Insider Newsletter 4: April 2022

Thank you for being an Insider! In April’s newsletter, we’ll walk through our proprietary data, macroeconomics, on-chain data, technical analysis, conclusions, and a peek at our portfolio. This information is intended to help you understand the big picture and optimize your long-term holdings.

Crypto-ML Data

The market is indecisive. While Bitcoin is in the green channel, it’s generally a good time to invest for the long term.

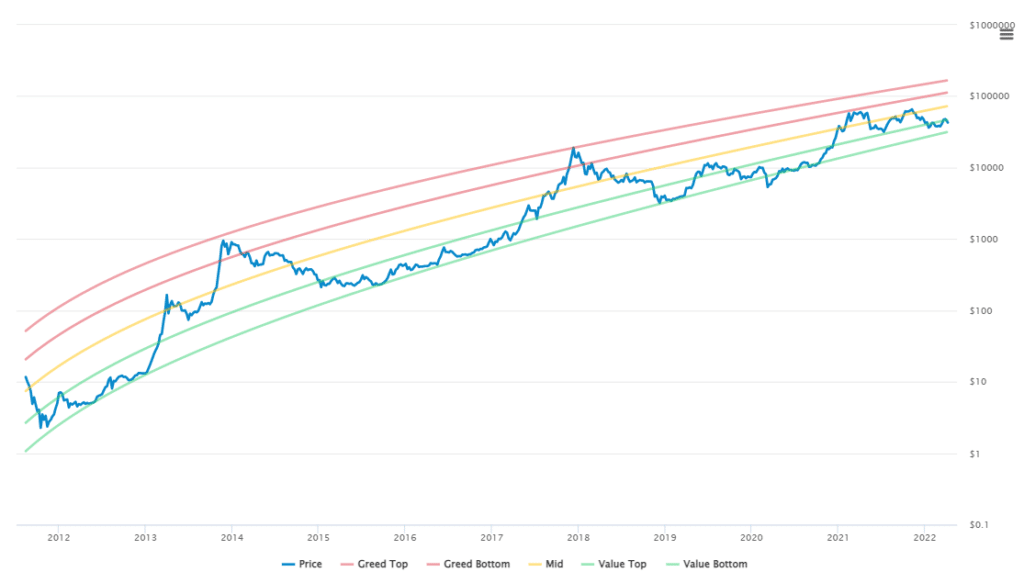

The Price Channels show we are still in the green “value” zone. Bitcoin broke above the green channel for about one week but has moved back in. We’re still in a good zone to buy for the long term, spanning $31,456 to $46,591.

That means we may reasonably see a 26% drop before a true bullish reversal occurs.

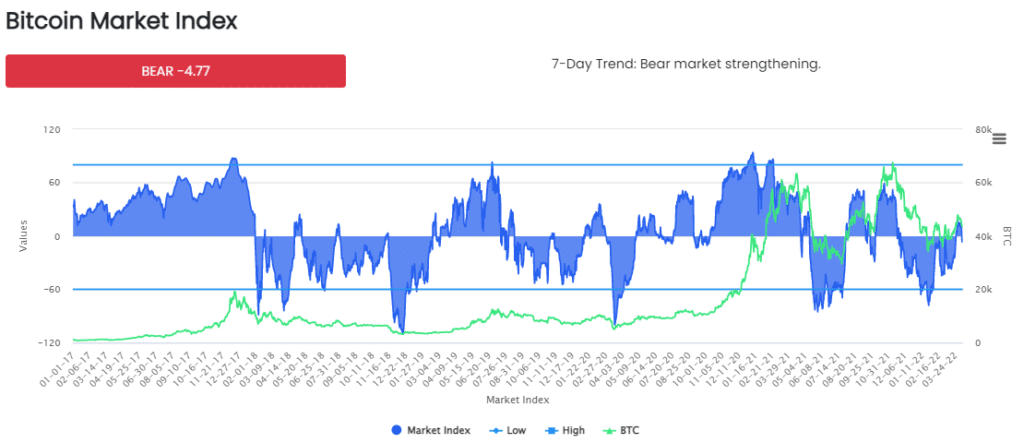

The Fear and Greed Index is showing an indecisive market. This means a wealth of sentiment indicators are conflicted or neutral. There is no strong conviction in the crypto markets. The rest of this newsletter will illustrate why this is the case.

