How to Stake Ethereum on Ledger…Plus Due Diligence

This post shows you how to stake Ethereum on Ledger easily, securely, and with any balance. We’ll also cover the critical differences with Ledger’s approach to staking ETH.

To do this, you will not need specialized knowledge, a minimum balance of 32 ETH, or a minimum hold time. All you need is a Ledger and some ETH.

Staking directly from your Ledger is great. You can manage your entire portfolio from a single place. But, if you’ve staked other crypto on Ledger, you’ll see the ETH is handled differently.

We’ll cover those differences here, perform some due diligence on the Ledger approach, and then walk you through staking step-by-step.

Don’t have a Ledger? Get one on the official Ledger Amazon store.

Alright, let’s get going!

Video Version: How to Stake Ethereum on Ledger

If you prefer to see the due diligence and watch ETH staking on Ledger, you can watch the video version here.

Timestamps

- 00:00 Intro and warning

- 01:28 Why you should stake

- 02:20 Staking calculator

- 03:23 Four staking options

- 04:32 Lido overview, due diligence, and strengths

- 05:28 stETH token

- 06:08 Lido fee

- 06:55 Lido concerns

- 07:31 stETH depegging

- 08:58 Stake ETH step-by-step on Ledger

- 10:26 Submitting transaction

- 12:05 Conclusion

If you prefer to read, here you go…

Why Should You Stake Ethereum?

Great investors expect their assets to both appreciate and generate income.

Don’t rely on interest alone

A key pillar in our Crypto Investing 101 approach is to earn interest on your crypto holdings. Great investors don’t rely on appreciation alone.

“If you don’t find a way to make money while you sleep, you will work until you die.”

Warren Buffett

Staking puts your Ethereum to work.

Calculate staking earnings

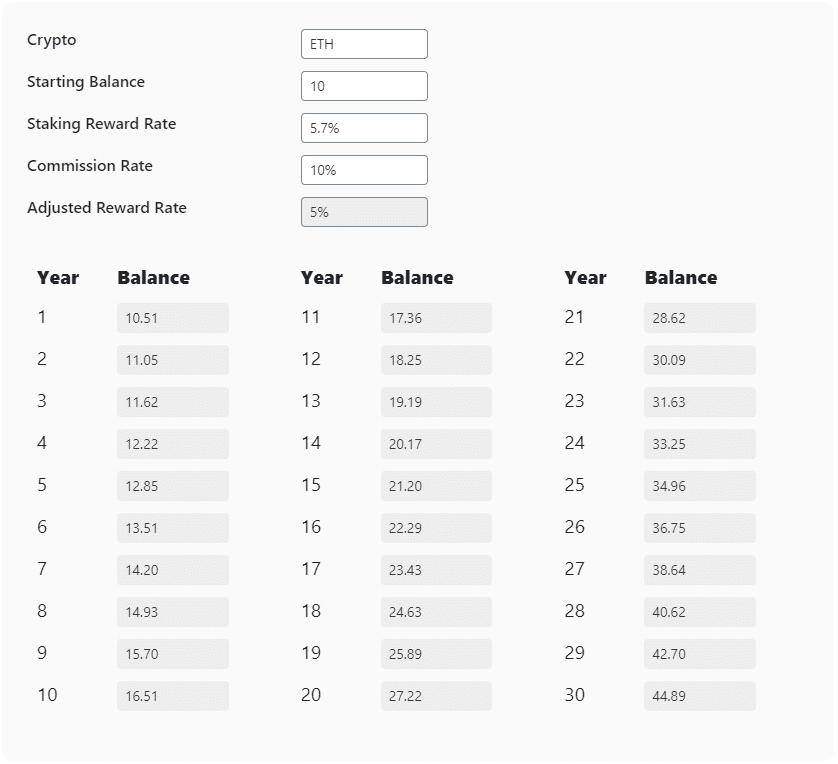

To see how much you will earn, use our Staking Calculator to calculate your earnings over time.

- If you have 10 ETH and don’t stake, then 10 years from now, you’ll still have 10 ETH.

- If you have 10 ETH and stake, then 10 years from now, you may have 16.5 ETH. In 30 years, that becomes 45 ETH!

Time goes by faster than you think.

The above example is based on the current ETH Reward APR of 5.7% and a 10% validator commission fee. Don’t waste time. In 30 years, your balance could grow 327%. Now imagine the price of ETH has also gone up during that time. Your value will have multiplied.

Analogy: don’t buy a house, leave it vacant, and hope the value goes up. Rent that house out!

Ethereum Staking Options

There are four ways to stake your Ethereum. This official Ethereum.org page does an amazing job of explaining these options: https://ethereum.org/en/staking/.

The first two options have steep requirements. Namely, you must have:

- Minimum 32 ETH

- Ability to operate a node with enterprise-grade uptime and security

Important: if you stake ETH directly via option 1 or 2, you still cannot withdraw your funds even though the Merge rolled out. The future Shanghai update will enable unstaking. The method we describe here, however, does allow you to unstake.

For most people, that means you need to look at options 3 or 4. Option 4 is staking via an exchange, such as Binance.

