Plan #01: The True Math of a Trading Loss

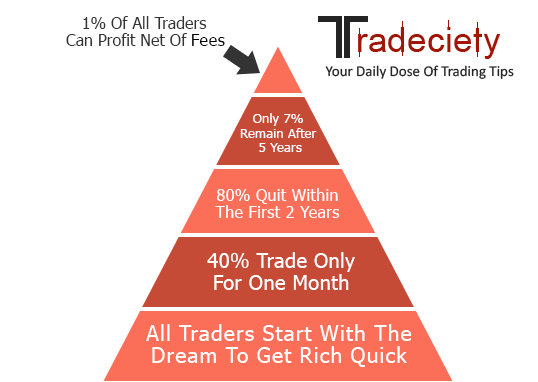

Markets are going up and its sparking an increased interest in crypto trading. Before you jump in, please be aware of this critical fact. On average, only 1% of traders are profitable over 1 year, after accounting for fees.

Trading is attractive, as everyone wants to get rich quick. Members in our own team would agree to this. But realistically, if you want to minimize your downside, it would take 5 years. And if you are wondering what to do in those 5 years, which many of our users have asked, we will soon have the answer packaged as a digital course, as we can add better context to information. We decided to keep it free for life, so there’s no need to sign up immediately. You can sign up even after a year; it will still be free. If you want to join the waitlist, click here.

In this conversation, we want to surface a hidden devil – the asymmetric nature of losses.

The Asymmetry of Losses: A Critical Consideration

Trading courses and influencers always talk about profits. That’s a good hook to capture people’s attention.

🚀101% profit in six weeks, we told you.

Did that headline get your attention? It usually does. But what about losses? What if we said the following?

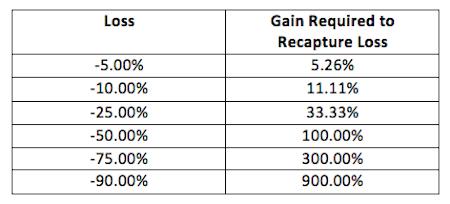

🧐If you make a 80% loss, you need a 400% gain to break even.

Doesn’t it sound right? (I’ve seen crypto conversations use a lot of emojis and decided to play with them.)

If it’s the first you hear an 80% loss requiring a 400% gain to break even, below is a quick reference sheet.

When Emotions Come In

Trading for the first time is emotional. A lot of effort is put into making it void of emotions, like putting in stop losses, knowing when to exit, etc.

But emotions still come in play and is best explained by the concept of sunk cost fallacy.

Consider a starting point of $1,000 and a hypothetical investor named Bob. If Bob were to make a 10% loss, his initial instinct would be, “It’s fine, I’ll make it back.” The hidden nuance is coming into play; for a 10% loss, he now needs a 11.1% goin to breakeven.

Over a month, his initial $1,000 is now $500, and his emotions are getting the better of him, and he is making bolder bets. This is because of the sunk cost fallacy.

His decision to invest more is based on the fact that he has already lost money, and only a bolder bet will get it back. His decisions are being biased.

This carries on till his bolder bets yield more losses, and now he is at $200. Few things have happened

- Trading consumed much of his time, which could have been better spent elsewhere.

- His friends & family might be witnessing his rage.

- He is now at an 80% loss and needs a staggering 400% gain just to break even. We both know a 400% gain is hard to achieve, and its fair to say Bob doesn’t have the track record to get there.

An existing loss makes quitting harder; as those losses compound, we make bolder and bolder bets. Our decisions are biased toward getting our money back, which leads us down a dark, ugly road.

Short Term vs. Long Term

Short-term traders have one advantage & disadvantage. Its time. The returns are expected to be quick, which means the losses should also be offset equally quick.

Making profitable trades consistently is hard, identified by its success rate of just 1%. Even Sam Bankman Fried experienced it with his trading firm, Alameda Research. It made a lot of money in the start around 2017 due to arbitrage in token prices, only to experience massive losses from 2021.

If you focus on long-term strategies with timeless investing fundamentals, you can build incredible wealth (around 10x your investment over a five-year timeline) by putting in just 15 minutes of your time a week. If you are wondering how, it’s time-tested – Dollar Cost Average. Many consider it boring, but it’s practical.

Key Takeaways

- Asymmetric Nature of Losses: A 25% loss requires a 33% gain to break even. Be aware of this nuance.

- Know when to stop trading: Sunk cost fallacy is real. People take bolder risks after losing money, in hopes to gain it all back, only to lose more.

- Dollar Cost Average is practical: Trading has its charm because it’s advertised as getting rich quick. Investment firms would have eaten the whole pie if it was that simple. If you dont want to spend all day trading, consider a dollar-cost average strategy.

Whenever you are ready, there is one way we can help you.

- Crypto-OS: Learn how to apply proven long-term investing principles to the crypto market. It’s free, actionable, and to the point.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.