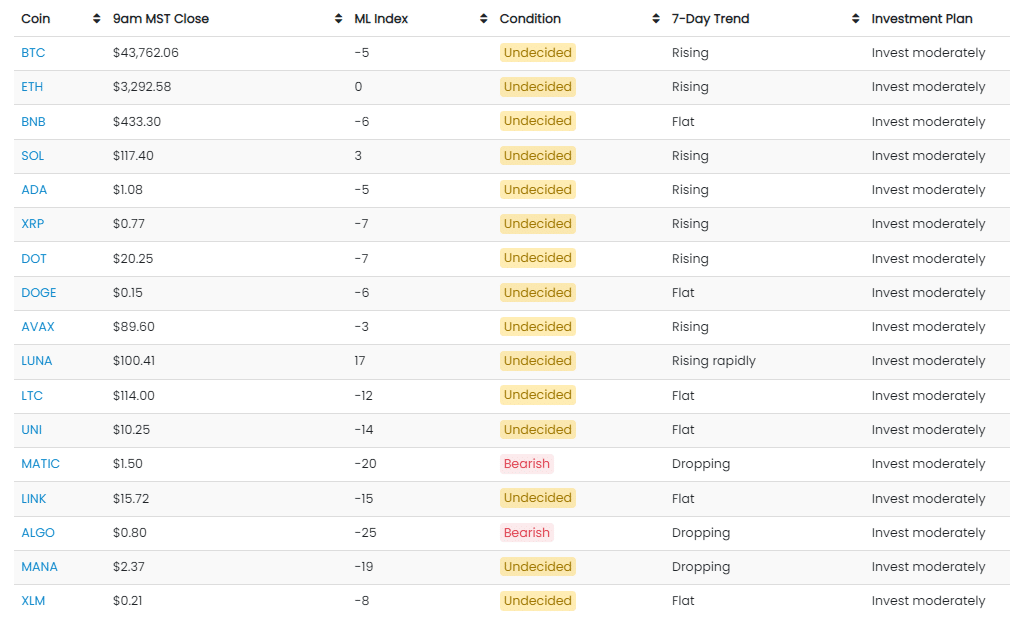

Both Bitcoin and altcoins are largely undecided.

Macro-Economic View

There are numerous macro risks and few monetary tools left to tackle them.

While it’s not clear if we’re headed into a global recession or not, there are some worrying factors:

- Inflation is causing prices to go up across the board. This leaves people with less discretionary money. As you pay more for basics (food, shelter, and gas), you have less available to invest and consume. Consumer prices jumped 7.9% in February, which is the highest increase since 1982.

- Supply chain issues continue to add expense to basic goods. With transportation costs increasing, this will be further compounded.

- Interest rates are moving up, making housing, vehicles, and other goods less affordable and further squeezing discretionary spending. Mortgage rates in the US have gone from around 2.67% to 5.08% over the last quarter. Coupled with housing price increases, the median home mortgage has gone up about $600 per month. Looking at interest alone, every 2-percentage-point increase results in about an extra $115 to the monthly payment per $100,000 in purchase price. As a result, mortgage demand is down about 40% year-over-year.

- This reduction in consumer demand reduces the demand for labor, which causes a reduction in wages.

- War will continue to impact global markets negatively, especially if tensions drag out for an extended time.

- Altogether, you end up with a downward spiral in the economy that can be difficult to recover.

Governments and reserve systems do have the ability to mitigate these issues and help avoid downward spirals. However, these monetary policy tools were largely overused during COVID. This means there may be limited means to counteract the forces in play.

