Altcoin Fundamental Analysis: 7 Steps to Picking Great Investments

Most altcoins of today will not be around 5 or 10 years from now. But some will grow and become critical components of our future. We’re at a unique spot in history where we can get in early and be part of the potentially explosive growth ahead for decentralized technologies.

But with the confusing terminology, complex technology, and rapid pace of change, how do you pick great altcoin investments?

This guide will show you how.

Coming soon: Crypto-ML will provide fundamental analysis of numerous altcoins to help you easily evaluate altcoins based on the framework described here.

Video Version

Prefer to watch the altcoin fundamental analysis video?

Hop in here…

Or keep reading…

Altcoin Fundamental Analysis

With complex on-chain metrics and confusing analyst buzzwords, it seems like a daunting task to understand crypto projects.

But the good news is you can effectively assess most altcoins using timeless and basic fundamental analysis principles.

Selecting an altcoin investment is very similar to selecting any business investment. In fact, many blockchain companies sell coins to raise capital.

With traditional companies, investors who get in prior to the company going public typically see the largest growth in wealth. The problem is, most of us cannot get in at that stage.

Altcoins, though, allow us to invest during these early stages.

Because of this, you have an opportunity to get in on the early stages of ventures during the early stages of our decentralized future. This has the potential to be absolutely life-changing.

Since many of these coins are in early stages, we’ll analyze altcoins similarly to how venture capitalists analyze a startup.

Here’s are the 7 components of our altcoin fundamental analysis framework:

- Unique Value Proposition

- Competition and Threats

- Leadership and Funding

- Development and Ecosystem

- Advanced Questions

- Your Portfolio

- Investment Timing

As further good news, you can do this sort of cryptocurrency fundamental analysis in about 1 hour. During that time, you’ll gain valuable insights and learn a lot about crypto in general. That’s faster than digging through Telegram, Twitter, and Reddit looking for advice from internet strangers.

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

Warren Buffett

Disclaimer: Since Warren Buffet loves fundamentals as much as we do, you’ll find his quotes sprinkled throughout this guide.

Ready to get started? Make this a working session. Pick an altcoin to work through the steps in this guide. We’ll look at these three as examples throughout this guide:

- Uniswap UNI

- Polkadot DOT

- Shiba Inu SHIB

“Give someone a fish, you feed them for a day. Teach someone to fish, you feed them for a lifetime.”

Not Warren Buffett

1. Unique Value Proposition

The unique value proposition is a complex way of saying what the purpose of an altcoin is.

Pick: What you can simply explain.

Avoid: What you don’t understand.

“An industry with which we are familiar and whose long-term business characteristics we feel competent to judge.”

Warren Buffett

The first step of evaluating an altcoin is to understand what it does.

Questions to Answer

- Why does this project exist?

- What problem is it attempting to solve?

- Can you explain it?

- Who will use it?

Resources

- Website and videos explaining the altcoin

- White paper of the altcoin

Examples

Uniswap Pass

It’s a protocol and app to “swap, earn, and build on the leading decentralized crypto trading protocol.” (https://uniswap.org/)

At its core, it’s a decentralized exchange with additional finance capabilities.

If you believe crypto banking activities will shift to decentralized solutions, then shortlist Uniswap.

Polkadot Pass

A platform to “facilitate an internet where independent blockchains can exchange information and transactions in a trustless way via the Polkadot relay chain.” (https://polkadot.network/about/)

This imagines a future with many blockchains that need to communicate. Polkadot can enable interoperability and become a key portion of the infrastructure for Web3.

If you believe the future of Web3 needs an interoperability layer to support many blockchains and decentralized applications, then shortlist Polkadot.

Shiba Warning

“The Shiba Inu token is our foundational currency that allows investors to hold millions, billions, or even trillions, of it in their wallets.” (https://shibatoken.com/)

While the Shiba token team has done some great work, it’s not clear what the unique value proposition is.

Summary

For an altcoin to grow in value, it must address a need that will expand over time. This means it will need to provide real value to real people at scale. Is it clear what that value proposition is? Can you explain it?

2. Competitors and Threats

Now that you know what problem your altcoin solves, it’s time to understand the landscape.

Who else is solving this problem? And does this problem really even need to be solved?

This is a fact-finding step to help better perform later steps.

Pick: Altcoins addressing big problems in areas that have high barriers to entry.

Avoid: Heavily saturated markets with low barriers to entry that solve questionable problems.

“Stocks of companies selling commodity-like products should come with a warning label: ‘Competition may prove hazardous to human wealth.’”

Warren Buffett

Questions to Answer

Competitors

- What other altcoins are solving this problem?

- How are they different?

- How big are they (market cap) and what is their transaction volume?

- How long have they been around?

