Insider Newsletter 6: June 2022

This is fear. You know the feeling if you have had money in the game during any type of true market crash.

During fear, most people will lose money.

Poorly managed projects and companies will fail.

But the next generation of wealth will also be seeded.

In previous Insider Newsletters, we covered how the broader, macroeconomic picture is the primary cause of the recent cryptocurrency price drops. This is evidenced by drops in nearly all other sectors.

However, we are now seeing something different.

The extreme macroeconomic pressure is exposing cracks in the foundations of certain altcoins and crypto companies. This has also exposed the real possibility of total loss for many in the crypto realm. This will trigger legal pressure and a corresponding ramp in regulation.

As a result, we can expect a large-scale shakeout of crypto businesses that are fraudulent or simply don’t have the resources to comply with future regulations.

- Poorly run, low-value, and fraudulent coins and companies will fail.

- High-value crypto assets will be on sale.

“It’s only when the tide goes out that you learn who’s been swimming naked.”

Warren Buffett

As you read the content and recommendations below, please keep in mind this is targeting investors who have a multi-year time horizon.

General Overview

This is a particularly long newsletter, so here are the summary bullet points:

Broad economic concerns will suppress crypto prices

During slow economies, expect limited investment in speculative assets, such as crypto.

Recessions tend to last two years

While there is still discussion about whether or not a macro recession has started, the good news is recessions are relatively short-lived.

Not all crypto assets or companies will survive

As the market pushes to extreme states, business problems, technology problems, fraud, and other crypto-specific concerns are surfacing. As a result, quality crypto assets will survive, but many others will not. This makes the possibility of total loss real and pressing.

Technical analysis and on-chain metrics will struggle

During extreme times, indicators commonly break down or lose predictive capabilities. Be cautious relying on them until the market slows back down.

Don’t time the bottom but do accumulate quality assets

When the broader market recovers, quality crypto may rise just as quickly as things have fallen. By trying to time the market, you may miss out entirely. Instead, invest at regular intervals as your budget allows. Quality assets are on sale.

If you are still holding large balances that are now at a loss, consider moving out of questionable altcoins and into higher-quality coins to better position yourself for the next bull cycle.

Crypto Market Foundation Cracks

Before diving into our traditional newsletter analysis, it’s worth looking at two prominent examples of emerging cracks in crypto’s foundation.

Terra, UST, and Do Kwon

Terra’s stablecoin UST algorithmically pegged itself to the value of the US Dollar. As the crypto markets began selling off, its value dropped, losing its peg on May 9, 2022. This resulted in an implosion and the loss of $60+ Billion of coins (bloomberg.com).

This became a total loss for many of its holders.

Initially, this appeared to be a technical competency issue, where the Terra team was attempting to do something complex and unfortunately failed. However, as additional detail surfaced, it appears fraud may have also occurred.

It has been alleged Do Kwon (the Terra founder) withdrew $2.7 billion from his ecosystem to a competitive stablecoin prior to the crash. This indicates he was aware the system would fail and prioritized preserving his funds. Not only that, but it appears large investors also divested just prior to the crash. The behavior almost certainly accelerated to the crash.

South Korean authorities are investigating these allegations now. To read more:

- How a Trash-Talking Crypto Founder Caused a $40 Billion Crash (nytimes.com)

- Legal troubles mount for Terraform Labs as Seoul police investigate (cointelegraph.com)

- Here’s how Do Kwon cashed out $2.7 billion using Degenbox to drain liquidity out of the LUNA & UST system and into hard money like USDT (reddit.com)

It may demonstrate the corruptibility of humans and the risks of having incredibly high-value operations running in low-regulation environments.

Celcius Network withdrawal freeze

Celcius Network is a crypto financial service provider that operates more similarly to a traditional bank, providing interest-bearing accounts and loans to its 1.7 million customers. It has somewhere around $25 billion in assets. It is based in the United States and has raised $864 million in funding. They have also won many industry awards and generated a large following.

We have recommended Ceclius as a simple way to earn interest on your holdings. While some of our team members have moved purely to hardware wallets, some of us still have a significant portion of our holdings with Celcius.

Last week, Celcius announced it was pausing withdrawals, swaps, and transfers (blog.celcius.network).

This comes as news of stETH (a token representing staked ETH) also lost its peg. Celcius was a major holder of stETH.

It appears Celcius does not have enough funds to honor withdrawals and is taking measures to avoid a bank run. The problem is Celcius has provided zero details on why the pause occurred and what can be expected by its users.

This is leading to speculation that a worst-case scenario may be playing out and depositors will face a total loss of their funds.

This is out of character for a company that prides itself on “next-level transparency” in the form of audits and regular, open discussions with its leadership.

Further worrying depositors, the Celcius CEO has canceled weekly AMA sessions. This was a career-defining moment and case study in poor leadership. In a time of crisis, leaders are expected to step up, address reality, and rally employees and customers around a plan forward.

Instead, this inaction leaves a vacuum of information making it seem as though the top priority is to minimize personal liability.

It is possible depositors will eventually gain access to their funds. If Celcius is insolvent, investors or competitors may move to acquire parts of Celcius or otherwise provide the funds needed to bridge operations.

Celsius Recovery Plan – A Statement From Simon Dixon And Bnk To The Future (bnktothefuture.com)

What these cases show

These cases highlight a couple of points that make this market drop about more than just a reaction to high inflation and other macro concerns.

The macroeconomic pressure is exposing systemic problems that are still in the process of surfacing. In addition to the two examples above, the following have also occurred:

- Depegging of USDT, GYEN, USDN, DEI, USDD, USDX, MIM, and more

- Potential insolvency of Three Arrows Capital

- Withdrawal pausing by Binance and Babel

- Lawsuits against companies such as Terraform Labs, Coinbase, Celcius, Do Kwon, Elon Musk (for improperly promoting Dogecoin), and more

Here’s what this tells us about the crypto markets:

1. Crypto technologies may fail

Technical problems, such as those faced by stETH and UST, may surface elsewhere. This is complex technology operating at massive scale.