For more detail on these issues:

- Fed’s Patrick Harker is ‘acutely concerned’ about inflation (CNBC)

- Is a global recession coming? In US, China risks are mounting (Aljazeera)

- The bear-market rally in stocks is over and investors need to stay defensive (Yahoo)

- ‘Bear market rally’ is setting stage for a correction, Morgan Stanley’s Mike Wilson warns (CNBC)

- Deutsche Bank is the first big bank to forecast a US recession (CNN)

Apart from the risks, there are potential positives:

- An end to the war would be received positively by investors as an economic stablizer. This could rapidly boost markets.

- Businesses are showing true growth and strength. S&P 500 companies just received the best analyst ratings in over a decade (finance.yahoo.com).

- Economists are still mixed, with many pointing to positive fundamentals that will outweigh risks.

Bitcoin during a recession

Many Bitcoin purists say it is a hedge against economic downturn. Ideally, this is true. It could be a “store of value” while everything else collapses. In some cases, this has been seen. For example, as the Russian ruble collapsed, some people were able to protect their wealth by moving it to Bitcoin early.

However, if the broad economy faces decline for more than 3 months, you should not expect Bitcoin to be a hedge.

The reality is, Bitcoin is mostly a speculative asset. Bitcoin’s price behaves like a risky tech stock. During downturns, most investors move from high-risk assets to low-risk assets. This means it is likely to drop faster than the overall market. The COVID crash is evidence of this.

Why is this the case? It comes down to numbers.

