Insider Newsletter 7: July 2022

Last month, we led the Insider Newsletter with “this is fear.” Now, some of that fear has subsided.

This month, we analyze Crypto-ML indicators, macroeconomics, crypto news, on-chain metrics, and technical analysis to paint a nuanced picture and provide guidance for long-term investors.

To summarize:

- The rally over the last week may be nearing exhaustion.

- Significant economic headwinds may not be resolved for another 1.5+ years, hampering significant bullish action.

- Large bitcoin wallets are buying at significant levels. If you’re buying now, you’re in good company.

- Unless there is a major unexpted adverse event, the market bottom may roughly be in.

- Bitcoin continues to prove itself and will likely come back stronger in the next bull cycle.

If you are a long-term investor:

- Don’t time the bottom. Buy quality assets at regular intervals during this bear market. If prices go up dramatically, you will have great positions. If prices drop dramatically, you didn’t go in all at once and you can continue buying.

- Prepare for a long bear market and do not expect an immediate return. While unlikely, a worst-case scenario would be Bitcoin at $10,000, which is a psychological level but also corresponds to a potential worst-case drop in the S&P 500.

Of course, every investor has different risk tolerance and timelines. You need to make decisions that are best for you.

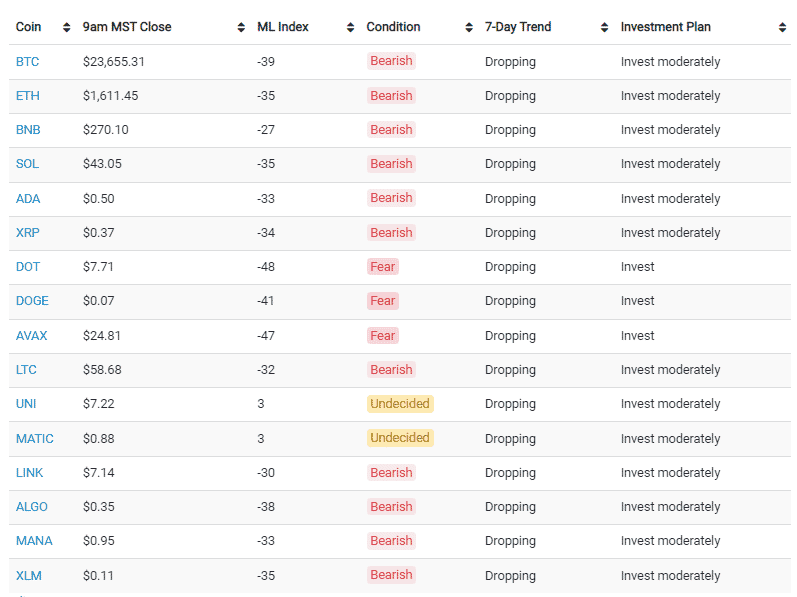

Crypto-ML Data

Either the bottom is in or we are in an era of new crypto market price action. We could see a sustained bear or sideways market, but levels may not drop significantly lower.