2. Additional fraud may yet be exposed

Crypto has long been a relatively easy way to use technology to create money in less-than-transparent manners. Abusers have leveraged this to generate cash at other people’s expense.

3. CeFi and DeFi risks may not be well understood

During extreme market conditions, financial products are tested on their performance during edge cases. Crypto finance products are still in their infancy, yet they’re being tested with billions of dollars at stake.

4. Regulation will increase

The natural response to all of these risks is for regulatory pressure to ramp dramatically. Compliance will be prohibitively complex and expensive for small and mid-size crypto projects.

In summary, this crypto bear market will likely drive systemic change in the crypto ecosystem. Surviving projects will likely be larger, more stable platforms.

Crypto-ML Data

Investing in quality assets during times of extreme fear is how wealth is created.

Our data reflects the extreme fear and two dominant conditions:

- Macroeconomic downturn

- Crypto-specific concerns

While these indicators are in extreme fear zones, we will likely see historically good price points for quality assets. But as mentioned earlier, don’t try to time the bottom.

We noted earlier that on-chain and technical indicators may struggle in extreme market conditions. How do our measures handle extreme cases?

- The Price Channels offer insight into the market being oversold, but this model has technically been exceeded. It therefore cannot indicate when or if price will return to its previous schema.

- The Fear and Greed Index does, however, maintain accuracy. It is measuring market sentiment with many different data points. The market is indeed in extreme fear. This provides guidance for long-term investors and will be key to watch as the market recovers.

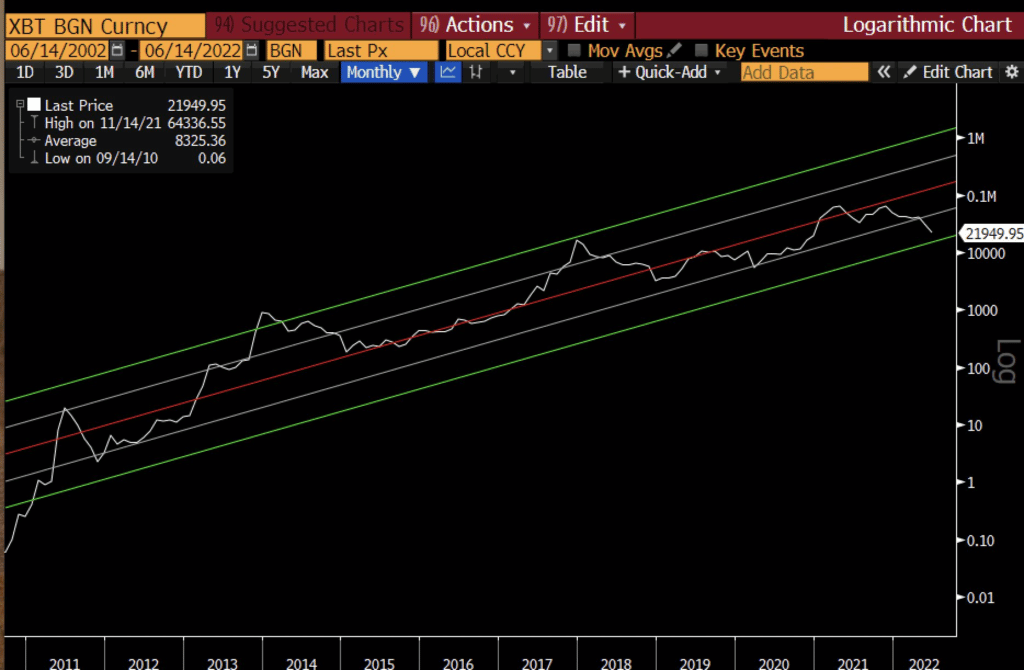

Price Channels

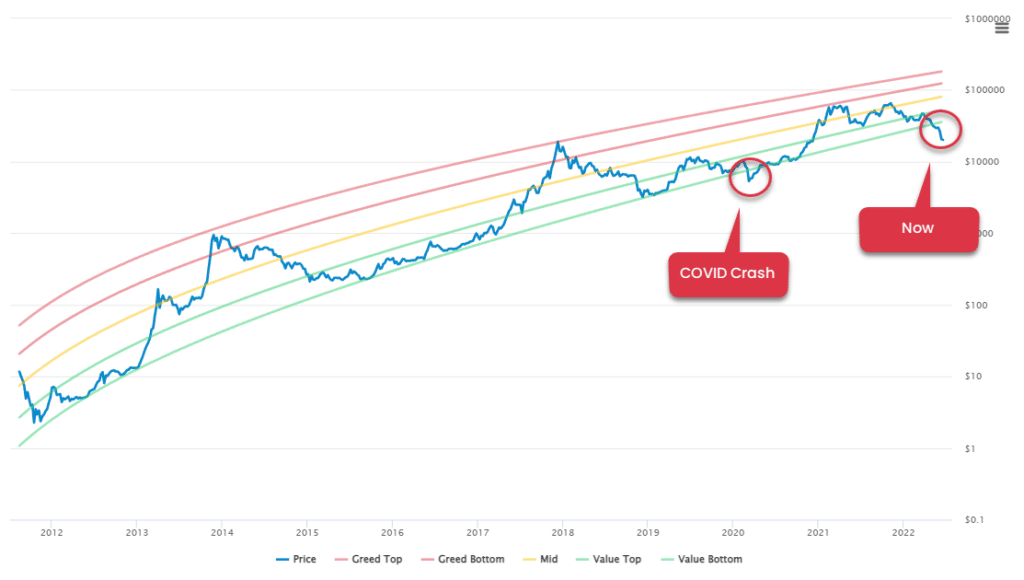

Bitcoin has now exceeded the regression model shown in the Crypto-ML Price Channels for the second time in Bitcoin’s entire history.