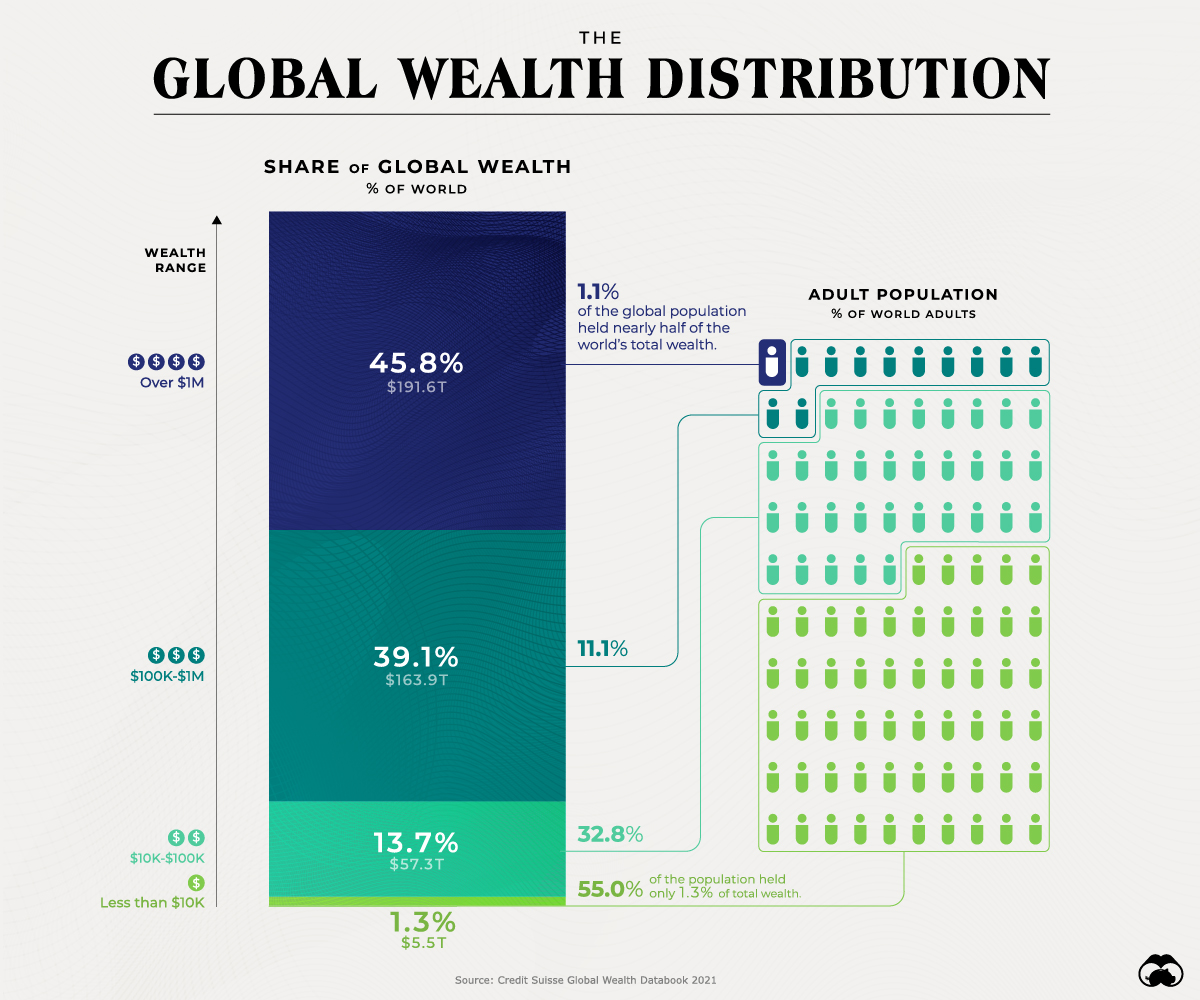

Large investors and funds invest in Bitcoin to make money. Since they control such a significant portion of the overall wealth, their behavior drives prices.

- About 46% of the world’s wealth is held by 1% of the population.

- About 85% of the world’s wealth is held by 12% of the population.

This means 88% of the population holds only 15% of the world’s wealth.

For Bitcoin price to stabilize and act as a hedge, most of the world’s population would need to adopt it as a go-to form of currency -or- investment institutions need to evolve to view it as a hedge to economic downturn rather than a speculative asset.

BlockFi settlement

BlockFi is a major crypto exchange that has offered tremendous interest rates on crypto holdings. It has been hit with a $100 million fine in a settlement with the SEC.

This resulted in many alarmist headlines, such as: Is Crypto Coming to an End? This $100 Million Settlement Will Impact Crypto Forever (entrepreneur.com).

However, the details show this is about BlockFi’s registration, marketing, and disclosure practices. This is not fundamentally about cryptocurrency. That is why similar companies such as Celcius, Nexo, and Crypto.com are not included in this action.

“BlockFi has not been very transparent. I think that is part of the reason why [the] SEC went after them,” said PitchBook fintech analyst Robert Le. “These are new products, so no one really knows what the real risks of these products look like.”

pitchbook.com

BlockFi has received our recommendation as a great way to earn interest and compound earnings. We hope to see BlockFi address these issues and come back stronger than before.

This action stands to better clarify the regulatory requirements for exchanges in the US, which many leaders in the crypto industry have been asking for regulatory clarity for years. Ultimately, this will remove uncertainty and increase acceptance of cryptocurrency.

What caused the latest crypto rally?

Bitcoin and others had somewhat of a surprise rally in March. There were a couple of key factors.

Terra announced plans to purchase $3 billion of Bitcoin for stablecoin backing. It has purchased over $1 billion worth so far (nairametrics.com).

Short liquidations pushed the market up. As participants become overly bearish, they took short positions late in the drawdown. An initial sharp bullish move rapidly knocked these positions out, which caused an imbalance that further drove upward pressure. Glassnode analysts observed this starting around February 24th.

Bullish news

Perhaps the most bullish news is the potential wide-scale adoption of the Bitcoin Lightning Network as a backend payment provider for ecommerce.

When merchants accept payments, those payments need to traverse expensive, outdated networks, typically costing the merchant around 3%. The Bitcoin Lightning Network can replace this plumbing and dramatically reduce the cost of processing payments.

