Is It Better to Trade XBT or BTC Bitcoin Futures?

If you are a Bitcoin trader, it is generally best to use futures for Bitcoin trading. But there are two Bitcoin Futures choices: XBT and BTC. Which is better to trade and what are the differences?

If you’re a Bitcoin investor or want to use cryptocurrency technology as a tool, then it makes sense to utilize actual cryptocurrency. But as a trader, Bitcoin Futures offer many advantages, which we discuss here: The Top 7 Reasons You Should Trade Bitcoin Futures.

Assuming you are trading Bitcoin Futures, you may wonder which contract is best. The CME offers BTC and the Cboe offers XBT. Both are available on most major trading platforms.

But, there are a couple of significant differences, which we’ll cover in this post.

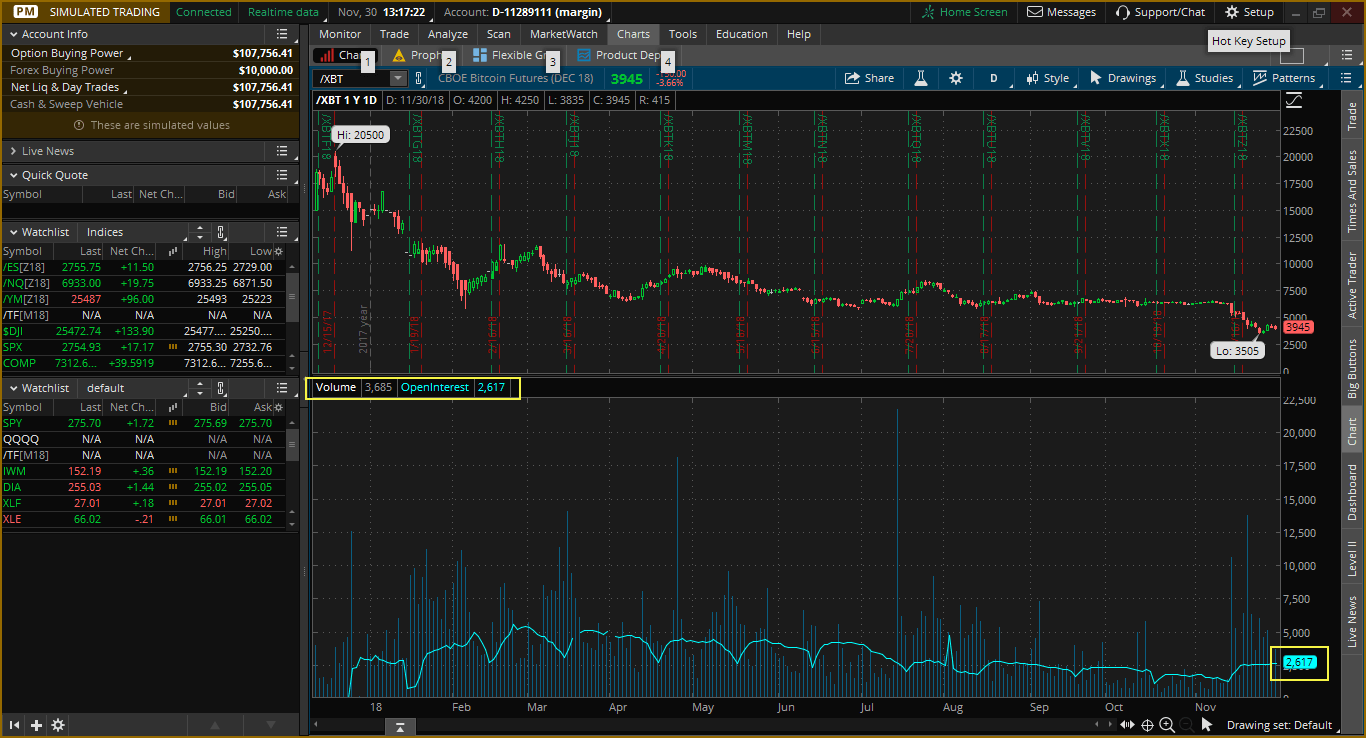

The screenshots in this post are from a paper trading account with ThinkorSwim. If you want to experiment with Bitcoin Futures, here’s where you can get your own free ThinkorSwim Paper Trading account. Crypto-ML is not affiliated with TD Ameritrade or ThinkorSwim.

Bitcoin Futures Overview

At a high level, the futures market is very similar to the stock market. Through traditional accounts and platforms, you can trade futures much in the same way you trade stocks. Major trading companies such as E*Trade, TD Ameritrade, and TradeStation offer Bitcoin Futures trading and are available in many markets worldwide.