During the COVID Crash of 2022, Bitcoin dipped to a low of about $3,850. The model predicted a minimum of $7,623, meaning it exceeded the model by -50%. It also spent 8 weeks below the “Value Bottom” line.

We have now hit a minimum of $17,593 versus a predicted $35,731. This exceeds the model by -51% as well. Price has been under the model for 7 weeks.

These numbers really only compare two samples and shouldn’t be seen as a clear reversal sign.

- Based on the data in this model and assuming a decade+ price behavior pattern holds, we should see a swing back above $35,000 in the near term, even if we stay in an ongoing bear market.

- But it is also possible we are entering a new epoch of Bitcoin behavior that deviates from the past. In this case, the Price Channels model will be invalidated and a new model will be needed.

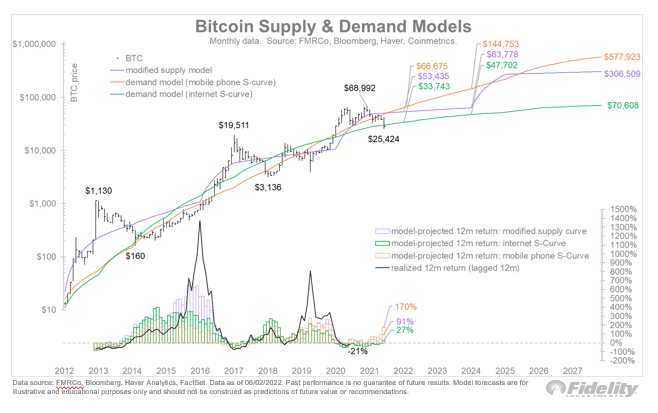

Interestingly, in an in-depth Twitter analysis on June 2, Fidelity’s Director of Global Macro, used a similar-looking model to set his 2025 price target of Bitcoin at $63,778 (twitter.com). This analysis is based on looking at past technology adoption patterns.

Fear and Greed Index

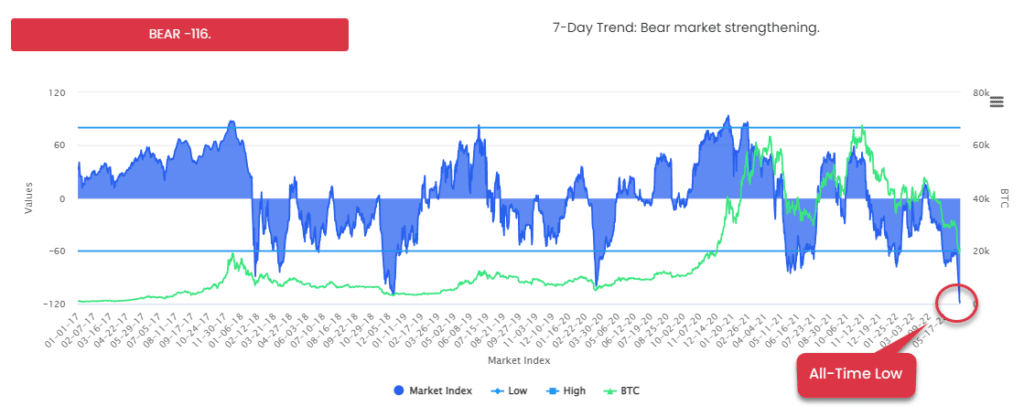

The Crypto-ML Fear and Greed Index is in the most extreme state it has been. This is the first time it has seen both a broad-market recession and significant issues in the crypto markets.

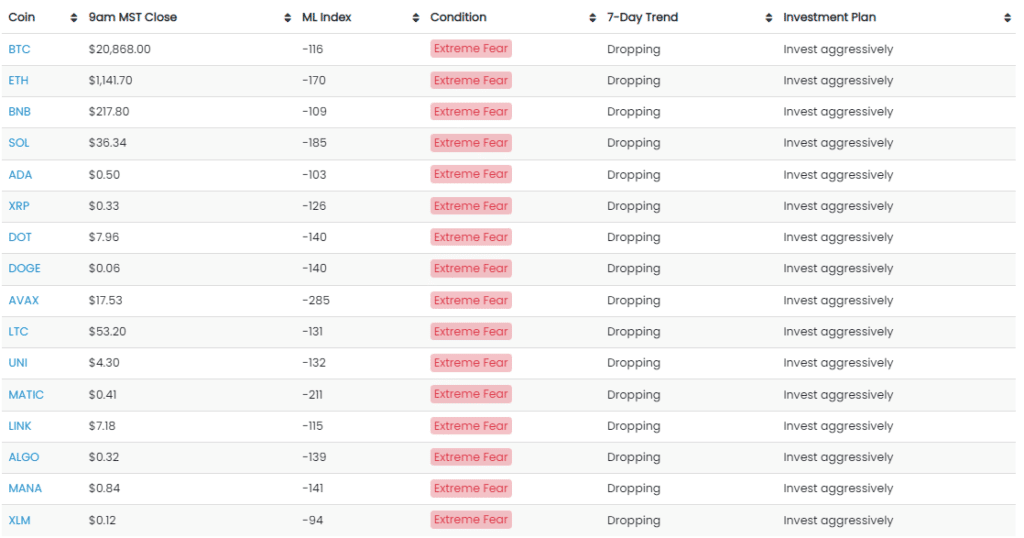

Market sentiment is the same across all altcoins:

As noted above, the market is indeed in extreme fear. This is an overall “feeling” the Fear and Greed Index seeks to quantify. While markets may continue to drop from here, if you approach investing with a multi-year time horizon, this is the time to accumulate assets you expect to add value for years to come.

This is no different than buying rental properties during housing crashes.

