Crypto Investing 101: The Crypto-ML Approach

Investing in cryptocurrency can feel daunting. With its wild highs and sharp lows, crypto is seductive yet dangerous. As with any endeavor, it’s good to regularly brush up on the fundamentals, which we cover here in Crypto Investing 101.

The post includes timeless investing advice as well as unique features of the crypto markets.

Invest for Years

Crypto-ML started at the start of 2018 as an automated swing-trading platform, exclusively leveraging machine learning and big data. We tracked results publicly, which put reality front-and-center.

Our trading accounts would grow rapidly, but a single bad day or sharp red wick had the ability to wipe out months of progress (read more at Crypto-ML is Radically Changing).

It was clear that our longer-term investments consistently beat out shorter-term trades. This was especially true over time.

- While trading seems seductive and is marketed heavily as a “be your own boss” option, studies show only around 1% of traders are profitable after fees (source).

- Even large funds employing teams of dedicated experts and leading-edge technologies struggle to beat the market. In 2021, only 20% of actively managed funds beat the market (source).

“Time in market beats timing the market.”

As a result, Crypto-ML now provides tools and education to help individuals find great crypto investments they want to hold for at least 1 year.

By doing so, you will hold a long-term capital asset and take a specific approach to analyzing, buying, and selling.

If you are investing for the long-term, it’s fundamental to know markets move in cycles. That means nothing moves only up forever. Rather, you will see boom and bust cycles in nearly every asset class. As we’ll discuss below, these cycles are often driven by factors entirely unrelated to the asset.

As a long-term investor, you can optimize your returns by knowing how to respond to these cycles.

Crypto Investing 101 Resource: Crypto-ML Member Dashboard. It’s part of Market Index Pro and offers tools to assist you in your crypto investments. See more info on our tools and approach below.

Bitcoin is Fundamentally Different than Altcoins

People tend to lump all cryptocurrencies into a single category. However, crypto projects really only share a common technology foundation, which is blockchain.

Bitcoin is extremely unique for a variety of reasons, but most notably that it does not have management.

It has run on its own without a CEO, founder, or management since 2010. This makes Bitcoin an independent, predictable system that operates outside of human intervention. This is harder to replicate than most people think. It’s not easy to create something worth over $1 trillion and walk away from it.

Most altcoins, on the other hand, are startup companies. Altcoins differ dramatically in terms of their value proposition, the way they are managed, and their approach to raising money.

Additionally, altcoins are often led by individuals or very small groups with their own goals and motivations. People make mistakes, fail, and even deceive.

You need to analyze each altcoin in-depth, just as a venture capitalist analyzes founders and their companies.

- When you invest in Bitcoin, you’re investing in the concept and system.

- When you invest in altcoins, you’re investing in people and a company.

Crypto Investing 101 Resource: Why Bitcoin Has Value (Crypto-ML guide).

Invest in Altcoins as Startup Companies

Investing in altcoins is risky and challenging. But doing so also offers a way to invest in the early stages of a company and participate in outsized returns if things go well.

Outside of crypto, it’s challenging for individuals to invest in early-stage companies. In the US, for example, only accredited investors (sec.gov) have access to these types of investments. Since the risk is higher, the thought is that early-stage investors need to demonstrate a degree of sophistication.

Somewhere around 90% of startups fail (source). Over the long run, altcoins will probably normalize to a similar rate.

However, the potential reward is also higher as you can get in during the initial growth of a company. Not only that, crypto and Web 3 as industries are in initial growth phases, potentially allowing you to invest ahead of broader mass adoption.

So as you invest in altcoins, start with the assumption the altcoin, like 90% of them, will fail in the long run. Use rigor to investigate. Be extremely selective.

Consider most altcoins to be tokenized capital raises. They are raising capital. By buying their coin, you are investing in their project and the people running it. Your job is to be ruthless in your selection of altcoins. Perform your due diligence. Don’t just hop on the latest coin trending on social media.

Crypto Investing 101 Resource: Altcoin Fundamental Analysis: 7 Steps to Picking Great Investments (Crypto-ML guide and video).

Macro Economics First

Bitcoin and certain altcoins are considered an alternative to the standard monetary system. It’s thought that Bitcoin should act as a hedge or safe haven from traditional markets, however, while true in concept, that is not yet a reality.

Currently, crypto is dominated by large institutions and investors that tend to bucket crypto with other speculative assets. They invest in Bitcoin to make money. Since they control such a significant portion of the overall wealth, their behavior drives prices.

