Why Bitcoin Has Value and Is Unique Among Crypto

The simple, definitive guide to understanding why Bitcoin has value and is unique.

In May of 2021, Bitcoin crossed $1 trillion in market cap, which means it’s worth more than Facebook, Wal-Mart, Johnson & Johnson, Visa, Bank of America, every ETF, and almost all other companies and many financial benchmarks. Bitcoin’s rapid growth is truly exceptional.

This naturally creates considerable buzz and curiosity. Why has it grown so significantly? Is Bitcoin actually useful? Why is Bitcoin unique? Will some other technology replace it?

Finding clear, simple answers to these questions is not easy. Bitcoin conversations tend to drown in engineering, economic, and industry-specific jargon.

“If you can’t explain it simply, you don’t understand it well enough.”

Albert Einstein

With this post, I am seeking to side-step all of that and instead break things down into relatable, easy-to-understand concepts.

So buckle up, nerds and non-nerds. In this article, I’ll cover:

- What Bitcoin is in simple terms

- Why Bitcoin is worth over a trillion dollars

- Why Bitcoin is unique–even among other cryptocurrencies

- Bitcoin’s place in global finance

- Simple Bitcoin investment strategies

A Simple Bitcoin Overview

“It’s a new online currency that’s been developed. It’s just like actual money, except you can’t see it, hold it, or spend it on anything.”

Sheldon Cooper, The Big Bang Theory – 2017

Bitcoin can most easily be thought of as “the money of the internet.” These are five simple but extremely powerful words.

Looking at a couple of similar technology milestones will help break this concept down:

- The internet gave us open and decentralized information

- Email gave us open and decentralized communication

- Bitcoin gives us open and decentralized money

Email is an amazing analogy for Bitcoin.

Email is something we use daily and probably take for granted. Yet it has transformed our world in a very short time.

Prior to email, we relied on physical mail, couriers, and faxes to send written information. These methods were and still are expensive and slow. These methods limit the ability to easily share written information. They also put the control into centralized systems, such as government-run postal services.

Now that we have email, communication across the globe is instant. The only requirement is that you have internet access, making it cheap or even free. There is virtually no censorship as you can send messages to almost anyone on the planet.

Email is made possible by protocol technologies even non-technical people have likely seen before, such as IMAP, POP3 and SMTP. Like Bitcoin, these protocols are:

- Open-source

- Decentralized

This is important because it means no company or government owns or controls email. It’s fascinating to realize something so impactful isn’t “owned.” Rather, a collective of ever-changing volunteers contributes to these protocols, improving them over time.

To put in perspective just how rapid the email revolution has been, consider Gmail only became publicly available in 2007. And it left beta status in 2009!

Now step back and think exactly how much our world has leaped forward since the public adoption of email. How many companies and services have been made possible because of it?

Just as email enabled massive, global change, Bitcoin stands to do the same.

By creating a form of money that is built for the internet world, Bitcoin will likely trigger a similar revolution, ultimately leading to new industries, new companies, new services, and disruptive technologies we have yet to imagine.

The world is on the precipice of another massive change, on par with the advent of the internet and email.

How Much Bitcoin is Worth Comparatively

As of this writing, Bitcoin is worth $1,123,593,760,893.

To put that in perspective:

- Gold and the S&P 500 are worth more, about 10 and 33 times more respectively.

- Facebook is worth about $884B.

- Giant companies such as Berkshire Hathaway ($615B), JP Morgan ($474B), Visa ($488B), Mastercard ($377B), Walmart ($394B), Walt Disney ($338B), and Proctor & Gamble ($337B) are each worth considerably less.

- ETFs and most other financial benchmarks are worth less, with the SPDR S&P 500 ETF Trust ($363B) coming in highest.

That means in just over a decade, Bitcoin has skyrocketed to an enormous value on par with some of the largest global financial benchmarks.

| Rank | Name | Market Cap |

|---|---|---|

| 1 | Gold | $11.079 T |

| 2 | Apple | $2.233 T |

| 3 | Microsoft | $1.94 T |

| 4 | Saudi Aramco | $1.89 T |

| 5 | Amazon | $1.725 T |

| 6 | Alphabet (Google) | $1.522 T |

| 7 | Silver | $1.39 T |

| 8 | Bitcoin | $1.186 T |

| 9 | $887.04 B | |

| 10 | Tencent | $763.8 B |

The remainder of this article covers details on why Bitcoin is worth over $1 trillion, but fundamentally, the markets understand Bitcoin is a technology that will disrupt the world in the same way email did. That is why it is valued so highly.

