Wealth Preservation with Cryptocurrency

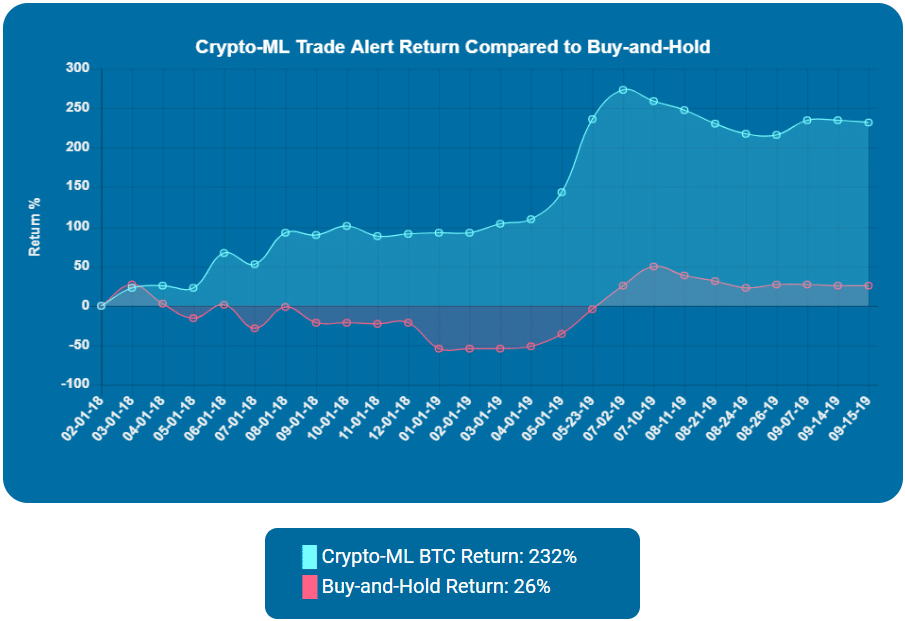

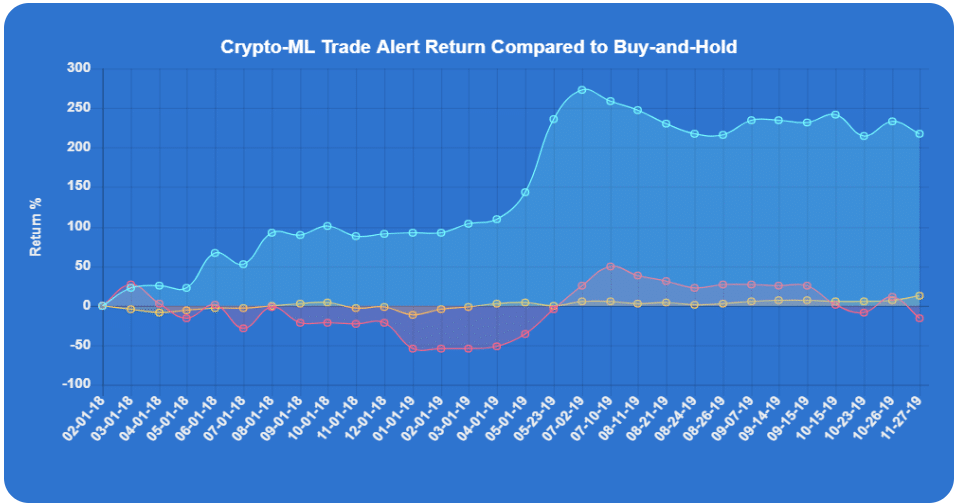

Crypto-ML hit an amazing milestone with its last closed trade, which is described below. This milestone illustrates the importance of taking a systematic, strategic approach to managing your trades and investments. It also shows the value of wealth preservation with cryptocurrency. This post will show you those details and give you approaches to protecting yourself during bear markets and better positioning yourself to capture big swings during bull markets.

