Is Robinhood Good for Crypto Trading?

Robinhood is a unique entry as a crypto trading platform. It is positioned very differently from the traditional trading platforms, including the ones we have previously covered such as Coinbase Pro, TradeStation, and ThinkorSwim.

Specifically, Robinhood is designed to have no trade fees, which is pretty groundbreaking in and of itself. But it also has a re-imagined, modern interface. It’s designed mobile-first. And it wants to be simple.

But it’s not without its controversy. Investopedia, in particular, continues to publish very harsh reviews of Robinhood (giving it a 2 out of 5). And industry incumbents are also quick to criticize.

As we’ve seen the rising popularity of the platform and questions from our members, we decided to give it a try. Uber killed taxis. Is Robinhood here to slay the traditional brokers? More specifically, is Robinhood good for crypto trading?

Find out below.

Are Robinhood trades really free?

Yes. Robinhood allows you to trade crypto for free. There are no minimums. You can trade as much as you want.

This is actually extremely impressive. If you’re an active trader, you know just how fast trading fees can rack up. Additionally, fees immediately put you in the hole. To break even, you need your instrument to move in the right direction to overcome your fee before you can consider profit.

We’ve talked about the fee advantages of using Futures over trading on an exchange like Coinbase Pro. But getting fees down to zero is game-changing.

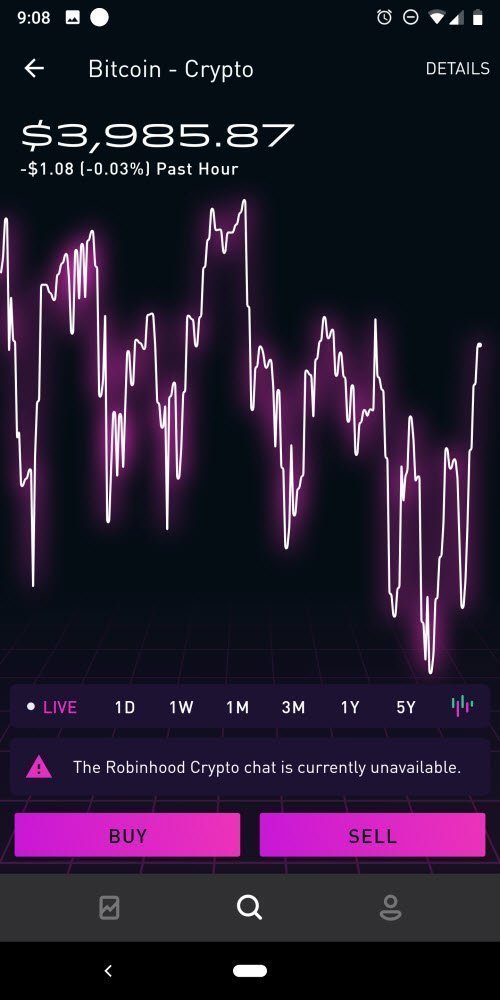

Blast from the past! Look at that Bitcoin price.

How does Robinhood make money?

While Robinhood doesn’t charge trade fees, it is certainly in business to make money. Put simply, Robinhood makes money on interest, margin, and premium services–much like a bank.

Some people speculate income is also generated by offering poor spreads or favorable “order flow” to market makers. This would negatively impact traders, especially those placing exceptionally large orders. Robinhood disputes these claims but there continues to be controversy. Robinhood, like all brokers, is heavily regulated. This makes deceptive practices unlikely.

To read more about this, check out A Letter From Robinhood Co-Founder and Co-CEO Vlad Tenev. He explains in-depth how Robinhood makes money and states they achieve better order execution than the competition.

How easy is it to trade on Robinhood?

If free trades are the #1 reason to use Robinhood, the interface is #2.

1) Opening an account

Signing up with Robinhood is a fairly simple process. The challenge for any broker is there are certain regulatory requirements they must meet when starting an account. Robinhood is good about helping you navigate the complexities and tends to feel much more modern and user-friendly than traditional brokers. I was able to complete the process on mobile alone.

In terms of requirements to get started, there is nothing much to note. There are no fees to open or maintain the account. There is no minimum balance.