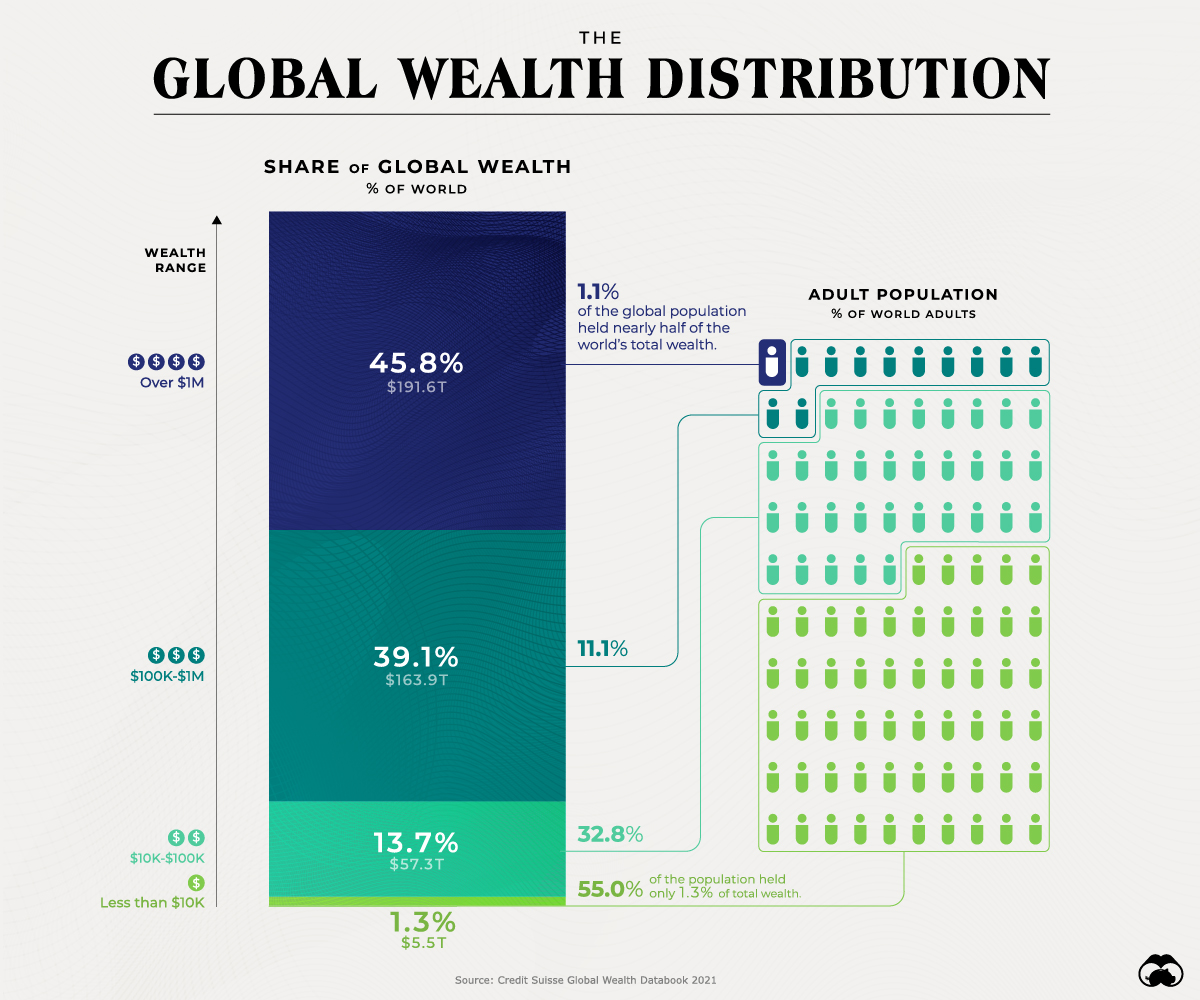

- About 46% of the world’s wealth is held by 1% of the population.

- About 85% of the world’s wealth is held by 12% of the population.

This means 88% of the population holds only 15% of the world’s wealth. It’s mathematically difficult for adoption at the individual level to drive price.

For Bitcoin price to stabilize and act as a true hedge, most of the world’s population would need to adopt it as a go-to form of currency.

So what does this mean for you?

Macroeconomics determines crypto bull and bear markets.