Crypto-ML: preserving wealth

We’ve hit a fascinating milestone with Crypto-ML. While we used the technology privately prior to 2018, our first Bitcoin trade alert delivered to actual customers happened on February 7, 2017. The alert was issued at $8,207.

Now, over a year-and-a-half and 50 trades later, our platform closed a trade at $8,263.

Despite Bitcoin making a round trip to the $8,200 level, it has experienced huge fluctuations during that time. There have been times the market has outperformed Crypto-ML. And of course, there have been times Crypto-ML has outperformed the market.

“Balance risks in ways that keep the big upside while reducing the downside.”

Ray Dalio, Principles

It’s fascinating to see how the numbers have played out over time. Bitcoin is back to where it started, but we are not. As Ray Dalio so concisely put, we have been able to keep the upside and reduce the downside.

Whether you follow the ever-improving Crypto-ML trades perfectly or you use our variety of tools to make your own informed decisions, you will find that protecting your money during risky times while also positioning yourself to capture big moves during less-risky times optimizes your results.

Preserving wealth during crypto bear markets

Tools such as the Crypto-ML Fear and Greed Index and Trade Alerts that help us determine the overall market strength. Armed with such information, how do we best protect our wealth during down markets?

As a prerequisite, you must determine your own personal risk acceptance and tolerance. The most basic form of guidance is exactly what we place on this site: never trade more than you are willing to lose.

1. Reduce your exposure to crypto

Many crypto traders know and love the crypto markets. Even when they are down, you may still want to look for reversal points and bounces. This can be acceptable (depending on your personal risk tolerance), but we recommend considering four ways of reducing your exposure during adverse markets:

- Trade a smaller amount than your risk tolerance normally allows.

- Use tighter stop losses.

- Cash out of profitable trades sooner and with less confirmation.

- Seek more confirmation before opening new trades.

2. Take short crypto trades

Shorting the crypto markets is the most aggressive option you can take during down markets. This should be done if you have particularly high risk tolerance.Crypto-ML provides signals for short-selling Bitcoin, which can be a tool in your arsenal.