Why Bitcoin is Unique–Even Among Other Cryptocurrencies

The technology behind Bitcoin (blockchain) is open source and readily available. As a result, we’ve seen countless other cryptocurrencies hit the market.

A common concern is that Bitcoin will just be another AOL or Myspace. Won’t some newer, better technology make Bitcoin obsolete?

While the technology is intentionally easy to replicate, its circumstances are not. In addition, Bitcoin is not an “all or nothing,” solution. It fits into a bigger financial picture and relies on complementary technologies. As you’ll see, there is plenty of room for innovation, but replacement is highly unlikely.

Origins and Founder

Perhaps the most unique aspect of Bitcoin is the story of its creator, Satoshi Nakamoto.

Satoshi has had no apparent gain from Bitcoin.

- No fame: Satoshi has never revealed his or her true identity.

- No control: Satoshi has no privileged access to Bitcoin.

- No financial gain: There has never been any movement of the early coins Satoshi acquired.

The “no control” is particularly important. Satoshi explicitly designed Bitcoin in a way that the entire ledger—covering every single transaction—could be run by a traditional consumer PC. That decentralizes control, pushing it away from the hands of large institutions, governments, and firms.

Further cementing this concept of decentralization, Satoshi vanished in 2011.

On April 26, 2011, Bitcoin creator Satoshi Nakamoto sent his final emails to fellow developers in which he made clear he had “moved on to other projects,” at the time handing over a cryptographic key he had used to send network-wide alerts.

10 Years Ago Today, Bitcoin Creator Satoshi Nakamoto Sent His Final Message (Forbes)

There appear to be no ulterior motives in play. Rather, Bitcoin is truly an anonymous gift to the world.

It is hard to imagine creating something worth a trillion dollars and not benefiting from it. This simply goes against common human traits.

Nearly all other crypto and fintech projects stand in stark contrast. They have CEOs, investors, boards, and profit targets. It takes time and capital to get these ventures going. In return, these companies set aside a portion of the coins for themselves and maintain control of their own networks. Outside of Bitcoin, you tend to see much more traditional corporate factors at play.

Bitcoin is truly a unique tale of selflessness.

If you haven’t already, you owe it to yourself to read Satoshi’s words firsthand: The 9-Page Bitcoin Whitepaper.

Timing

The second factor that makes Bitcoin unique is its timing.

Bitcoin emerged during the Global Financial Crisis of 2007-2008. While the causes of this crisis were complex, Bitcoin’s features directly addressed many of the suspected issues.

Since it launched at this time of crisis, it likely received much more attention than had it been launched at a time of financial stability or growth.

What About Other Cryptocurrencies?

Email is not the only internet communication option. We also have voice and video calling. We have instant messaging. You can imagine a stack of different communication technologies that have all become important in our lives. But these don’t directly compete–they instead solve different problems.

You’ll find the same is true in the world of finance and cryptocurrencies. There are many opportunities for truly valuable, complimentary services. I’ll discuss some of these areas further below. But the bottom line is the role of Bitcoin isn’t necessarily diminished by the fact that other cryptocurrencies exist.

To sum up, while the technology of Bitcoin is open and simple to replicate, it’s hard to imagine repeating its circumstances. The value of Bitcoin comes from this exceptional extraction of human greed, dropped off at just the right time.

And just like email protocols, Bitcoin is likely to be maintained, upgraded, and improved over time by an ever-changing community of volunteers.

Bitcoin’s Key Features

Bitcoin has four distinctive features:

- Limited supply: will not lose value due to inflation

- Security: final settlement of transactions

- No censorship: anyone with internet can use it

- Decentralized: not controlled by any company or government (no one can mess with the above three features)

Limited Supply

There will only ever be 21 million bitcoins. That may sound like a lot, but consider there are almost 350,000,000 people in the US alone. That means only 6% of people in the United States could possibly own a full bitcoin. Expand that out to the roughly 8 billion people we have globally, and it’s obvious just how rare owning a full bitcoin will be.