Institutional investors make decisions based on the macroeconomic picture. As the world enters risky periods, there is a movement of funds to stable assets. When broad prosperity begins, you can expect movement to higher-risk assets.

That means crypto behaves similarly to tech stocks. It rises fast and crashes even faster. More importantly, it means you need to learn and pay attention to the macroeconomic picture as it is currently the number one driver of crypto prices.

Fundamentals Second

Macroeconomics determines broad investment in different asset classes, including crypto. But within a given class, investments are picked by the fundamental qualities of each individual asset.

- As large money flows into crypto, altcoins with better fundamentals will receive a bigger portion of the money.

- As large money flows out of crypto, altcoins with poorer fundamentals will receive a bigger reduction in investment and may not recover once the market swings back.

By picking altcoins with great fundamentals, your investment will be more resilient during bear markets and grow faster during bull markets.

The good news is you can effectively assess most altcoins using timeless and basic fundamental analysis principles. It takes about one hour to gain valuable insights and shortlist an altcoin. That’s faster and better than digging through Telegram, Twitter, and Reddit looking for advice from internet strangers.

Here are the basic components to analyze:

- Unique value proposition

- Competitors and threats

- Leadership and funding

- Development, community, and ecosystem

- Advanced questions

- Your portfolio mix

- Investment timing

Crypto Investing 101 Resource: Altcoin Fundamental Analysis: 7 Steps to Picking Great Investments (Crypto-ML guide and video).

Dollar-Cost Average

Once you’ve found cryptocurrencies you expect to grow over time, you can begin investing. The problem is determining when it’s best to invest.

After all, markets move in cycles. There are bull and bear phases. Often, these phases have little to do with the asset and are more driven by macroeconomics.

Dollar-cost averaging solves the problem of timing.

If you identify an investment, do not feel you need to go all-in immediately. Rather, you should consistently invest a certain percentage of each paycheck you receive. This removes emotion and systematizes your investing. You’re no longer worried about timing the top or bottom.

This is called dollar-cost averaging and is how most of us invest in our retirement accounts, especially company-sponsored plans like 401Ks.

It means you will buy at a variety of price points over time, deliberately building long-term positions.

There are two options:

1. Mid-term investing

This approach allows you to slowly move in and out of your investments, capturing profit. This helps you take money off the table and redeploy elsewhere.

Based on market conditions, you buy or sell.

- Dollar-cost average in (buy some predetermined amount monthly) during bearish months when prices are relatively low.

- Dollar-cost average out (sell some predetermined amount monthly) during bullish months when prices are relatively high.

2. Long-term investing

This approach is designed to efficiently build large positions in assets you want to hold for many years and potentially hand down to future generations.

Based on market conditions, you throttle the amount you buy.

- Dollar-cost average in aggressively (buy a relatively high predetermined amount monthly) during bearish months when prices are relatively low.

- Dollar-cost average in moderately (buy a lower predetermined amount monthly) during bullish months when prices are relatively high.

Neither option takes an “all or nothing” approach. And neither attempts to time the market. But they do require awareness of the macroeconomic picture and understanding of the market.

Crypto Investing 101 Resource: Crypto-ML Member Dashboard. Available as part of Market Index Pro, our tools help you identify the type of market we’re in. See more info below.

Don’t Rely on Appreciation Alone

Great investors buy assets that both appreciate and generate cash flow. That is, great investments provide income.

Real estate investors expect the value of their houses to go up over time. But they also expect to collect monthly rents.

Generating income reduces the stress of bear markets. You’re not relying on the value of the asset alone. If you’re going to invest your hard-earned money, make sure it’s working for you.

“If you don’t find a way to make money while you sleep, you will work until you die.”

Warren Buffett

In crypto, this generally means you need to earn interest on any investment.

If you earn a 15% interest rate, your holdings will double approximately every 5 years. That’s the magic of compounding interest.

Approximate results of investing 1 Bitcoin with and without interest:

| 0% Interest | 10% Interest | |

|---|---|---|

| Year 1 | 1 Bitcoin | 1 Bitcoin |

| Year 5 | 1 Bitcoin | 2 Bitcoin |

| Year 10 | 1 Bitcoin | 4 Bitcoin |

| Year 15 | 1 Bitcoin | 8 Bitcoin |

| Year 20 | 1 Bitcoin | 16 Bitcoin |

As another bonus, earning interest provides a minimum dollar-cost averaging. Each time you earn interest, you’re buying back into the asset.