How to Short Bitcoin for Cryptocurrency Traders

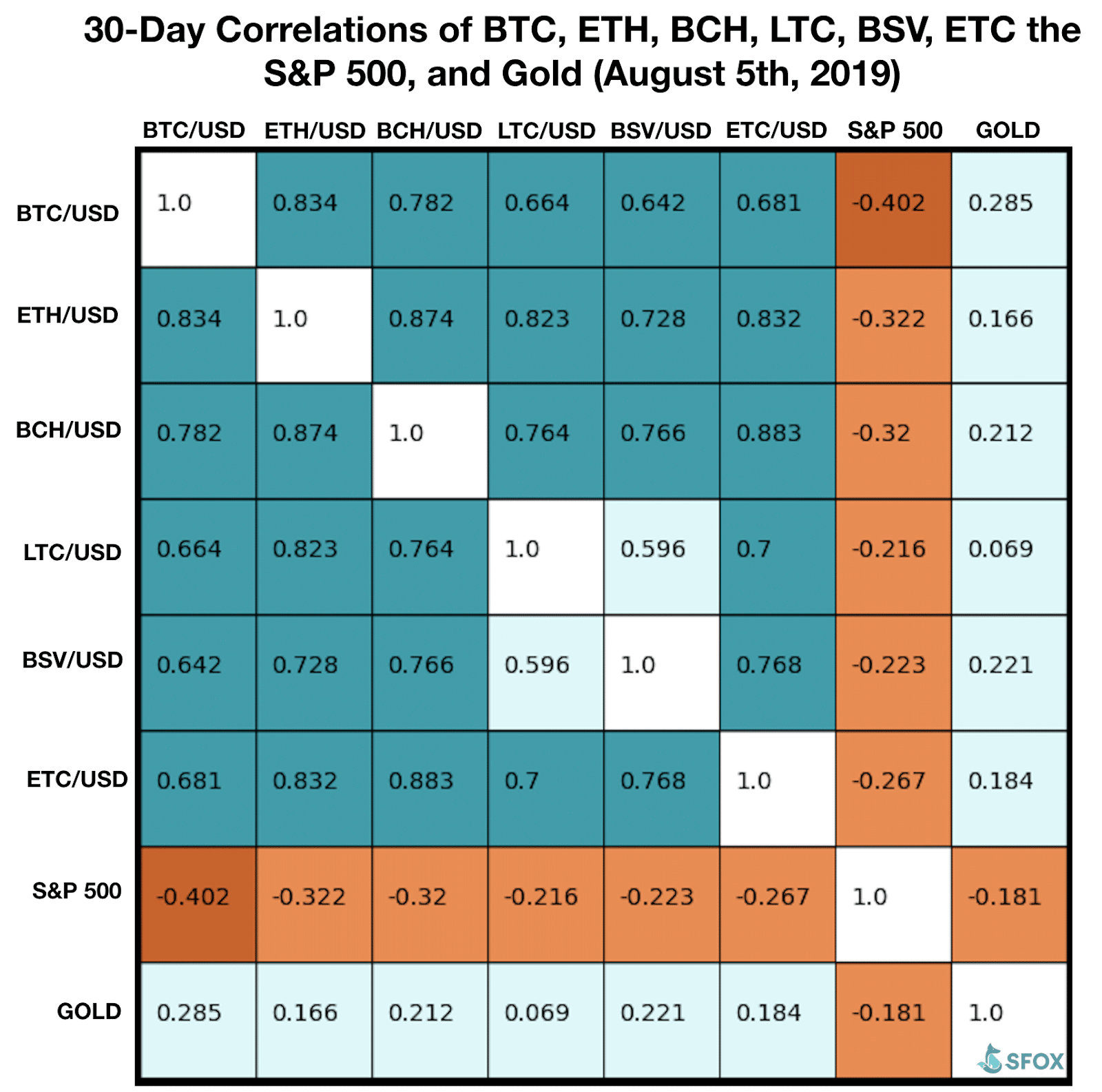

3. Trade and invest in non-correlating assets

As a trader or investor, your primary goal should be to maximize your wealth. As such, it doesn’t matter what vehicle you use to achieve this goal.

In other words, don’t pigeon hole yourself into trading cryptocurrency. If the crypto markets are exceptionally risky, forcing trades exposes you to unnecessary risk.

If you monitor the crypto markets closely and have a great feel for their movements, take bear markets as opportunities to learn a non-correlating market equally well.

Capturing profits during crypto bull markets

As history has shown, Bitcoin bull runs are truly exceptional. Being able to capture even a portion of them has historically yielded incredible results.

1.Optimize your exposure to crypto

When your tools and analyses say the crypto markets are in a bullish phase, you can consider trading nearer the limits of your personal risk tolerance. Whereas we advise reducing exposure during bear markets (i.e. backing off from your established risk levels), during bullish times, you may want to instead work your way back toward your calculated risk. Likewise, you may adjust your stop losses and profit targets accordingly, keeping them less tight than you would during bear markets.

With these options in mind, taking a systematic approach to determine the broad market condition, identify entry and exist points, and track results is the key to effectively capturing profit during upswings.

How to Use Machine Learning to Trade Bitcoin and Crypto

2. Reduce exposure to non-correlating assets

Last, you may consider exploring non-correlating assets and adjusting those funds as appropriate. There are times in which moving long-term assets into crypto may help protect your broader portfolio. This is particularly true if your local currency is facing sharp devaluation.

Coin Metrics provides a great correlation analysis tool: https://coinmetrics.io/correlations/

Summary

The charts and data here are fascinating. It really illustrates the potential cost of following a “HODL” approach. Simply holding an asset without a systematic approach to managing it is not really a strategy. Taking an approach that locks in gains and minimizes risk can yield significantly different results.

And by the way, if you haven’t read Ray Dalio’s book Principles (quoted above), you should definitely pick it up. He very openly shares his ups and downs with systematizing his approach to trading.

Do you have thoughts or questions? Let us know on the Community Forums.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.