Bitcoin Futures allow you to:

- Trade easily with great tools, just like stocks

- Simple to go long or short

- Trade on margin (to amplify gains and losses)

- Enjoy very low fees

- Trade in geographies that don’t allow access to crypto exchanges

- Other benefits discussed here

Typically, you usually need to just let your brokerage know you want to trade futures. They may have you acknowledge a few documents and you’ll be all set.

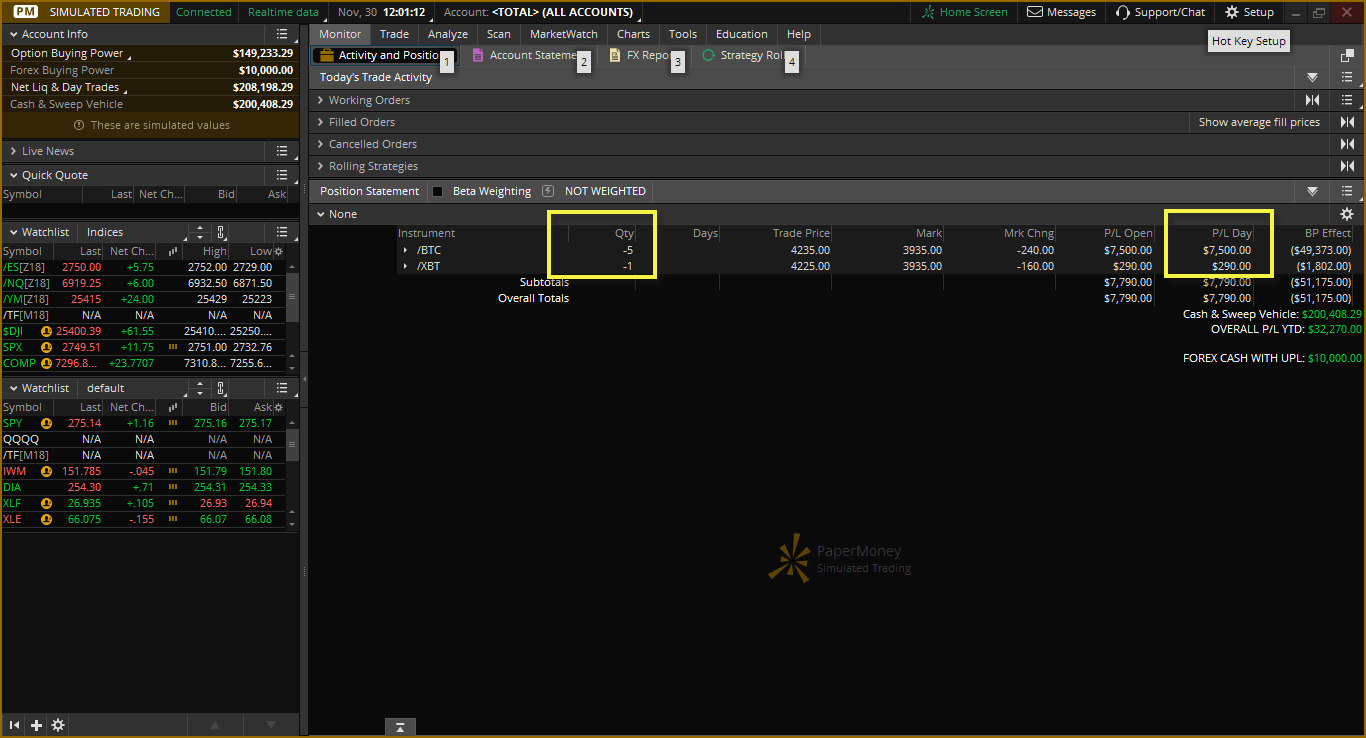

Here’s a screenshot of TD Ameritrade’s ThinkorSwim platform. It shows simulated trades opened yesterday.

- BTC Futures shorted 5 contracts at $4,235. Profit in under 24 hours is $7,500.

- XBT Futures shorted 1 contract at $4,225. Profit in under 24 hours is $290.

Quotes for futures are typically done by entering a slash “/” before the symbol. This differentiates a futures quote from a regular stock quote.

XBT Compared to BTC

Both the XBT and BTC are available futures choices. If you go into your trading platform, you can pull quotes for both and trade both. The question is which is best for you.

Fundamentally, BTC is bigger than XBT.

- BTC is generally for traders willing to take on higher risk and who have larger account balances. Purchasing 1 BTC contract is the equivalent of buying 5 Bitcoin. With Bitcoin currently trading at about $4,000, that means a single BTC contract is worth $20,000.