To be clear, this is not about accepting crypto as a payment method. Rather, merchants continue to accept and receive traditional currencies. It’s just the transfer of funds from processors to merchant accounts that becomes more efficient.

“Any online merchant that uses Shopify can accept payments without the 1949 boomer network, receive it instantly, cash final, no intermediary no 3% fee.”

This is officially announced for Shopify. Other names listed as upcoming adopters include McDonald’s, Walmart, Home Depot, and Best Buy (source forbes.com).

This is a critical step forward because it doesn’t rely on individuals adopting Bitcoin one at a time. It instead tackles a different use case that drives large-scale, backend adoption.

On-Chain Metrics

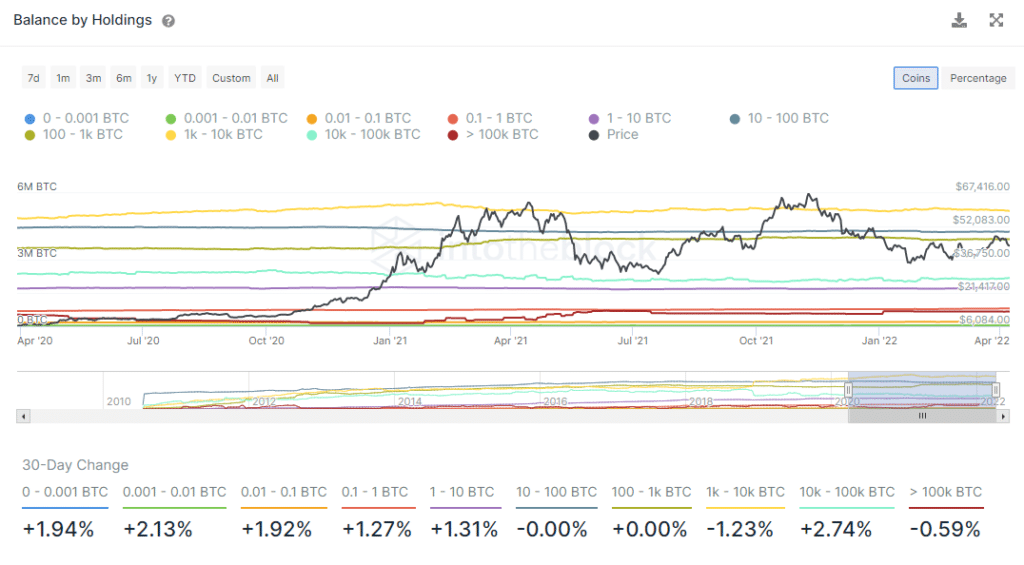

High-balance accounts have grown the most in percentage terms over the last 30 days.

Large accounts holding 10K-100K BTC have increased their holdings more than any other group over the last 30 days.