This “Limited Supply” section is the most complex of this article. Fundamentally, Bitcoin provides a hedge against the risks of inflation. If that’s all you need to know, you’re welcome to move on to the next section.

The reason this section is long is I feel the topic deserves a look at the nuance. Many in the Bitcoin community make inflation out to be purely negative. But as with the rest of this article, I prefer to discuss how Bitcoin fits in with traditional systems rather than arguing it should completely displace everything else.

Bitcoin comes embedded with an algorithmic, non-discretionary monetary policy. This just means that Bitcoin creates a predictable approach to money that cannot be manipulated by individuals or governments.

With traditional currencies (fiat), the opposite is true. Governments manage the supply of their money. This typically means printing more money, which leads to the reduction of its value over time. This is called inflation because the prices of everything in that economy inflate.

A steady, low level of inflation is generally considered good for a growing economy. But increasing the money supply is also a dangerous and seductive tool used to overcome short-term problems at the expense of the future.

When the supply of money increases, your savings lose value and everything becomes more expensive. This encourages you to spend your money now.

Additionally, inflation causes a tendency toward additional inflation. Printing more money temporarily relieves the problems inflation causes. If your savings loses value, you can imagine receiving more money from the government would feel good. But yikes! This can ultimately lead to a death spiral known as hyperinflation.

Investopedia.com provides a detailed, neutral look at the impact of inflation. To sum it up, large-scale economies are extremely complex and still not fully understood. But by continuously smoothing over short-term issues, inflation almost certainly delays problems and can set economies up for future failure.

In fact, inflation has been a key contributor to numerous historical catastrophes. You might be surprised that since 1920, there have been 56 cases of catastrophic hyperinflation, 17 of which occurred within just the last 30 years! These events have led to wars, governments collapsing, and the annihilation of wealth.

This is a very timely topic as the response to COVID shutdowns is a “test in progress” of how hitting the market with a massive supply of dollars will play out.

(CNN) A leading Democratic economist on Wednesday urged the White House to shift course after the government reported higher-than-expected inflation last month, which has heightened fears of fresh trouble for the recovering US economy.

Larry Summers sends inflation warning to White House: Dominant risk to economy is ‘overheating’ (CNN)

Read more:

- Inflation Risk Intensifies With Supply Shortages Multiplying (Bloomberg)

- Inflation speeds up in April as consumer prices leap 4.2%, fastest since 2008 (CNBC)

- Warren Buffett just sounded the alarm on inflation–here are 8 ways to be ready (Yahoo! Finance)

To be clear: this is not to say monetary policy is always a bad thing. And it is not to say Bitcoin must replace fiat currencies. Governments can benefit from controlling the amount of money in circulation. Nations can position themselves strategically against other nations. Growth can be managed. But it does introduce the risk of very human factors:

- Mismanagement

- Selfish behavior

- Short-term thinking

- Unintended consequences

In contrast, Bitcoin is locked to a supply of 21 million bitcoins. More cannot be printed to solve short-term problems. It is not susceptible to the repercussions of inflation.

This explains why Bitcoin is called digital gold.

Like gold, there is a limited supply and it becomes harder and harder to extract over time.

By limiting supply, Bitcoin gives you a unique option for protecting your wealth.

The other interesting ramification is you can more easily predict price. Since price is determined by supply and demand, we can say the following: Bitcoin supply is predictable and limited. If demand goes up, the value of Bitcoin goes up.

Security

Just as email offers decentralized, instant communication across the globe, Bitcoin offers decentralized, instant transfer of value across the globe. Security refers to ensuring those “transfers of value” are accurate and final. In other words, if you receive a payment, you want to feel secure that the payment is truly yours.

At the foundation of Bitcoin is blockchain technology, which makes the entire accounting ledger public. This means anyone, including you, can go inspect every single transaction that has ever occurred. As such, Bitcoin’s security lies in the fact that it is an entirely open book. Not only will you see the value transfer into your personal wallet, but you can also go and independently see the credit and debit on Bitcoin’s open ledger.