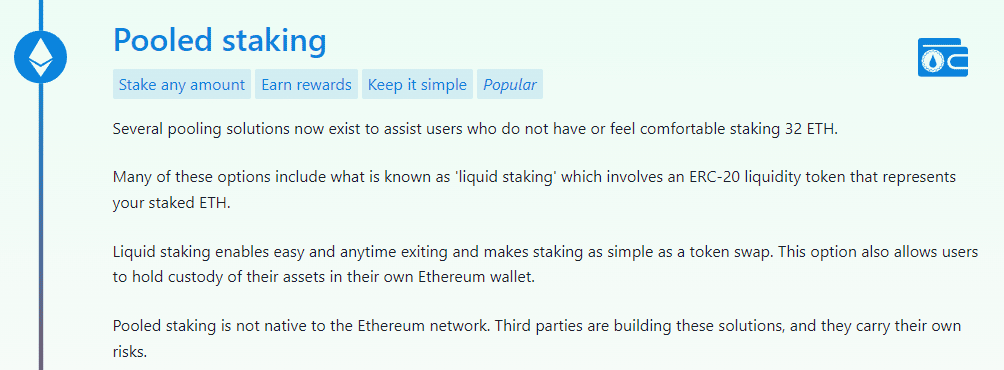

This leaves us with option 3: staking on a pool.

Stake ETH on Ledger with Lido

You can shop staking pools and connect with them outside of your Ledger interface. And we do encourage you to shop around. But Ledger has integrated the Lido staking pool directly into the Ledger interface.

To be more accurate, Lido is a platform that facilitates staking in a decentralized manner using smart contracts. But operationally, it can be considered a pool.

This makes it easy to connect, reduces human error, and helps you keep all of your stakings in one centralized place

What is Lido

Ledger is a trusted name in the market. So when they select a partner, you can assume some degree of credibility. However, it’s very important to really understand what is happening with your crypto and not blindly trust third parties.

Lido is the largest staking provider for Ethereum. When you stake with Lido, blockchain technology is used to control the transaction. This means your funds are governed by smart contracts. While your ETH is staked, Lido provides you stETH as a token to represent your staked balance. Learn more about stETH here.

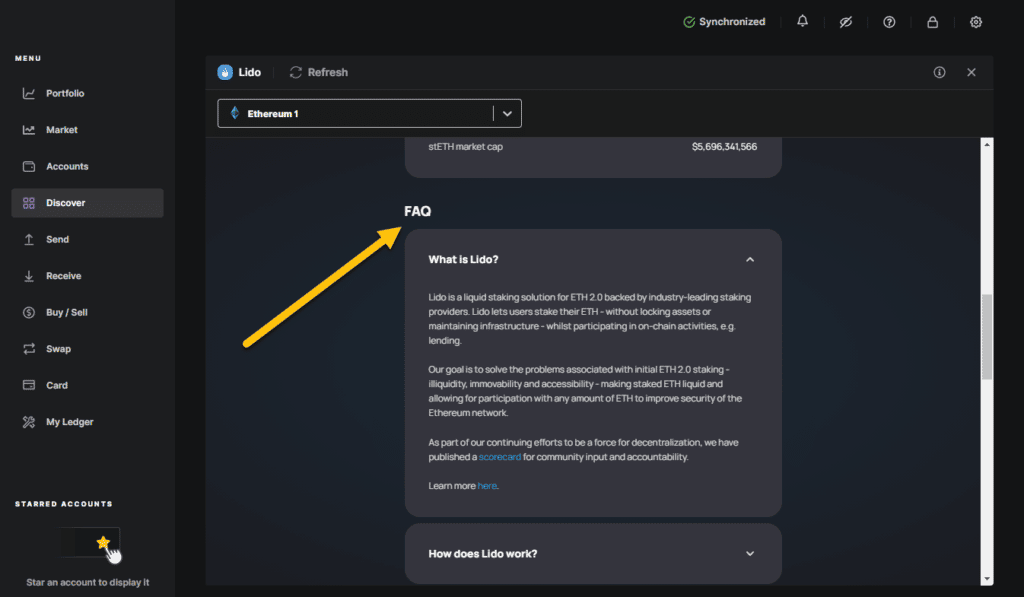

The Lido FAQ explains how it works and the risks very well.

Lido pros

- It is a decentralized organization that uses smart contracts

- Open source code with active bug bounties

- Publicly audited

- No minimum ETH balance

- No minimum holding period

- No technical knowledge needed

- Rewards are compounded daily

Lido cons

- Your ETH is replaced by stETH. When you stake with Lido, you will swap your ETH for stETH. To unstake, you’ll need to swap your stETH for ETH at an exchange.

