How To Reduce Crypto Trading Fees

If you’re an active crypto trader, every fraction of a percent matters when it comes to performance. Smaller numbers–both positive and negative–add up shockingly quickly. Gaining any edge in trading is a challenge, so if something is simple, it’s important to spend the upfront tackling it.

This article provides you some of the key tips on how to reduce crypto trading fees, helping to make a long-term impact on your results.

Why You Need to Manage Trading Fees

In general, as long as your average trade is greater than your fee, then you will be profitable. For example:

- If your round-trip trade fee is 1%, your average trade result needs to be +1% just to break even.

- If, on the other hand, your round-trip fee is 0.15%, that same +1% average trade now nets you +0.85% every trade.

In general, the higher the reward, the higher the risk. That means if you have a trading system that is averaging 5% per trade, it is probably riskier than a trading system that is averaging 1.5% gains on many trades.

So in general, if you’re able to use a system that trades frequently and consistently gets small wins, you’ll likely outperform in the long run. You just can’t have the fees eating up those small profits.

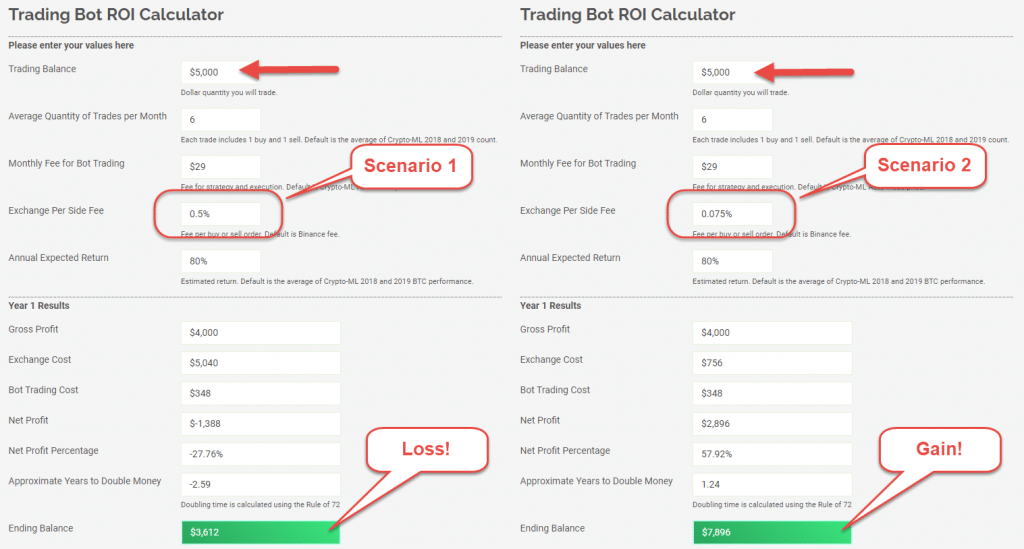

The scenarios below show fees play out over time (with the help of our Crypto Trading Profit Calculator):

- Scenario 1: With an average 1% round-trip fee, this system results in a 28% loss.

- Scenario 2: Considering the same variables but with a 0.15% round-trip fee, results switch to a 58% gain.

Given the massive impact you see above, it makes sense to put effort into optimizing the fees you pay.

Step 1: Shop Exchanges

This may seem to be an obvious step, however, many people actively trade on high-fee exchanges.

Of course, fees are not the only consideration when selecting an exchange. But all else equal, ensure you’re getting the most competitive fee structure.

Let’s look at a few choices from a US perspective (all fees are as of this writing; please be sure to do your own research):

Coinbase Pro

Coinbase Pro is the Coinbase platform designed for traders.

Coinbase Pro’s fees are much lower than Coinbase. To use Coinbase Pro, you must transfer your funds directly to it; your funds are not shared with the standard Coinbase.

Coinbase Pro fees start at 0.5% per side and go down to 0.04%. Most retail traders will pay between 0.5% and 0.35%.

On Coinbase Pro, a round-trip trade will cost 1% or less.

The fee schedule is here: https://pro.coinbase.com/orders/fees

Sign up for Coinbase Pro: referral link* or direct at https://www.coinbase.com/

Binance

Binance fees start at 0.1% per side but go all the way down to 0%. If you pay your fees with BNB (more on this below), even basic retail traders will be charged 0.075% per side.

On Binance, a round-trip trade will cost 0.15% or less.

That means at a basic level, Binance is about 6.7 times cheaper than Coinbase Pro. This causes the large difference in results you see in the scenario above.

The full fee schedule is here:

Sign up for Binance:

- Binance.com: referral link** or direct at https://www.binance.com/

- Binance.us: referral link** or direct at https://www.binance.us/

Robinhood

Robinhood offers commission-free trading for cryptocurrency. This is fantastic, but the downside is Robinhood has a less-robust platform and set of integrations.

If you manually trade crypto, live in one of their approved states, and are okay with their limited crypto selection, Robinhood is tough to beat.

