Release 6: Major Machine Learning Upgrade

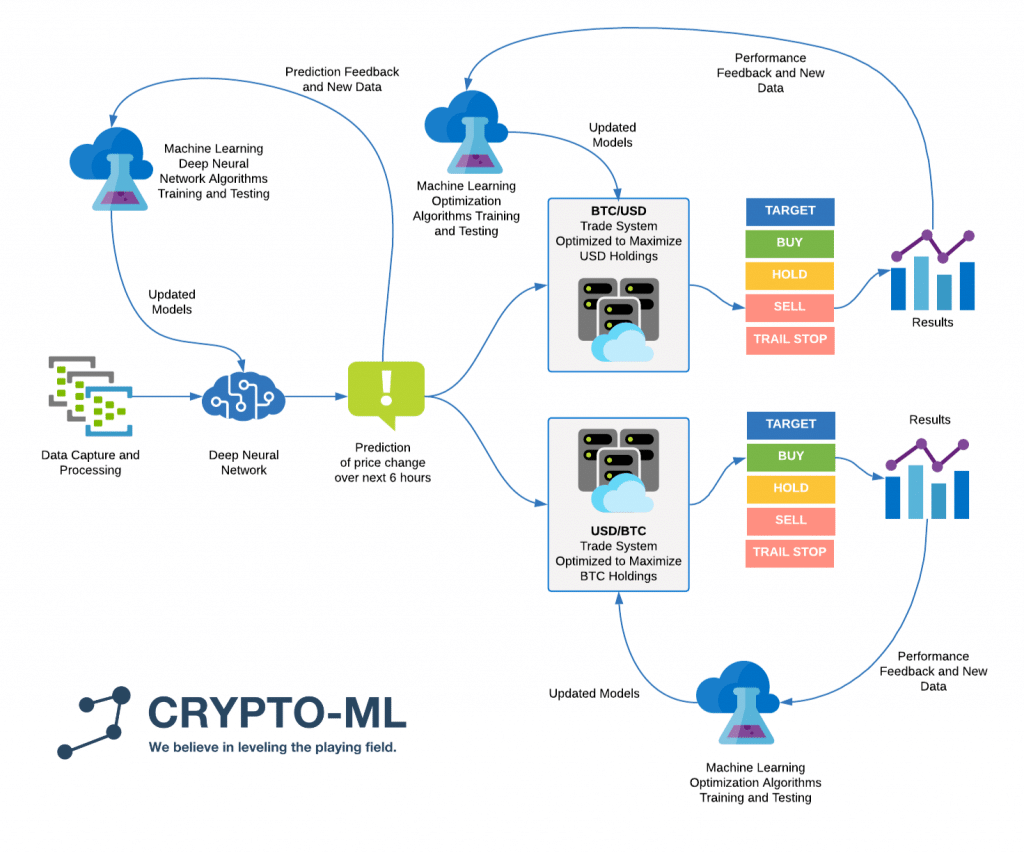

Release 6 of Crypto-ML’s neural network prediction engine is now live. This change brings a host of improvements to speed, precision, and data capabilities. All come together to deliver higher-accuracy, lower-risk trade predictions for Bitcoin and Ethereum.

Six months ago, Crypto-ML debuted Release 5, which upgraded the machine learning behind our cryptocurrency price prediction platform to neural networks.

Crypto-ML Release 6

Now, we are ready to release the next major upgrade. Release 6 will provide a new level of speed, accuracy, and data ingestion in our machine learning workflow. This gives us the ability to quickly capitalize on faster market movements with less risk.

This upgrade is a direct result of our experience working with neural networks in a production trading capacity over the last half-year. We’ve seen what works well, what the challenges are, and where we can ramp up speed and capacity.

Simply put, Release 6 takes our neural networks to the next level.

The key highlights include:

- Nearer-term predictions

- Greater accuracy

- Faster reactions to market changes

- Better extensibility

Near-Term Predictions

Central to the upgrade is a new, 6-hour prediction window. In prior releases, we targeted 24-hour predictions, asking the question: where will price be 24 hours from now?

Through our extensive evaluation and testing, the 24-hour interval provided the most reliable predictions and best statistical metrics.

However, the problem is a lot can change in 24 hours, especially in the crypto markets. Indeed, time is the enemy to traders. The longer your trade is open, the greater your risk becomes.

Thanks to our enhancements, we’re now able to effectively quadruple our machine learning processing and, as a result, cut the prediction window by 75% without sacrificing statistical measures.

Greater Accuracy

Since Release 6 will give you predictions for price 6 hours from now, our trading engine will be able to generate more reliable trades.

ETH R6’s preliminary results showed:

- 21% reduction in error

- 80% reduction in losing trades

BTC R6’s preliminary results showed:

- 4% reduction in error (BTC R5 is already performing well)

- 70% reduction in losing trades

On top of accuracy improvements, the tighter prediction windows simply allow for less to go wrong.

Faster Reactions to Market Changes

Since Release 6 ingests more data, it sees more market conditions more frequently. This builds up the pattern library and allows it to predict in a smarter manner. It can react and adapt more quickly to crypto market changes.

Arriving at Release 6, however, was a delicate balancing act. A higher frequency of data is not always desirable. If data frequency is too high, the signals wash out against background noise. When this happens, machine learning won’t have as many exceptions to learn from. Finding the right balance is the key to Release 6 and where our production experience became critical.

As a real-life example, one of the challenges faced by the Release 5 ETH model was that market dynamics recently changed from channeling to trending. Based on past data, counter trading was an effective strategy and was therefore adopted by the ML. This resulted in excellent trades for our ETH model during the first half of the year.

However, as the market began trending, counter trading became dangerous. As a result, our ETH model misjudged the best way to play the markets and has struggled to shift to a better approach.

On the other hand, our BTC model was able to adjust fairly rapidly. Comparing the details between these two gave us critical insights to move our technology forward and address this type of scenario.

Extensibility

On top of the faster processing and nearer-term predictions, Release 6 affords us the ability to readily add controls to aid trading in uncertain conditions.

Though additional controls are not immediately in scope, several options are in the lab being explored.

Past controls have been added to manage open positions, such as profit targets. But there is also an opportunity to manage closed positions. For example, there are times the predictions are wrong but a trade should be opened. Or perhaps the market is simply too risky to allow trading. In these types of scenarios, our system can alter behavior to adapt accordingly.

Additionally, enhancements to stop loss handling are currently in separate Alpha testing. These enhancements will optimize limit orders and place stops directly on the exchange, with the goal of improving results during fast market drops.

Live Now

After a successful Alpha and Beta Program, Release 6 has been live over the last few weeks. However, it has been operating in a throttled manner. Release 6 is now fully active. You can see its predictions on the Member Dashboard and your Auto Trade connections are now also feeding fully from R6.

If you have questions, please let us know in the comment below, discuss on our Community Forums, or join us on Telegram.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.