Stock-to-Flow: Predicting Bitcoin, Gold, and Other Commodities

Stock-to-flow is an economic model used to measure the scarcity of a commodity. Can stock-to-flow predict Bitcoin and other commodity prices?

Stock-to-flow (SF) is the ratio of the current stock (the amount of the asset that is already in circulation) to the annual flow (the new supply that enters the market each year). This model has been applied to various commodities like Bitcoin, gold, silver, and platinum.

The higher the ratio, the scarcer the commodity is considered to be. This is because the higher the ratio, the longer it would take for the current stock to be replaced by the new supply.

At Crypto-ML, we need to ask if calculations like stock-to-flow predict Bitcoin price. If so, we can add them to our AI models that generate Bitcoin price predictions.

Stock-to-flow formula

Let’s say that there are 10,000 ounces of gold in circulation and we can mine an additional 500 ounces this year.

The SF ratio would be 20 (10,000 ÷ 500 = 20).

S2F = STOCK / FLOW

This means it would take 20 years of production to double the existing supply of gold. And the harder it is to mine, the higher the S2F value.

Simple.

Bitcoin stock-to-flow

This model is particularly relevant for Bitcoin because it is a scarce digital asset.

Like gold, Bitcoin’s scarcity is a fundamental feature that makes it valuable.

Learn what makes Bitcoin unique.

Bitcoin’s maximum supply is fixed at 21 million coins, which is expected to be reached in 2140. This means that the SF ratio for Bitcoin will continue to increase as more Bitcoins are mined and added to the current supply.

At the time of this writing, Bitcoin’s current SF ratio is around 55, much higher than most other assets.

This is because Bitcoin has a fixed maximum supply, and the flow of new Bitcoin entering the market is decreasing over time due to the halving event that occurs every four years. The halving event cuts the block reward in half, which reduces the amount of new Bitcoin that is created and added to the current supply.

An increasing S2F value is programmatically built into Bitcoin.

Stock-to-flow for commodities

The stock-to-flow model has also been applied to gold, silver, and other precious metals.

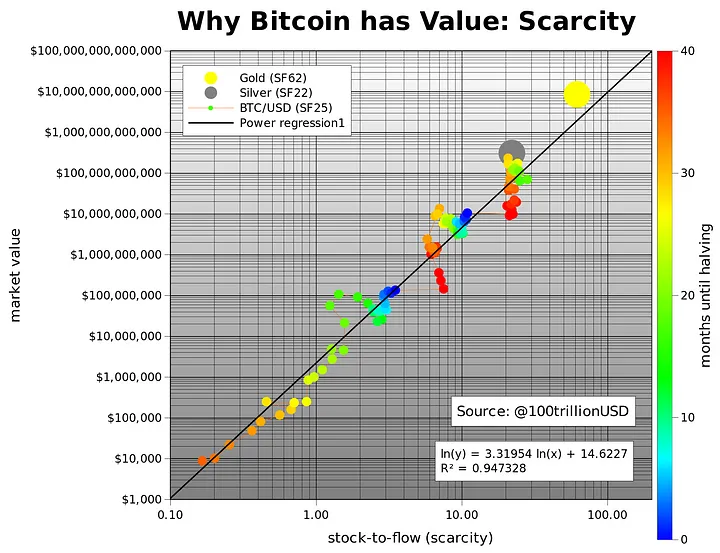

Gold has a very high SF ratio, around 62, which is why it has been considered a store of value for centuries. This model shows that gold is a scarce asset and will remain so for the foreseeable future.

Stock-to-flow is an essential tool for analyzing the scarcity of a commodity, whether it is gold, silver, platinum, or Bitcoin.

This model highlights that the more scarce an asset is, the more valuable it is, which is why gold has been used as a store of value for centuries.

Can stock-to-flow predict price?

While the stock-to-flow model has been widely used to measure the scarcity of assets like gold and Bitcoin, its ability to predict future prices accurately is a matter of debate.

Some model proponents argue that it can accurately predict prices, while others believe it is too simplistic and cannot account for other factors that may influence the price.

One study by PlanB, a well-known analyst and advocate of the stock-to-flow model for Bitcoin, found a strong correlation between Bitcoin’s price and the SF ratio. In his analysis, he found that the SF ratio had a 95% correlation with Bitcoin’s price, and he used this to create a price prediction model for Bitcoin that has been fairly accurate so far.

However, other analysts have been critical of the stock-to-flow model’s predictive ability, arguing that it does not account for other important factors that can influence prices, such as market sentiment, regulatory changes, and competition from other assets. They also point out that the model may be subject to data mining bias, where the historical data is manipulated to fit the model.

A study by researchers at the University of Cologne found that while the SF ratio does have some predictive power for gold and silver prices, its predictive ability is limited.

The researchers found that the SF ratio was only able to explain about:

- 13% of the variation in gold prices

- 10% of the variation in silver prices

They noted that the predictive ability of the model was more robust in the long term, but less reliable in the short term.

Overall, while the stock-to-flow model has been an important tool for measuring the scarcity of assets, its ability to predict future prices accurately is still a matter of debate. It is important to consider other factors that may influence prices and to exercise caution when using historical data to make predictions.

Does Crypto-ML use stock-to-flow in its AI models?

Crypto-ML uses 55+ data points to generate our Bitcoin predictions, but we do not currently use stock-to-flow directly.

From a machine-learning perspective, halvings are infrequent. Mining happens at a gradual pace. Together, this means few samples and little variation at the 30-day timescale. Stock-to-flow is more useful for year or multi-year timeframes.

We’ll continue to monitor and add stock-to-flow metrics when they add to the predictive capabilities of our AI.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.