Machine Learning Upgrade to 5.0: Deep Neural Networks

Crypto-ML is in the process of releasing version 5.0 of its machine learning cryptocurrency trading platform, which implements Deep Neural Networks and raises the platform to the top ML infrastructure level.

Upgrade Details and Goal

Crypto-ML’s 4.0 machine learning model of crypto trading was introduced on October 26, 2019, as “BTC Beta” and later rolled out to all models on February 1, 2020. This moved Crypto-ML from a machine learning model that acted as a super technical indicator to a machine learning approach that looks for anomalies in the market that tend to precede big price changes.

These anomalies can exist in any of the data points our machines consume. This is a much more complex and robust approach to analyzing the markets. The primary advantage of this flexible concept is that it tests well across different time periods. It seems to fundamentally understand how to navigate most market conditions. You can read more about it at Bitcoin Trading with Machine Learning Anomaly Detection.

With the 4.0 release, we introduced a completely new framework for taking insights from this model and turning them into a functional system capable of issuing trades in real-time.

When we speak of the 4.0 framework, that includes a new data inputs, new machine learning algorithms, new machine learning models, and a new trade execution system (which also uses a secondary machine learning system to find trigger points).

The upgrade to 5.0 will swap out the machine learning components but retain the rest of this framework. The goal is to increase the precision of our predictions.

This upgrade is akin to swapping out the engine of a car. We’re able to use the existing body, transmission, and suspension, but under the hood, we’re putting in a new engine capable of much more horsepower.

Ensembles

The machine learning used in 4.0 is a type of ensemble algorithm that is highly efficient, lightweight, and fast. These characteristics are ideal for trading. In general, you want to use the most efficient approach possible, especially when speed matters.

“Ensemble methods are models composed of multiple weaker models that are independently trained and whose predictions are combined in some way to make the overall prediction.

Much effort is put into what types of weak learners to combine and the ways in which to combine them. This is a very powerful class of techniques and as such is very popular.”

https://machinelearningmastery.com/a-tour-of-machine-learning-algorithms/

However, as we’ve found, with the right cloud-based infrastructure, we can utilize a more complex machine learning type and greatly increase the precision of our predictions.

To perform this upgrade, the challenge is not in developing the new model, but instead, it is in building a web-based infrastructure that can handle highly-complex operations at the speed we need. It’s a large investment, but well worth it.

Deep Neural Networks

Neural Networks are a type of machine learning algorithm. They have captured the attention of the general public because they were specifically designed to model the human brain.

What’s also interesting is Neural Networks contain hidden layers that will process data in a way that we do not have visibility into. That is, other algorithms create models and can then show you how decisions will be made. But with Neural Networks, we lose the ability to understand exactly how information is being processed and why predictions are being made.

If you want to explore these ideas further, Codementor has a great article: A Gentle Introduction to Neural Networks for Machine Learning.

Neural Networks are ideal for handling complex and abstract concepts. They are used for tasks such as image recognition and voice processing.

And as it turns out, they can handle the complexities and peculiarities of financial markets. Our team has been able to use these algorithms to build very precise pictures of cryptocurrency movement.

Specifically, we are using Deep Neural Networks with two hidden layers to generate our 5.0 models.

Of note, “deep” algorithms are contrasted by “shallow” algorithms. In general, machine learning experts will use shallow as much as possible and only favor deep when true additional benefits can be gained. Oftentimes, the simpler solution is best. It is much more “expensive” in many senses of the word to use deep options.

If you want to learn more about this concept, the following OCDevel podcast episode provides an excellent overview of why shallow algorithms are preferred in many circumstances.

Despite the many benefits of shallow-learning algorithms, there are times the results from deep algorithms are great enough that the loss of efficiency is warranted.

In our case, this is true. With our recently upgraded framework, we’re able to exploit the benefits of Deep Neural Networks. They can deliver highly precise results when it comes to making predictions in the crypto markets.