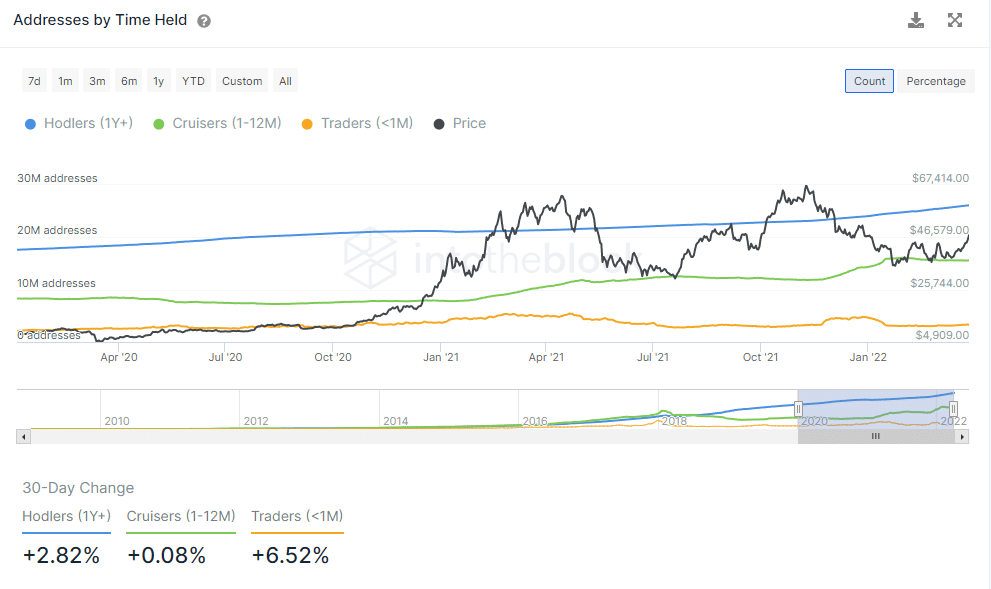

Long-term holders (blue) continue to grow and build positions, outpacing all others over the last few months. New accounts (orange) have ticked up in the 30 days, kicking a general downtrend over the last year.

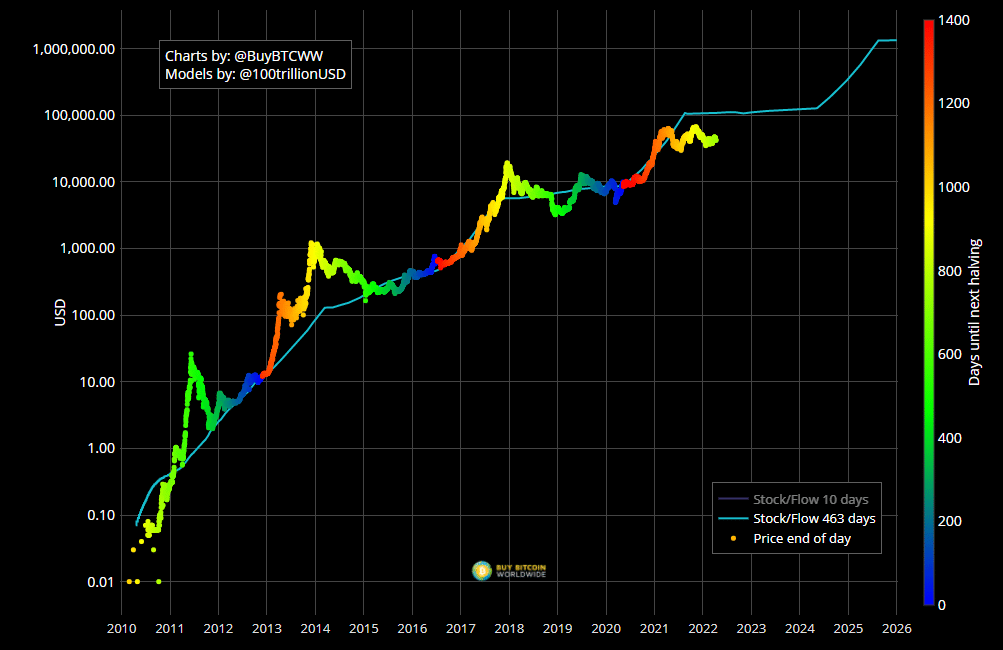

Bitcoin Stock-to-Flow is showing the largest negative divergence post-2011. This could indicate we’re at an exceptional investment point, pending a large reversal. Or it may indicate the model has been invalidated. Regardless, the model has Bitcoin anchoring around $100,000 between now and mid-2024.