On Robinhood, a round-trip trade will cost 0.

For more information on available states, available crypto, and other details: https://robinhood.com/us/en/support/articles/commission-free-cryptocurrency-investing/

Sign up for Robinhood directly at https://robinhood.com/

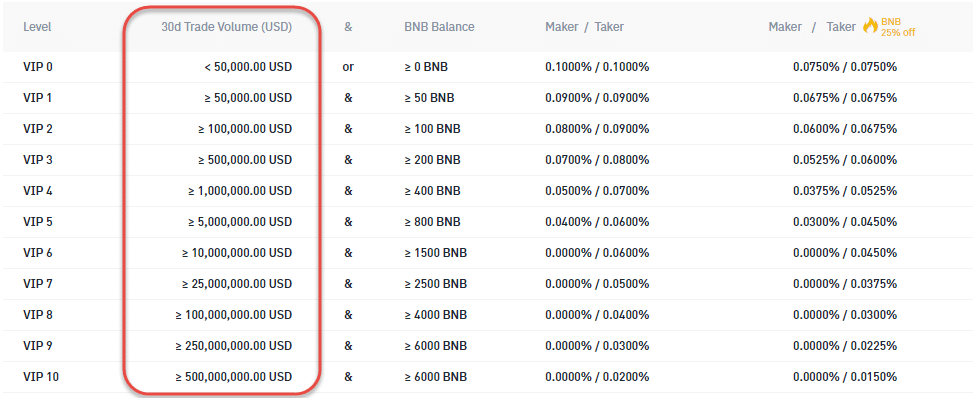

Step 2: Understand Tiers

Most exchanges, including Binance and Coinbase Pro, reduce fees as you:

- Increase your trading frequency

- Increase the funds you trade

Those two factors determine your Trade Volume, which is the total amount you’ve traded over the last trailing 30 days.

- So if you traded $30,000 twice in 30 days, then your trading volume is $60,000.

- Likewise, if you traded $5,000 twelve times in 30 days, your trading volume is also $60,000.

Even if you have a smaller account balance, you might be surprised by how quickly you can move up the tiers as you trade more frequently. This is another argument for more frequent, lower-risk trades (e.g. going for 1.5% gains rather than shooting for 10% gains).

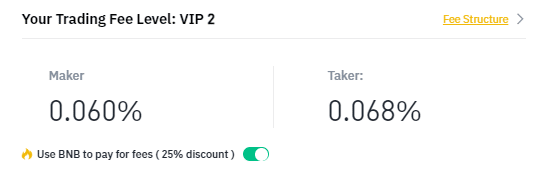

Step 3: Pay Binance Fees with BNB

If you use Binance, you can receive an additional 25% off your trading fees if you pay your fees with BNB, which is Binance Coin.

From Binance’s perspective, this increases adoption of BNB. From your perspective, it’s a simple way to reduce costs.

To get this discount, simply add some funds in your BNB wallet (enough to cover your trading fees) and then:

- Log on to your Binance account

- From the homepage, click Dashboard

- Scroll to the very bottom and flip the “Use BNB to pay for fees” switch (as shown above)

Step 4: Deduct Your Crypto Trading Fees From Taxes

As a general tax rules:

- Profits made are taxed.

- Expenses needed to attain those profits are deducted.

Your trading expenses, including trading fees, are tax-deductible. This effectively reduces your expense burden by another large percentage. Most exchanges provide a year-end report to help you account for fees properly.

In fact, you may be able to deduct most trading-related expenses, such as bot fees, software, training, tax advice, computer equipment, and more.

Learn more about Crypto Taxes on Crypto-ML University.

Read more:

- https://finance.zacks.com/deduct-trading-platform-fees-11077.html

- https://traderstatus.com/traders/securities-trader/trader-tax-deductions/

As with any tax-related advice, you should consult a tax professional to discuss your unique situation.

Step 5: Understand Maker Versus Taker Fees

As you look at fees, you’ll also see the terms “Maker” and “Taker” widely used. The fee differences usually don’t kick in until higher tiers, but it’s still good to be aware of the difference and how you can benefit.

A “Maker” is someone who adds liquidity to the market by placing an order on that books that sits there waiting for someone to “Take” it. Simply put:

- A “Maker” order is a limit order. These open positions on the exchange.

- A “Taker” order is a market order. These close positions on the exchange (triggers the closure of an open market on the exchange).

By having lower “Maker” fees, the exchanges are providing an incentive for people to place orders on the books. In addition to the added liquidity, this creates a more orderly and predictable market.

So as you advance in the tiers, be mindful of your order type and the fee implications. Certain exchanges move to $0 Maker fees very quickly.

Conclusion: How to Reduce Crypto Trading Fees

Taking the time to optimize fees for your situation is much more important than many people realize.

Want to offer your suggestion or ask our community about their experience with exchanges and fees? Let us know in the comment below, discuss on our Community Forums, or join us on Telegram.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.