How to Stake With a Ledger to Earn Crypto

This simple guide will walk you through how to stake with a Ledger wallet. To demonstrate, we’ll stake Cosmos (ATOM) with a full set of screenshots. This flow, however, does apply to staking any eligible crypto on Ledger.

Earning interest with your crypto investments is critical to your long-term success. The easiest way for is to use an exchange that manages staking for you or provides other simplified, managed DeFi services. For example, with Binance, you can do a single “click of a button” to stake. You can read more about options like this in our post Simple Ways to Earn Interest On Crypto Holdings.

However, this means you’re trusting a 3rd-party to manage your funds. And as we’ve unfortunately seen, some centralized finance firms in crypto have not been fully trustworthy and even lost customer funds. This is particularly true with companies that chase yield on your behalf. They might not be transparent about the risks they’re taking.

If you’re considering moving to your own wallet, read our post Non-Custodial Wallet Pros and Cons.

If you want to stake yourself, the best first step is to stake with a Ledger directly. This post will show you how.

Why should you stake your crypto?

Great investors don’t rely on appreciation alone. They buy assets that both appreciate and generate income.

“If you don’t find a way to make money while you sleep, you will work until you die.”

Warren Buffett

- Earning at a 15% rate will compound to double your investment in just 5 years

- Earning continuously buys you back in, “automating” dollar-cost-averaging

- Reduce stress as market fluctuations matter less when your investment is working to make you money

Think about it this way: if you bought an investment house, would you just hold it and wait for its value to go up? Or would it be better to also rent it out for income?

There are numerous ways to earn money with crypto, but many of them are high-risk and deceptively complex.

Staking, however, is relatively low risk. It allows you to participate with a proof-of-stake validator, meaning you verify transactions and thereby ensure the integrity of the blockchain. You’re adding real, predictable value.

You can stake Ethereum, Cardano, Binance Coin, Avalanche, Cosmos, Polkadot, Solana, Tron, Polygon, and many others.

Calculate it for yourself with our Crypto Staking Calculator.

How much will you earn when you stake with a Ledger?

Expect to see rates for common coins to be between 3% and 20%.

Rewards vary by cryptocurrency. They also fluctuate daily based on supply and demand.

- Supply is how many others are staking.

- Demand is how many transactions need to be validated.

This means busier networks with fewer stakers tend to pay more.

Before collecting your fee, you will pay a commission to a validator, which is discussed below. That commission will consume 2% to 10% of your earnings. If the earn rate is 10% and you pay a 5% commission, your net earnings rate will be 9.5%.

You can visit StakingRewards.com to see current rates.

Don’t have a Ledger?

If you have a Trezor or other type of wallet, these same principles apply. But you will likely need to connect your wallet with a third-party system.

Steps to stake with a Ledger

Alright, enough introductions. Let’s get started!

Step 1: Deposit eligible crypto

This may sound obvious, but as a first step, transfer eligible crypto to your Ledger. Ledger maintains a list of crypto that can be staked. Look for Ledger Live options.