Security comes from transparency.

Can you imagine a company publishing a live, complete copy of their accounting records online?

No Censorship

Bitcoin does not care about your location, your religion, how much money you have, your gender, or what language you speak. If you have an internet connection and a smartphone, you can use Bitcoin. You can store value in your own Bitcoin wallet. And you can transact with others across the globe using Bitcoin. The system is inherently made available to everyone. It does not censor or discriminate.

Of course, governments may interfere and introduce legislation, but that is no different than a government limiting your access to email. There is nothing in the technology itself that prevents you from using it.

In developing countries, mistrust of government and financial systems and devaluation of currency due to inflation have contributed greatly to Bitcoin’s appeal. But groups that have suffered traumatic legacies of oppression and economic exploitation under the national financial structures of developed countries, including the United States, can also gain by embracing Bitcoin.

Bitcoin gets Wall Street’s attention. But its power lies in aiding oppressed peoples. (NBCNews)

Decentralized

All of the above features sound great, but what if someone could alter them for their personal benefit?

This sort of thing happens all the time with technologies and economies. Knowing that centralized control would undermine the three key features discussed so far, decentralization was built into the core of Bitcoin.

It cannot be owned by a government or large institution. A president seeking reelection cannot cause more bitcoins to be printed for short-term gain. One organization cannot prevent certain people from using Bitcoin.

Decentralization eliminates the common pitfalls and temptations that traditional currencies face.

Apart from Satoshi leaving Bitcoin at an early stage, there are also technological considerations built-in that drive decentralization. As noted earlier, the entire Bitcoin ledger can be run on a standard, consumer-grade computer.

Bitcoin could, alternatively, be designed to take advantage of massive server farms. By doing so, the network could process a much higher volume of transactions more quickly. However, Bitcoin is optimized for decentralization. All other features come secondary, including speed and volume. That’s the level of commitment Bitcoin has to decentralization.

Bitcoin’s Place in Global Finance

To understand Bitcoin’s value, it’s important to understand its role in finance.

While Bitcoin can be thought of as an alternative to modern, centralized banking, there are also many ways it can be integrated into existing global finance. It’s not an “all or nothing” concept.

Bitcoin’s features “democratize” money, giving everyone their own, personal bank with the ability to easily transact globally. Bitcoin’s features are also attractive on the other end of the spectrum, meeting the use cases of large financial institutions.

Consider these scenarios:

- Banks process many checks. But they do not transact each of those one-by-one with the other bank involved. Rather, on a regular basis, they batch all checks for a large bank-to-bank transfer that settles the total amount between the two banks.

- You may run many Visa transactions in a day. In the backend, your transaction is being authorized, not settled. It actually takes 3-5 business days for those transactions to settle because Visa is also doing large batch transactions with third parties to bring all of these individual charges to closure.

- In order to handle transactions across nations, you can imagine similar scenarios but with a few additional steps to facilitate the large movement of funds across borders.

- Governments also move money. To enact monetary policy, they direct funds in and out of central and reserve banks.

All of these examples illustrate that global finance is layered.

- At the top are high-frequency, low-risk transactions that move numbers in a database.

- At the bottom are low-frequency, high-risk transactions that are the final settlement of physical currency.

Bitcoin does not need to replace the US Dollar or another fiat currency.

Rather, Bitcoin will be useful for some layers and not others.

This is why you see large financial institutions and payment firms, such as Visa and Mastercard, actively integrating Bitcoin, Ethereum, and other blockchain technologies into their systems.

Visa’s CEO Al Kelly is a cryptocurrency advocate, commenting during their March 31, 2021 earnings call:

“Our focus is on five different opportunities that we see in this space. And I would say that this is a space that we are leaning into in a very, very big way and I think are extremely well-positioned.”

Visa CEO Al Kelly discussing cryptocurrency – news.bitcoin.com

Numerous countries are also exploring blockchain technology to see how it fits into their settlement and management ecosystem. Ultimately, a country may no longer need to rely on settling in the physical space. They may move to an entirely digital economy, which can enable new levels of efficiency and automation. These blockchain technologies generally offer more security than traditional databases and more convenience than physical currency.