Macro-Economic View

Expect 1.5 to 2 years of economic slowdown or recession ahead. This will suppress crypto market prices since most large investors see crypto as a speculative asset class.

When looking for market guidance, it is good to monitor the actions of large companies. Their actions are driven by analysts and investors with the goal of best positioning themselves for the near-term future.

The primary action companies have taken recently is to slow or freeze hiring, especially in the tech sector. They are preparing for belt-tightening over the next couple of years.

- Tech Layoffs In 2022 (crunchbase.com)

- Microsoft Slows Some Hiring Amid Economic Uncertainty (wsj.com)

This matches broader economic expectations and indicators:

- A severe recession is possible, economic expert warns (finance.yahoo.com)

- Markets should brace for ‘fire’ and ‘ice’: Morgan Stanley executive warns of a recession and even bigger ‘paradigm shift’ (fortune.com)

- Bonds are sending a stark message about the economy (cnn.com)

Inflation and quantitative tightening

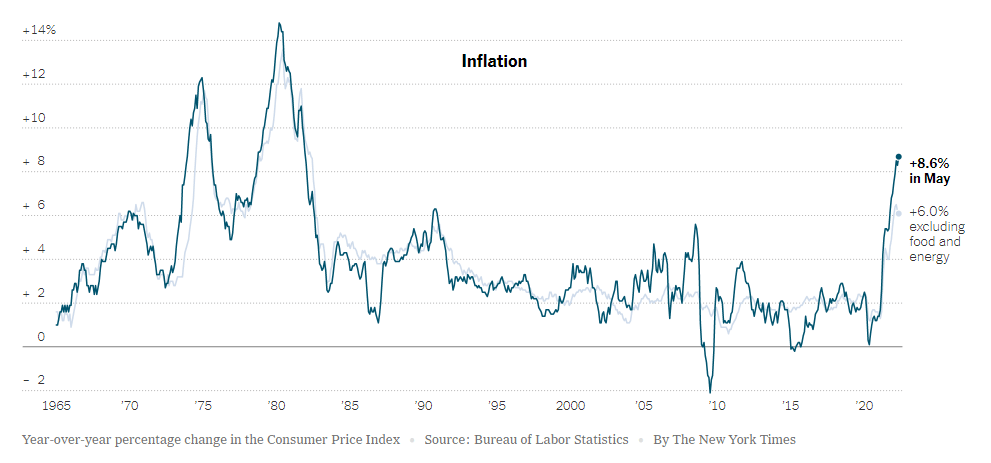

Inflation just hit a 40-year high, exceeding economist predictions. This triggered sell-offs across most markets. Nearly every member of the Dow was in the red (nbcnews.com) following the data release.

Specifically:

- The US Consumer Price Index is up 8.6%, spanning prices for housing, gasoline, and food. This is the largest 12-month increase since December of 1981.

- Gasoline +48.7%

- Fuel oil +106.7%

- Food +10.1%

- Airline fares +37.8%

US Inflation Unexpectedly Accelerates to 40-Year High of 8.6% Pressuring Fed and Biden

Higher prices result in reduced spending. This reduces corporate profits, which softens the job market. It can lead to a downward economic spiral that can take years to recover from.

To curb inflation, central banks reduce money availability (quantitative tightening). This is primarily seen in terms of increased interest rates. Higher interest rates make money more expensive, further reducing spending and slowing the economy.

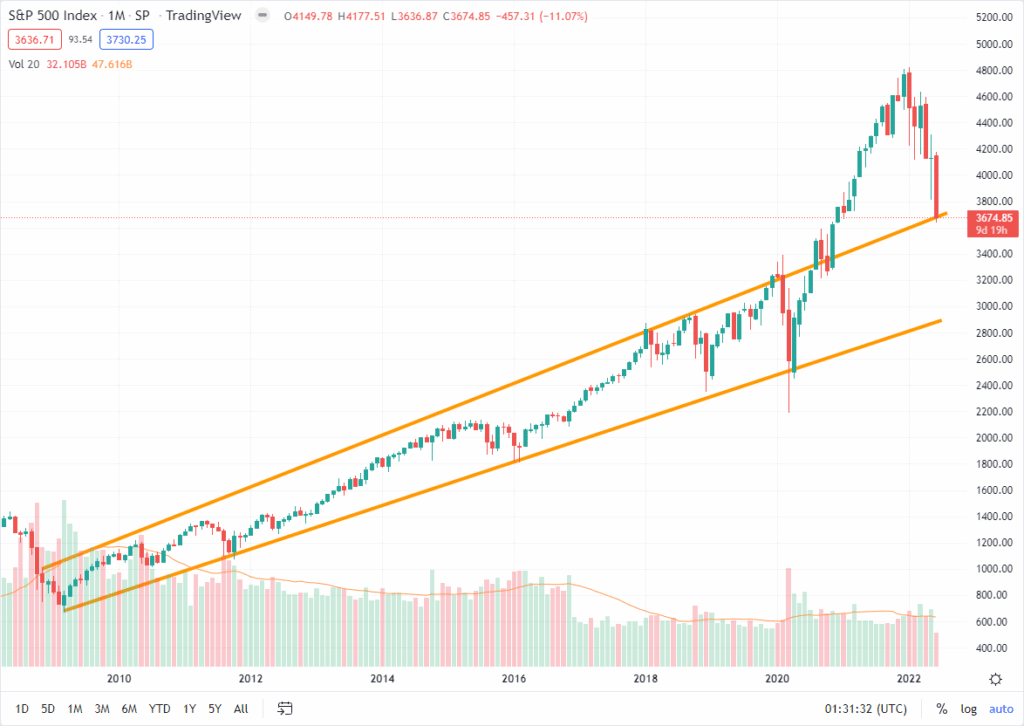

Looking at the S&P500 as an indicator of overall economic health, you can see just how far the market might still drop. This shows the possibility of another 21% drop if the market were to renormalize back to pre-COVID trends.