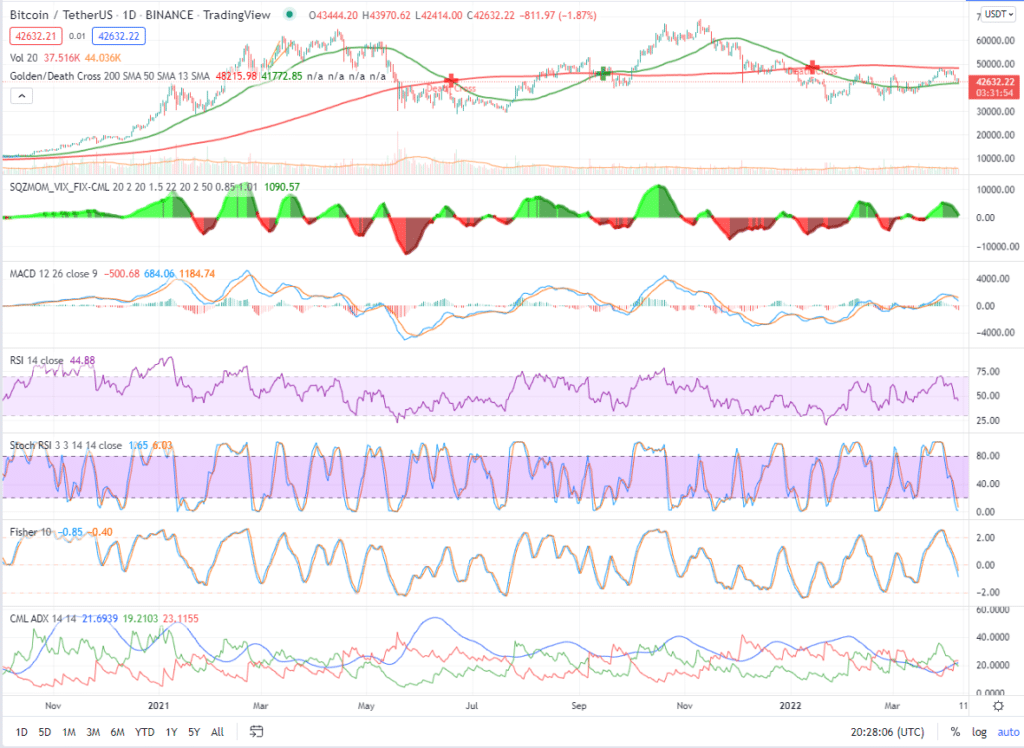

Technical Analysis

Indicators point to negative, sideways movement in the near term. We may see this through the end of May before a new trend emerges.

Looking at large-scale patterns, the triangular formations still dominate. They indicate sideways action through the end of May.

Note the reduction in trade volume over time.