- XBT, on the other hand, is for most traders with lower risk tolerance and moderate account balances. Purchasing 1 XBT contract is the equivalent of buying 1 Bitcoin.

There are other differences, which are as follows:

Margin Required

Margin is the amount of money required to trade a futures contract. The below figures are current for TD Ameritrade:

- XBT: 45% of price of 1 contract

- BTC: 50% of price for 5 contracts

If we assume the current spot price of Bitcoin is $4,000, that means you would need this much:

- $1,800 to trade 1 XBT (equivalent to 1 Bitcoin or $4,000)

- $10,000 to trade 1 BTC (equivalent to 5 Bitcoin or $20,000)

These values should apply whether you go long or short.

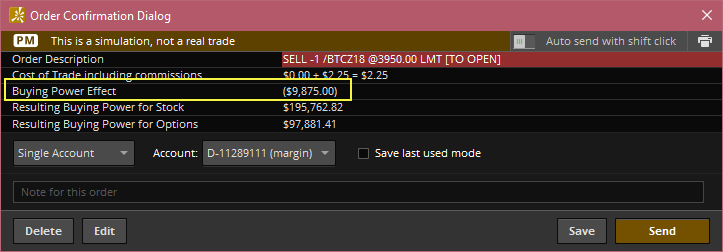

Here you can see by shorting 1 BTC at the price of $3,950, my buying power is reduced by $9,875. That is because the price ($3,950) times 5 Bitcoin (1 contract size) times 50% margin = $9,875.

Please note that these numbers are subject to change. With your brokerage, you will have “buying power” which is the amount of money you can trade based on your account balance. When you get a quote or begin entering a trade, you’ll see how much your “buying power” will be reduced by the trade.

Margin is very similar between the two as long as you understand how many Bitcoin each contract is worth.

Volume

Volume is important because it facilitates getting in and out of contracts easily and at the price you want. Volumes are generally fairly similar across both, but XBT is currently more traded and has more open interest.

Looking at listing values, we currently see:

- BTC open interest of 3,423

- XBT open interest of 3,790

If I look at the actual numbers, we see fairly similar figures. Both contracts are traded more or less equally with XBT having a slight edge. Interestingly though, BTC volume seems to be growing more over time. Assuming this trend continues, BTC may have a competitive edge in volume in the near future.