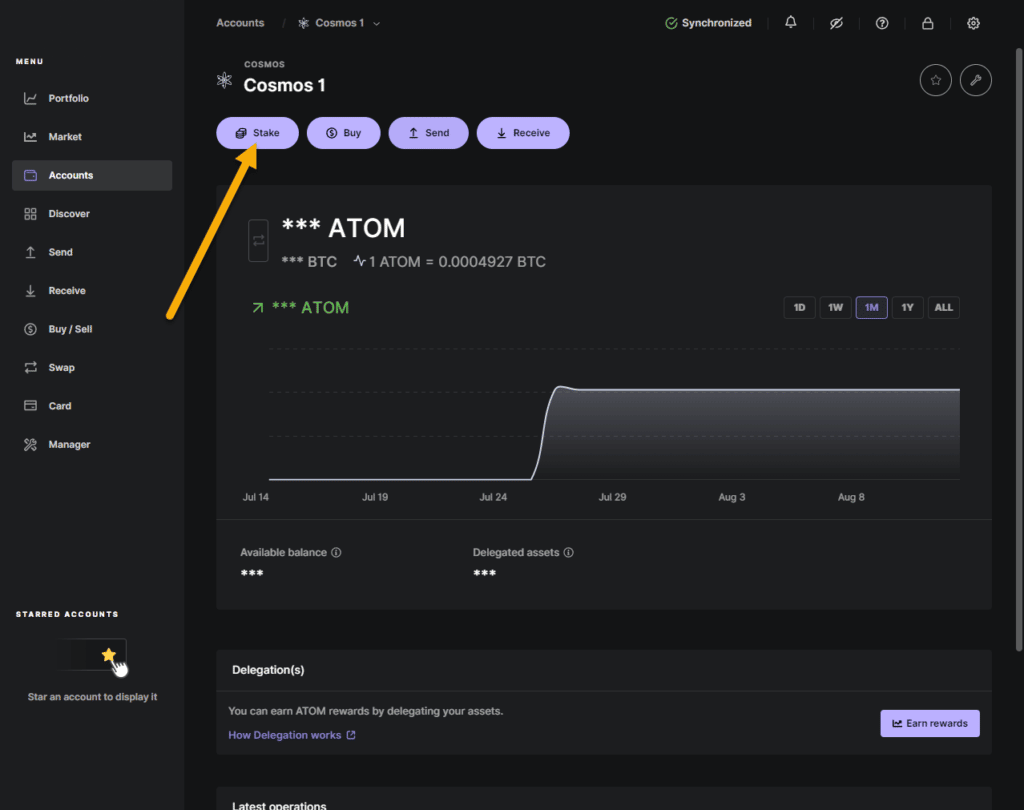

Go to the account for the crypto you want to stake and hit Stake. This will launch a pop-up with a set of options.