“Deep Learning methods are a modern update to Artificial Neural Networks that exploit abundant cheap computation.

They are concerned with building much larger and more complex neural networks and, as commented on above, many methods are concerned with very large datasets of labelled analog data, such as image, text. audio, and video.”

https://machinelearningmastery.com/a-tour-of-machine-learning-algorithms/

If you enjoyed the podcast on shallow learning algorithms, here is OCDevel’s episode on deep learning:

The 5.0 Upgrade

To perform this upgrade, our task at Crypto-ML is simply to scale up our infrastructure to meet the new demands and ensure our system delivers real-time results.

We’re pleased to announce this infrastructure upgrade was completed successfully and has been running in an alpha state for approximately one month.

In terms of timing:

- Ethereum was upgraded March 13, 2020.

- Bitcoin was upgraded March 16, 2020.

- Bitcoin Cash was upgraded March 27, 2020.

Each deployment will occur assuming performance is as expected and meets production metrics.

Statistical Measures

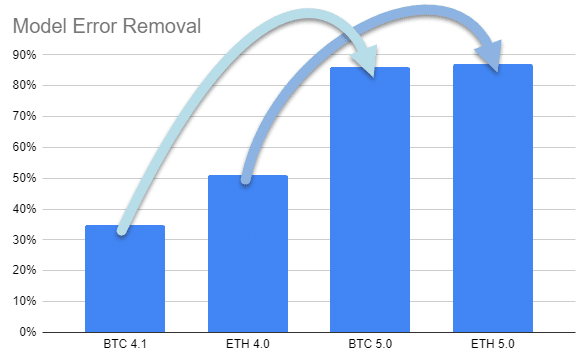

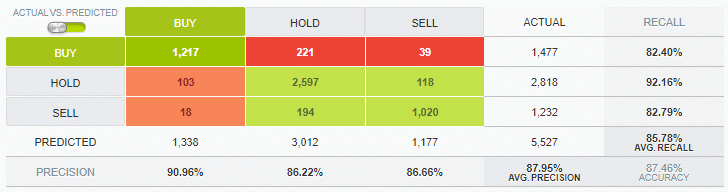

In terms of results, we’re looking at more precise predictive capabilities.

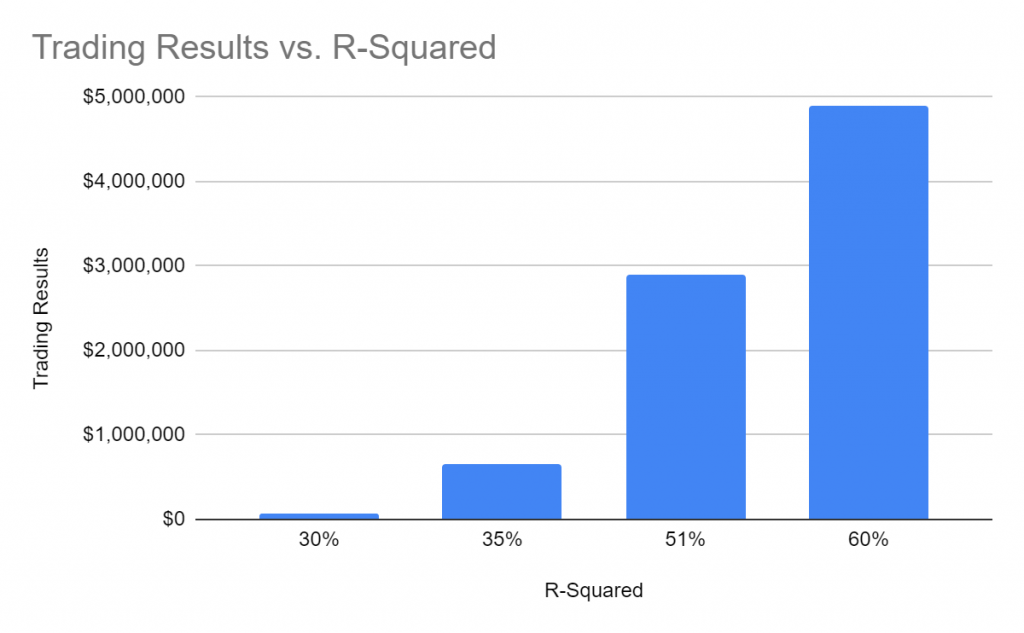

One of the key measurements we review is R-Squared. This metric proves out directly in trading results.

