How Crypto-ML Works

Crypto-ML offers cryptocurrency trading signals that are generated by a sophisticated machine learning platform. This system has evolved over the years, culminating in Release 5 which uses Deep Neural Networks to deliver predictions to the trading engine.

In an effort to provide continued transparency and insight, this post will provide a peek into how the Crypto-ML works behind the scenes.

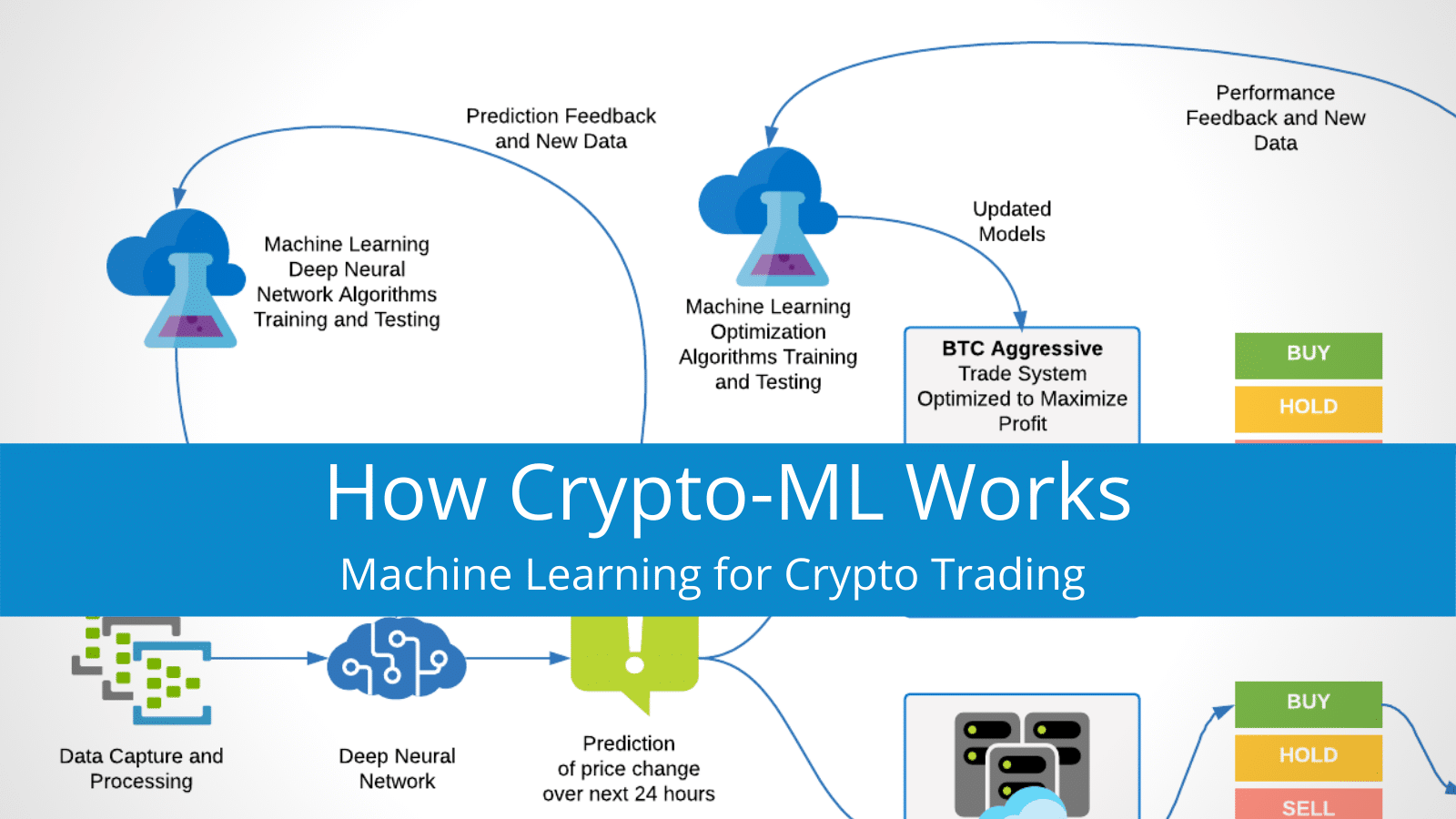

Crypto-ML workflow

This chart illustrates the workflow executed by Crypto-ML on a real-time basis throughout the day:

To deliver a trade signal, here’s what happens on a continuous basis (from left to right above):

- Our system gathers real-time market data and then applies a set of equations to transform it into information our model can use.

- This processed data is passed to a Deep Neural Network model, which in turn outputs a price change prediction and a confidence level. In simple terms, it says “price is expected to change by X% in the next 24 hours.”

- The prediction is passed to our trading system, which determines if those values are significant enough to warrant a trade call. Above a certain threshold, it will issue a “buy” signal. Below a threshold, it will issue a “sell.” Additionally, it may call “stop loss” or “trailing stop.”

That is the system in a nutshell.

Machine learning for price change predictions

The second step in our diagram shows the data going through a Deep Neural Network to generate a price prediction. This is the most important component of Crypto-ML. The better the predictions, the better everything downstream can perform.

Thanks to our March, 2020 upgrade to Deep Neural Networks, we expect to see a game-changing improvement in precision and outcomes.

Additionally, this approach is capable of adding new scenarios to its playbook over time. This means it becomes increasingly better at handling exceptions and edge cases, which are a challenge for all trading systems and technical indicators.

Want to try creating your own model? Check out our complete guide: Bitcoin Price Prediction with DIY Machine Learning in Excel.

Machine learning for buy and sell triggers

Once the Neural Network model delivers a prediction for price change, we now have the question of what to do with it. How do we act in response to these predictions?

You can think of this step as determining optimal levels to take action:

- At what point should we buy?

- At what point should we sell?

- What’s the best point for stop losses?

- How should trailing stops be set?

There is a subset of machine learning algorithms called optimization algorithms. They are perfect for this task. You supply a single goal, and they will find the optimal tuning for any countless number of parameters–such as these trigger points.

Learning and improving

The final piece of our system is continuous learning.

- Changing market dynamics constantly present.

- New market data is fed back into the “algorithm lab” to be learned from.

- Predictions are compared to actual results, providing a natural feedback mechanism.

- As above, new market data is fed back into the “algorithm lab” to be learned from.

- Feedback on trade performance helps determine if updates should be made.

Conclusion

That’s the “under the hood” view of Crypto-ML. We hope this provides great insight into our platform.

If you have any questions or comments, please hit us up in Comments below.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.