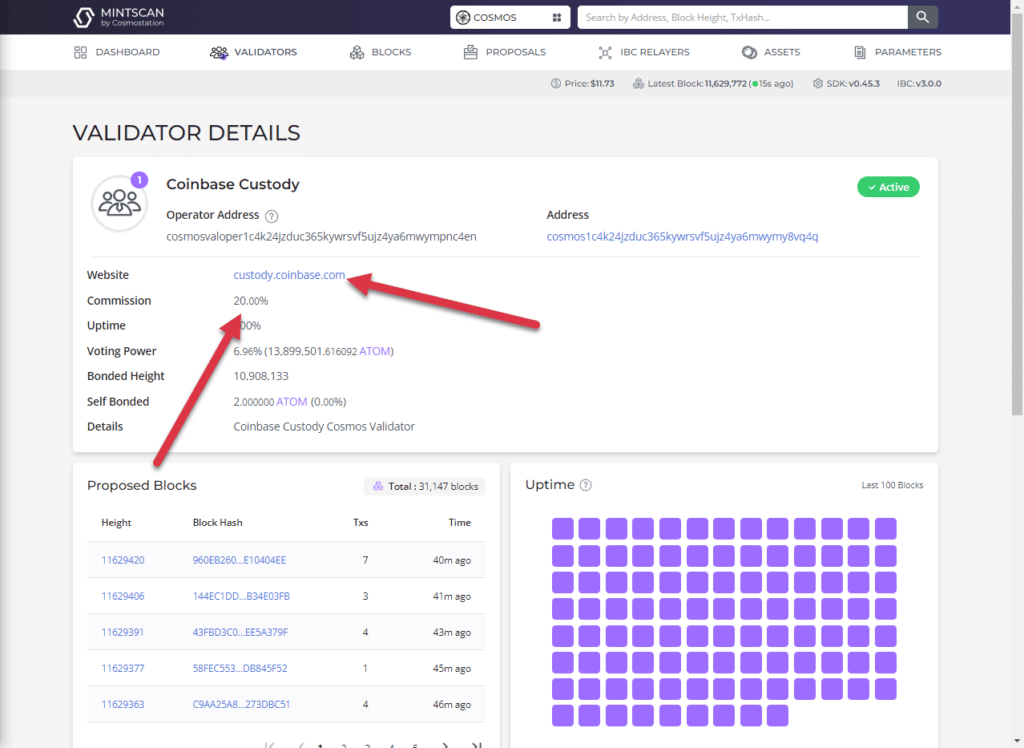

After hitting Stake, you’ll see this description and validator warning. Don’t worry, we’ll help you there.

Important: when you stake, you are committing your funds for a certain amount of time and therefore will not be able to immediately access them. In the screenshot here, you can see it will take 21 days to regain full control of the ATOM balance being staked.

Step 3: Choose a good validator

Alright, this is the most complex step. Unless you have a significant balance and the technical expertise to become a validator yourself, you need to join a validator. This is similar to joining a mining pool for proof-of-work crypto.

You will delegate your crypto to this validator. They do not control your keys but you will be in a contract with them. They utilize your coins for a specified period of time.

If validators experience downtime or attempt to manipulate the blockchain, they will likely be penalized which can cost you crypto.

You want a trustworthy validator that charges a competitive commission.

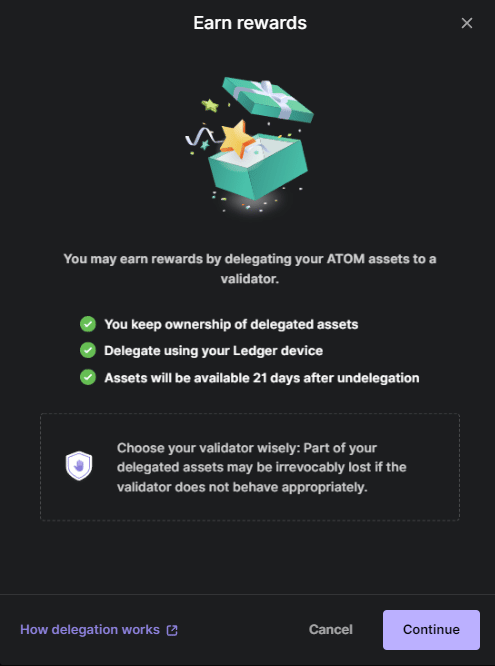

In this screenshot, you see a list of validators with:

- Names, which you can research to determine trustworthiness.

- Commission rates show you how much the validator keeps from your earnings. Important: this is not what you earn. A higher rate here means you earn less. Coinbase, for example, takes 20% of the earnings you generate. If you earn 10 ATOM, Coinbase will keep 2 and give you 8.

- Total stake shows how much that validator has staked, including anyone who has decided to stake with them.

Ledger runs its own validators for several cryptocurrencies. You’ll see them at the top of the list. Ledger has a good name in the industry, so you may choose to join them as a default.

However, you can see there are options that have lower commission rates, meaning you can earn more.

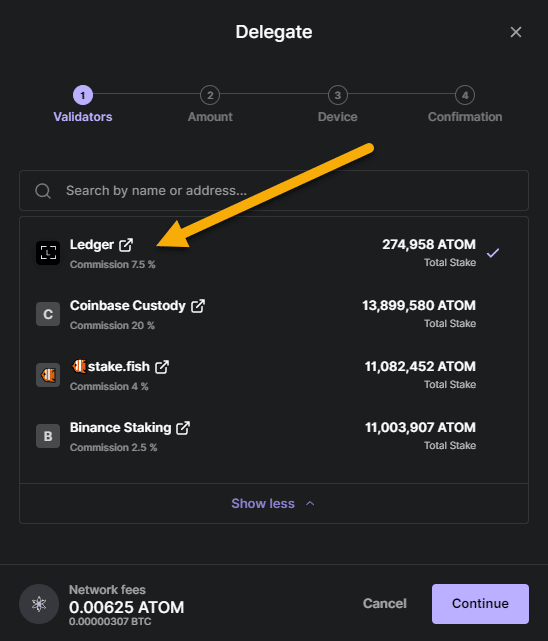

Clicking the arrow next to each validator’s name will take you to a page with details about the validator.

