Has the Crypto Market Bottomed Out? Measuring Fear.

The crypto markets have dropped around 50% since reaching record highs in April. This was yet another huge and incredibly fast drop in value. Played properly, though, corrections like this set up strong opportunities, especially for long-term investors.

Is now a good time to buy back in?

It’s very difficult to call the bottom of a particular cycle, but looking at our data, we can say two things:

- Fear has set in.

- The market is likely not yet ready to turn back around.

The end of a crash tends to have these characteristics:

- Price extending quickly below recent levels.

- Negative press coverage, with titles such as “Bitcoin is finally dead,” “Sell Your Bitcoin and Never Look Back,” and “The End is Here for Crypto.”

- The exit of retail traders from the market.

- Reduction in speculative, leveraged trading.

These negative-sentiment ingredients tend to signal the end of a bear market and the start of a bull market. The seasoned pros are buying back in while everyone else has given up.

The best time to buy is when everyone else is panicking.

What the Crypto-ML Fear and Greed Index tells us

The Fear and Greed Index has just been heavily upgraded to pull in many more data points, attempting to monitor the characteristics noted above. Specifically, the Fear and Greed Index now consumes the following variety of data points to determine its score:

- Exchange data: such as price and volume

- Technical data: such as momentum and moving averages

- Social media data: such as Twitter sentiment and volume of discussion

- Search trend data: such as quantity and type of search queries

- Dominance data: how Bitcoin compares to altcoin market capitalization

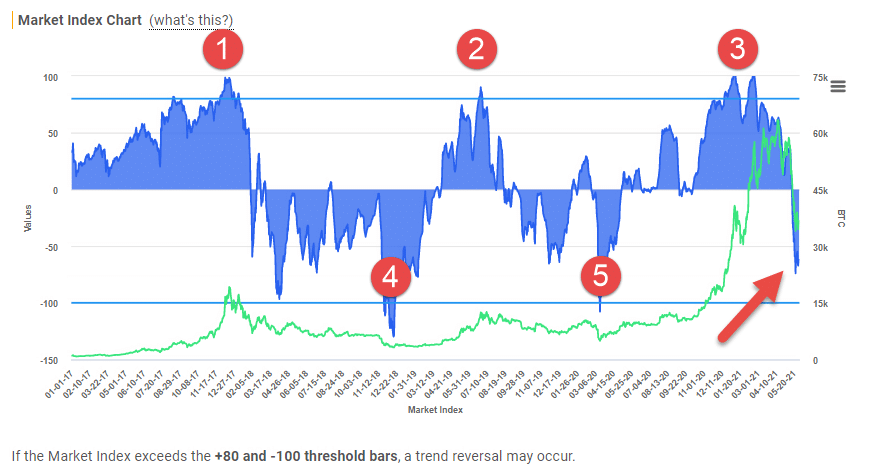

These factors come together to paint a picture of just how extreme the market may be. Here’s a snapshot of the Fear and Greed Index as of June 1:

Looking at the chart, you can see that when the Fear and Greed Index exceeds +80, it’s a warning sign that the bull run may be nearing a peak. This happened at points 1, 2, and 3.

You’ll also notice points 4 and 5 signals a new bull market may be in the making.

As of today, the Fear and Greed Index is around -60. This means:

- It still may need to fall further before we start a new bull cycle. Perhaps the drop needs more time or a further price reduction.

- According to our aggregated data, people are fearful, but they have not yet entered full panic.

Limitations of this data

In the history of cryptocurrency, there have only been a handful of large trend reversals. But with machine learning and statistics, you prefer to have thousands of samples of the events you’re trying to predict.

As such, we have a limited understanding of when the crypto markets will actually reverse. We instead look at commonly accepted factors that have led to reversals in numerous other financial markets.

That said, please consider the following:

- The trend may reverse without first crossing -100.

- The Fear and Greed Index drop below -100 but price will continue down, possibly to zero.

Taking action

The Fear and Greed Index shows fear has definitely set in with the cryptocurrency market. Depending on your goals, this may be a great buying opportunity, especially for long-term positions.

- You could wait to consider buying until the Fear and Greed Index drops below -100.

- You could begin adding to your long-term positions each month the Fear and Greed Index is negative.

Learn more about the Fear and Greed Index. Access to the Fear and Greed Index is included in Crypto-ML’s free membership option.

If you have questions, let us know in the comments below!

4 thoughts on “Has the Crypto Market Bottomed Out? Measuring Fear.”

Leave a Comment

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.

There may be a bull trend if price crosses above 44k (i guess)….although fundamentals are not strong due to fear in stock market & inflation etc…….but due to ethereum’s upcoming update ….some traders believe ether price will shoot up as bitcoin whales will try to take advantage of the situation by increasing both bitcoin along with ethereum prices.

This can be true if there is sudden surge without any price correction to 44 or 45 k……signalling entrance of whales.

Yes, good info and thanks for the comment!

Crypto bull market not gaining momentum…after BTC reaching 44-45k …it seems to me that the whales don not wish to participate…..they seem to hate institutional investors and vice-versa….with both trying to have control on BTC market..also stock market seems to be reviving slowly with some fear…plus there is fud due to upcoming US bill.

Overall it’s healthy for the market in the long run….I would suggest to proceed cautiously as there is no increase in BTC addresses having BTC > 10, 100 & 1K only some increase in wallets with BTC >1

Thanks. Great info. This was a critical zone, but like you mentioned, it appears we need the big players to push this further. All Crypto-ML signals have also closed.