CTO’s Bitcoin Market Analysis: November 17, 2021

Long-Term Bitcoin Price View

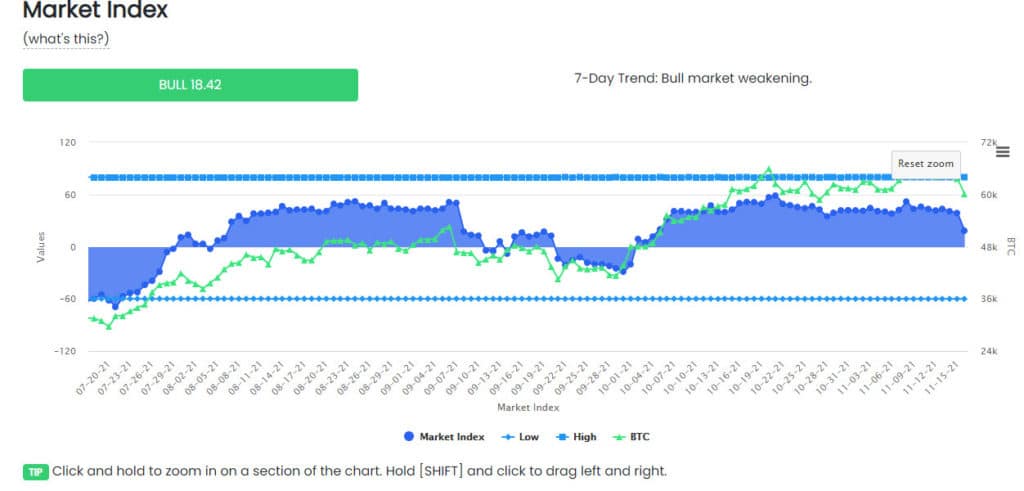

The Crypto-ML Fear and Greed Index is currently at 18.42 and has been declining for 4 days now. Bitcoin price has corrected about -8.5%. We may see the Fear and Greed Index might cross under its zero line and into bearish territory.

Notice when Fear and Greed Index is under the zero line, price action tends to stay sideways and/or down until Fear and Greed Index starts climbing back up. (Pic 1)

The daily chart confirms why Fear and Greed Index has tanked over the past days. Resistance was acting as support: $63,500. Resistance was tested five days in a row before the bears were able to take control. Not only did the bears crash through $63,500, but they also crashed through support from Mid-April, 2021, and have tested Support 1 at $58,904 over the past 2 days. (Pic 2)

Short-Term Bitcoin Price View

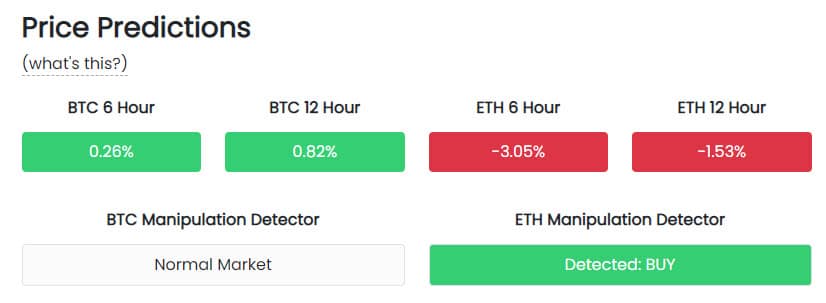

Crypto-ML’s Price Predictions are indicating the following:

Bitcoin:

- Sideways and a normal market. Not a good time to buy, volatility is low.

Ethereum:

- Bears in control, prediction for 6 and 12 hour are both negative as is price action.

- But the Manipulation Detector has detected bullish market manipulation. Interesting that the Manipulation Detector thinks this is an unusual price prediction! Let’s see what CML-A has in store for us.

- Note: Even though a bullish manipulation has been detected, you’ll notice a trade hasn’t been opened. That is because overall market conditions are considered too uncertain to open a trade. These types of checks and balances are built into the machine learning behind CML-A.

Bitcoin Targets

The 1-hour charts are showing some life after the -8.5% correction. Maybe we will see a test of “Support from Mid-April, 2021.”

I am seeing lower highs. I suspect there will be some zig-zagging while price goes up and starts testing $61,1xx.

If a cross under of Indicator Y (red line) occurs, expect more testing of Support 1. The daily candle needs to close green (UTC) for more upwards movement. (Pic 4)

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.