Better yet, you can search the blockchain’s validator directly. In our example, we can search Cosmos Validators to see the data directly at https://cosmoscan.net/cosmos/validators-stats.

Before selecting a validator, go out to its website. Do some research to help determine trustworthiness. Is there negative or questionable feedback online? Are there stats showing penalties?

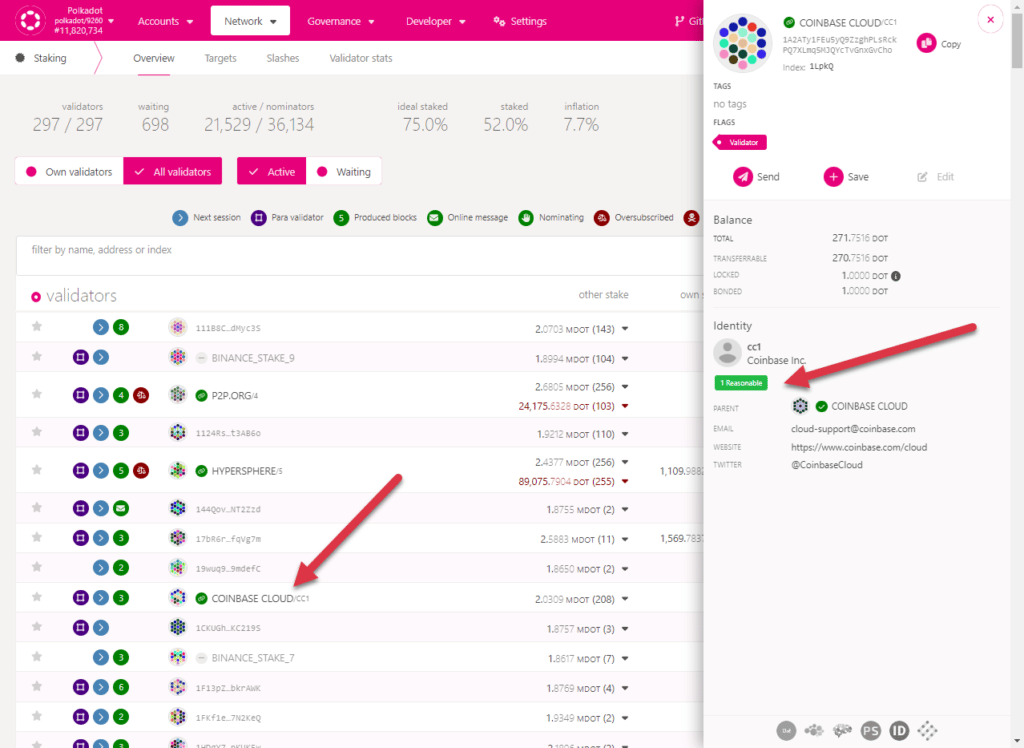

There is an opportunity for spoofing here. It is possible a validator registers with a common name to intentionally mislead you. For example, how do you know the “Coinbase Custody” validator is really Coinbase?

Remember, the crypto world is unfortunately full of scammers. Take your time.

Some blockchains seek to verify the identity of their validators through a variety of means, namely through registrars. That is not the case for Cosmos. But Polkadot, as another example, does show identify confirmation data for their validators.

Alright, this selection is the most complicated step. But you now can make a reasonably good decision on which validator to choose.

When choosing between trustworthiness and low commissions, lean toward trustworthiness. It takes significant investment and expertise to successfully operate as a validator. If they are not charging enough money for this, something may be off.

