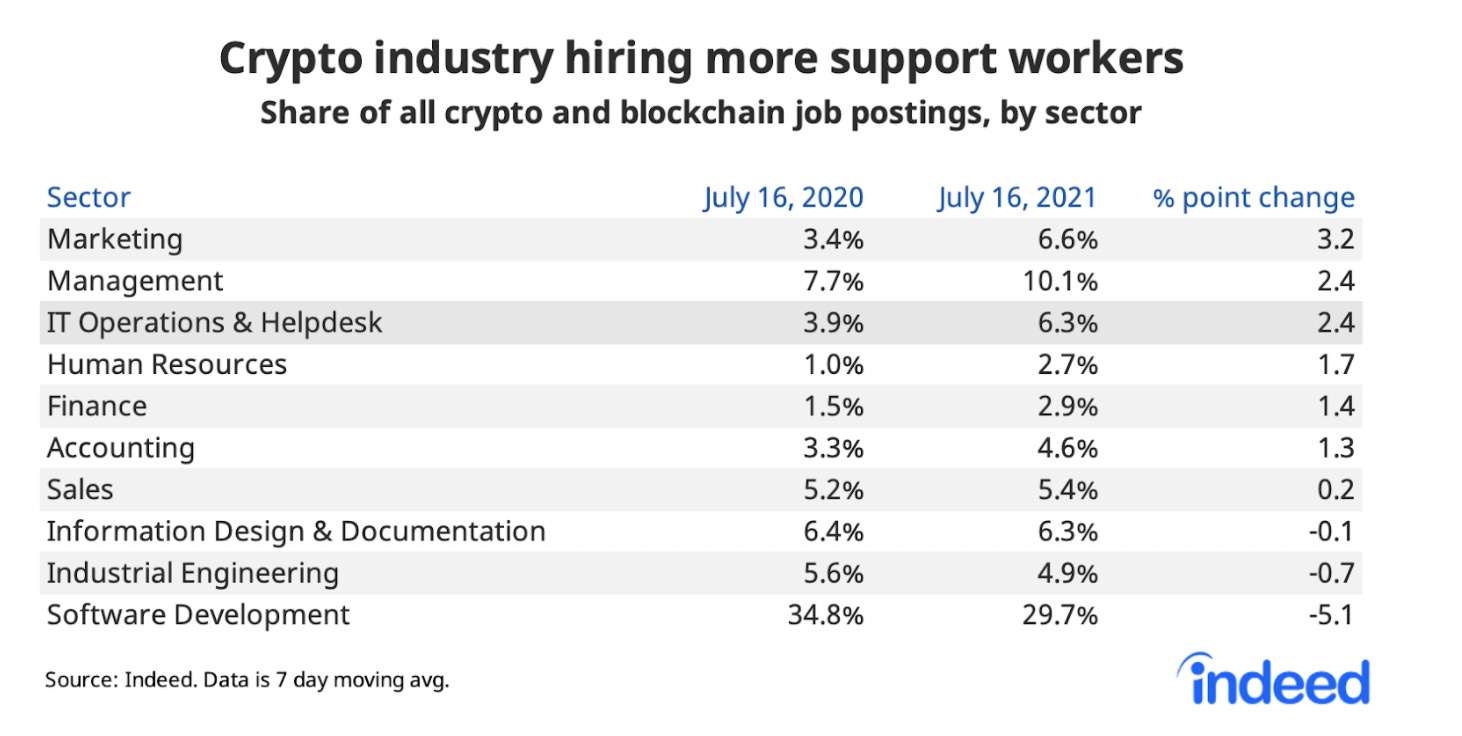

- It’s a good time to join the blockchain and Web3 workforce. Google, and other large tech players, are investing in blockchain heavily. CNBC Google Cloud is hiring a legion of blockchain experts to expand its business.

- Venture Capital continues to pour into crypto projects, with 2021 seeing 709% growth over 2020, totalling $30 billion. This will slow if money becomes more expensive, but a significant commitment has already been established.