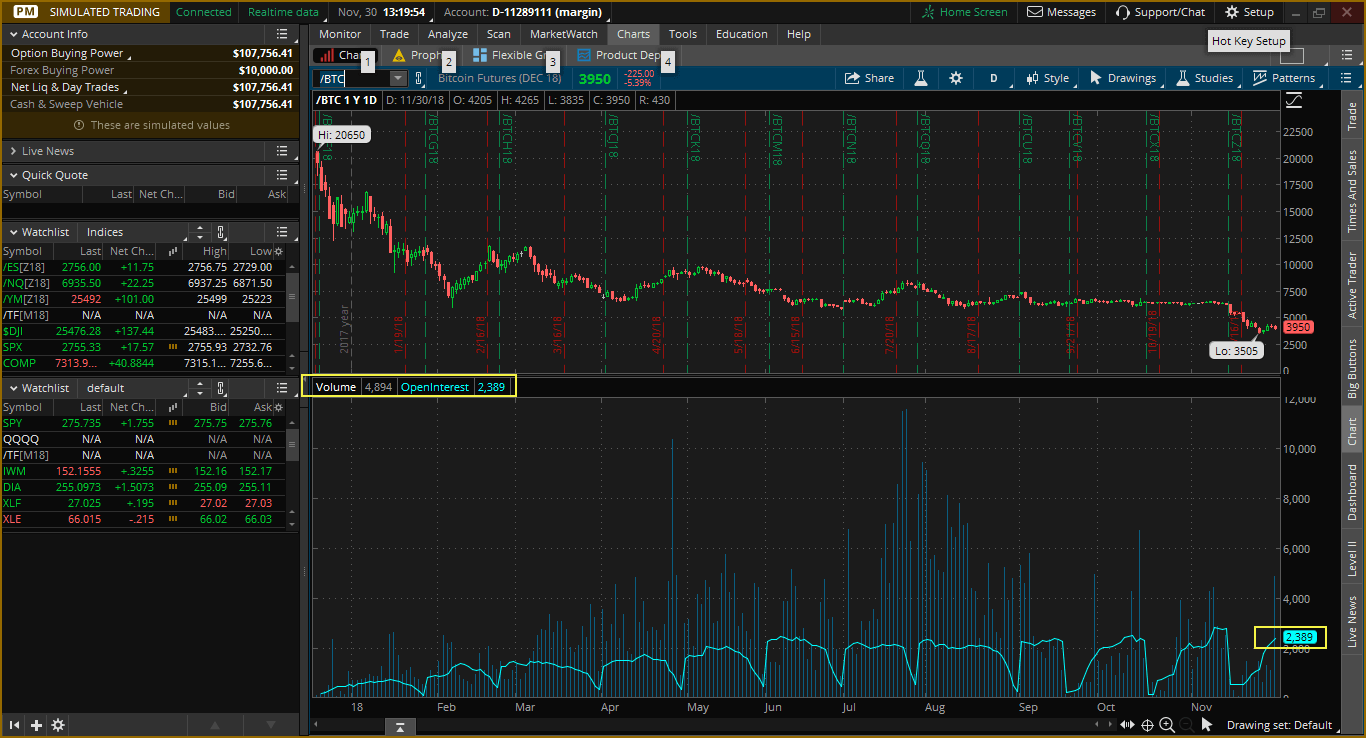

BTC Futures:

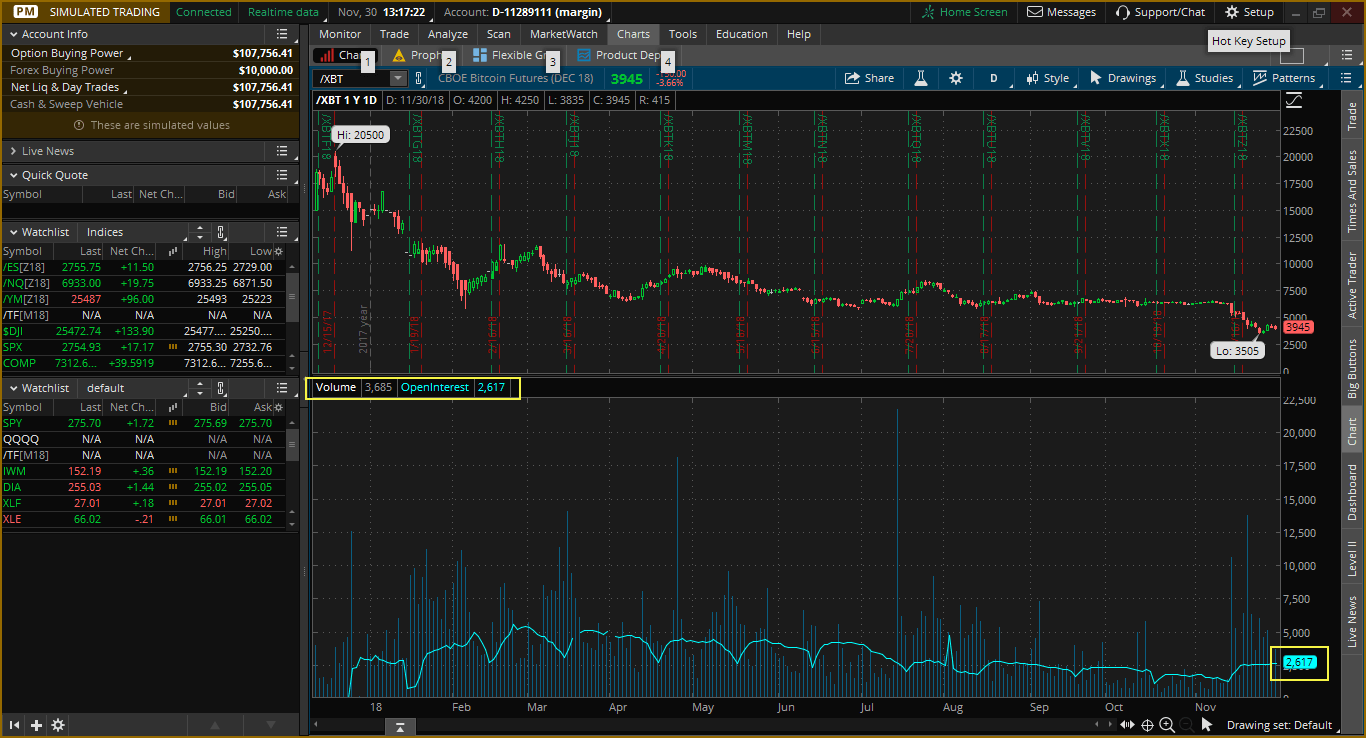

XBT Futures:

Full Specifications

If you’d like to read more about the details of Bitcoin Futures, here are the spec sheets:

- XBT Specifications (cboe.com)

- BTC Specifications (cmegroup.com)

Conclusion

For most traders, especially if you’re just starting out with futures, XBT will be the better trading option. If you haven’t traded futures before, start a paper trading account and ensure you’re comfortable with buying and selling before you use real money.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.