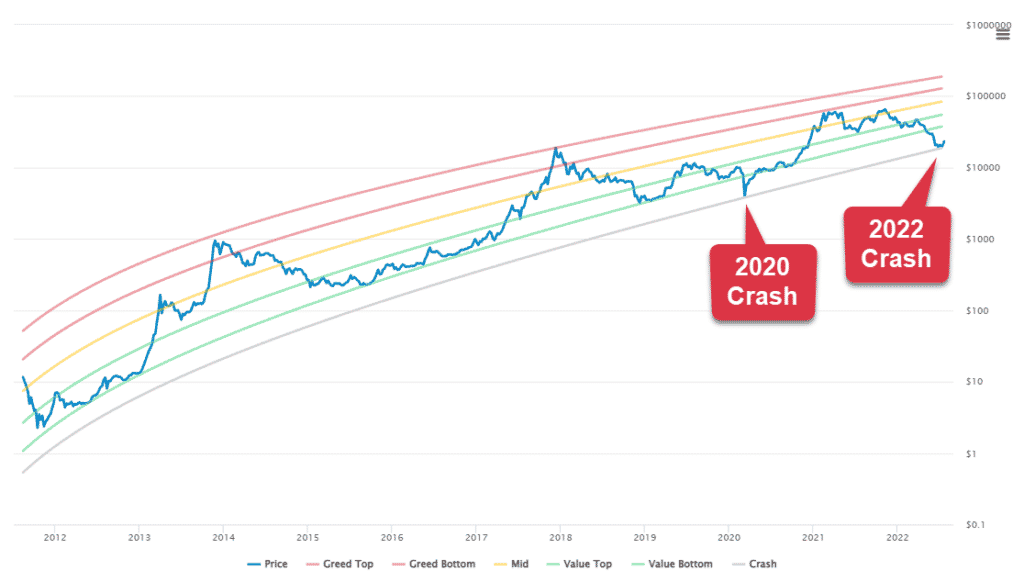

Price Channels

Last month, we added an additional “Crash” line to the Crypto-ML Price Channels. This is simply 50% lower than the Value Bottom regression line. It catches the COVID crash of 2020 and so far seems to also be the floor of our current crash.

A move above $37,600 will get Bitcoin back to the regular model that has held for over 10 years of price action.

Conversely, if Bitcoin breaks convincingly below $18,000, that will confirm the decade+ price behavior is no longer valid.

Many analysts consider this logarithmic regression view as key to understanding Bitcoin as it matches nicely with stock-to-flow and generalized economic growth models.

Any ongoing deviation from this will be the end of an era and time to reassess how to fundamentally value Bitcoin.

Fear and Greed Index

The Crypto-ML Fear and Greed Index has finally moved out of “Extreme Fear” and is displaying a significant rebound in sentiment. This means the search phrases, social media tone, and price action has shifted dramatically over the last couple of weeks.

The Bitcoin Fear and Greed Index was at an all-time low of -117 on June 20. One month later, it is at -38. This reflects people willing to call a bottom and begin purchasing crypto. It also matches the Price Channels nicely.

Be cautious to celebrate too much. The overall sentiment is still bearish. And there, of course, is no guarantee the market has truly bottomed out.

Macro-Economic View

Following on last month’s Insider Newsletter, we continue to expect 1.5 years or so of broader economic challenges. This will limit the crypto markets.

As an important reminder:

- Nearly all recessions last two years. See the data here: https://crypto-ml.com/insider/newsletter-6-june-2022/#Recession_expectations

- Bitcoin and other crypto tend to follow the overall market and act as a speculative asset rather than a hedge.

As such, it’s reasonable to expect we still have a 1.5 years+ of choppy markets ahead.

Recession, inflation, and default

From a terminology perspective, you may hear some people say we are in a recession and others say we’re just in a bear market. It turns out, the definition of a recession isn’t that straightforward.

A common measure is to call a recession at two quarters of negative GDP growth (reuters.com). In this case, we are already in a recession. That means, following past patterns, we have another 1.5 years or so of recovery ahead.

However, most economists believe there is more nuance needed. The National Bureau of Economic Research officially declares recessions (nber.org). Until they make that call, which may be lagging, you will continue to hear mixed messages about our current cycle. This could mean we have another quarter or so of recovery to account for.

Regardless, most markets have been in a downtrend for the entirety of 2022 and there are significant headwinds that only seem to be ramping up.

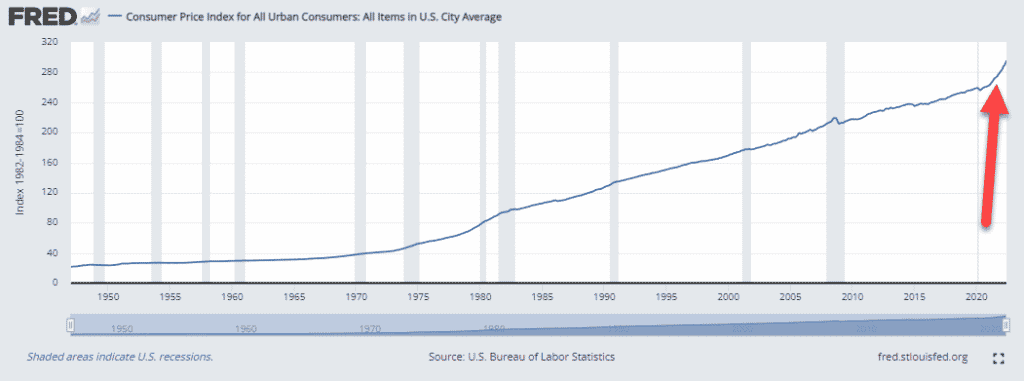

June posted 9.1% inflation year-over-year increase. This came in higher than expected. We haven’t seen inflation increases like this since the 1970s and 1980s.