Step 4: Choose the amount to delegate

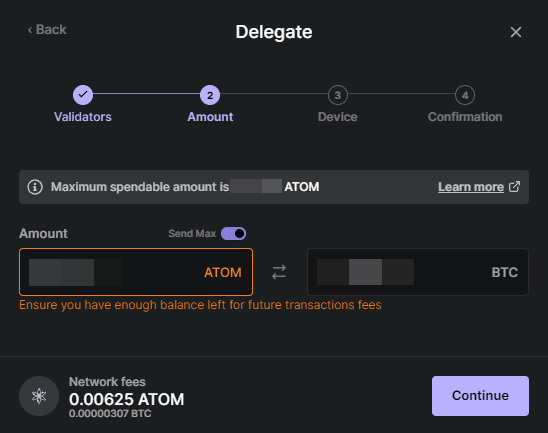

The next step is to choose the amount you want to delegate. It’s tempting to stake everything, but there is a catch.

There is a fee for making transactions on the blockchain. This may include staking, collecting earnings, and reinvesting those earnings. You need to leave some balance in your wallet to cover transaction fees.

The good news is for most proof-of-stake crypto, fees are very small. Ledger will show the transaction fee for staking on the bottom left. You can use this to estimate future fees.

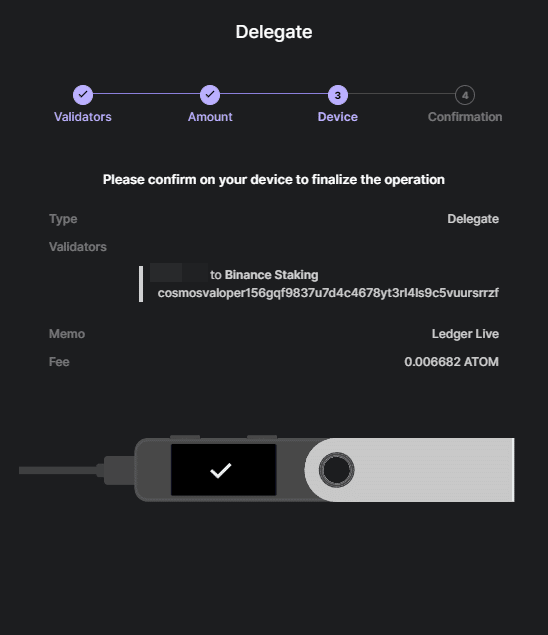

Step 5: Confirm the transaction

As with any Ledger transaction, you’ll need to follow a few steps physically to sign the transaction. Once you do, you’ll be all set.

Before approving, just confirm the address against the validator list you found in Step 3.

Success!