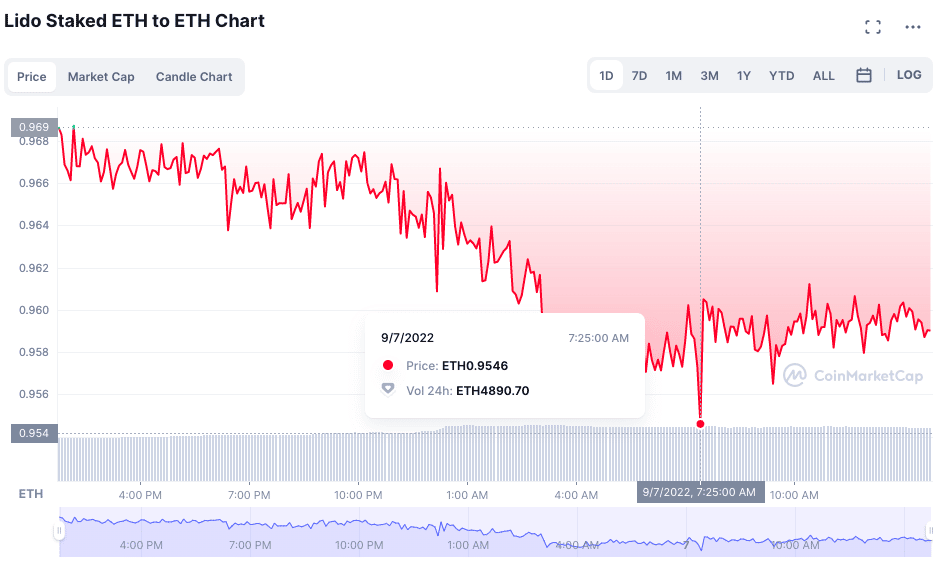

- stETH may depeg from ETH, meaning the amount you staked may not be the amount you receive back. This has actually already happened in both June of September of 2022. All stETH should be 100% backed by ETH (validated by smart contracts), but if there is a technical fault that is exposed, we could see a dramatic collapse of this market.

- Lido may lead to centralization risk. Lido is a dominant player. Some have raised concerns about it threatening decentralization (fortune.com), which would reduce the security of Ethereum. Though Lido counters that it brings more decentralization and security to Ethereum.

- See additional risks on the Lido FAQ.

Lido fee

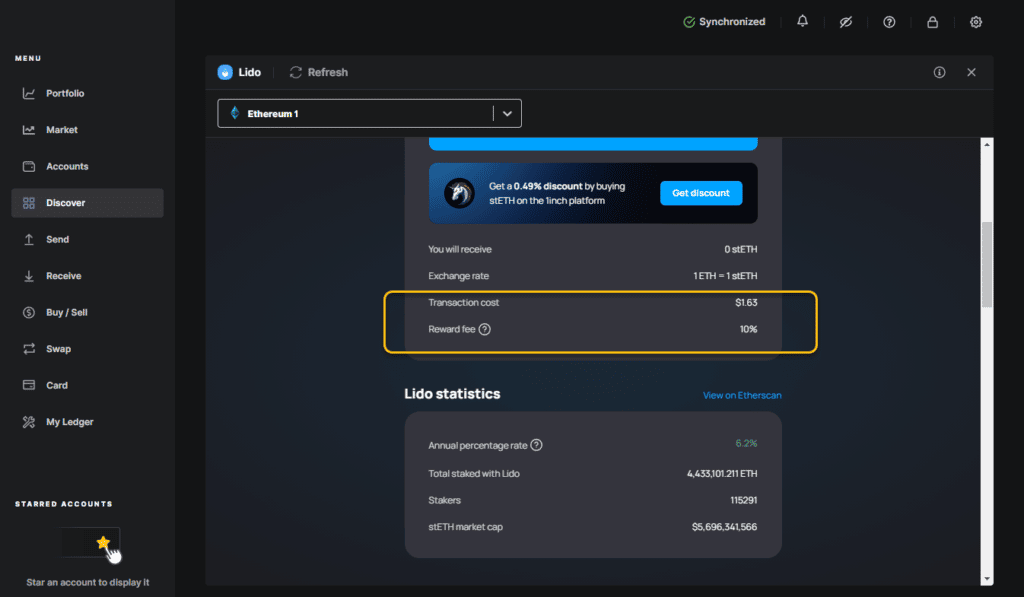

Staking pools charge a commission fee for the convenience they provide. Currently, Lido charges a 10% fee on your rewards. This fee is charged against earned rewards, not your balance.

Example: if you earn 1 stETH in rewards, they will give you 0.9 stETH and keep 0.1 stETH. See current Lido fees here.

This 10% is accounted for in the Staking Calculator example we gave above, where you see the 10% commission rate.

Lido is running a costly set of services in order to provide you with the pros listed above. The 10% charge is reasonable and on par with the market. You may find lower commission rates elsewhere, but that may come with lower trust, lower uptime, and other risks.

Critical differences from traditional Ledger staking

We’ve already touched on these points, but to be clear, here are the critical differences to understand:

1. Your staking occurs through a 3rd-party (Lido) rather than directly on-chain. This is due to the unique staking requirements of Ethereum. This means you must trust Lido. Scroll back up to see our Lido pros and cons.

2. Your ETH will be converted to stETH. This type of conversion doesn’t happen with other coins you stake directly on-chain. If you want to unstake or get your ETH back, you’ll need to convert your stETH to ETH via an exchange. Ledger and Lido do provide links to exchanges you can use.