With this, the probability of a formal recession continues to rise. In a Bloomberg survey of economists last week, the median probability of a recession in the next 12 months jumped from 30% to 47.5%.

Read more about June’s inflation report:

- Inflation rose 9.1% in June, even more than expected, as consumer pressures intensify (cnbc.com)

- Red-hot inflation boosts talk of full-point rate hike, recession, stock drop, debt worries (usatoday.com)

- U.S. Inflation Hits New Four-Decade High of 9.1% (wsj.com)

While food and energy make up a large portion of this increase, those categories are critical components of the economy. This is especially true for more emerging economies.

Argentina just posted 64% year-over-year inflation in June, with expectations they’ll hit 90% by year-end (bloomberg.com).

These countries have already defaulted on their debt:

- Lebanon

- Sri Lanka

- Russia

- Suriname

- Zambia

According to Reuters.com, about a dozen other countries are on the brink, with some big names, including Argentina, Ukraine, Egypt, Belarus, and Pakistan.

China is particularly exposed to these failures. They have been one of the largest lenders to emerging countries, which are now distressed debtors (smh.com.au).

Meanwhile, the US and Europe have been increasing interest rates at faster rates than expected (cnbc.com).

JPMorgan Chase, the largest US bank, announced it is preparing for an “economic” hurricane:

- There are still serious (economic) issues to contend with

- Quantitative tightening will reduce liquidity in global markets

- Markets will remain volatile for the foreseeable future

Read more at Jamie Dimon battens down the hatches for a recession (cnn.com)

JPMorgan isn’t alone. Citigroup, Deloitte, PNC Financial, Bank of America, and Wells Fargo have all revised their outlook to state that a recession is likely within the next 12 months (cnbc.com).

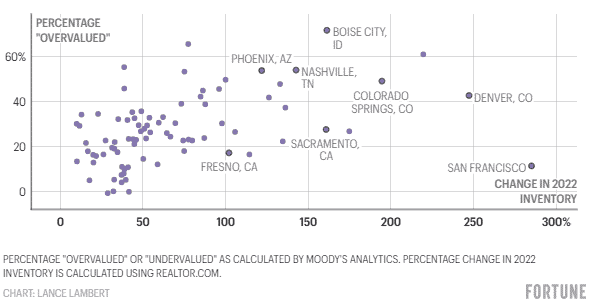

As a final note, stocks, crypto, and commodities have been dropping for almost six months. Housing, which tends to be slower, is finally turning. In larger US markets, housing inventory (houses for sale) has spiked triple digits from just six months back (fortune.com). San Francisco inventory is up 280%, Denver is up 247%, and Austin is up 220%.

This indicates components of the economy are still in the early stages of dropping.

How the markets will react

Markets move based on expectations of the future. Right now, there are many variables in play that make the outlook murky, This is why markets are volatile. They don’t like uncertainty.

- Will the war in Ukraine escalate? Or will it become a long, multi-year, protracted war?

- Will governments successfully mitigate inflation and create a soft landing? Or will economies fall further out of balance and we enter a full-blown, global recession?

- Will more developing countries fail?

As the murkiness remains, we will have sideways, choppy, volatile markets.

- Unexpected good news may rapidly accelerate us into a bull market.

- Unexpected bad news may drop traditional markets down another 25% to the $3,000 level for the S&P 500. That may be an equivalent drop of 50-60% for Bitcoin, bringing it near $10,000 in a worst-case scenario.

As you can see from the economist survey and large bank outlooks, the experts are leaning toward sideways and further downside being likely.