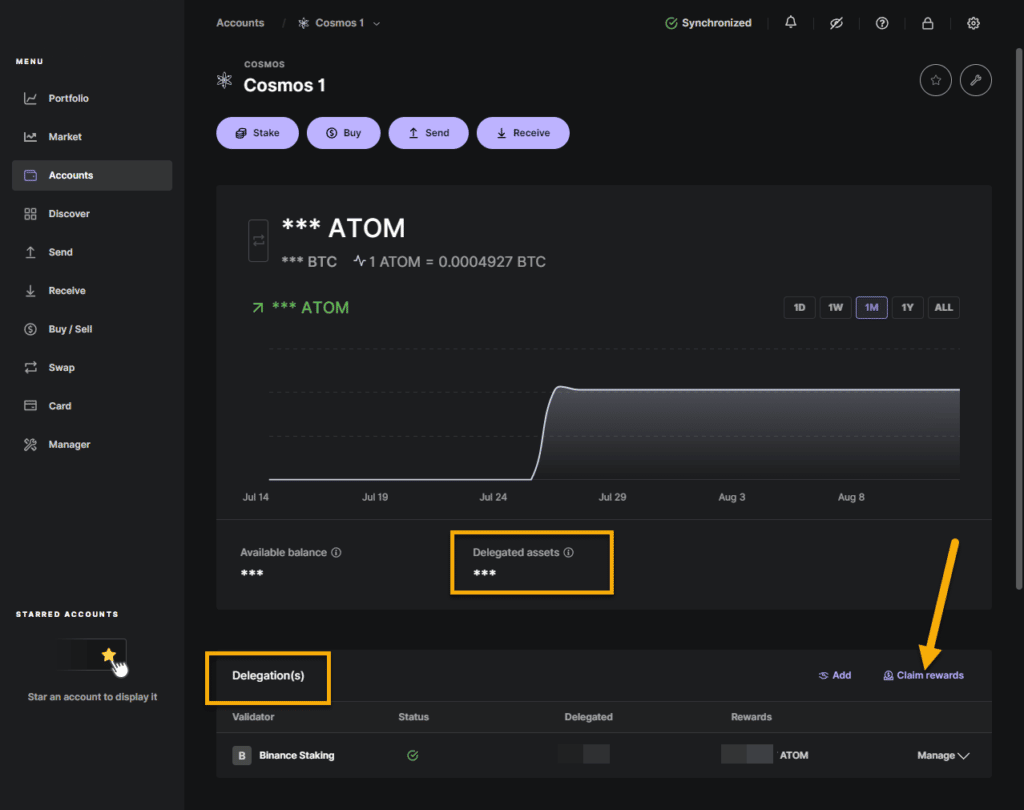

Step 6: Claim rewards

When you use an exchange to stake, they typically claim your rewards and reinvest them automatically for you.

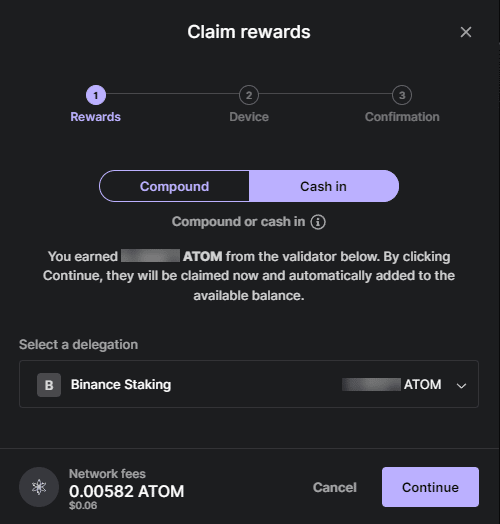

However, when you stake with a Ledger, you need to claim rewards and determine what to do with them.

Claiming rewards in Ledger is simple. Just go to your account and click Claim rewards.

Doing so, however, comes at the cost of a transaction fee. Transaction fees are typically flat (not percentage) meaning the longer you wait to claim, the lower percentage the transaction fee will be.

On the flip side, if you wait, that reward won’t compound.

The answer to when to claim is complex. But as a general rule of thumb:

- Large balances can claim weekly

- Smaller balances can claim monthly

When you claim rewards, you can choose to compound or withdraw the rewards.

- Compounding puts the reward back with the validator. Now your new money is earning rewards too. Your account will benefit from the magic of compounding. This takes two transactions, so the fee will be higher than cash.

- Cashing in puts the reward into your standard, unstaked balance. This costs one transaction fee.

This page will give you a clear sense of the cost and help you determine a good cadence for claiming rewards.

Once you do, put a recurring reminder on your calendar!

You are now in charge of ensuring your crypto is optimally used. Take steps to operate like a pro.

Conclusion

It’s relatively easy to manage your own keys, reduce your dependence on centralized exchanges, and still ensure your crypto is working for you.

Your goal should be to work through your crypto balances and find great ways to put them to work. Learning how to stake with a Ledger is an ideal first stop.

Have questions or comments? Let us know here!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.