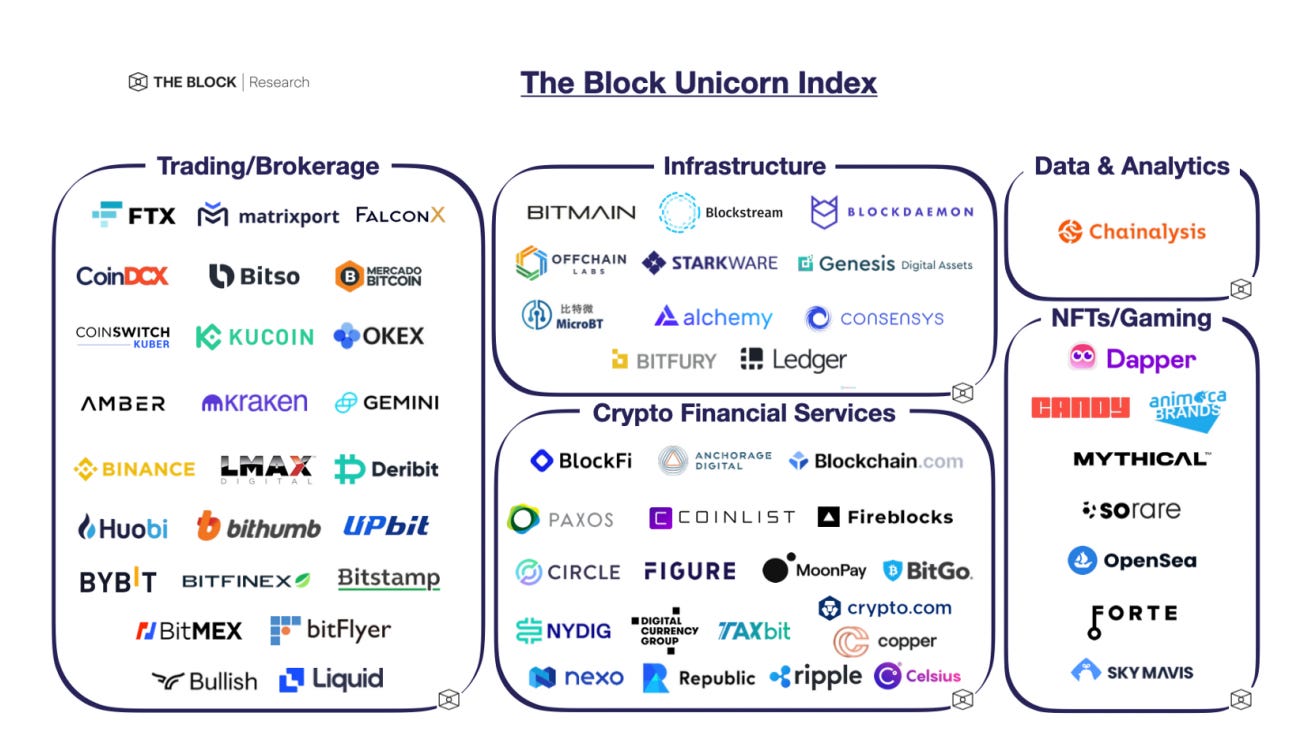

- 65 crypto companies have hit a valuation of $1 billion or more.

All of this means there is a tremendous amount of momentum in the crypto space. Companies, venture capitalists, and growing workforces are dedicated to evolving and growing the space.

Investments now in the right projects will see growth into the future as mainstream adoption of various enabling technologies occurs.