Recession expectations

As the economy slows, it’s good to set expectations on how long recovery may take. Based on past recessions, it is good to plan for a 2-year period. As you can see in our list below, the data is very consistent.

This is why we expect Bitcoin and crypto to stagnate for the next 1.5 to 2 years.

List of recent recessions:

- The Great Recession: 2007 to 2009

- Dot-Com Recession: 2001

- Gulf War Recession: 1990 to 1991

- Energy Crisis Recession: 1981 to 1982

- 1980 Recession: 1980

- Oil Embargo Recession: 1973 to 1975

- Recession of 1969-1970: 1969 to 1970

- Recession of 1960-1961: 1960 to 1961

- Recession of 1957-1958: 1957 to 1958

- Post-Korean War Recession: 1953 to 1954

- Post WWII Recession: 1945

- Roosevelt Recession: 1937 to 1938

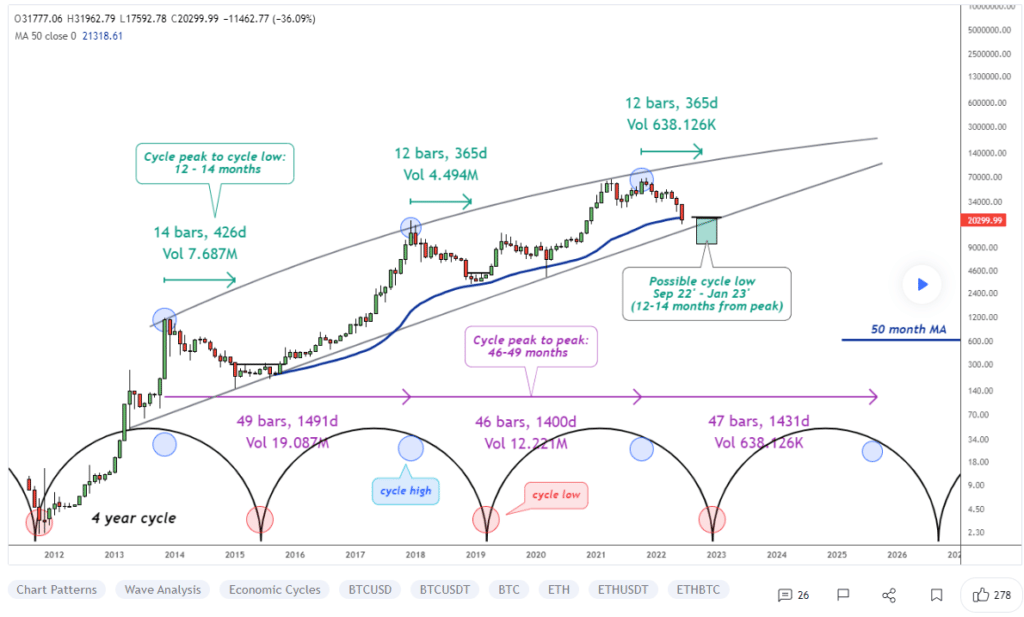

Interestingly, this lines up fairly well with this Bitcoin cycle analysis (tradingview.com).

This pegs the Bitcoin low coming in sometime late this calendar year or early 2023.

Economic recovery triggers

Investors rely on expectations. When inflation, rate hikes, or unemployment numbers are worse than expected, the markets react negatively. Likewise, we should watch for “better than expected” news that will likely be in the form of:

- Inflation easing faster than expected.

- Better-than-expected corporate earnings.

- End to the war in Ukraine.

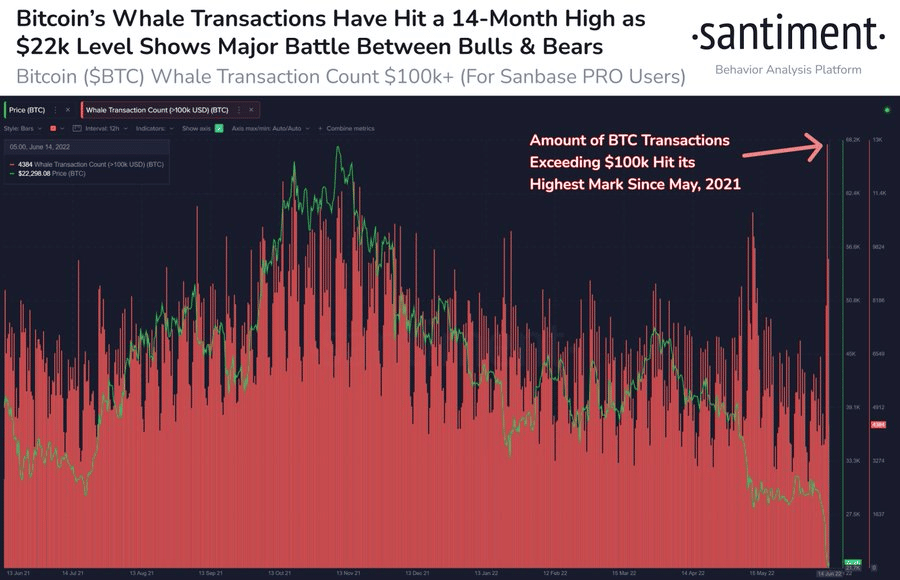

On-Chain Metrics

On-chain data is struggling to paint a clear picture of current market behavior. Focus on buying behavior instead of complex indicators.

Questionnable indicators

On May 31 when Bitcoin was at $31,763, the CEO of CryptoQuant said BTC was close to its bottom, based on their UTXO metric (dailyhodl.com). He also noted that institutions will support at $23,000.

On June 11 when Bitcoin was at $29,1097, the IntoTheBlock Head of Research announced Bitcoin was flying off exchanges (dailyhodl.com) amid “price stagnancy.” These outflows are believed to be bullish.

