Insider Newsletter 1: January 2022

Thank you for being an Insider! And thank you for your continued patience as we evolve Crypto-ML. This is the first Insider Newsletter. We hope it provides a broad and detailed view of the markets, covering macro, technical, on-chain, and proprietary data.

As an Insider, this is just the start of what you’ll see. We have some insightful data-driven tools coming soon. You can also look forward to deep dives into altcoins and different ways to optimize your holdings.

For now, hop on in and let us know your questions and thoughts in the comments below.

Macro-Economic Perspective

Omicron COVID Shutdowns

The Omicron variant of COVID-19 appears to be about 4 times as transmissible as the Delta variant (Fortune). Further, vaccines might be 40 times less potent against Omicron compared to other variants (Scientific American).

This may result in mass shutdowns of schools, stores, and essential services. Employers are already struggling to find labor. So it’s easy to imagine a scenario where many workers at a grocery store become infected with Omicron, causing the store to shut down due to lack of labor. The same scenario might happen with many other businesses and services requiring in-person staff.

Why does this mean for crypto?

Fundamentally, it probably doesn’t mean anything. But market prices will still react if there are widespread shutdowns. Shutdowns cause general-market panic and investors will pull out of more speculative assets. Given there is already uncertainty, there is a possibility of a fast drop in crypto.

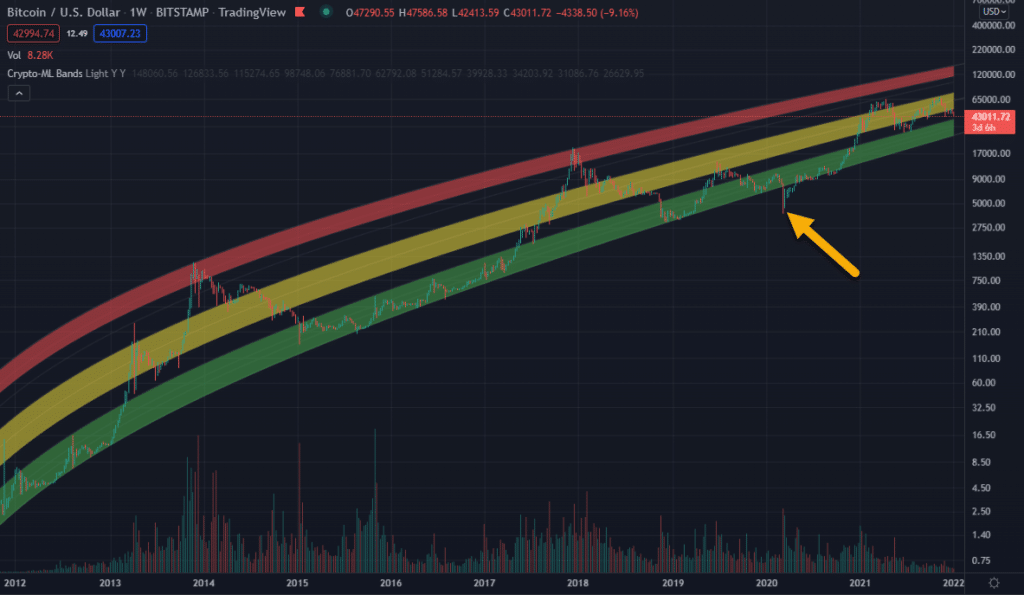

When COVID first hit the markets in March of 2020, Bitcoin dropped down to $3,850. Notably, it broke long-standing confidence channels and became a very unique opportunity to buy in at exceptionally low prices.

Interest Rate Hikes and Reduced Quantitative Easing

Across the globe, interest rates have been held at records lows for an extended period of time in order to stimulate the economy. Additionally, many governments have been practicing Quantitative Easing (bookings.edu), which is purchasing debt securities and other activities designed to increase the amount of capital available.

These actions make money easier to come by, which is intended to boost the economy. The cost, however, is inflation. So ultimately these stimulating activities need to be reduced in order to avoid knock-on effects. Since inflation is increasing at the fastest rate in nearly 40 years, it’s now time to curtail stimulus.