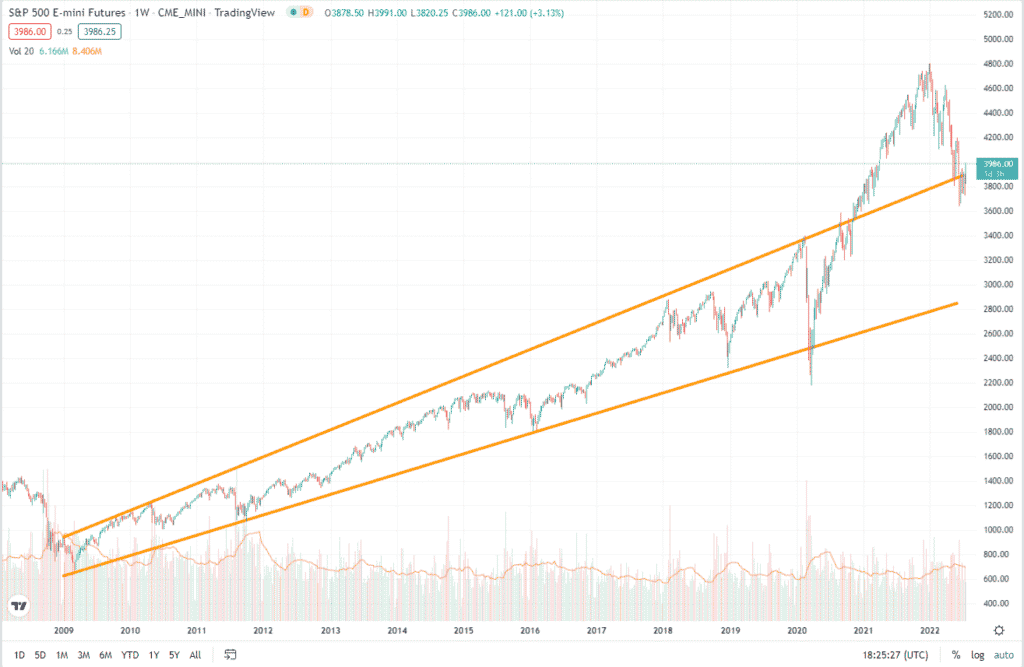

For reference, the average S&P 500 drop during an official recession is 29% (source). That would correspond with it correcting to near the lower yellow line.

Since no one knows the future with certainty, the action you can take now is to buy quality assets at regular intervals that you want to hold for years. You also must accept that prices may continue to drop, but you will buy at these lower prices too because you didn’t go all in.

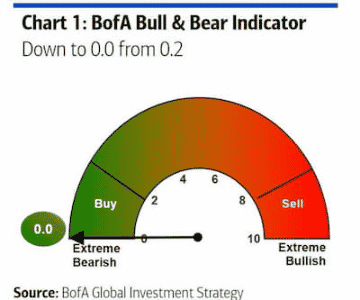

To further cement this, here is Bank of America’s bull and bear indicator:

As noted above, it has hit the most extreme bearish point it can hit. But do you see what it says to do when you’re extremely bearish? Buy.

Will Bitcoin bounce back stronger?

While we may face volatile markets for the next 1-2 years, it’s very likely Bitcoin will come back stronger. After this current period is over:

- More investors will have a better understanding of its core value proposition and how it can protect against inflation.

- More people in highly-impacted countries will see its utility in standard transactions, such as is happening in Russia, Ukraine, Argentina, and parts of Africa now.

- More regulation will legitimize the industry, improve investor confidence, and drive broader adoption

Altogether, there are numerous avenues for Bitcoin to outperform traditional investments as the markets recover.

Crypto News

Bad actors and failed projects have destroyed billions of dollars of value. These actions have already been priced in, but forthcoming regulation may have a significant impact on longer-term price action.

We need trustworthy, regulated, value-add companies in the crypto industry to help grow in the long run.

Managing your own keys has many advantages, but it also has numerous disadvantages. It is complex, requires strong security practices, and can lead to alternate avenues of loss. We’ve all heard of the lost hard drives and keys. This thread on Reddit is from a person who just lost $88,000 worth of crypto on MetaMask likely due to some form of malware.

If you want to earn a return on your holdings, which you should, DeFi is likewise complex and difficult for many to understand and use effectively.

We will be writing numerous Crypto-ML University pieces on self-custody, but it’s too simplistic to say “not your keys, not your coins.”

Celsius

Financial institutions, like Celsius, should be ideal for people who don’t want the responsibility of managing their own keys and navigating the complexities of earning yield. Ideally, you have a team of security, compliance, and investment experts working for you in a fiduciary manner.