Despite these comments, Bitcoin continued to crash down to a low of $17,593.

This does not mean on-chain metrics are meaningless, but do be cautious when reading titles like ‘Can it get any easier?’ Bitcoin whales dictate when to buy and sell BTC (cointelegraph.com). That is a quote from another on-chain analyst service, Whalemap.

These services tend to suffer from the same issue many technical analysts do: small sample sizes. They often take a handful of cases and generalize outcomes.

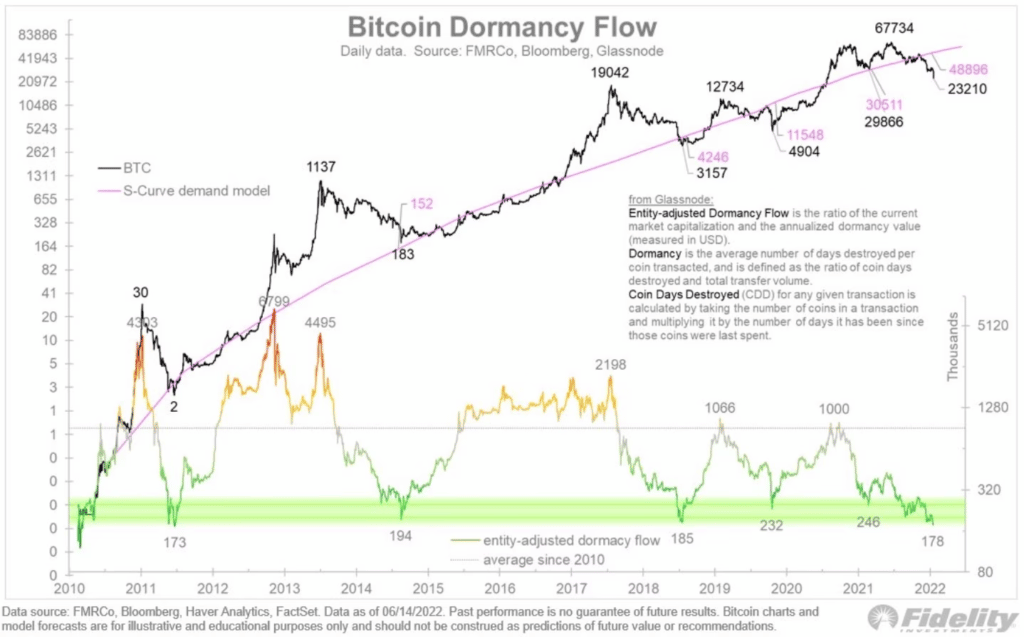

Leaving you with one more, here’s another analysis from Jurrien Timmer of Fidelity. This another chart (twitter.com) shows some on-chain data also suggesting a bottom. We will see how this plays out.

At this point in the market, we do not recommend putting too much weight into highly specific on-chain indicators.

Who is buying now?

One great thing about on-chain analytics is we can be reassured we’re in good company.

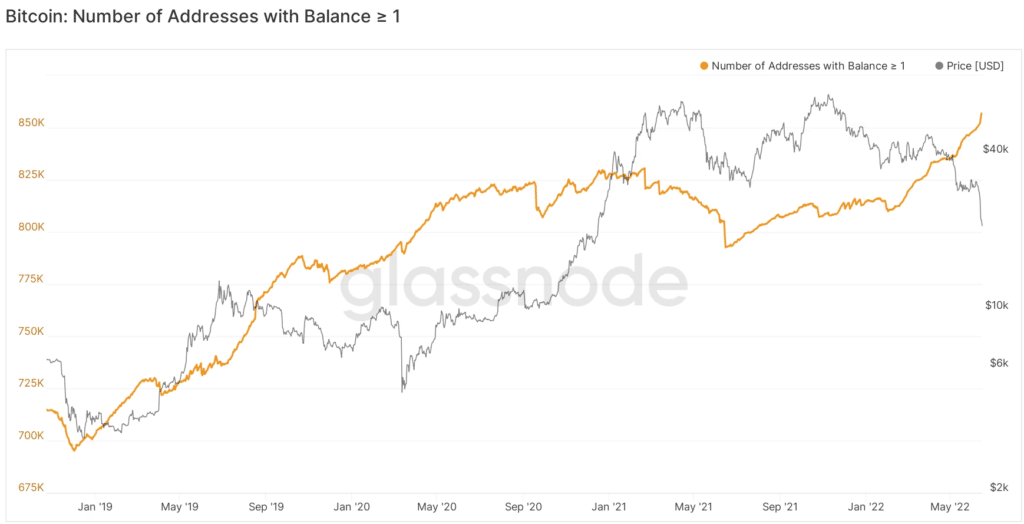

People with strong conviction continue to stock up on Bitcoin. Addresses with a balance of at least 1 BTC are growing rapidly:

Additionally, we have big players building positions:

- Hedge Fund Billionaire Anthony Scaramucci Says His Firm Bought the Carnage on Bitcoin (BTC) and Ethereum (ETH) (dailyhodl.com)

- Biggest Bitcoin Whale in Existence in Accumulation Mode, Stockpiles $20,900,000 in BTC (cryptonewsbtc.org)

Like watching large companies navigate economies, watching large investor behavior gives you insight into their expectations.