As a result, the US Federal Reserve announced there will likely be three interest rates hikes in 2022 (Open Market Committee Minutes, federalreserve.gov). Interest rates have not gone up for three years. The first hike is targeted for March.

Likewise, we are expected to see more measured supply in 2022.

This increases bond rates, the risk-free rate, and cost of capital. Bond rates and market prices move in an inverse fashion because this causes money to be more expensive and harder to come by.

Learn more about this relationship and the risk-free rate and cost of capital (corporatefinanceinstitute.com).

What does this mean for crypto?

Again, this does not change the fundamentals of crypto. In fact, this is a great real-world use case for Bitcoin’s programmatic money supply. We all know what to expect and can avoid these policy-driven swings.

But it will affect the inflows of money to the crypto markets in general. People and organizations will need to make tougher choices with their money. They will likely become more conservative. It will be more expensive to use borrowed money. Leveraged positions will be limited.

Whereas Omicron may cause a crash, increases in interest rates and decreases in easing may cause more of an extended downturn in the crypto markets.

The crypto markets have greatly benefited from the “easy money” of the last couple of years. People have been more willing than normal to expose themselves to risk, leverage, and debt. We could see this speculative money diminish dramatically.

Macro Case For Bullish 2022

While the information to this point has been negative, there are some really exciting things to consider:

- Global adoption of cryptocurrency and decentralized finance solutions, particularly in developing countries. For some governments and populations, it makes sense to skip traditional, centralized finance infrastructure and go straight to a modern, technology-first solutions. This may be particularly true in rapidly maturing markets in Latin America, Africa, and Asia. See Crypto Makes History in 2021 (cointelegraph.com) for details.

- Bitcoin continues to become more demanded as a percentage of any healthy investment portfolio. This is true for individuals, institutions, and companies.

- Regulation could legitamize cryptocurrency and reduce uncertainty. This will provide much-needed guiderails and reassurance for traditional investors. Demand for companies like BlockFi, Celcius, Crypto.com, Coinbase, and Binance is forcing regulators to address crypto. The US, for example, has summarized plans for 2022 in the Joint Statement on Crypto-Asset Policy Sprint Initiative and Next Steps (occ.gov).

Technical View

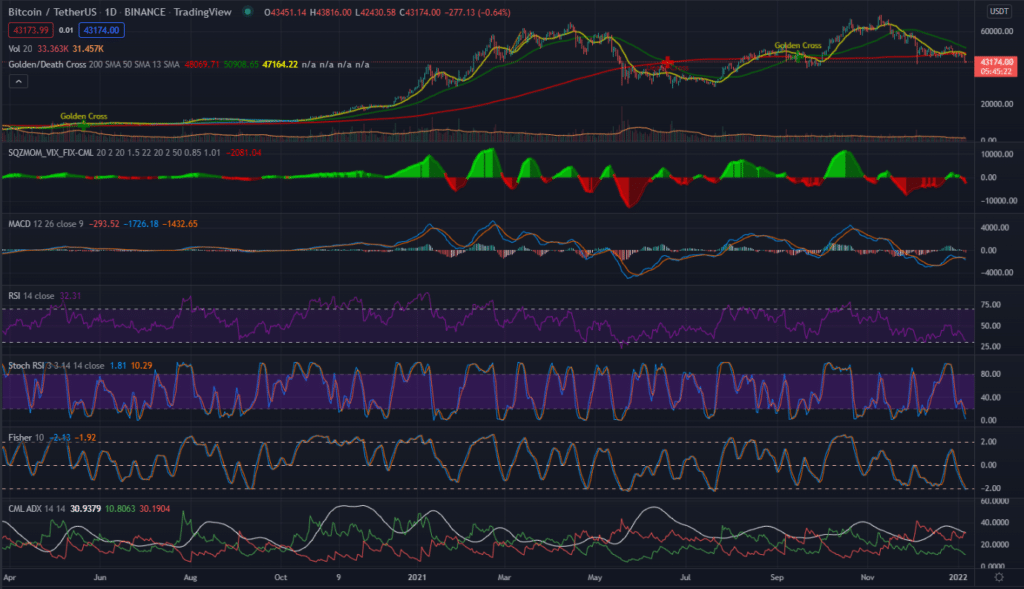

From a technical analysis perspective, indicators are naturally in bearish territory. They generally do not yet appear ready to turn around, however, selling pressure may be declining.