3. Compounding happens automatically and daily for no transaction fee. When you stake other coins on-chain, you must manually claim rewards and then restake via the blockchain. This causes two transaction fees. Lido handles this for you and does not trigger extra fees.

4. There are no withdrawal limits. When you stake other coins on-chain, there is typically a waiting period for unstaking, which locks your assets up for a period of time. With Lido, you can unstake at any time by exchanging your stETH for ETH.

As you can see, it’s a mixed bag of pros and cons. More than anything, it’s important you understand what’s happening in the background so you’re not surprised when your ETH balance drops.

Stake Ethereum on Ledger Step-by-Step

Ready to move forward?

Let’s walk through the simple steps to stake your Ethereum on Ledger with Lido.

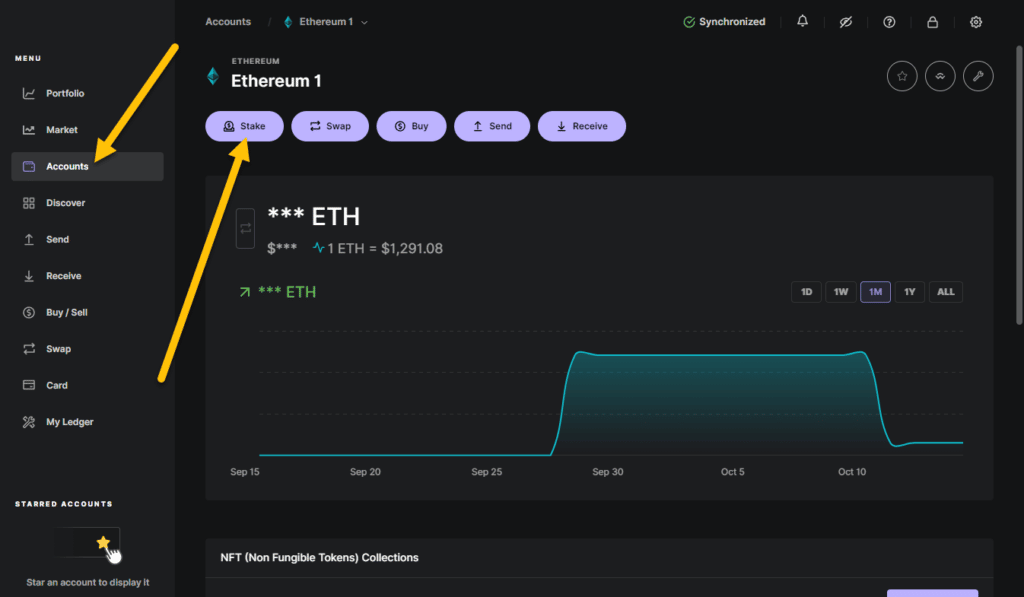

Step 1: Log into Ledger and go to your Ethereum account

You will see a Stake button on the top left.

If you don’t see this button, you need to drill down a layer into one of your Ethereum subaccounts. Since Ethereum can hold multiple tokens, you need to ensure you’re looking at the right spot in the account.

Step 2: Review terms and choose ETH amount to stake

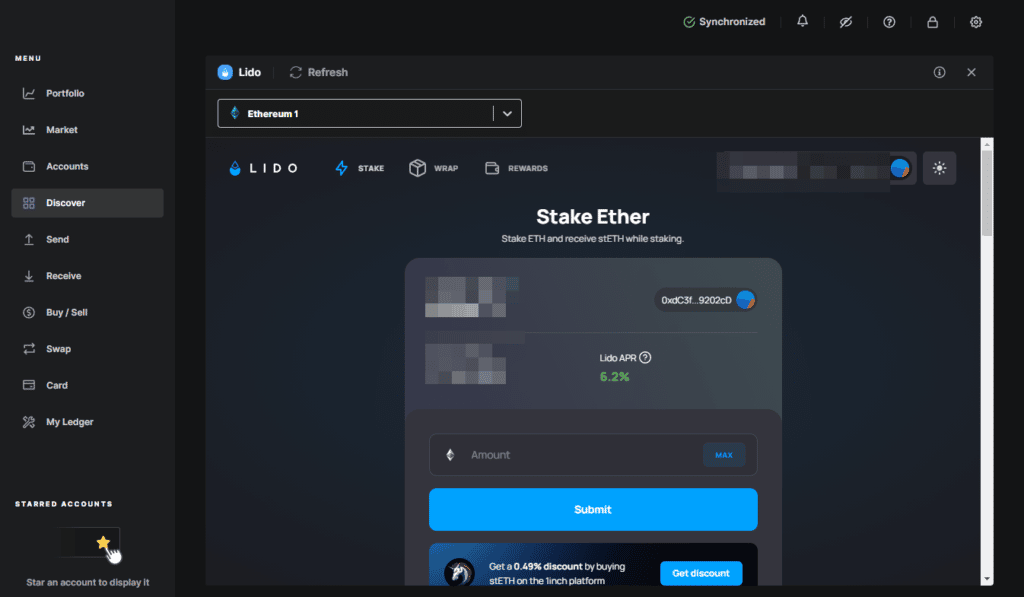

You now see the Lido logo. Please ensure you read the important information about Lido in our due-diligence sections above. You’ll also see the current APR, which changes daily.