Even the United States is officially exploring digital currencies: Digital Dollar Project to launch five U.S. central bank digital currency pilots (Reuters)

It’s likely that we have yet to see what revolution Bitcoin will cause within global finance, but it will continue to solve existing problems, increase efficiency, and open up new opportunities across the economic spectrum.

Is Bitcoin for Buying Cups of Coffee?

It’s common to see criticism of Bitcoin in the news. One of the big hitters is that Bitcoin is too slow, too expensive, and too volatile to be used for everyday purchases.

If you’ve read this article to this point, hopefully, you already understand why this is a flawed argument, but it’s worth diving into.

Using Bitcoin to pay for coffee is like wiring money to pay for coffee.

Just like Bitcoin, wires represent final settlement. As such, they’re typically used for large transactions that must be final (such as buying a house). Because wires are final, they go through numerous validations causing them to be slow and expensive. They are simply not designed for small, everyday purchases.

If we go back to our layered finance concept, high-volume transactional payment networks, like Visa’s, are built on top of larger settlement technologies. In this same manner, other cryptocurrencies can be optimized for small, fast transactions. In the finance stack, they can rest on top of Bitcoin. There is plenty of room for multiple blockchain technologies to complement both each other and legacy financial systems.

But since Bitcoin is just software, can’t it be optimized for everyday purchases?

While it may be the case in the future, right now, there are various trade-offs blockchain technologies must optimize for. Typically, those trade-offs are between:

- Scalability: how many transactions can be handled?

- Security: how final is each transaction?

- Decentralization: how easily can the blockchain be manipulated?

Bitcoin is optimized for security and decentralization. Period.

In a practical example, we get back to the fact that Bitcoin drives decentralization by ensuring it runs on consumer equipment rather than in data centers. This, of course, comes at the cost of scalability.

How to Invest in Bitcoin

Hopefully, you now have a solid understanding of why Bitcoin is valuable. If you want to start investing in Bitcoin, following are some tips.

I’ll provide the standard disclaimer that this is neither tailored guidance nor financial advice. Before deciding to trade or invest in anything, you should carefully consider your investment objectives, level of experience, and risk appetite.

Most Bitcoin enthusiasts either hold or actively trade Bitcoin.