Here are a few notes on the daily Bitcoin chart:

- The 13/50 Death Cross has not yet been hit but is imminent. This suggests further downside.

- Squeeze Indicators and MACD are suggest we are just entering a negative wave.

- RSI and Stoch RSI are nearing reversal zones but have yet to confrim a turnaround.

- ADX shows continued selling pressure but the strength of the selling is waning.

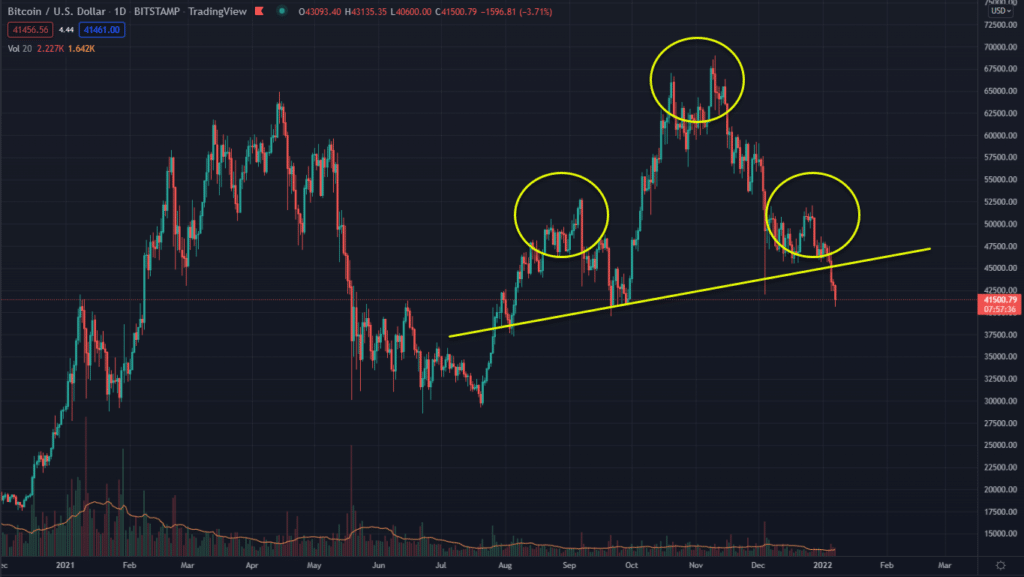

Additionally, there is a fairly strong “head and shoulders” pattern, which would typically indicate a large drop ahead.

$40,000 is a critical support level. If that breaks, we may see movement down to the $30,000 levels, which is where the 2021 second-half rally started.