Calculate it for yourself with our Crypto Staking Calculator.

Fortunately, there are many great ways to earn interest with your crypto investments.

- Centralized financial institutions (CeFi) pay yields. This is like depositing money at the bank. It’s the simplest option. Examples include BlockFi, Binance, and Crypto.com.

- Decentralized finance (DeFi) options also pay yields. These require more study and attention but can provide greater flexibility. Examples include staking, liquidity pools, governance, and more. If you have a Ledger, you can start with its staking and lending capabilities.

Regardless, your job is to ensure all of your investments are working for you and earning money.

Crypto Investing 101 Resources:

Simple Ways to Earn Interest on Crypto Holdings (Crypto-ML guide and video)

How to Stake With a Ledger to Earn Crypto (Crypto-ML guide)

Buy Fear and Sell Greed

Alright, we talked about dollar-cost-averaging, which you adjust based on market conditions. We also said markets move in cycles. Understanding these cycles helps you optimize your returns over the long run.

Market cycles can generally be bucketed into:

- Greed: bull, boom, exuberant

- Fear: bear, bust, despair

The difficult trick here is you need to do the opposite of what your instincts tell you.

If you are investing in something you believe will move up over the long term, you need to buy when everyone else is panicking.

Greed

When everyone is exuberant and excited about cryptocurrency, that is greed. It is a sign the current market phase may be topping out. Common characteristics:

- Price extending quickly above recent levels

- Exuberant press coverage

- Fear of missing out (FOMO)

- Extreme optimism of market participants

- Mass influx of retail traders

- Highly speculative and leveraged trading

When you recognize these patterns:

- Mid-term investors: dollar-cost-average out of positions to secure some profit and redeploy your gains when the market cools back off.

- Long-term investors: reduce your dollar-cost-average in to better utilize your overall available capital.

Fear

When everyone is certain crypto is dead and that it was a joke, Ponzi scheme, and scam from the start, that is fear. Common characteristics:

- Price extending quickly below recent levels

- Negative press coverage, with titles such as “Bitcoin is finally dead,” “Sell Your Bitcoin and Never Look Back,” and “The End is Here for Crypto.”

- Fear, uncertainty, and doubt (FUD)

- The exit of retail traders from the market. Only long-time holders remain.

- Liquidation of speculative, leveraged trading

When you recognize these patterns:

- Mid-term investors: dollar-cost-average into positions as aggressively as your plan allows. Redeploy funds you pull out during times of greed.

- Long-term investors: ramp up your dollar-cost-average in as aggressively as your plan allows. Maximize your positions at relatively low price points.

Be warned

These concepts are easy to understand but very difficult to do in practice.

It is challenging to throw your hard-earned money at something people are certain is dead. You will feel foolish and scared yourself.

Likewise, when everyone is extremely excited about crypto, it can be very mentally hard to sell or reduce your investing.

But who becomes wealthy investing in real estate? The people who buy houses during housing crashes.

And who becomes wealthy in the stock market? The people who buy companies during crashes.