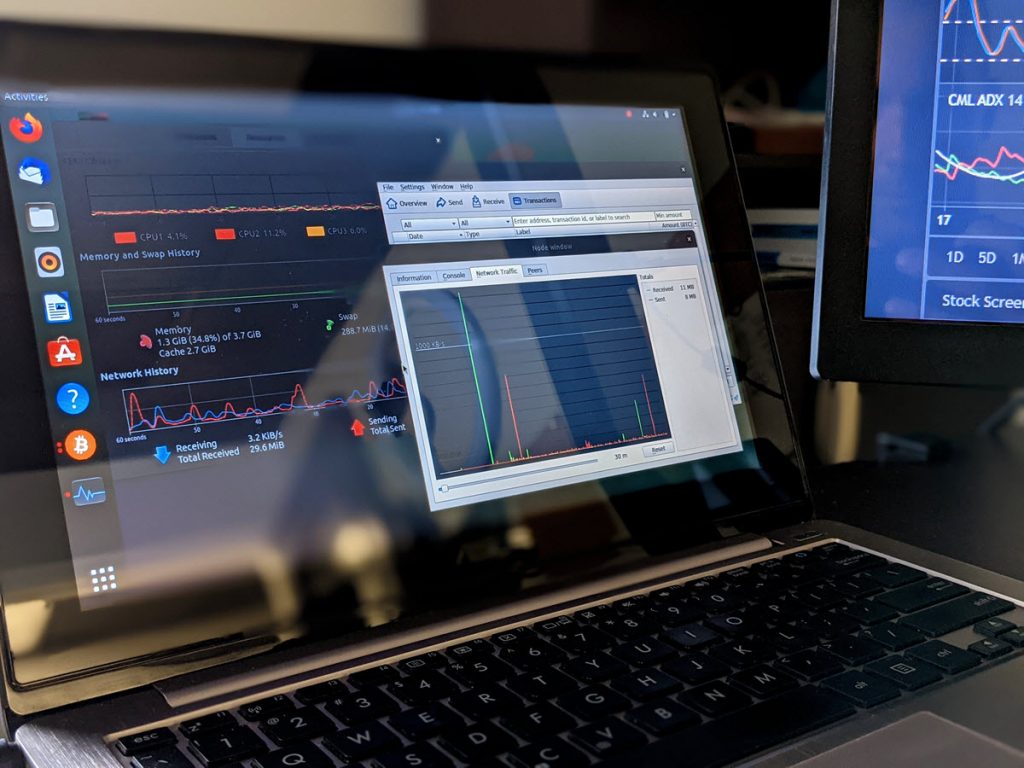

I have been an active trader most of my life. Trading is what introduced me to Bitcoin, but I’ve since learned to appreciate its underlying value. As such, I personally both hold and trade Bitcoin. I do these activities in separate accounts with separate objectives.

Why is Bitcoin Price so Volatile?

Despite being worth over a trillion dollars, Bitcoin is still in its early stages. There is a lot to figure out in terms of regulation, integration, and adoption. As such, the market is trying to determine the right value to assign.

As Bitcoin matures, it should become less volatile. In the meantime, this volatility can provide some exciting investing and trading opportunities.

Holding Bitcoin

If you buy Bitcoin and hold Bitcoin, you believe in the long-term value proposition and believe it to be a good store of value. Remember, the supply is known. If you expect demand to go up, price will go up.

To hold Bitcoin, you can open an account on an exchange (someone else holds your Bitcoin) or create your own wallet (you hold your Bitcoin).

Exchanges to consider for holding in the US and numerous other countries:

- BlockFi is my personal favorite because it pays interest on your holdings.

- Coinbase is probably the most well-known exchange.

- Gemini is another large exchange that pays interest as well.

If you want to hold your own Bitcoin and “be your own bank,” which if nothing else is a great intellectual exercise, Bitcoin.org provides excellent information to get you started: https://bitcoin.org/en/choose-your-wallet.

Crypto-ML’s Fear and Greed Index uses big data and machine learning to help you improve your long-term Bitcoin investing. It’s available to free members.

Trading Bitcoin

If you want to take advantage of the volatility Bitcoin offers, you can try your hand at trading Bitcoin.

A huge advantage trading offers is it doesn’t matter where price currently is. You can enter the market at any time. Long-term investors have to worry about whether price is currently too inflated. Is it too late to get in the game? With trading, you don’t have to ask that question.

Most of the same trading principles that apply to stocks, options, futures, and forex also apply to Bitcoin. The nice thing is Bitcoin trades 24 hours per day, every day. That means if you have a standard job, you can trade Bitcoin in the off hours–something that’s difficult to do with stocks.

To be active, your Bitcoin must be on an exchange. For this, I recommend Binance.us. It is an ideal solution for traders as it has low feeds and all of the advanced tools any self-respecting trader with four monitors and 12 cups of coffee could ask for.

Investing in Other Cryptocurrencies

As you continue to explore Bitcoin, you’ll undoubtedly venture down the path of other cryptocurrencies (aka “altcoins”).

For trading, they can provide even heavier volatility than Bitcoin. However, they are likely less predictable and more easily manipulated (not as decentralized). This can provide great opportunities but also additional risk.

For investing, there are a few considerations when thinking about the long-term:

- In general, it’s a good idea to diversify, including across cryptocurrencies.

- Most altcoins are similar to companies. As noted above, they likely have CEOs, investors, and particular business objectives. Buying their coins is somewhat similar to buying their stock. As such, you should understand their business objectives, the real-world use cases, and their competitive landscapes.

- Bitcoin and altcoins tend to go through cycles. It may be the case that Bitcoin rallies for a period then stalls out. At this point, altcoins tend to take their turn rallying (aka “alt season”).

Simple Strategy to Build Your Bitcoin Portfolio

For those of you ready to get going with Bitcoin investing now, I can offer some timeless advice:

- Determine the percentage of your monthly savings you want to allocate to Bitcoin.

- Every time you are paid, buy Bitcoin with the amount you have determined.