On-Chain Metrics

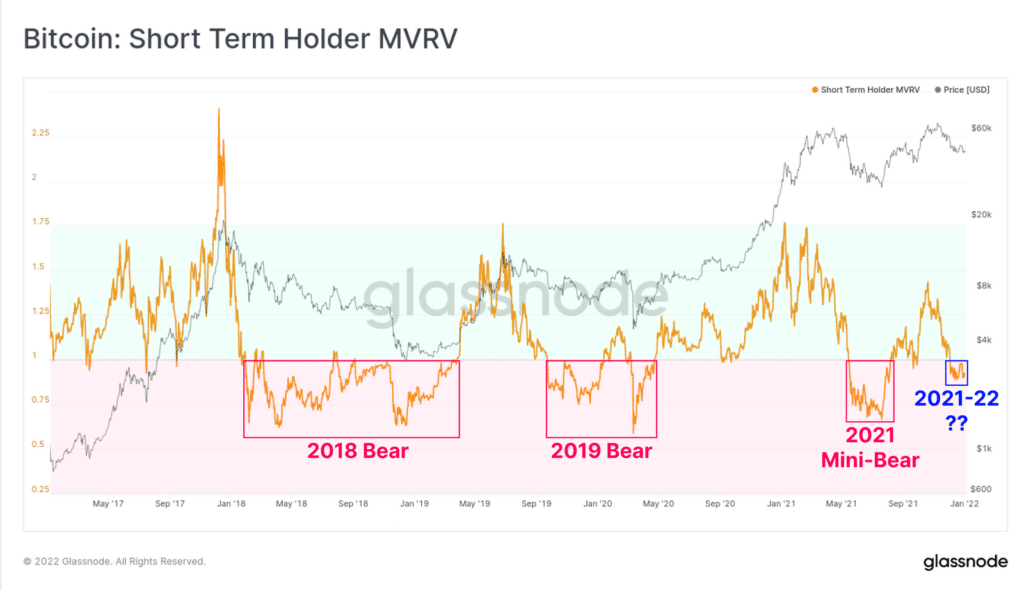

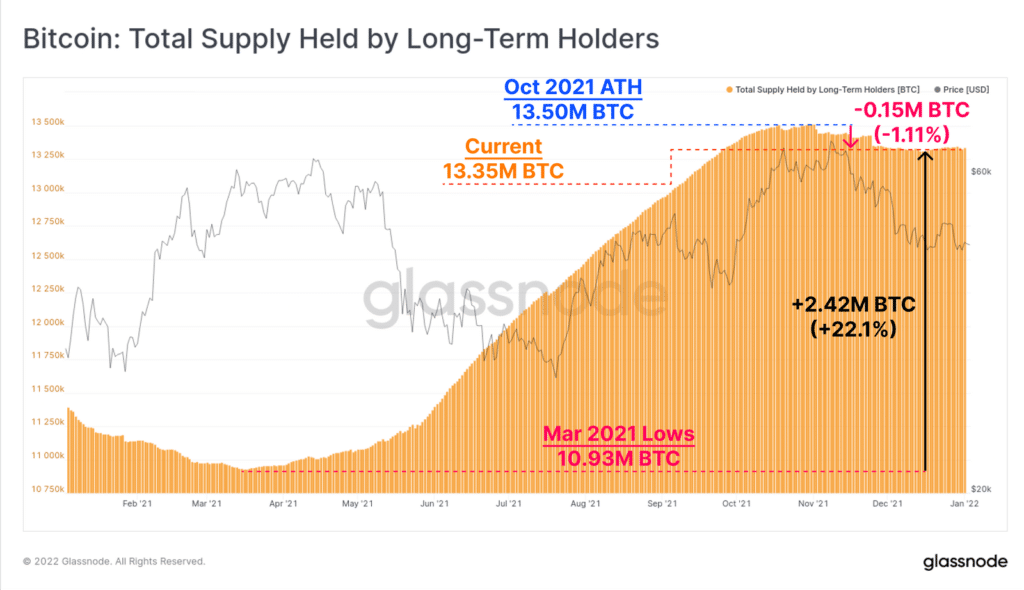

On-chain metrics show long-term holders are largely keeping their postions. The selling is coming from short-term holders, which is generally the speculators. Additionally, most short-term holders are in negative positions with an average cost basis of $51,400, whereas long-term are in positive with an average cost basis of $17,700.