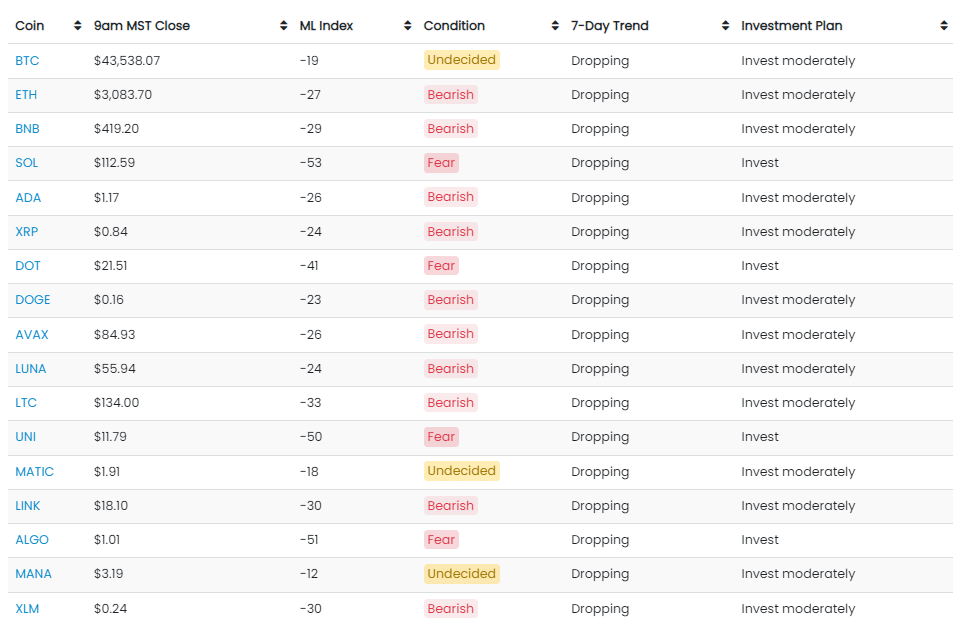

Crypto Investing 101 Resource: Crypto-ML Fear and Greed Index. Available as part of Market Index Pro, this index measures fear and greed sentiment across top cryptocurrencies.

Use Select Tools Measure Market Sentiment

Bringing everything together so far, you can see it is critical to understand the overall market conditions. Once you do, your decisions can be simple and automated.

If you’ve lived through a few cycles with money on the line, you probably have developed a sense of what fear and greed feel like in reality.

Crypto offers investors a huge advantage: whereas housing and stocks may take decades to cycle, crypto can go through multiple cycles in just a few years.

This means you can experience market cycles firsthand and become a seasoned investor relatively rapidly by investing in crypto. By contrast, huge swings in housing may only come up once or twice in a lifetime.

Apart from gaining a seasoned feel for market conditions, you should also leverage tools to help you quantify this feeling and the market itself. This allows you to validate assumptions and also test strategies with historical data.

Crypto-ML has two tools designed specifically for the investment strategy outlined in this guide.

Fear and Greed Index

The Crypto-ML Fear and Greed Index measures fear and greed, leveraging data points to cover all of the characteristics noted in the Fear and Greed section above. The points come together in an index value that captures the overall market sentiment.

On top of seeing the current values, you can also download past data to run your own tests. The value of the Fear and Greed Index can easily be validated with very simplistic strategies, one of which we outline in this Fear and Greed Index video.

The Fear and Greed Index is available as part of Market Index Pro.

Price Channels

In addition to measuring sentiment, it’s important to see how Bitcoin sits in terms of its growth curve. Using regression modeling, we have created a series of Price Channels that show Bitcoin’s position relative to previous fear and greed price points.

When these channels were initially created, the only time price exceeded the regression model was during the COVID market crash in March of 2020 (where you could have bought Bitcoin below $4,000 just prior to it running up to $65,000!).

The Price Channels are available as part of Market Index Pro.

Other Tools

An endless array of tools are available, ranging from technical analysis to on-chain metrics. It is good to learn the pros and cons of each while also limiting the amount of information you consider. It’s easy to be overwhelmed and let conflicting information drive you to inaction.

Pay Your Taxes, if Applicable

If you’re going to invest in crypto, or pretty much anything, chances are you need to pay taxes at some point. The list of countries (koinly.io) that do not tax crypto is pretty small.

Reddit and other social media outlets are littered with horror stories of people who have faced tremendous headaches and penalties by not thinking about taxes upfront. See our post Crypto Taxes: Why, Risks, and How for more on the tax basics, the risks, and how you’re tracked.

Typically, this is only when you sell. This makes life very difficult for day traders, but as a longer-term investor, it’s not as much overhead.

Some tips:

- Research your local tax laws

- Talk to a tax professional

- Use software to track your transactions

Crypto Investing 101 Univesity Post: Crypto Taxes: Why, Risks, and How (Crypto-ML guide)

Start Simple, Go Complex Later

The crypto space is a wild frontier of innovation. We’re seeing many amazing products and technologies arriving at a rapid pace. It’s easy to rush in, be swept up in the excitement, and get in over your head.

Take your time. Start with the basics. Use the products to gain first-hand experience. Only invest in what you understand.

And don’t feel bad. Bitcoin tackles extremely complex problems that economists, who have dedicated their lives to understanding, still disagree on. Likewise, many DeFi projects are working on highly sophisticated financial products that are traditionally only used by licensed professionals.

Crypto represents a broad, vast space. Find the area that speaks to you then grow your expertise and investment proportionately.

Crypto Investing 101 Summary

By following these Crypto Investing 101 principles, you’ll leverage timeless investment approaches and outperform the vast majority of crypto traders.

Do you have any thoughts, corrections, or tips of your own to share? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.