Technical View

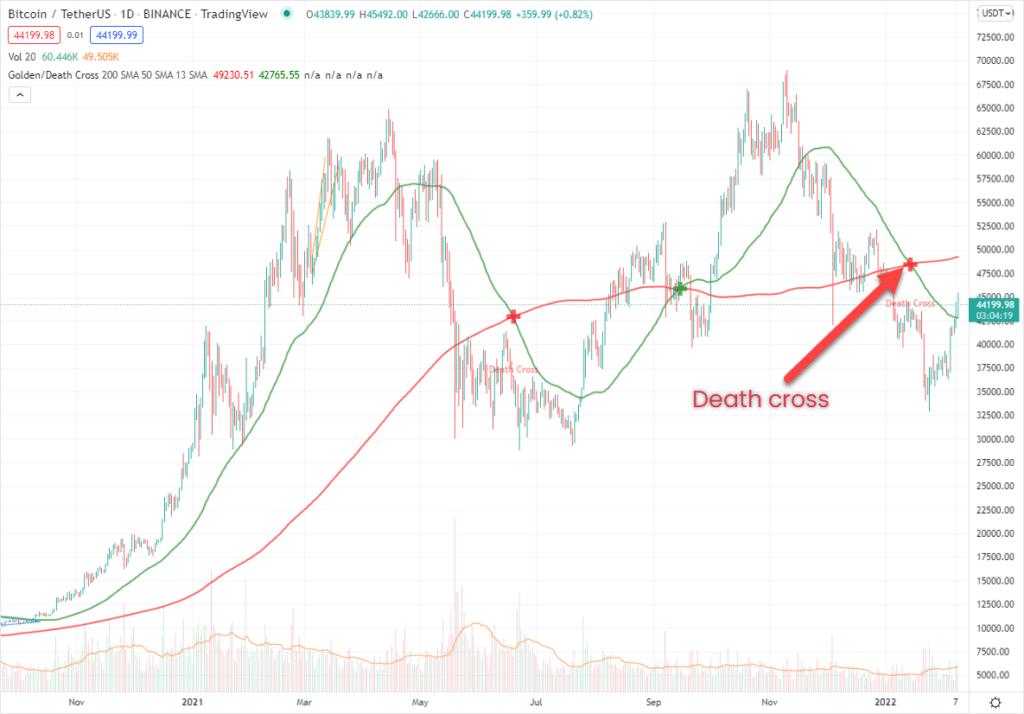

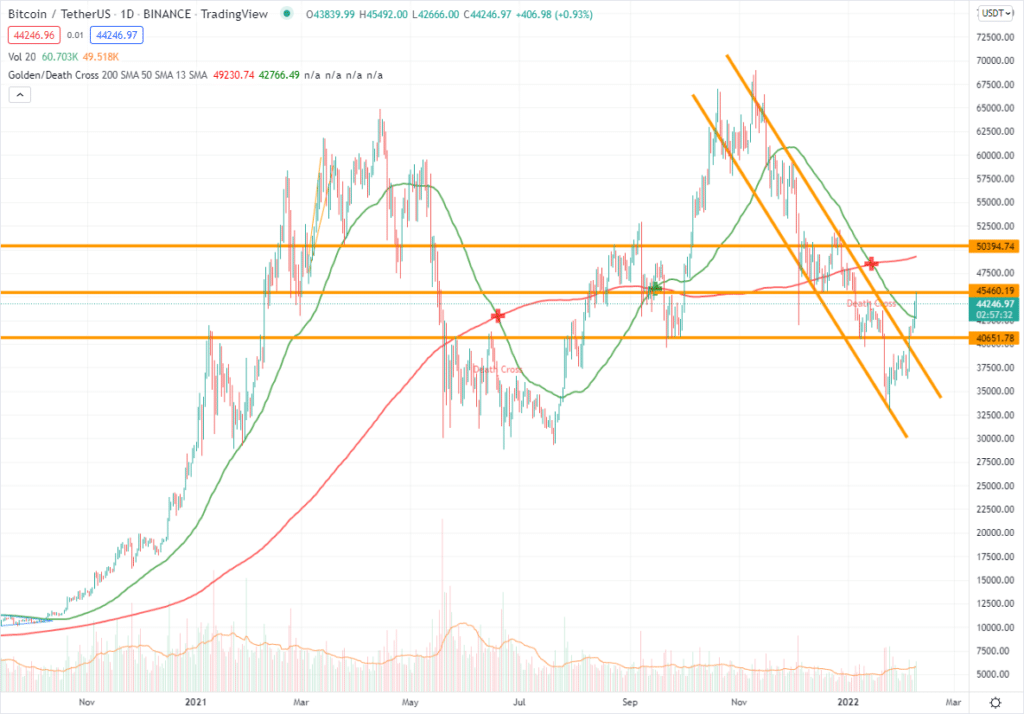

Bitcoin is still in a bear market and short-term resistance may be faced.