Here, you can choose an amount to stake or hit the Max button to stake all of your ETH (the transaction fee will be accounted for).

If you have not done this before, stake a small amount first to test.

Before submitting, review the terms on this page. You’ll see the commission (called Reward fee), which is the service fee Lido charges on earned interest.

While we provided considerable info on Lido, you should continue scrolling down and read the FAQs completely. There is critical information about how the service works.

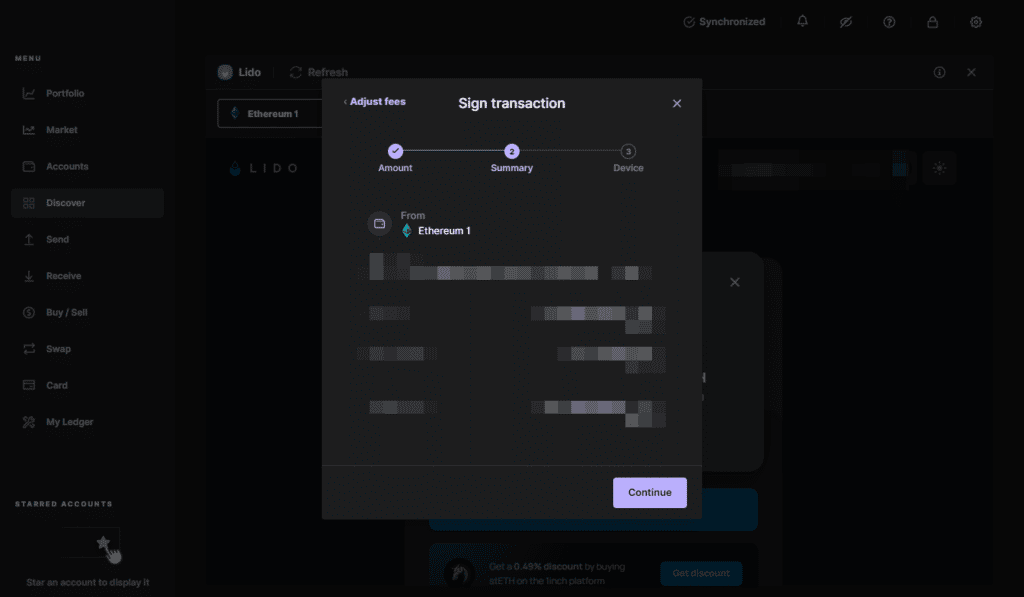

Step 3: Confirm the transaction

Review the summary of your transaction before proceeding.

Critical: By doing this, your ETH will be converted to stETH.

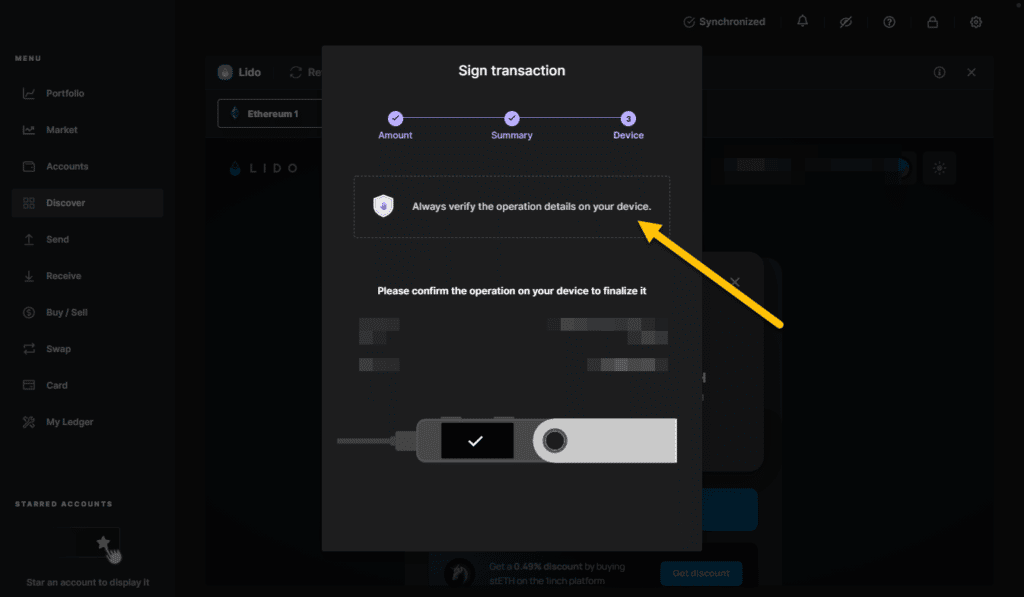

If everything looks good, you can start signing the transaction on your Ledger.