R-Squared

Fundamentally, R-Squared tells you how much error you have removed from the predictions. It is the percentage of variance that is explained by the model.

Important: we evaluate our models against data the models have never seen before. Said another way, data used to train our models is not used to test our models. Be cautious of advertised results that do not call this out specifically.

Crypto-ML’s method of evaluation is cross-validation:

Advantages of cross-validation:

1. More accurate estimate of out-of-sample accuracy.

2. More “efficient” use of data as every observation is used for both training and testing.

While R-Squared doesn’t tell the entire statistical story, we were able to demonstrate its relevance in our Bitcoin Price Prediction with DIY Machine Learning in Excel post. When we pipe models into our trading system, the results directly correlate with their R-Squared value.

In fact, by doubling the R-Squared value, we were able to achieve results 79 times better.

The following chart shows the difference between the 4.x and 5.0 models. By using Deep Neural Networks, we are making a large jump in precision.

- The BTC model increases by 2.5x

- The ETH model increases by 1.7x

While there are always ways to improve systems, as you can see by that chart, 5.0 brings us to a near “limit of precision” given current circumstances.

Trade Performance

As we put these models in our trade system and let them work against evaluation datasets, we see the following win ratios on trades:

- Bitcoin 5.0: 81%

- Ethereum 5.0: 83%

This reflects an improvement of about 74% over 4.0 models. Read more about Win Rate in our 4.0 introductory post.

As expected, based on the statistical measures, the trade performance shows considerable promise.

Alpha Performance

While looking backward is required to evaluate models, seeing real-world performance on yet-to-be-seen data is what matters most.

During alpha:

| ETH 5.0 | BTC 5.0 |

| 4 profitable trades | 5 profitable trades |

| 1 loss | 0 losses |

Based on this and backtested data, we expect the following trade frequency:

- BTC: about 5 trades per month

- ETH: about 3.5 trades per month

Benefits of 5.0

In evaluating trades issued by the 5.0 models, we see improvements in two key areas:

Better Edge-Case Performance

The primary benefit we gain is more precise predictions outside of “typical” price movements.

In software development, it’s often easy to get the primary path correct. Where you have trouble is when unusual or extreme situations occur. These “edge cases” will break your software and can be difficult to solve.

While they are unusual by nature, edge cases can be extremely adverse–and that’s exactly what we see in the cryptocurrency markets. Unusual behavior typically means a huge, unexpected movement in price.

We consider the current Coronavirus news and market meltdowns to be edge cases. It’s hard to train for these scenarios.

The 5.0 solution is much better at handling not only the core crypto price movement but also the less common scenarios. In fact, this is how the R-Squared value improved so much.

Smarter About Capturing Profit

Despite overall great results, one of the nagging issues that has followed us through models 1 to 4 is missing out on profitable closes. Nothing is more frustrating than opening a great trade, seeing it move into a profitable position, then watching as it stops out for a loss the next day.

Cryptocurrency, in particular, is challenging in this respect. We often see reasonable increases in price followed by huge, sudden drops.

With our Deep Neural Network models, the improved results are primarily coming from fewer and reduced losses. The models are setting tighter tolerances for exiting trades because their precision has increased. We expect to see this parlay into production trades.

Conclusion

Thanks to the foundation put in place by the 4.x models, we’re able to take another step forward and gain a significant level of predictive precision.

Do you have questions on these changes? If so, please let us know in the Comments below or on the Community Forums.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.