- Technology advantages tend to be fleeting, but do any competitors have unique technology, patents, or other intellectual property that will be difficult to replicate?

Threats

- Does this problem benefit from being a blockchain solution? (Not everything is better decentralized.)

- How might regulation impact this altcoin?

- What is the criticism of this altcoin and its competitors?

Try Before You Buy!

Does your altcoin have a usable product or app? If so, get your hands dirty!

This is a simple step that most investors skip. Huge mistake. Using something greatly improves your understanding of it and will help you get past the marketing speak.

- Is it delivering on its promise?

- Is it well built, fun, and easy to use?

- Will you use it?

- Do you see the potential for mass adoption?

- Can you try the competitors’ products?

Note: Not all projects are easy to try. Some may be infrastructure-related or early in their development phase. If it’s not possible for you to try the product, try to find discussions from users to see what their experience has been.

To be specific on a couple of our examples:

- Uniswap is a consumer product and can be tried here: https://app.uniswap.org/#/swap

- Polkadot may be more difficult to try if you’re not a developer. However, even non-developers can gain exposure to Polkadot via slot auctions on places like Binance.com/en/dotslot/. For a full list of ways to participate, you can see https://polkadot.network/crowdloans/#participate.

- Shiba Inu can be transferred between wallets to get a sense of wallet support, speed, and fees.

Resources

- Market cap of altcoin and competitors from Coinmarketcap

- The app or product

- Web search for [altcoin name] competitors

- Web search for criticism of [altcoin name]

- Web search for threats to [altcoin name]

- Web search for outlook for [problem statement]

Note: avoid generic websites that provide a system-generated table of alternatives to products and services. These usually just lump all crypto projects together. It’s better to seek out competitors from crypto-specific sites.

Example

Let’s look at just Uniswap this time.

Uniswap Warning

After identifying Uniswap’s competitors, trying the app, and reading about the domain, a few points came to light:

- The app is fantastic and easy to use.

- Uniswap has a big ecosystem of partners, apps, and developers.

- Because of gas fees, Uniswap is extremely expensive to use.

- There are numerous mature competitors, such as PancakeSwap, SushiSwap, and DoDo.

- Traditional exchanges (like Binance and Coinbase) may still attract the masses better.

- The regulatory environment is yet to be defined, which introduces risk.

If you believe DeFi will take off and fees can be reduced or eliminated, Uniswap seems well-positioned to be one of the bigger players. But it will face tough competition along the way.

Summary

When evaluating an altcoin, it’s critical you understand the playing field and the other teams. If you find a better altcoin, switch your focus to it. Digging into competitors is often where you find great investment opportunities.

3. Leadership and Funding

If you’re investing in something for the long term, you need to make sure the people in charge of it are in it for the long term as well.

Unfortunately, in the crypto space, there are many people who are out to make a quick buck. Crypto offers many ways to do this, such as founder’s tokens and pump-and-dumps. Don’t trust the latest Twitter craze.

Instead, do the research to identify teams committed to long-term success.

Pick: Leadership that is trustworthy, respected, and has a grand vision for the future.

Avoid: Leadership that is using a crypto project for personal gain.

“When we own portions of outstanding businesses with outstanding management, our favorite holding period is forever.”

Warren Buffett

While people change, the initial founders and investors instill certain values and also develop relationships that set projects off on a certain path.

Be sure to review this information for both your target altcoin and its competitors.

Questions to Answer

- Who are the founders?

- What’s their vision?

- What’s their reputation?

- How do they personally benefit from the project?

- Does the team receive a bunch of tokens upfront (generally a red flag) or do they have a vesting schedule with long-term incentives (generally better)?

- Has the project received funding rounds?

- What are the expectations of investors?

- How does this leadership team compare to that of competitors?

Resources

- Altcoin’s website (About Us or Leadership sections), but don’t rely on this!

- LinkedIn for details on the leadership team

- Crunchbase for company investment details

- Maessari.io provides excellent profiles

- Podcasts and YouTube videos with the founders

Example

This time, we’ll go back to analyzing Polkadot.

Polkadot Pass

Polkadot seems to be a mission-driven project many great people invested in seeing it succeed. Key findings:

- According to Crunchbase, Polkadot has gone through 11 funding rounds and received $294M. There’s a lot of commitment to Polkadot’s success.

- Messari.io’s Polkadot profile page covers a lot of great information on the contributors, investors, and funding.

- The founders and leadership team have previously achieved a great degree of success. They have solid reputations in the blockchain community. Gavin Wood, for example, was the co-founder and CTO of Ethereum. They don’t need to make a quick buck.

- The Web3 Foundation (a non-profit) provides grants for developing the Web3 ecosystem and is also a major supporter of Polkadot. It should be noted that Gavin Wood was a founder of both the Web3 Foundation and Polkadot.

