Plan #04: Bitcoin Halving in ~3 months. Now What?

We are trying new things. A discussion-based approach felt right. We challenge FOMO in real-time and layer our thinking.

Reason: We believe in a fact-based approach where we share facts with you. Our aim: enable informed decision-making.

(do give us your feedback on this email) 🤗

Today’s discussion was initiated by LisHere321, who talked about Bitcoin Halving.

It’s an excellent discussion to have. Let’s think it through.

Auditing Fact 1:

Bitcoin halving is scheduled around April 2024.

No one can predict the exact Bitcoin halving date as it’s block-based and not a time-based trigger. That is -> Bitcoin halving occurs every 210,000 mined blocks. Since each block mining takes, on average, 10 minutes, it’s anticipated to be every 4 years. As the halving block comes closer, the estimates become more precise.

Why does Bitcoin Halving matter?

If you are like me and like memes, here’s a good one:

Bitcoin halving signifies the deflationary aspect of Bitcoin. Unlike US Dollars, where the amount of money in circulation increases yearly by 10-15%, Bitcoin circulation decreases every 4 years. Given supply decreases and demand increases due to media hype, it’s normal to see Bitcoin prices rise.

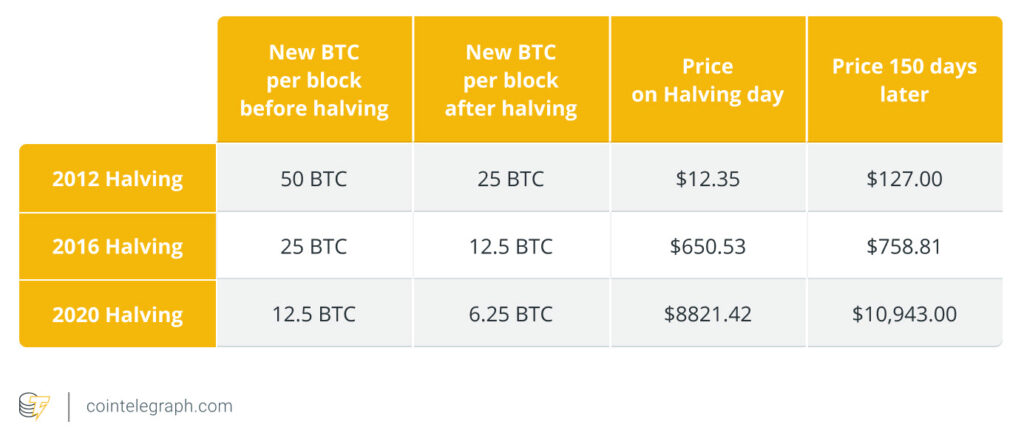

And thus, 150 days after a halving event, there is a price increase. The actual increase is speculative and based on the amount of media attention, but there was a 10x increase in two of three instances.

Halving doesn’t guarantee a 10x price increase, but people like to believe it’s true. However, indeed, the price after halving is usually higher than the price before halving.

Auditing Fact 2:

BTC spot ETF’s last approval deadline is on January 2024

ETFs are real, and once ETF money comes to Bitcoin, it will be the first time people inject real institutional money into it.

We wrote about it extensively on our blog, “How ETFs will change Bitcoin Price,” and we’ll share the best highlight here for efficiency of time.

Globally managed assets are around $38 Trillion. The best case estimate is that over time, 5% of all globally managed assets will be allocated to Bitcoin ETFs. It’s an allocation of $1.94 Trillion. If you were to inject $1.94 Trillion, and take note, it is a Trillion with a T, not a B or an M, a T, the new market cap of Bitcoin would be $2.80 T, giving a base price of $143,016 per Bitcoin.

Calculations at the time of writing

Bitcoin currently has 19,564,168 coins circulating for $43,899, giving it a market capitalization of $858,847,411,032 (19,564,168 coins * $43,899). Call it $858B.

- 5% of $38.8T (globally managed assets market cap) is $ 1.94 T.

- The new market cap of Bitcoin would be $2.80T ($858B + $1.94T)

- New Bitcoin base price: $143,016 ($2.80T / 19,564,168 coins)

EFTs will bring in real institutional money into Bitcoin, the type we have yet to see, and that will also bring mainstream adoption as Bitcoin will be a household name.

All this means shrinking supply and increasing demand.

And if you are waiting for ETF approval, it will take time!

The date of ETF approval or if it approves is unknown, and what to do about it ETFs, we’ve talked about it at the end of the email.

Auditing Fact 3:

A crypto bull market occurs after every BTC halving.

It’s highly debated and is not a guaranteed outcome. Don’t bet your house on the arrival of a bull market.

This type of speculation and hype is precisely what we stay away from, as it makes people feel that if they don’t act now, they will miss out on Bitcoin and take risks irrational risks, as a member of our team took with Luna. It felt safe, and he took big bets without understanding how it worked.

It’s essential to form your opinion and not take other people’s word for it.

How to process this email?

You work 60+ hours a week to earn the money you do. Ensure you form your opinion before investing in tokens.

For the very listed above, we recommend dollar cost averaging into Bitcoin for five years. If you haven’t started, use SwanBitcoin (the system we use to maintain our treasury) and buy 10 dollars weekly. Start your five-year journey instead of buying in bulk when emotions feel right (P.S. – It’s the hype trap)

Action steps for today

What did you think of this email?

Do you like it and want us to continue writing in this format?

Please give us feedback on whether this helps you make more informed decisions alongside potential topics you want us to cover.

(just hit reply and start typing) 😊

Whenever you are ready, there is one way we can help you.

- Bitcoin-OS Waitlist: Accumulate Bitcoin with Proven Strategies. It’s free, actionable, and to the point

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.