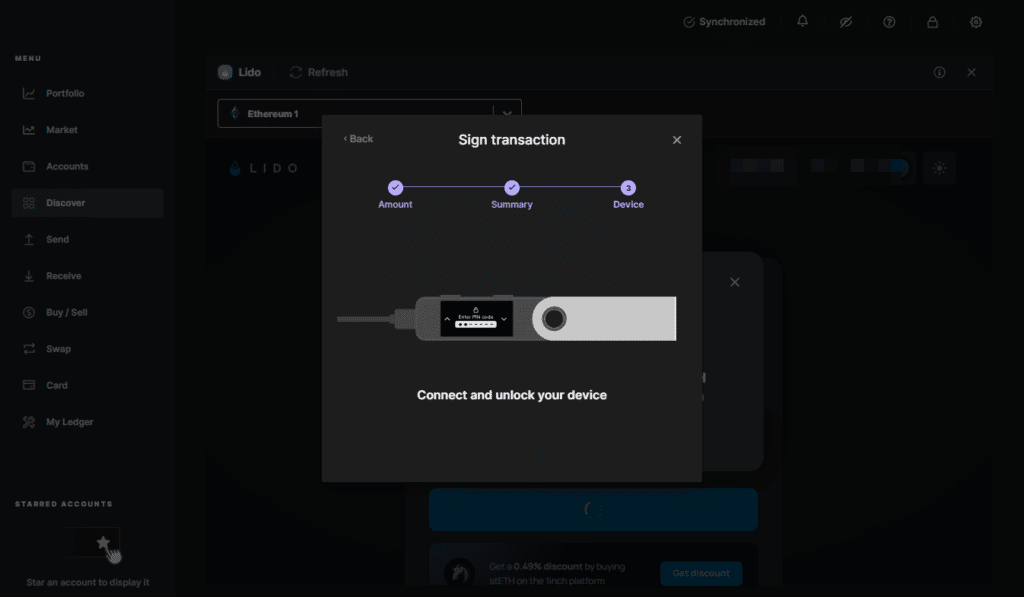

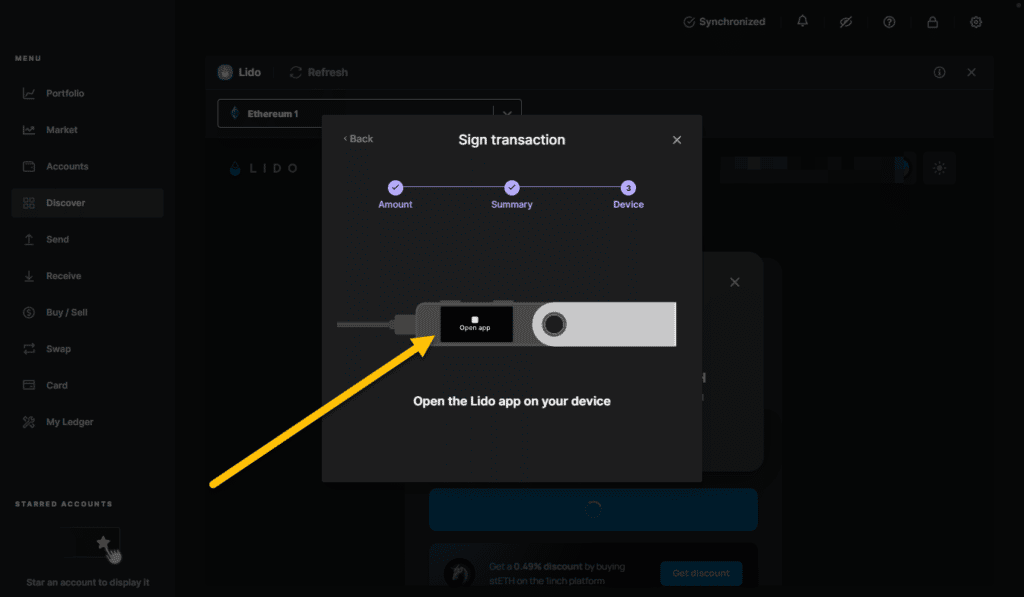

Step 4: Finalize with the Ledger Lido app

At this point, the Lido app will open and finalize the transaction. If you don’t yet have Lido installed, it will run a quick installation procedure.

Now you can perform the physical validation on your Ledger and finalize the transaction.