- Plenty of videos, interviews, and podcasts can be found with numerous leaders and stakeholders, such as Gavin Wood, Peter Mauric, Joe Petrowski, and Jutta Steiner. This gives insight into their vision and approach.

Polkadot’s leadership seems to be truly interested in the long-term success of Polkadot and decentralization in general. There is no indication they are there just out to make a quick buck at everyone else’s expense.

Summary

When you invest in an altcoin, you’re investing in the people behind it. Make sure you understand their motivations and incentives.

4. Development, Community, and Ecosystem

To launch an altcoin, you need great leaders. To sustain and grow an altcoin, you need developers, a community, and an ecosystem.

This is an important step as founders of altcoins regularly state the biggest challenge they face is attracting developers.

If industry experts are committing their time to a particular altcoin, that typically means they are bought into the technology, direction, and leadership of the project.

Pick: Activity, roadmaps, and engagement from 3rd parties.

Avoid: Altcoins with ghost town communities.

Questions to Answer

- How does this project’s developer base compare to that of competitors?

- Is there a published roadmap addressing technical issues and delivering valuable features at regular intervals?

- How many apps and other projects are integrated (particularly important for infrastructure and protocol altcoins)?

- Are 3rd parties committing money and time?

- Are there deals with big-name companies like Visa, Amazon, or Western Union?

- Is there a diverse and active community of users, developers, and support?

- Do wallets and exchanges support the coin?

Resources

- Reddit, Discord, and forums provide a sense of the community’s sentiment and activity level.

- Github will show how frequently Commits, Issues, and Discussions are happening related to the altcoin. Just search for the altcoin’s name.

- The altcoin’s website (Ecosystem section) typically showcases partnerships, but any company can paste a bunch of logos. Dig a level deeper to see what these really mean.

Example

Now we’re back to Shiba Inu.

Shiba Inu Warning

Shiba token does not look great through this lens. A few key findings:

- The shibatoken.org page title is “A Decentralized Ecosystem,” but there seems to be no information backing this up.

- Clicking on “Ecosystem” on shibatoken.org takes you to a section with no ecosystem information. Instead, it talks about burning tokens, giving some to Vitalik, and donations. These are great things but do not demonstrate 3rd party commitment.

- There does appear to be an expansion of features, but finding details on actual development activity is difficult.

- There is a large community (after all, it was one of the most popular coins of 2021), but diving into Telegram, Twitter, Reddit, or Discord shows the community is almost exclusively sharing memes and talking about mooning rather than the technology and real-world application.

While it’s great to have fun in the crypto space, popular coins don’t necessarily make amazing long-term investments. By digging into the 3rd-party support surrounding Shiba Inu, you can quickly see industry experts are not engaged.

Summary

Altcoins need a broad ecosystem of industry experts and contributors to thrive into the future. Jump in and see what level of 3rd-party commitment exists.

5. Advanced Questions

Having gone through the previous 4 steps, you should now have a solid understanding of your altcoin and its likelihood of long-term success. However, you’ve probably also uncovered additional questions that may be specific to the domain or goals of the project.

Here are some other areas you may want to dig into:

- What is the focus on stability, decentralization, and safety? These are key concerns for blockchain projects.

- What is the coin’s monetary policy? How are new coins issued? Is there an inflationary or deflationary policy?

- Is the altcoin dependent on another project?

- How centralized are the coin’s holdings?

- How are change and governance handled?

- How might this altcoin be affected by regulation?

If we look at Uniswap as an example, we see it is built on the Ethereum blockchain. If Ethereum’s gas fees are high, then Uniswap may be prohibitively expensive to use for most people. At this point, we can look into roadmaps for Ethereum and Uniswap to see how they may eventually alleviate fees. If this happens, Uniswap could rapidly gain market share.

“The best thing that happens to us is when a great company gets into temporary trouble…We want to buy them when they’re on the operating table.”

Warren Buffett

In that quote, “temporary” is the operative word. Diving into details may help you determine if an altcoin has unrealized potential or inherent faults.

During Polkadot research, we found “earn” options up to 9.02% (as of this writing) on DOT holdings. That is a huge bonus that amplifies this investment. For more, see our guides:

6. Your Portfolio

Don’t forget that you are part of this equation!

Different investors have different goals, risk tolerance, and day-to-day life considerations they must balance. Because of this, there is no one-size-fits-all approach.

General Considerations

This is beyond the scope of this guide, but crypto should be part of your overall investment strategy.

- Are your non-crypto investments healthy?

- What is your time horizon?

- What risk can you accept?

Diversity

As you’ve seen, altcoins can serve very different purposes. One way to reduce your risk is to select altcoin investments from different categories, such as:

- Infrastructure

- Protocols

- Apps

Lifecycle

Another way to adjust risk is to select altcoins in different lifecycles.