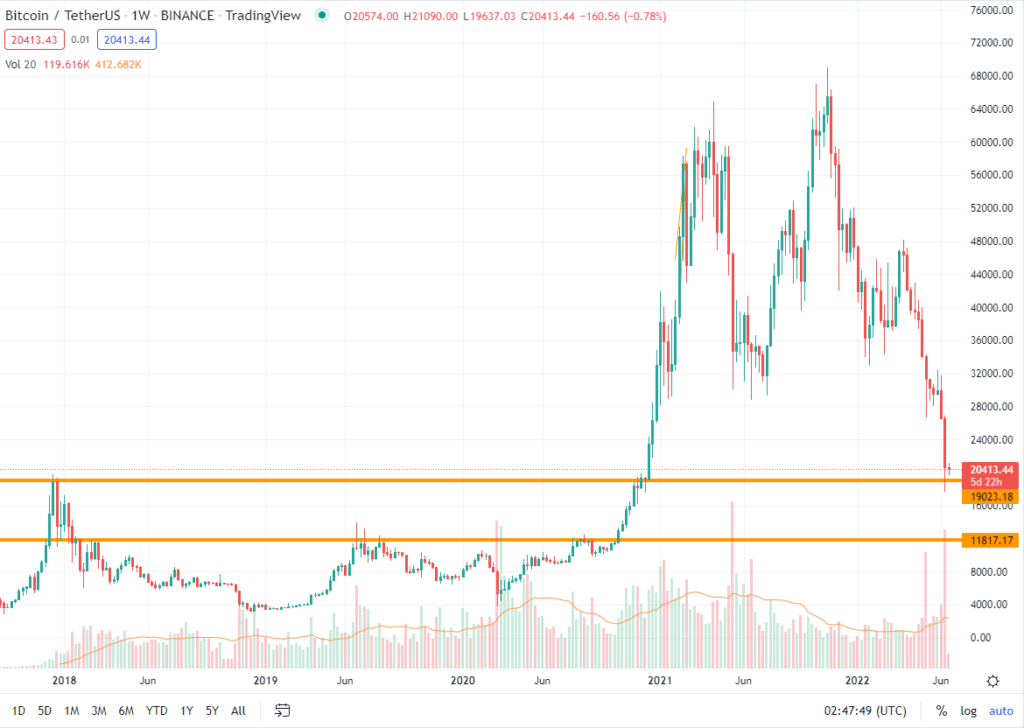

Technical Analysis

Technical indicators struggle with extreme market conditions. Do not expect to find a perfect “bottom” indicator. Based on support and resistance, another market drop could rapidly bring Bitcoin to $11K to $12K.

Finding a bottom

Raoul Pal, CEO of Real Vision and former Goldman Sachs executive sees the odds favoring bulls right now. While indicators are no guarantee of a bottom, three of his top indicators have flipped bullish.

Macro Investor Raoul Pal Says He’s Doubling Down on Crypto Position in Face of Market Collapse (dailyhodl.com)

Interestingly, he looks at a similar logarithmic regression channel, which is identifying a buy zone:

He also sees solid numbers in RSI and his DeMark indicator.

But similar to our advice, he says:

“Don’t ever expect to nail the low…”

If this is not the low, we have a huge support and resistance gap below $19,000. Should the $19-$20K range fail to hold, the next major level of support is between $11-$12K.

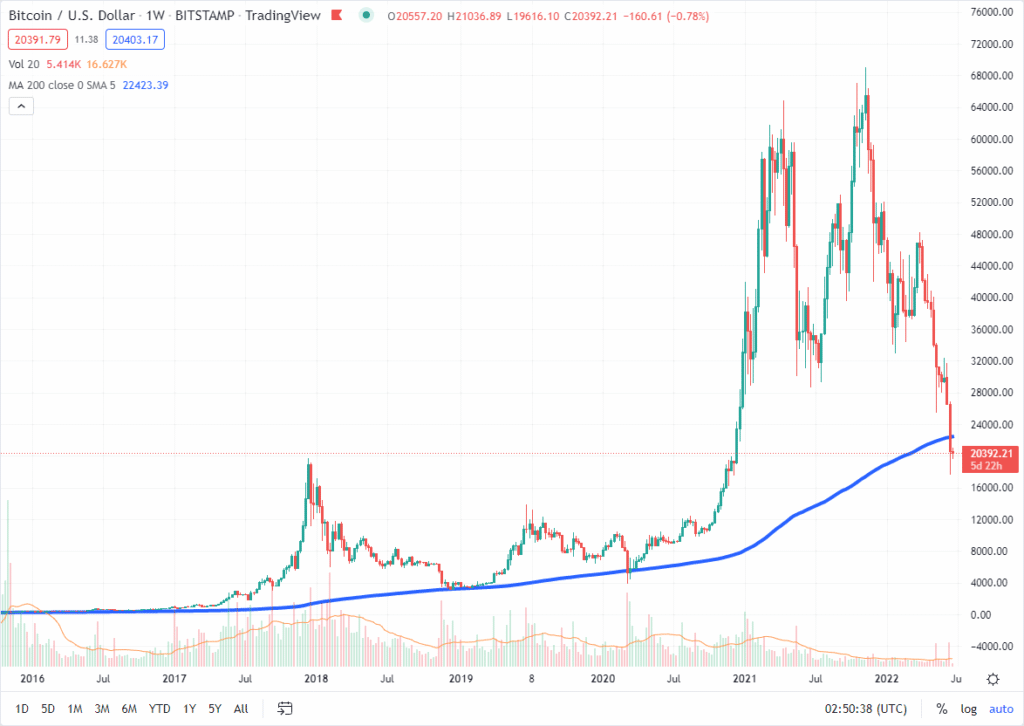

The 200-period weekly moving average has long been considered a strong support line for Bitcoin. However, it shows yet another model breaking down.

If price stays below the 200-week SMA, we will be in a new era of price behavior, potentially indicating a longer-than-normal bear market.

Technical analysis caution

As noted earlier, most technical analysis indicators struggle in extreme market conditions. They also tend to work better on shorter timeframes.

However, you’ll see no shortage of people using technical indicators to attempt to predict macro reversal points. For example, most people focused on the 200-period weekly moving average as a key reversal point.

Indeed, looking at a chart, you can see why people might suspect this. However, Bitcoin has only hit that line three times in the past. And one of those times, COVID 2020, saw price dropping a full 30% below the moving average line.