Step 5: Confirm the transaction

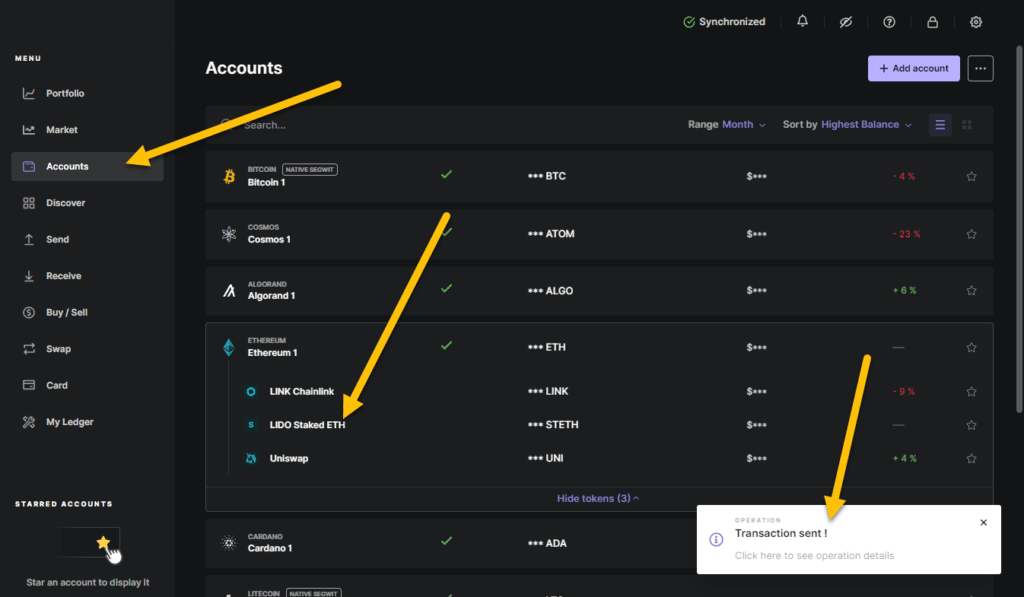

After signing, you’ll receive a Transaction ID that you can view on Etherscan. Or you can just wait about one minute and see the balances update in your Ledger.

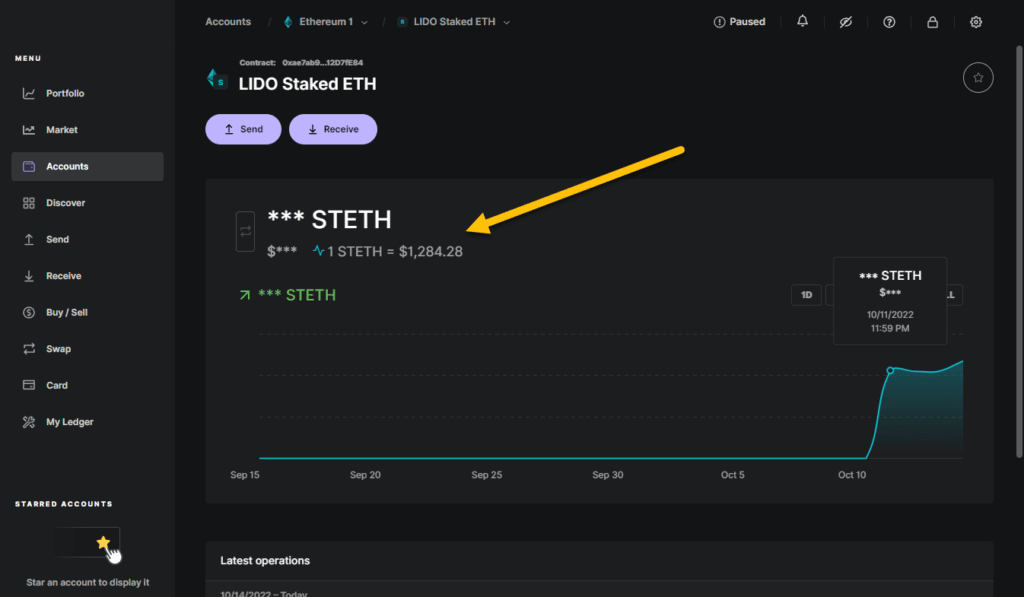

Specifically, head back to your Accounts page and expand Ethereum. You will see the balance moved into LIDO Staked ETH.

Once you drill into the account, you can see the balance has moved from ETH to stETH.

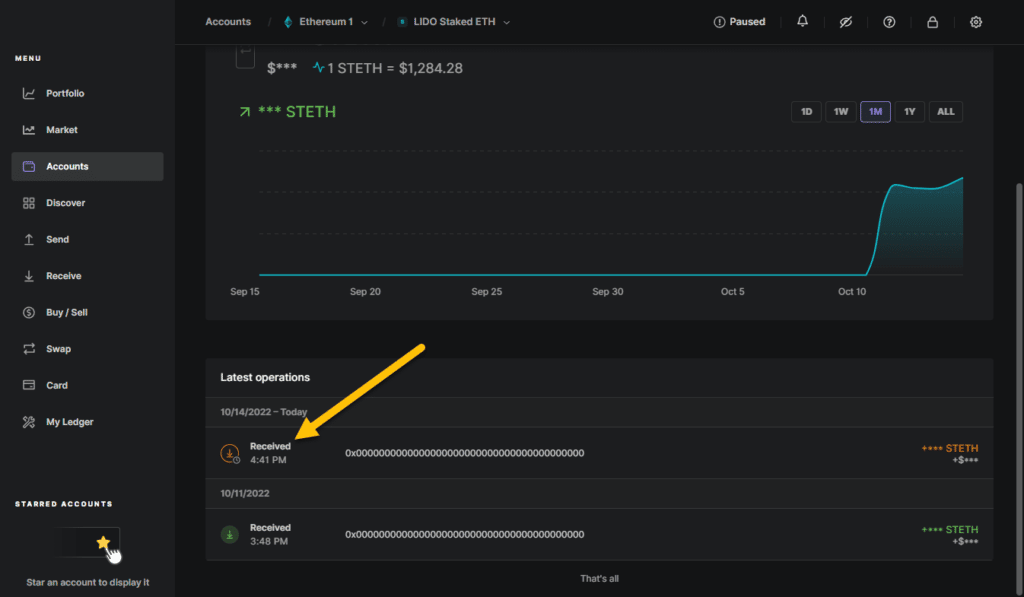

Step 6: Enjoy daily compounding rewards

Each day, you’ll receive a deposit automatically. Unlike direct on-chain staking, you don’t need to claim rewards and restake manually.