- Startup/concept

- Prototype

- Initial product

- Mature product

Altcoins in earlier phases will have much higher potential returns but also much higher potential risk. It is good to have exposure to altcoins in a variety of these phases.

7. Investment Timing

If by doing this research, you have found an excellent altcoin investment, the next natural question becomes is now a good time to buy?

If your altcoin fundamental analysis has checked most of the major boxes above and your time horizon is 2+ years, timing likely doesn’t matter that much. The altcoin value should go up as it addresses its use case and expands its user base and ecosystem.

Time in Market

When an asset is expected to go up over time, the best options are:

- Buy as soon as possible.

- Dollar-cost-average over time. This means you buy some amount every month at a variety of prices.

Important: Time in the market beats timing the market.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.“

Warren Buffett

Using Fear

That said, the wealthiest people have a knack for buying a great asset when everyone else is scared of it. This works in crypto, stocks, real estate, and just about anything else.

- Housing market crash? Buy real estate!

- Stock market crash? Buy stocks!

- COVID causes Bitcoin to drop to $3,000? Buy Bitcoin!

The risk with this approach is you may sit on the sidelines for years waiting for a crash. Worse, when the crash happens, you cannot overcome the feelings of panic and fail to buy.

“Be fearful when others are greedy and greedy only when others are fearful.”

Warren Buffett

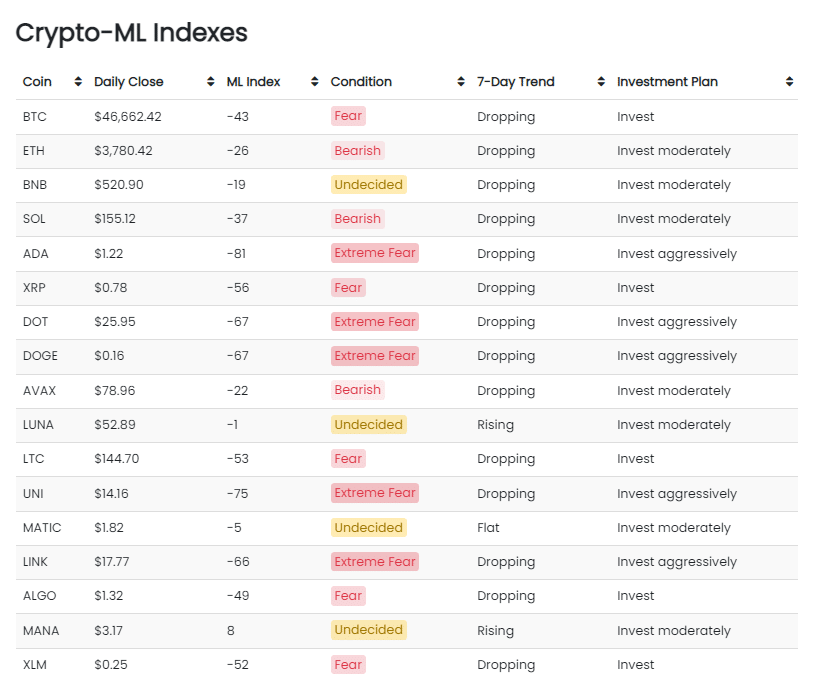

To help with this, we created the Crypto-ML Fear and Greed Index. It uses Big Data and machine learning to pull in many data points that seek to identify extreme market states, giving you an idea of how opportune a particular market may be.

Technical Analysis

If you do look at technical analysis charts, focus on weekly charts to reduce the noise. This will give you a sense of big movement patterns. Remember, you’re investing for the long term. Long moving averages may also help show when price is hitting extreme points. This type of information is also factored in by our Fear and Greed Index.

Handling Drawdowns

In an ideal world, you’d be able to sell at every peak and buy at every bottom.

The reality is these moves happen suddenly and are hard to predict. If you buy high and face a subsequent drawdown, consider taking these steps:

- Redo your fundamental analysis. Has anything changed?

- Has just your altcoin dropped or has everything? Sometimes stocks, crypto, and everything in between crash. If everything has dropped, it’s likely we’re just seeing a cycle that has nothing to do with your particular altcoin.

If your investment still seems to have a solid future, then perhaps you just got lucky: it’s now on sale! This may be a great time to buy more.

Conclusion

By performing this type of altcoin fundamental analysis, you will feel confident in your decisions, learn about the crypto space, and become a better investor overall. All that’s left is for you to give your great investments time to deliver on their plans.

After reading this, do you wonder why Bitcoin has value? See our guide to Why Bitcoin Has Value and a 1 Trillion Dollar Market Cap.

Have we missed any tactics or resources? Let us know in the comments below and we’ll update this guide.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.