The fundamental problem here is a lack of appreciation for statistics among the technical analysis community. It takes many, generally hundreds or thousands, of samples to validate any indicator’s predictive power.

At the macro level, you just don’t get that sample size on an individual asset.

The type of technical indicator that can be trusted would have these qualities:

- Captures a fundamental measure of people’s behavior in the financial markets at scale.

- Shows the same behavior across many assets, thereby providing thousands of samples.

- Has been statistically validated by academic research.

Research examples on this topic include:

- On the Statistical Validation of Technical Analysis (researchgate.net)

- Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation (cis.upenn.edu)

An easy-to-read summary of research is 9 Technical Analysis Lessons You Can Learn from Academics Backed By Statistics (tradingsetupsreview.com).

Relevant findings are:

- Technical indicators work better on short time frames. This makes sense because you have many more samples to evaluate on a minute chart than a monthly chart.

- Select chart patterns do hold statistical significance, namely head and shoulders, double bottoms, and triangles.

- Technical analysis does not consistently generate above-market returns.

All in all, be cautious when using technical analysis, especially during extreme markets. Stick to investment fundamentals instead.

Putting It All Together

Alright, after going through all of this information, hopefully the overall message is clear:

- Macroeconomic stress will suppress crypto prices, likely for another 1.5 to 2 years.

- This stress is exposing crypto-specific technical flaws, business problems, and fraud that will further suppress recovery and potentially drive low-quality assets to zero.

- You should not try to time the bottom. Instead, select a few high-quality crypto assets and begin accumulating on a regular basis during this time of extreme fear.

This begs the question, how do you determine high-quality assets? How do you know what will survive?

The answer lies in determining what projects have leadership teams dedicated to continuing to add external value over time.

We discuss this step-by-step here: Altcoin Fundamental Analysis: 7 Steps to Picking Great Investments

What about Bitcoin?

While challenges mount in the crypto economy, Bitcoin remains unique. Nothing has fundamentally changed about Bitcoin.

- Blockchain and decentralization remain important concepts.

- The rapid market drop has not exposed a technical flaw, bug, or defect in Bitcoin.

- Without a CEO or leadership team, the risk of fraud remains virtually nill.

While it will face “guilt by association” challenges, Bitcoin itself has not changed.

Each time it is tested, it demonstrates resliance and comes back stronger. This drop may further separate it from other assets in the crypto space.

Current Crypto-ML Portfolio

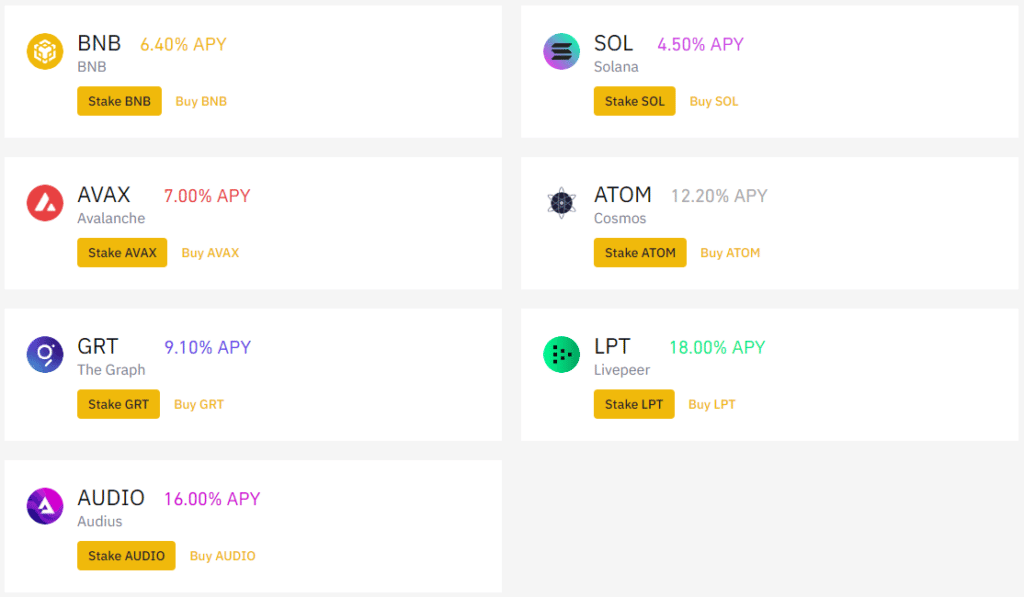

It is important to note that nearly all of this money is working for us to generate interest. We are not relying on appreciation alone.

This is a snapshot of our portfolio, provided to give you insights into our real-life decision-making.

This is a critical point: these investments are automatically buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

If you’re investing for the long term, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

BNB: 41% (+3%)

- Finally earning interest! It has been difficult for US residents to earn interest on BNB, but on June 7, Binance.us announced expanded staking options.

- This position became outsized due holdings acquired prior to BNB’s rapid rise in early 2021.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023. Some portion of BNB will likely stay as a long-term holding. Though not decentralized, Binance will still have a major role to play in the crypto space in the foreseeable future. The deflationary monetary policy is also attractive.

BTC: 36% (+3%)

- Earning interest through various means

- Long-term hold

ETH: 15% (-17%)

- Earning interest through various means

- Long-term hold

Stablecoins: 3% (flat)

- Earning interest

- This month, nearly the rest of this balance was moved from stablecoins to crypto. That is phasing in during the “Fear” and “Extreme Fear.”

- This balance was initially held because we phased out of positions during “Greed” and “Extreme Greed.” This booked profit and provided a pool of funds to reinvest at a later point.

LINK: 1%

- Earning interest through various means

- Long-term hold

DOT: 1%

- Earning interest through various means

- Long-term hold

Other: 3%

- This group consists of 35 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Questions and Comments

Have comments or questions? Please let us know in the comments below. For private matters, Contact Support.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.