We, as a team, have significant crypto balances locked on Celsius. This is a terrible position to be in and we are deeply sorry for anyone who also has their funds tied up in this mess.

Unfortunately, as is well known, Celsius froze withdrawals on June 7th and then declared Chapter 11 bankruptcy. It now appears Celsius has lied about their financials and practices since at least 2021.

Core Celsius statements:

- They only engaged in safe, over-collateralized loans.

- They were the most transparent crypto company, posting detailed, complete financials every week for the community to review.

While hindsight is 20/20, the reality is Celsius successfully attracted many sophisticated investors, managing billions of dollars and raising millions in funding.

What they told us simply did not match reality. They operated more like a minimally-controlled hedge fund with little oversight, losing customer money through high-risk endeavors.

We could go on endlessly with fraudulent public statements, but that is for another post. For a good summary, read this excellent 2-page PDF filed with the New York Bankruptcy Court (cases.stretto.com).

There are many others like it. You can follow the filings here: https://cases.stretto.com/Celsius.

If you prefer not to read the court documents, enjoy this 2-minute video compilation of their CEO lying.

You’ll also find plenty of other similar videos. His regular AMAs and interviews provide ample material.

Regulation

After TerruUSD, Celsius, Nexo, and other failures, we can only expect governments to ramp up regulation.

Here are some other recent headlines that will drive changes:

- Former Coinbase manager charged in crypto insider trade tipping scheme (cnbc.com).

- Singapore’s Zipmex exchange halts withdrawals, citing volatile markets and financial woes (blockworks.co).

- South Korean prosecutors raided 7 exchanges, including Upbit, Bithumb, Coinone, and more (watcher.guru).

In reaction, you have both the US and Europe seeking to move quickly on new regulations:

- Fed’s Vice Chair Brainard says crypto needs regulation now (cnbc.com).

- European Central Bank and Financial Stability Board: stablecoin rules must be implemented with urgency (bloomberg.com).

- The US Treasury seeks input on cryptocurrency risks and benefits for presidential report (treasury.gov)

Reasonable regulation that puts up safeguards for consumers while allowing innovation to continue will legitimize crypto and help it flourish in the long run.

However, we also run the risk of hasty, reactive regulation that hinders the industry and grinds investment to a halt.

Regardless, allowing a trillion-dollar industry to operate like the Wild West with little-to-no clear regulation has proven to attract fraudsters and scammers at scale. Unless put in check, this will harm the crypto industry’s ability to grow and achieve mainstream adoption.

On-Chain Metrics

Big wallets are buying in large numbers, however, based on past bear cycles, we should not yet expect a market reversal.

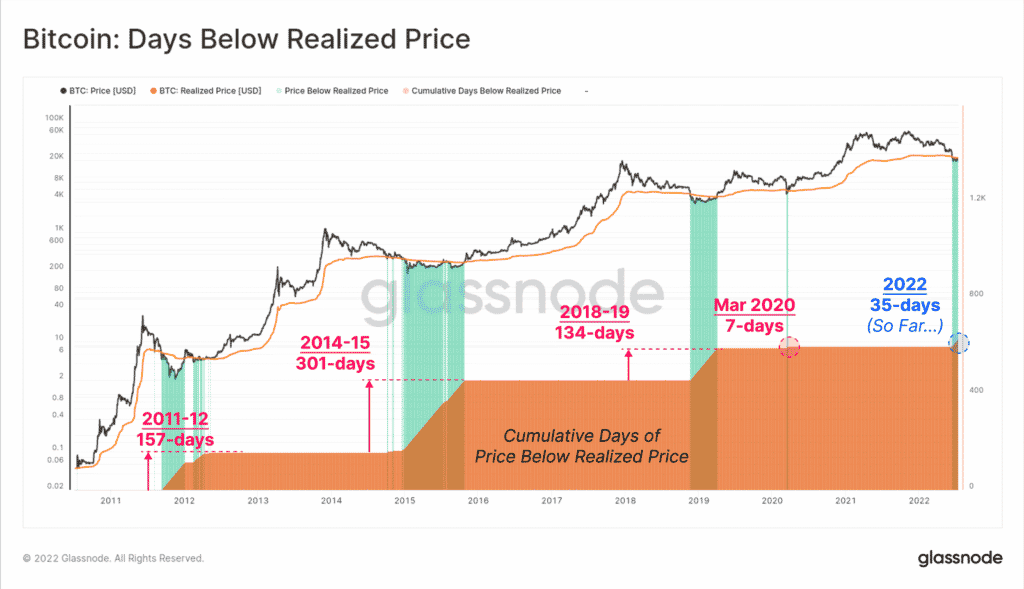

Bitcoin bear markets have historically bottomed out when Bitcoin spends a certain number of days below “realized price.”