2) Executing trades

Entering trades on traditional brokers and exchanges can be complex and intimidating. It can lead to mistakes and losses. And you likely need to be in front of an actual computer to do serious trading. Generally, you’ll want to paper trade for a while just to get used to the platform.

Robinhood puts this to rest by allowing you to place orders very easily. It’s a “mobile first” platform, so you should be able to execute trades on the go. Personally, I have missed out on many trades because I haven’t traditionally been able to get to a computer in time to place an order–Robinhood changes that.

Simplicity shouldn’t be confused with basic. You can enter stops, limits, and various types of options orders.

With Robinhood, it’s very easy to enter, exit, and monitor your trades.

3) Trading hours

Crypto trading is supported 24/7. We have not traded outside of typical US business hours, so it’s possible spreads grow during certain times of the day. Interestingly, stocks on Robinhood show volume metrics but crypto doesn’t show any volume data.

4) Crypto margin trading

Although Robinhood does allow margin accounts, as of now, Robinhood does not allow crypto to be traded on margin. In order to trade on margin and get a better bang for your buck, Crypto-ML recommends trading Bitcoin Futures.

Robinhood crypto margin trading note:

Your cryptocurrency assets are held in your Robinhood Crypto account, not your Robinhood Financial account, so they’re treated as non-marginable, with a maintenance requirement of 100%. This means your cryptocurrencies need to be backed entirely by cash, and can’t serve as collateral for equities positions.

Keep updated on the details on their Cryptocurrency Investing page.

How are Robinhood trade executions?

We have experienced no issue with Robinhood trade executions. Using limit orders, we were able to hit the desired price immediately on each trade. As noted in the link above, Robinhood states they are able to get better executions than the competition. However, it’s hard to quantitatively gauge this and there aren’t published metrics to confirm. Settlement is instant.

What crypto does Robinhood support?

Currently, Robinhood allows you to trade six cryptocurrencies, including each of the four supported by Crypto-ML. The six on Robinhood are:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

To see the latest list, see Robinhood Commission-Free Cryptocurrency.

As a trader, the variety of cryptocurrency doesn’t really matter–you just need one that moves enough for you to make a profit. As an investor, you may want a bigger range to choose from.

What geographies does Robinhood support?

Currently, Robinhood supports cryptocurrency in most of the United States, though certain regulatory steps need to be taken to reach all 50 states. As of this writing, it includes:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Idaho, Indiana, Illinois, Iowa, Kansas, Massachusetts, Michigan, Mississippi, Missouri, Montana, New Jersey, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C., Wisconsin, and Wyoming.

See here for the latest details: https://crypto.robinhood.com/

This implies the rest of the world is excluded, which is too bad. Looking at the Robinhood requirements, you must have a legal US residential address and citizenship, perm status, or a visa.

Does Robinhood support APIs?

For our developer and bot trading friends out there, API access is a key feature. It allows for automatic trading and would allow tools such as our Crypto-ML Auto Trade feature to place trades on your behalf.

It appears Robinhood does, in fact, have an extensive list of APIs, including those related to placing orders. That is great news! This means you could have zero-cost bot trading on your account.

However, we did not find official guidance or details on the APIs. This is unlike Coinbase Pro, which has ample developer support and detailed API documentation.

What you will find is Unofficial Robinhood API Documentation on GitHub. This is a good resource, but we’d certainly like to have official developer support.

What are the cons of Robinhood?

Robinhood is much better than the competition wants you to believe. But there are some limitations.

First, you will not have access to a deep set of technical analysis tools. Robinhood is more about placing orders than it is about deciding when to order. If you have another way to make your decisions or receive signals (such as a Crypto-ML Trader account) and you just need a place to execute trades, then this is a non-issue.

Second, as mentioned above, volume information is not there for cryptocurrency yet. We’d prefer a bit more transparency as well as some insight into when the most liquid times to trade are.

Third, it is geographically limited which excludes many of our global Crypto-ML Members.

Should you use Robinhood to trade crypto?

We have been pleasantly surprised with nearly all aspects of Robinhood. It certainly paints a bright future for traders.

If you can accept it as a platform to execute trades (for free!) and nothing more, then you will find it to be excellent as well. Just ensure you have an alternate way to do your analysis and receive signals.

What’s your experience? Let us know below.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.