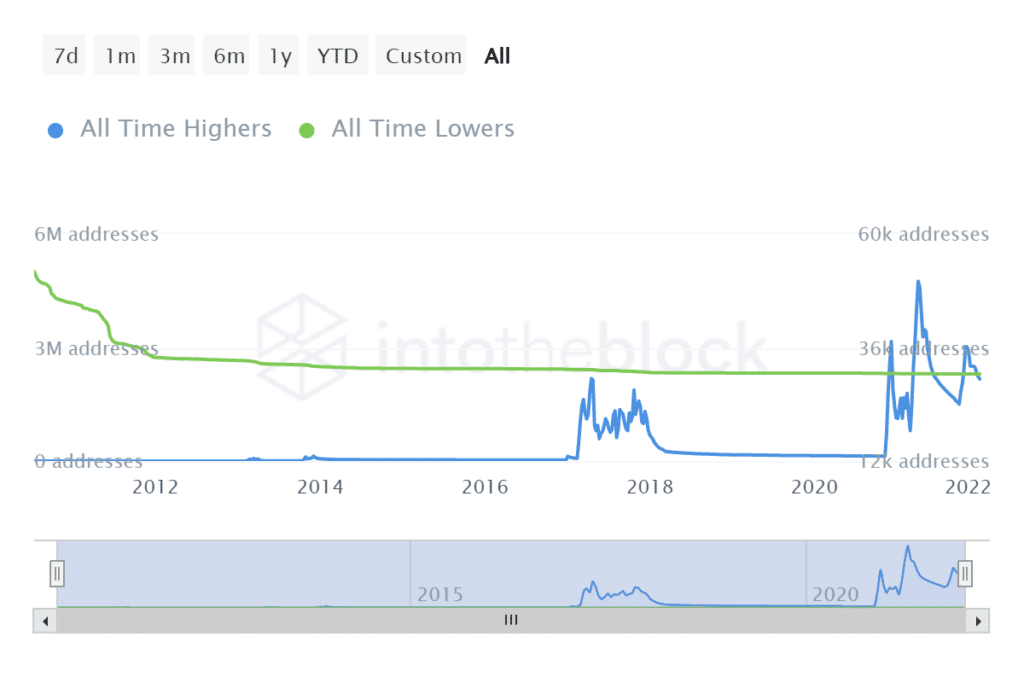

The blue line in this chart represents the number of wallets that bought within 20% of the all-time high. The shakeout of these addresses will keep selling pressure on Bitcoin.