The average time under realized price has been 197 days. So far, we’re at about 40 days. Keep in mind, that’s only sampling three past occurrences, but this data does show bear cycles tend to take longer to recover. This paints a similar story to the broader economic patterns.

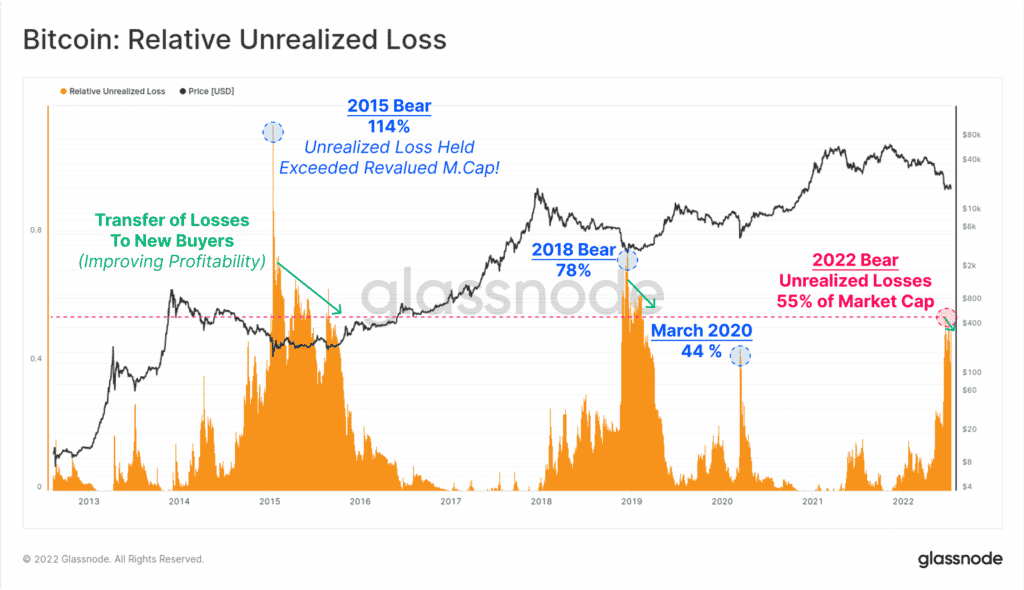

Looking at unrealized losses, we see a similar story. Before a reversal, we have historically seen a higher percentage of accounts in losing positions.

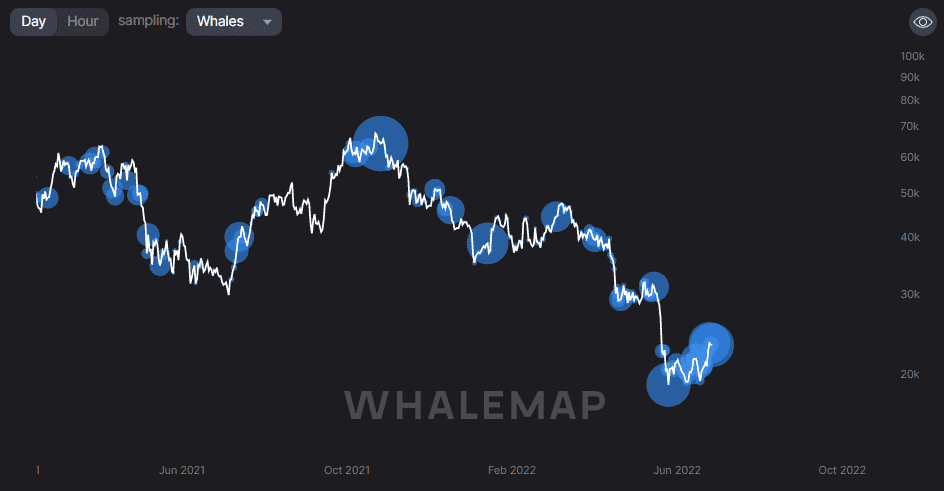

Regardless of how long the bear market will last, it can be certain that whales are accumulating now. The bubbles in this chart indicate large wallets accumulating Bitcoin. You see the heavy concentration around the $20K price point.