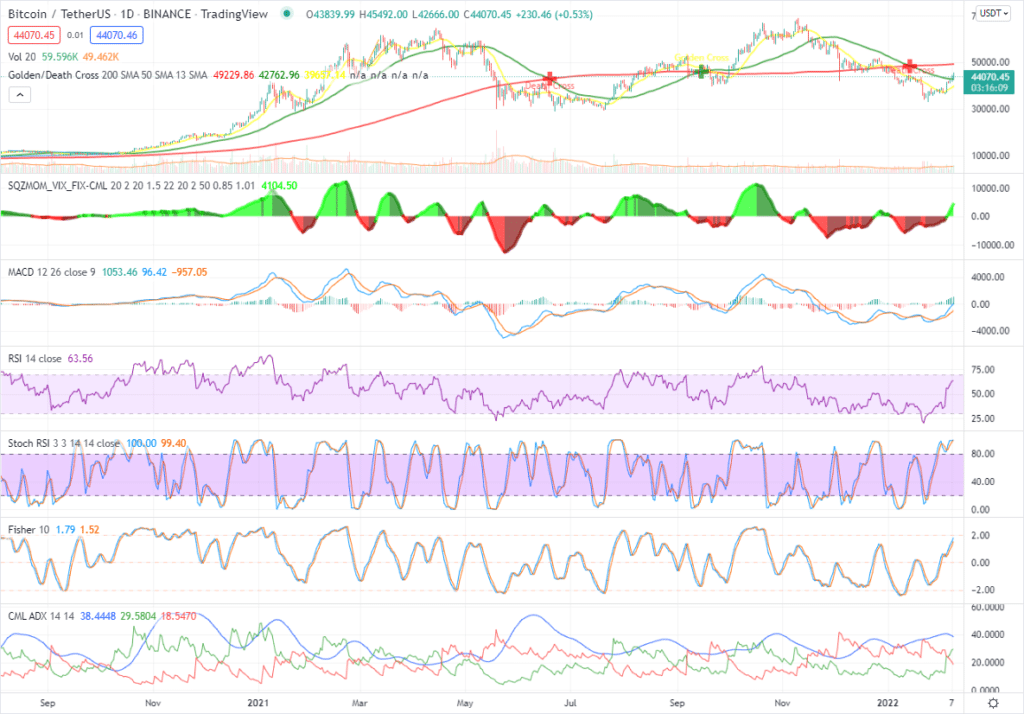

On the daily view for Bitcoin, most technical indicators are showing further upside potential, though there are some mixed readings.

- The 50/200 SMA lines are still in a Death Cross.

- The Squeeze indicator and MACD turned green, which typically signals the onset of a bullish phase. The last two have retreated quickly, but this one has started with more conviction.

- RSI, Stoch RSI, and Fisher are all pointed up, which is bullish. Stoch RSI is showing signs of over extension, but the other two show room to continue up.

- ADX shows bullish momentum that is beginning to fade.

Putting this together, we may see a bit more upside but this bullish wave (starting January 22) may soon run out of steam. From there, it will need another push to build the next wave and switch into a more bullish Golden Cross.

Looking at support and resistance lines:

- Bitcoin broke out of a consistent, months-long downward channel while also breaking above the $40K resistance. This is bullish.

- It’s currently butting up against $45K resistance, which lines up with the technical indicators starting to slow down.

- If it convincingly crosses $45K, we can expect to see resitance against at $50K.