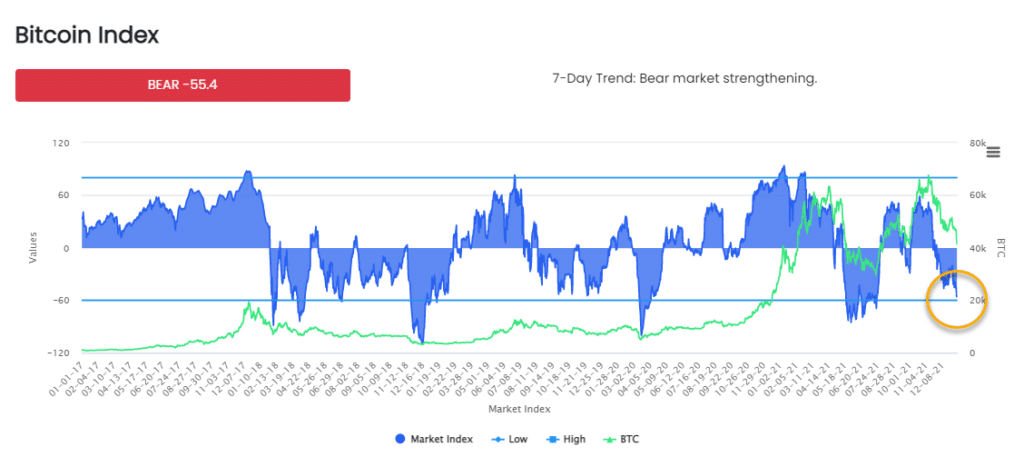

Fear and Greed Index

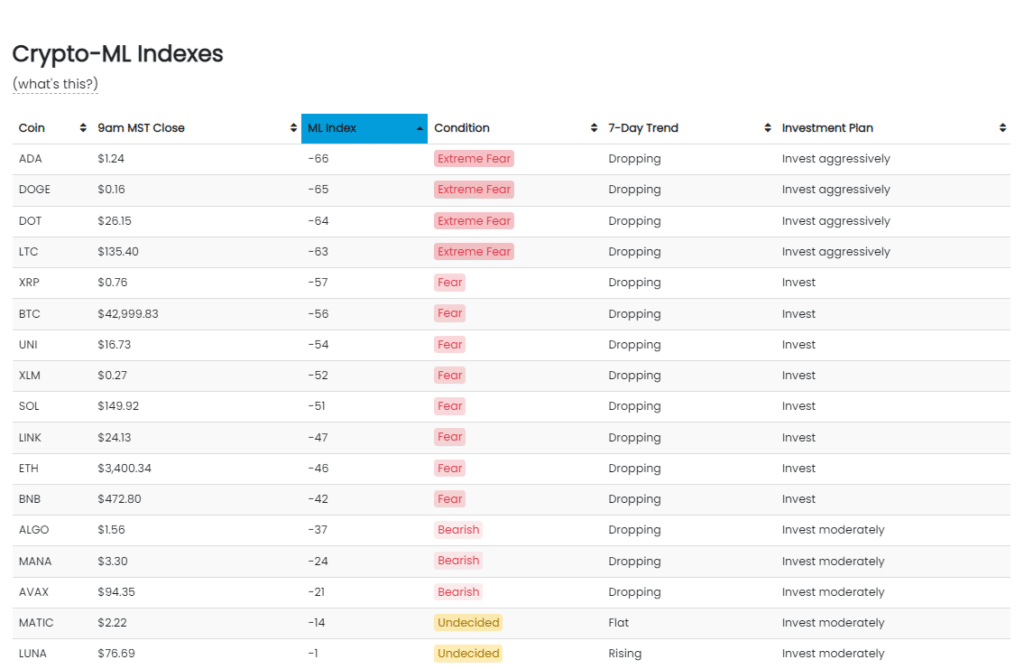

We are beginning to see certain coins drop into the Extreme Fear state. This is good from a long-term investment perspective.

Bitcoin’s price movement still dominates the overall crypto market and tends to pull altcoins with it. It is nearing extreme fear, but not quite there. That means there is still room for it to drag down the entire market.

During times like this, you can perform fundamental analysis on coins with the lowest index and consider phasing in funds to them to build your investment positions.

Putting It All Together

Verdict: add partial positions to strategic investments.

Evaluating all of this data, it seems we may see a sudden drop and/or a longer market downturn. This may sound negative, but the fundamentals for crypto projects with real-world value have never looked better.

This makes it a great time to slowly make strategic investments. Be sure to check out our Altcoin Fundamental Analysis: 7 Steps to Picking Great Investments.

Once you’ve identified great investments, it’s usually best to phase in your money during times of fear. Based on available data, it’s hard to imagine Bitcoin dropping below $20,000, but don’t wait for that point. Timing the exact bottom is not easy, so don’t try to go “all in” at once.

Additionally, by phasing in some of your investments now rather than waiting, you will avoid missing out if bullish news hits and we end up seeing a major rally. If we’ve learned anything, the crypto markets are great at surprising even the best analysts.

As a final note, altcoins with limited or no practical application may drop significantly and struggle to regain ground as investors in 2022 will need to be more selective with their money. Evaluate your positions in lower-value coins.

Current Crypto-ML Portfolio

This is a snapshot of our portfolio. This is provided to give you insights into our real-life decision-making.

It is important to note that nearly all of this money is working for us. We are not relying on appreciation alone.

If you’re just getting started on generating income with your crypto holdings, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

BNB: 31%

- This position became outsized due holdings acquired prior to BNB’s rapid rise in early 2021.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023. Some portion of BNB will likely stay as a long-term holding. Though not decentralized, Binance will still have a major role to play in the crypto space in the foreseeable future. The deflationairy monetary policy is also attractive.

- Not currently earning interest, which is a problem that needs to be addressed.

GUSD: 26%

- Earning interest

- Important: this balance is held because we phased out of positions during “Greed” and “Extreme Greed.” This booked profit and provided a pool of funds to reinvest at a later point.

- Ready to be used for phased buying of coins in “Extreme Fear.”

BTC: 23%

- Earning interest through various means

- Long-term hold

ETH: 14%

- Earning interest through various means

- Long-term hold

LINK: 2%

- Earning interest

- Long-term hold

DOT: 1%

- Earning interest

- Long-term hold

ADA: 1%

- Earning interest

- Long-term hold

ALGO: 0.5%

- Earning interest

- Long-term hold

UNI: 0.5%

- Earning interest

- Long-term hold

SOL: 0.5%

- Earning interest

- Long-term hold

Other: 0.5%

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Conclusion

It’s likely we’ll see less capital in the crypto markets in 2022. As investors juggle uncertainty, we’ll also likely see drawdowns and whipsawing in the markets. This does, however, provide excellent long-term opportunities It’s hard to invest when everyone else is scared, but that’s how smart money moves.

Do you have any thoughts or questions? Let us know in the comments below.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.