Overall, this mirrors the approach we are taking. We are prepared for a longer bear cycle but are continuing to buy at regular intervals to build long-term positions.

Looking at stock-to-flow, although price has extended well below the model (indicating a reversal is pending), based on “days until halving,” we could see another 100-200 days of negative or sideways price action.

As above, there are only a few past examples to base this on.

Technical Analysis

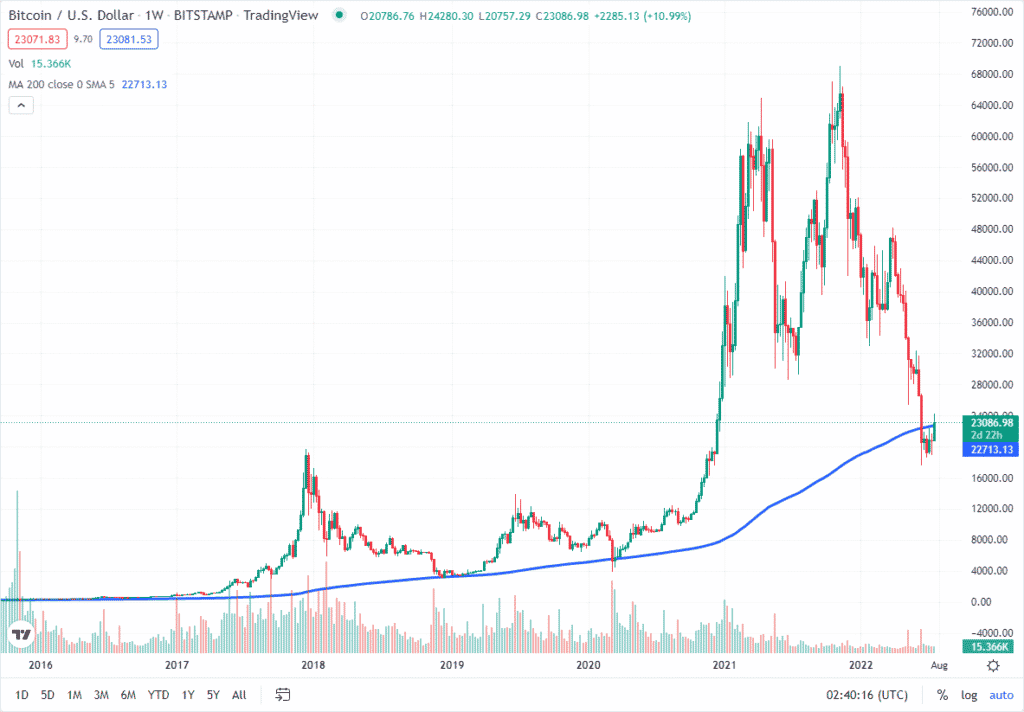

Short-term indicators show the months-long downtrend has ended. But the rally is exhausting. This is happening right at the weekly 200-SMA level which is acting as significant resistance.

The weekly 200-period SMA is what most people have their eyes on. Apart from a tiny dip during the COVID 2020 crash, Bitcoin has not closed under it until last month. What has acted as support for Bitcoin’s entire history is now acting as resistance.

You can see from this chart that Bitcoin is struggling to close above the SMA line. It will be very interesting to see how this week closes, but this chart indicates Bitcoin is likely to retrace back down.