On-Chain Metrics

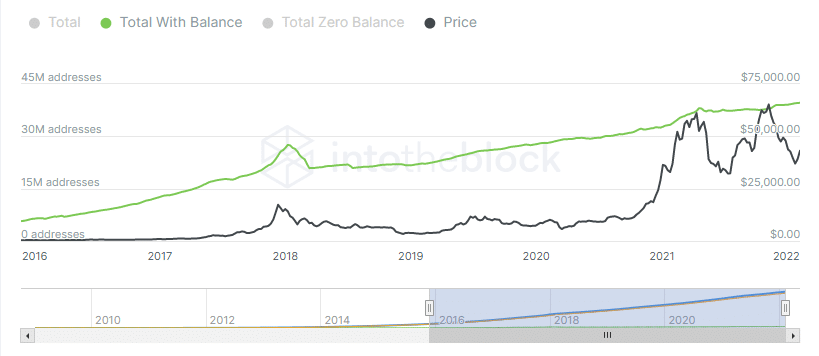

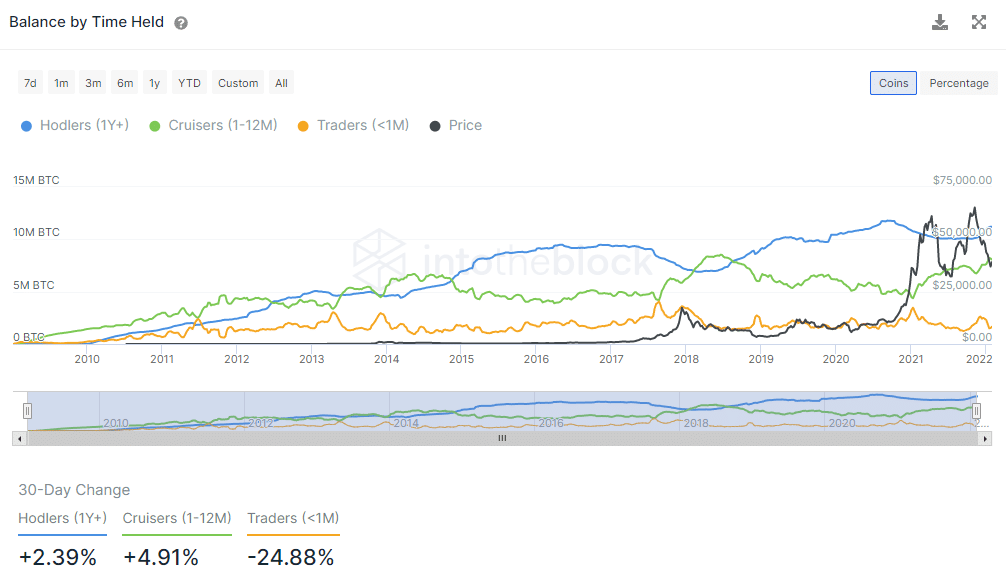

On-chain metrics show long-term, experienced money is staying in Bitcoin and growing positions especially when Bitcoin dropped below $40,000.

The number of wallets with balances, as a proxy for users, is continuing to grow. While not shown here, network activity is also increasing.

Traders (yellow) are leaving the market, but longer-term players (blue and green) continue to grow.

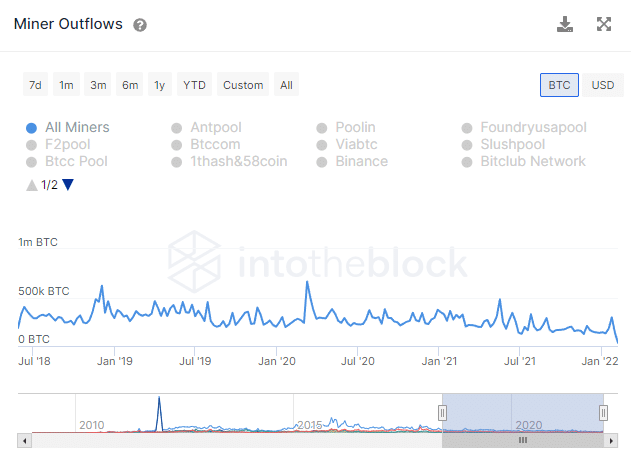

Miners are not sending funds out of pools. They are staying in Bitcoin. In fact, their outflows are dipping to new lows.

Fear and Greed Index

As noted in the opening of this newsletter, the Fear and Greed Index dipped into Extreme Fear on January 8. But it convincingly moved and stayed below starting January 22, then leaving starting February 4. This made the recommendation to Invest Aggressively while Bitcoin ranged between $32K to $38K.