For example, let’s assume you save $1,000 every month. You decide you want 20% of your savings to go to Bitcoin. Now, every month, on the day you receive your paycheck, you simply buy $200 worth of Bitcoin. Over time, you will buy at high prices and low prices. Regardless, your Bitcoin holdings will grow.

This is the dollar-cost-averaging method and it works because:

- It’s simple.

- You don’t have to worry about timing the market.

- It doesn’t require ongoing decisions.

In fact, most exchanges let you set up recurring deposits to truly automate this form of investing.

As a final note, when you invest for the long-term, the earlier you invest, the better off you typically are. That is, the longer the money is invested, the more it grows. So don’t wait for the time to be right—with dollar-cost-averaging, as soon as you receive the funds, invest them. Speed wins.

Conclusion

While I covered a lot in this article, I’ve only just scratched the surface. I’ve also likely hit a nerve or two on contentious topics. Let me know in the comments what I’ve missed, messed up, and what you’d like to hear more about!

If you want Bitcoin investing insights, be sure to check out our free and paid memberships. We hope to level the playing field and provide exceptional value to any Bitcoin enthusiast.

How much is 1 Bitcoin now?

Bitcoin price is currently:

On our Member Dashboard, we also stream bitcoin price live. If you’re not already a member, you can sign up for free.

What was Bitcoin’s lowest price?

Bitcoin started at $0 in 2009, but has had some notable lows since then. In February of 2011, Bitcoin hit parity with the US Dollar at $1 per bitcoin. In 2013, at its lowest, bitcoin cost $13. In 2017, you could get a bitcoin for as little as $1,100. In 2020, Bitcoin hit a low of $3,850.

What is the smallest amount of Bitcoin I can buy?

The smallest unit of Bitcoin you can buy is called a satoshi. A single satoshi is worth 0.00000001 Bitcoin. That is an extremely smaller unit, much smaller than cents in the US. While most people do not transact in satoshis, it does give Bitcoin incredible flexibility to be used by a variety of economies.

4 thoughts on “Why Bitcoin Has Value and Is Unique Among Crypto”

Leave a Comment

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.

Good help nice job/

Thank you!

PO l

Thanks for the positive description. It’s very nice to see your positive thoughts and efforts to introduce people to bitcoin.

I’m however a person that she’s the negative things as good knowledge. Like, why did the price drop from where it was to way below what investors thought would happen.

Considering the world pressures on the dollar with over printing and inflation and the creation of government gold backed cryptos, and the Chinese being broke selling their US treasury bonds, bitcoin should have increased in value against the dollar.

But the opposite happened. And the dollar was a much greater investment than Bitcoin. Why is the question.

So the answer is that to hold its price people have to not sell out the other holders. But they did.

Second to that you actually can’t be separate from fiat currency. Because you settle in them.

And the dollar turned out to be the world safe haven currency. Not Bitcoin. Again opposite of the fantasy of crypto enthusiasts expectations.

Thanks again.

Great point. Within our April 2022 Insider Newsletter, we discussed Bitcoin during a recession, which is exactly this.

“However, if the broad economy faces decline for more than 3 months, you should not expect Bitcoin to be a hedge.

The reality is, Bitcoin is mostly a speculative asset. Bitcoin’s price behaves like a risky tech stock. During downturns, most investors move from high-risk assets to low-risk assets. This means it is likely to drop faster than the overall market. The COVID crash is evidence of this.

Why is this the case? It comes down to numbers.

Large investors and funds invest in Bitcoin to make money. Since they control such a significant portion of the overall wealth, their behavior drives prices.

For Bitcoin price to stabilize and act as a hedge, most of the world’s population would need to adopt it as a go-to form of currency -or- investment institutions need to evolve to view it as a hedge to economic downturn rather than a speculative asset.”

Despite not yet being a safe haven, we expect that behavior to change over time. Bitcoin is not dead. Despite these huge setbacks, it’s still holding significant value. Enough people understand these concepts to keep it alive.

Over time, more people will read articles like this. More people will watch videos, read books, and listen to podcasts that cover this topic. Some of these people will be our next generation of leaders in the financial markets.

To invest in Bitcoin at this stage is to invest in the idea that people of the future will see it as a hedge rather than a speculative asset.