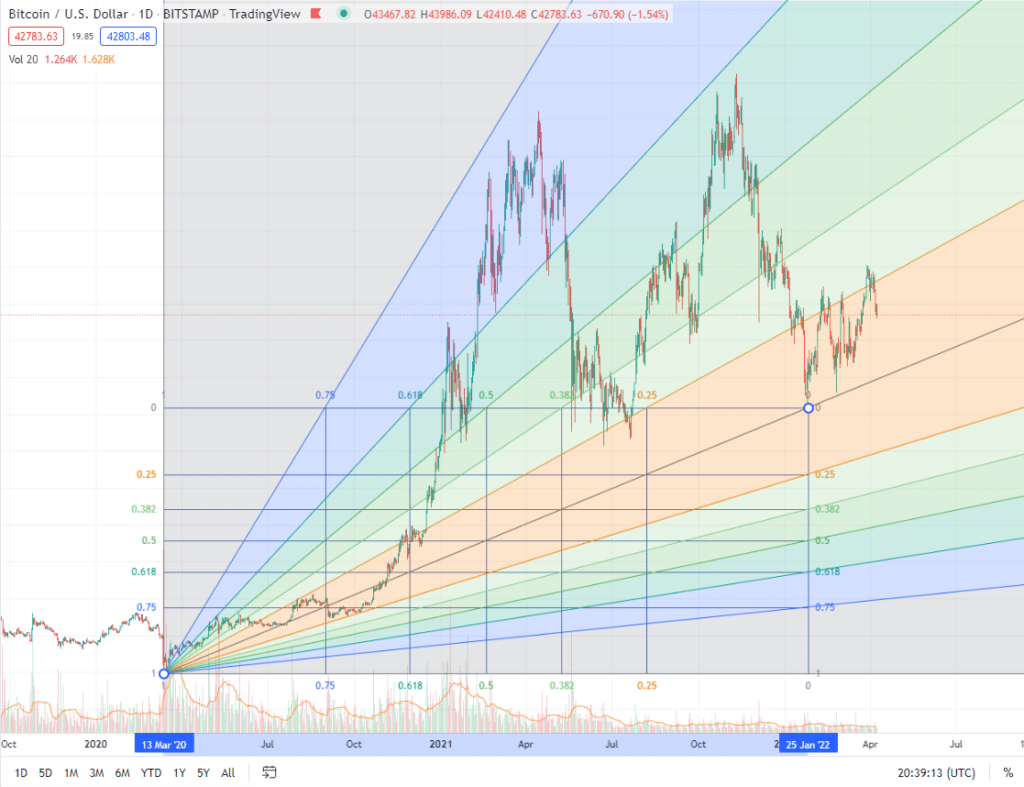

Fibonacci fans paint a pretty accurate picture of support and resistance, showing our low support at around $37K, which is similar to the triangle base shown above.

From an indicator perspective:

- The 50/200 SMA lines are still in a Death Cross.

- The Squeeze indicator and MACD have turned negative and will likely need to go through a red cycle (potentially a couple of weeks) before turning back up.

- RSI, Stoch RSI, and Fisher are all showing further bearish pressure ahead.

- ADX is showing bearish momentum is on the rise.

Putting It All Together

Regardless of the noise, we will still be investing while price is in the green channel.

In fact, over the last month, we’ve moved about half our stablecoins into crypto, as you’ll see in our portfolio changes below.

The economy is very uncertain right now. Significant positive or negative news could cause crypto to move sharply in either direction. Our expectation is a sideways market over the next 30 days, with a bearish bias. If there is a move to the downside and we see $31K, that is acceptable and we’re prepared to invest more.

If a broader recession does hit, just remember, if you can invest for the long term, it’s probably an amazing time to do so.

The message is worth repeating:

- Housing crash? Buy houses.

- Stock crash? Buy stocks.

- Crypto crash? Buy crypto.

A crash in these markets often has little to do with the fundamentals of the assets impacted. So if you’re buying a quality asset, expect it to come back and then some.

Will you time the bottom of the market? Not likely.

But if you have a multi-year horizon and invest in great assets throughout downturns, you will likely do exceptionally well.

Current Crypto-ML Portfolio

This is a snapshot of our portfolio. This is provided to give you insights into our real-life decision-making. You’ll notice a significant shift over last month. While the markets were in the mid “green zone,” we moved capital into cryptocurrencies from stablecoins.

It is important to note that nearly all of this money is working for us. We are not relying on appreciation alone.

This is a critical point: these investments are automatically buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

If you’re investing for the long term, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

BNB: 35% (+25%)

- This position became outsized due holdings acquired prior to BNB’s rapid rise in early 2021.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023. Some portion of BNB will likely stay as a long-term holding. Though not decentralized, Binance will still have a major role to play in the crypto space in the foreseeable future. The deflationary monetary policy is also attractive.

- Still not earning interest, which is a problem not yet addressed.

GUSD: 16% (-45%)

- Earning interest

- This balance is held because we phased out of positions during “Greed” and “Extreme Greed.” This booked profit and provided a pool of funds to reinvest at a later point.

- About 45% of the prior month’s balance was moved back into cryptocurrencies over this last month.

BTC: 28% (+12%)

- Earning interest through various means

- Long-term hold

ETH: 15% (+25%)

- Earning interest through various means

- Long-term hold

LINK: 1%

- Earning interest through various means

- Long-term hold

DOT: 1%

- Earning interest through various means

- Long-term hold

ADA: 1%

- Earning interest through various means

- Long-term hold

Other: 3%

- This group consists of 29 altcoins (+3).

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.