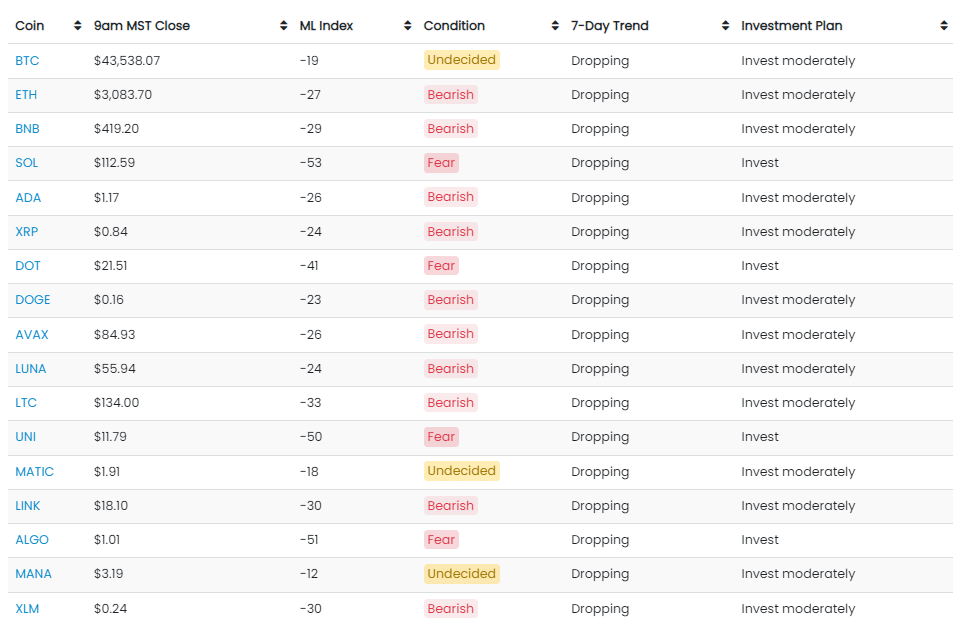

Currently, Bitcoin and other crypto have moved out of Extreme Fear into a bearish-leaning stance. Bitcoin seems to be leading the way, which is generally good for continued movement upward.

Putting It All Together

Verdict: add to long-term, strategic positions but expect short-term uncertainty. We are still in a bearish market.

When the Fear and Greed Index hit Extreme Fear and the statistical distribution hit the Green Channel, we saw a great opportunity to buy Bitcoin. It’s likely we may see a pause before another push upward.

From a near-term perspective, we are still in a Bear Market. This means price may be particularly sensitive to any bad news. If considerable bad news hits the market, we may see a worst-case drop to $28,000.

But stepping back and taking a multi-year perspective, there are many reasons to suspect the crypto and blockchain markets will continue to grow significantly. Institutional investors, venture capitalists, and many companies invested in crypto all throughout 2021 and in the early part of 2022.

One of our goals at Crypto-ML is to reduce day-to-day anxiety and shift perspectives to the longer-term horizons focused on economic and business fundamentals. If you agree crypto has long-term growth potential, then you see fear for what it is: a value opportunity.

Current Crypto-ML Portfolio

This is a snapshot of our portfolio. This is provided to give you insights into our real-life decision-making.

It is important to note that nearly all of this money is working for us. We are not relying on appreciation alone.

If you’re just getting started on generating income with your crypto holdings, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

BNB: 28%

- This position became outsized due holdings acquired prior to BNB’s rapid rise in early 2021.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023. Some portion of BNB will likely stay as a long-term holding. Though not decentralized, Binance will still have a major role to play in the crypto space in the foreseeable future. The deflationairy monetary policy is also attractive.

- Still not earning interest, which is a problem that needs to be addressed.

GUSD: 28%

- Earning interest

- This balance is held because we phased out of positions during “Greed” and “Extreme Greed.” This booked profit and provided a pool of funds to reinvest at a later point.

- This balance was used to add to positions during “Extreme Fear” but due to price depression, the approximate percentage of the portfolio has actually gone up from the last newsletter.

BTC: 25%

- Earning interest through various means

- Long-term hold

ETH: 13%

- Earning interest through various means

- Long-term hold

LINK: 1%

- Earning interest through various means

- Long-term hold

DOT: 1%

- Earning interest through various means

- Long-term hold

ADA: 1%

- Earning interest through various means

- Long-term hold

Other: 3%

- This group expanded from last month as we added to numerous altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Wrapping Up

Do you have any thoughts or questions? Let us know in the comments below.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.