Market Orders vs Limit Orders for Crypto

Market orders and limit orders are both available for cryptocurrency investors and trades. Each order type has its own set of pros and cons. This post will help you choose the best option for your particular trading needs.

Market Orders vs Limit Orders

Most crypto traders and investors are familiar with Market and Limit Orders. At a high level:

- Market Orders are designed to execute as quickly as possible at the current market price. By selecting this type of order, you acknowledge that the market price may fluctuate up or down as your order fills.

- Limit Orders set the maximum or minimum price at which you’re willing to buy or sell. By selecting this type of order, you acknowledge that your order may not be filled.

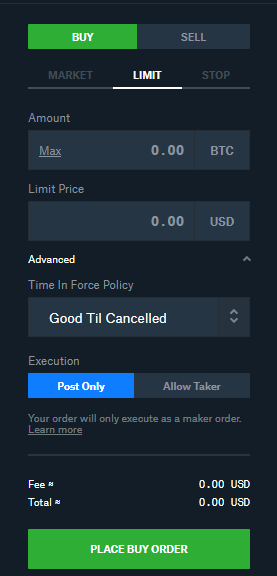

Limit Orders have another parameter that covers the length of time the order is valid. For example, if you have a Bitcoin position, you may say you are willing to sell if a certain price is hit. That statement can be valid for the day or indefinitely. You have an option to select a timeframe.

There may also be additional configurations available for Limit Orders depending on your exchange.

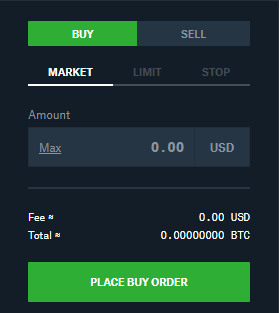

These screenshots from Coinbase Pro highlight the differences between Market and Limit Orders:

Crypto-ML Auto Trade supports both types of orders.

Cryptocurrency Market Orders

Market Orders are the most common and easiest way to place an order on an exchange.

Market Order Pro

- Market Orders will fill completely.

Market Order Con

- Order fills will have slippage. They will not be filled exactly at the price you want.

Market Orders and Liquidity

Liquidity is the biggest risk factor for Market Orders. If you’re trying to buy, how many people are trying to sell? The lower the liquidity, the more slippage you will have on your price. Slippage can be positive or negative, but ultimately it’s out of your control so it is, therefore, a risk.

You can determine liquidity by monitoring the spread, which is the difference between bid and ask prices. During peak, stable times on Coinbase Pro, it is common to see a $0.01 spread on Bitcoin. This means most orders will be filled within pennies.

These factors will negatively impact your liquidity:

- Trading a large quantity.

- When crypto prices are moving quickly. During times of extreme movement, positions cannot be filled and are at greater risk of having a huge spread.

- Trading a crypto with low volume. Bitcoin has better liquidity than most cryptocurrencies because it trades at higher volumes.

- Trading during non-peak times. This is particularly true in the traditional financial markets.

- If your exchange is not high volume. As of this writing, Binance processes about 5 times the volume that Coinbase does (Cryptocurrency Exchanges by Volume). However, both are large volume exchanges.

Based on the above, it is best to understand your exchange, experiment with trades, and determine whether or not typically slippage is acceptable for you. Just be aware that during times of extreme price movement, Market Orders will introduce uncontrollable risk regardless of exchange, size, and other factors.

Cryptocurrency Limit Orders

Limit Orders have a variety of functions. They can be set to establish long-term buy and sell levels. Or, they can simply be used to control your risk when it comes to trading.

Limit Order Pro

- You set the price at which you’re willing to buy and sell.

Limit Order Con

- Your orders may not fill or may only fill partially. If you own Bitcoin and set a Limit Order to sell, that order may not fill, yet price may continue to drop unacceptably. In this case, you will likely face a worse loss than had you used a Market Order.

Limit Order Time Range

While most training programs for traders will recommend only using Limit Orders, this is likely being recommended from a day-trading perspective. Since traders work in highly-granular timeframes and may issue several trades per day, missing one is more acceptable. Additionally, since these trades will be set for small wins and losses, slight slippage will have a large percentage impact on results.

Crypto-ML operates in more of a swing-trading timeframe. This means trades are issued less frequently and minor slippage is less impactful on a percentage basis. It also means missing a trade carries excess risk since they are less frequent.

What if you missed the 2017 bull run because your limit order couldn’t fill? This is the sort of question you should ask as you examine your own risk tolerance.

Question or Comments?

If you would like to share your questions, comments, or experience, let us know in the comments below.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.