Member Dashboard Guide

Member Dashboard

Once you have joined Crypto-ML, you will spend most of your time on the Member Dashboard. This document provides an overview of how to use the Member Dashboard.

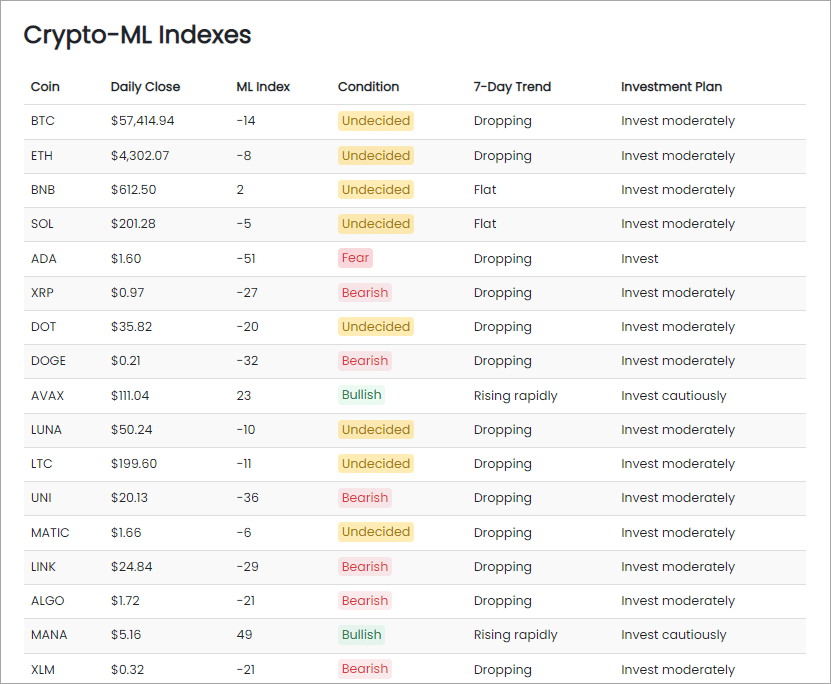

Market Index Pro

While Crypto-ML’s other indicators are focused on short-term timeframes and trading, the Fear and Greed Index is designed to provide a big-picture view of markets to help cryptocurrency investors.

The Fear and Greed Index uses big data and machine learning techniques to measure market sentiment and determine a score.

- If the index exceeds +80, a bull cycle may be nearing its peak. Resist buying in this phase. Instead, start taking profits.

- If the index goes below -60, a bear cycle may be ending. This is the time to buy aggressively.

► Learn more about the Fear and Greed Index

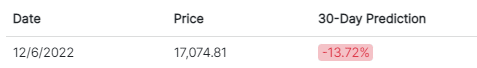

Predictions

Bitcoin price predictions are the cornerstone of Crypto-ML’s platform. These predictions are generated by our neural networks.

This model uses a broad array of data points covering the economy, indexes, sentiment, technical, and on-chain data to generate a prediction of Bitcoin price movement 30 days in the future.

- The price change 30 days from now is predicted.

- Predictions are updated daily.

- The predictions change automatically on the Member Dashboard.

- You can also view the prediction history log to get a sense of how it performs.

In this example, you can see Bitcoin price is predicted to drop 13.72% 30 days now.

Note that the predictions are not meant to be interpreted alone. Please see the interpretation notes below.

► Learn more about our 30-day Bitcoin Price Predictions.

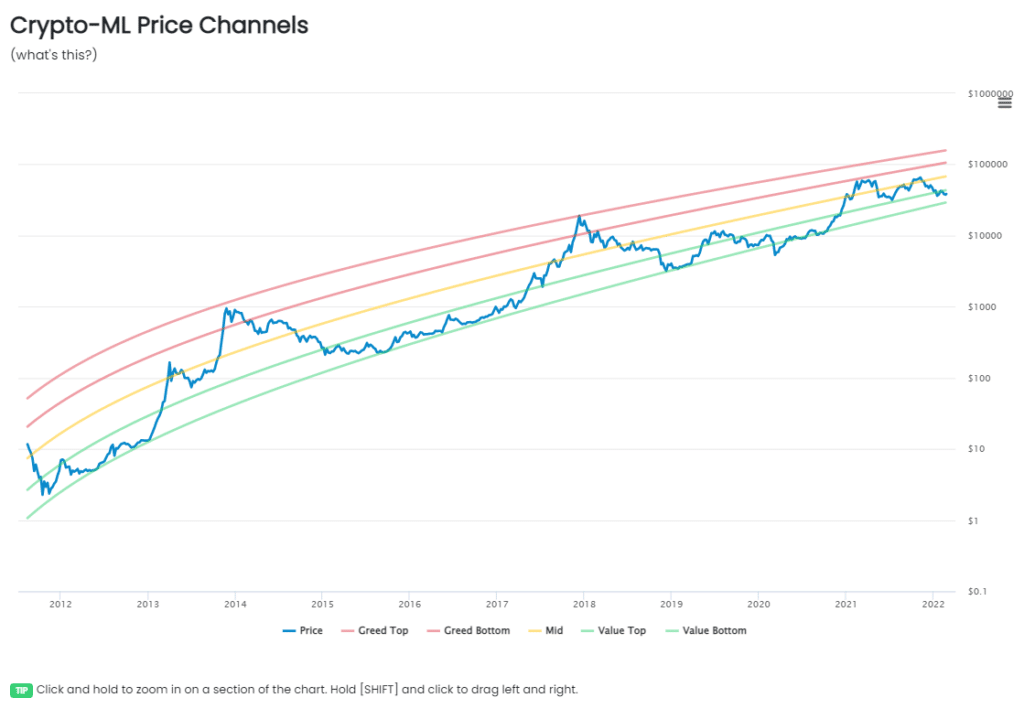

Price Channels

Crypto-ML offers unique Bitcoin price channels that help identify statistically-likely ranges of future price movement. The Crypto-ML Price Channels graph pairs with the Crypto-ML Fear and Greed Index to provide a more complete picture of the crypto markets.

Price Channels are also designed to help investors focus on the long-term, big picture. This can help you reduce stress and make better decisions.

These channels are derived from a regression model. The Fear and Greed Index is more robust, but these channels will help confirm and validate current market conditions while also helping you identify likely market tops and bottoms.

► Learn more about the Price Channels

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.