Market Report: Bear Reversal Timing

Crypto Market Analysis for December, 2019: When will the 2019 crypto bear market reverse?

Based on our machine learning models, market insights, and experience, the Crypto-ML Market Reports provide guidance to Crypto-ML customers.

Summary

Caution

- Bearish expectations: maintain caution and conservative exposure. Manage risk by trading smaller amounts.

- $7,000 BTC/USD line is critical. The next support line is approximately $5,200 BTC/USD. If price holds below $7,000, the next drop could be sharp and fast.

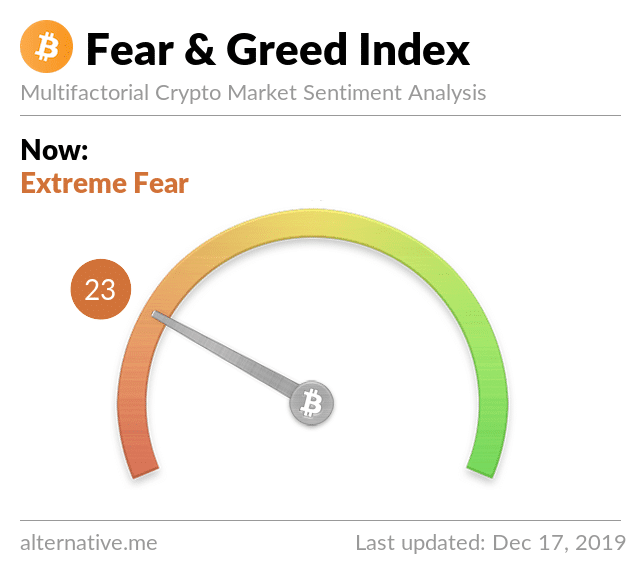

- Look for the Fear and Greed Index to drop below -60 to indicate a bear trend bottom.

Commentary

This post will provide some information on how to gain insights into a potential market reversal into a new bull phase. But before this, let’s look at where the crypto market stands.

Recent Market Performance

Here is a snapshot of the last 5-days of the crypto market. This chart goes from the best performer down to the worst. This means the best performing asset lost -4.55%.

Courtesy Barchart.com

Looking at the last 6 months, we get an even worse picture. Bitcoin is the best performing crypto, coming in at -26.60%. Bitcoin Gold has lost 81% of its value in this time. Some major names, such as Litecoin, not far behind.

Courtesy Barchart.com

Zooming out further to the year in full, the first half of the year was bullish, but the second half has been bearish. We have yet to see where the year will finish out, but the downward trend of the second half seems to be fairly consistent and measured.

Alternative.me provides some interesting crypto market tools that wrap up a variety of factors, including:

- Volatility

- Market momentum/volume

- Social media

- Surveys

- Dominance

- Trends

Their system is currently showing extreme fear.

As a side note, we will have a future post covering whether or not this “Fear & Greed Index” is predictive in nature. Our models have considered this data, therefore we can provide a quantified analysis.

Technical Analysis View

Looking at general trends and key levels, we see a solidly bearish picture.

The uptrend during the first half of the year was exuberant and unsustainable. But the downtrend that has followed is more traditional and measured.

The descending triangles that have formed are bearish formations and they have broken key levels, which typically implies further downside is pending.

It the $7,000 level does not hold, we likely won’t see support until somewhere around the $5,200 level. That is a big gap and gives us the potential for a fast drop.

Crypto-ML Tool Insights

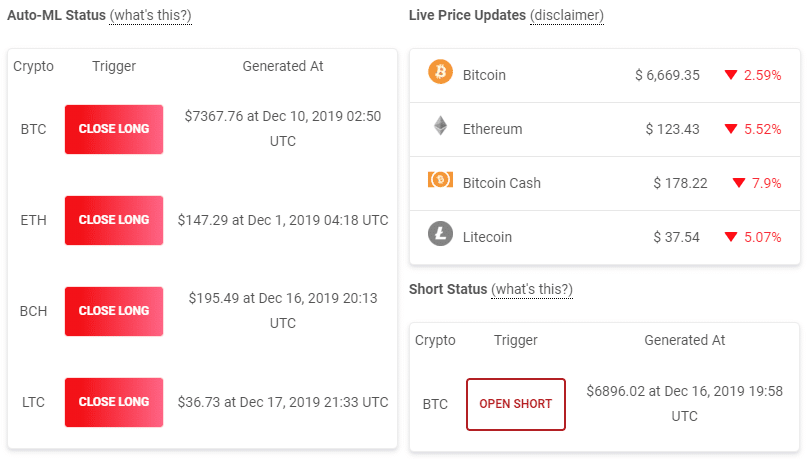

Moving to the Crypto-ML indicators, we can see “red” signals across the board, with the long signals closed and the short signal open.

In fact, the Crypto-ML trade signals have been very inactive lately. This is because they are aware of the broader market view and are therefore taking a cautious approach to opening trades.

Minimizing trade activity is a way to manage risk.

The Crypto-ML Fear and Greed Index has been dropping consistently since June and is signaling a strengthening bear market. The Fear and Greed Index is a machine learning model incentivized to predict 30-day movement.

When can we expect a reversal of the crypto bear market?

Given the above data, the current market situation seems grim. However, as we see greed and despair increase, it is natural to ask if we are nearing the bottom.

Based on historical Fear and Greed Index data, trend reversals seem to happen at extreme levels:

- Above +60 (bull market has peaked)

- Below -60 (bear market has bottomed).

From a statistical analysis standpoint, there have not been enough instances of market reversal be certain on these values–ideally, you would have hundreds or thousands of reversals before applying statistical measures. But there is a clear pattern in the data thus far.

As such, we may be in for a lengthy bear market. As the Fear and Greed Index changes, we will continue to provide insights and commentary.

Update for December 19

Since preparing this analysis, the markets have seen extreme whipsaw movement. As a result, a couple of long trade alerts have issued and price has bounced back above the $7,000 level.

This is a positive sign. If price were to hold below $7,000, the next movement could be much lower.

Regardless of the volatility over the last couple of days, the recommendations and commentary from this Market Report still hold.

In the current market, please exert caution and be conservative.

Join the Conversation

What are your thoughts on the market? Are there major news items or technical views you’d like to share? Please join us in the Community Forums to discuss.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.