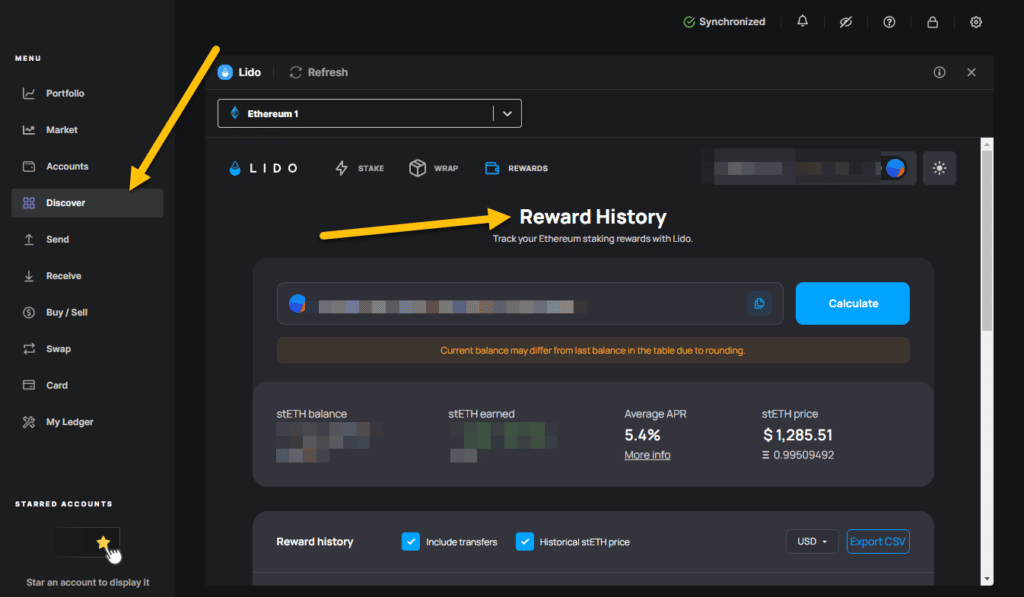

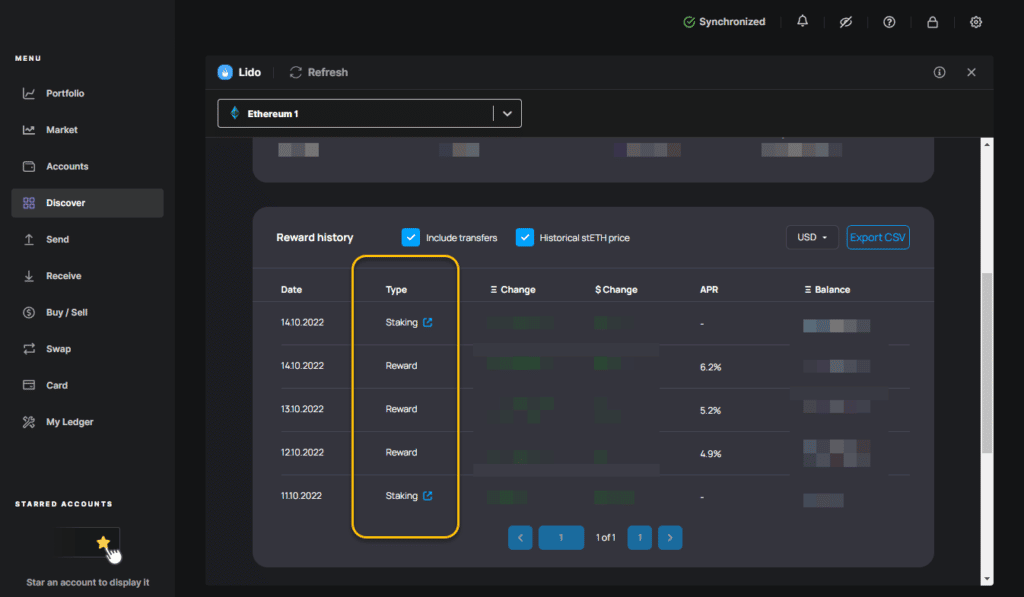

You can also go to the Lido app through the Discover tab to see more details about your staking.

Scrolling down will show a complete history.

Conclusion

You need to put your money to work in order to grow your wealth over the long term. Staking Ethereum with Ledger is a way to do this. As you can see, the approach with Lido is unique and comes with pros and cons. If you decide to do this, you’ll earn a great rate and be able to easily manage your investment.

Have questions or thoughts? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.