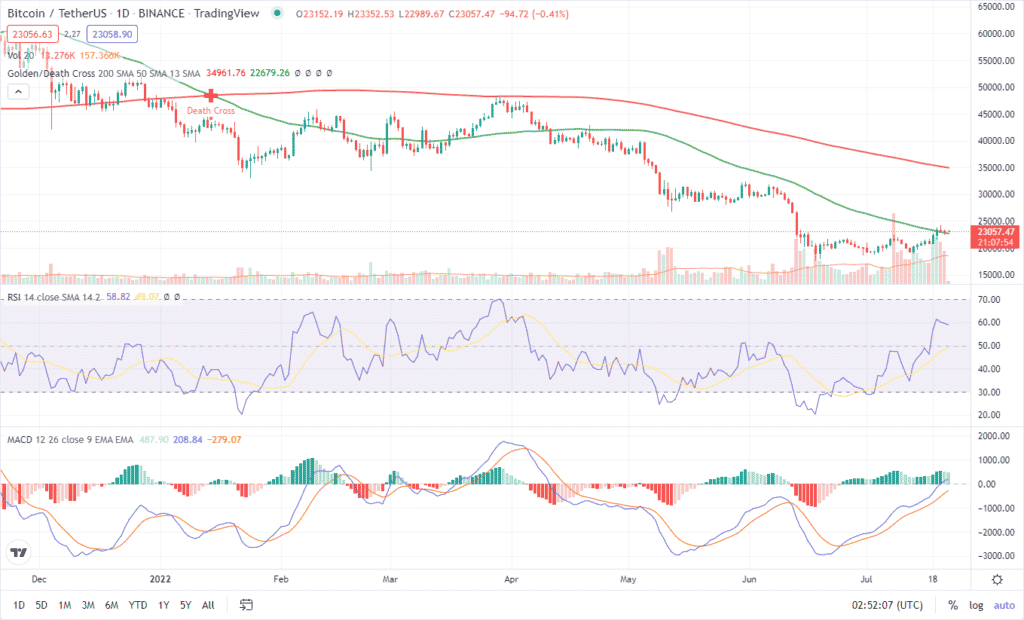

The daily chart paints a more positive picture, with Bitcoin breaking both a downtrend and a local resistance line.

Daily RSI and MACD both show the rally may have a few days of upside left, but we’re nearing the end.

Bitcoin also remains in a death cross, with the 50-day SMA yet to turn up. This means the overall trend remains negative and bearish.

These are lagging indicators, but seem to show we’re nearing the end of a small relief rally.

Putting It All Together

Nearly every indicator and expert is predicting challenging economic headwinds that will last at least through 2022. Large financial companies are adjusting strategies. Large tech companies are adjusting hiring. The pros are hunkering down.

What does this mean?

They cut costs and avoid high-risk investments. They focus on building long-term positions in quality assets. They do not attempt to time the bottom. They make regular, deliberate purchases.

For many crypto investors, quality assets are Bitcoin and select altcoins. Investing weekly or monthly will ensure you gain exposure to many price levels.

Bitcoin has proven it is not going away. It continues to survive the shenanigans of the broader cryptosphere. It has not had a technical failure. We are in a low part of a cycle. As it continues to prove itself, Bitcoin will likely come back stronger.

Current Crypto-ML Portfolio

It is important to note that nearly all of this money is working for us to generate interest. We are not relying on appreciation alone.

This is a snapshot of our portfolio, provided to give you insights into our real-life decision-making.

This is a critical point: these investments are automatically buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

Of note for this month, our portfolio is officially fully out of stablecoins, all of which have been deployed into crypto. The stablecoin balance was built up during earlier periods of “Extreme Greed.”

If you’re investing for the long term, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

BTC: 44% (+22%)

- Earning interest through various means

- Long-term hold

BNB: 39% (-5%)

- Earning interest through staking

- This position became outsized due holdings acquired prior to BNB’s rapid rise in early 2021.

- Though not decentralized, Binance will still have a major role to play in the crypto space in the foreseeable future. The deflationary monetary policy is also attractive.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023. Some portion of BNB will likely stay as a long-term holding.

ETH: 14% (-7%)

- Earning interest through various means

- Long-term hold

Stablecoins: 0% (-100%)

- This balance has been completely phased out during “Extreme Fear.” It originally consisted of funds that were booked during “Extreme Greed.”

LINK: 1%

- Earning interest through various means

- Long-term hold

DOT: 1%

- Earning interest through various means

- Long-term hold

Other: 1% (-67%)

- This group consists of 35 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Questions and Comments

Have comments or questions? Please let us know in the comments below. For private matters, Contact Support.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.