Insider Newsletter 18: June 2023

We’re in a market laced with fear and headlines including “crypto is dead” and “now is the time to get out.” Yet significant long-term tailwinds are coming for Bitcoin specifically.

So how are we playing this market?

Here’s an in-depth look at our AI, crypto news, economic picture, technical analysis, and on-chain data to build a clear picture for you.

The news is deceptive and complex this month, so we’ll dive in deeper there than normal.

A quick TLDR:

- Our AI measures predict a flat month ahead.

- Headlines read “crypto fear” but positive news is hidden underneath, specifically for Bitcoin.

- Technical and on-chain analysis both show a bullish outlook.

Altogether, this is the most bullish we have been about the long term in months.

Actions We’re Taking

Looking at our newsletters all the way back to January 2022, you can see the full list of actions we’ve taken.

In the middle of 2022, we:

- Converted all stablecoins to Bitcoin.

- Began aggressively buying new Bitcoin each week using the Dollar-Cost-Average (DCA) approach.

We eventually automated the DCA with Swan Bitcoin, which buys from traditional bank accounts (on-ramp) and automatically transfers out to our non-custodial wallets.

For the reasons you’ll see below, we made another major bulk Bitcoin purchase at the end of June.

We are also continuing to DCA.

If you’re interested in trying Bitcoin for your investing automation, here are a couple of links:

- Affiliate link (you and Crypto-ML get a $10 deposit): https://www.swanbitcoin.com/crypto-ml/

- General link: https://www.swanbitcoin.com/

Crypto-ML Data

Our systems are calling for another relatively flat month ahead, with Bitcoin holding the $30K line and awaiting the next bullish catalyst.

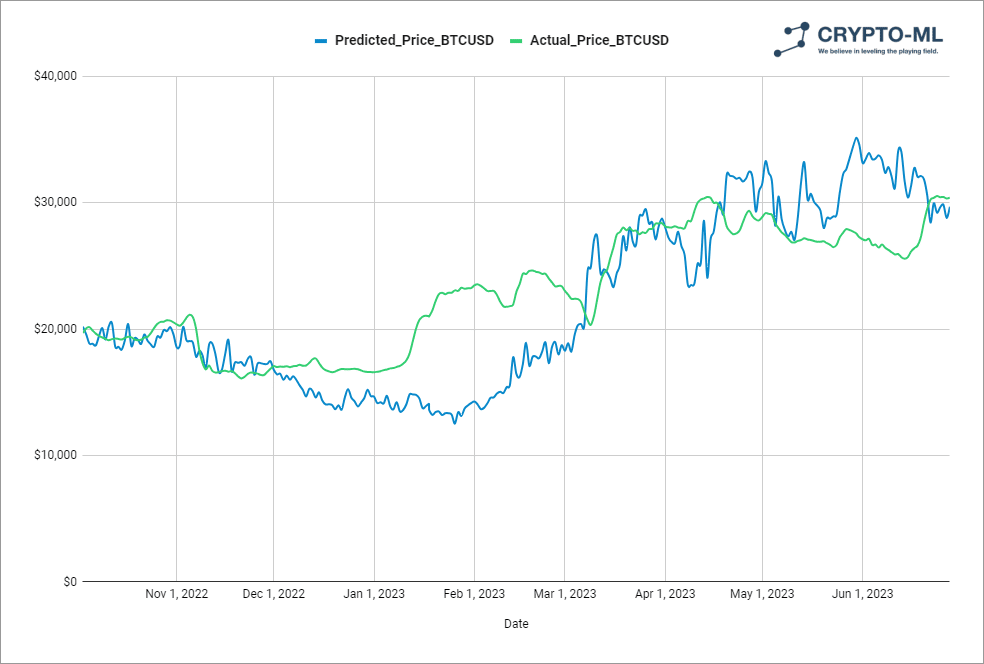

30-Day Price Prediction

Our 30-day price predictions called for a rally in the early part of the month that did not happen. But it did pick the right end for the month at just above $30K.

It turns out our AI did not predict the SEC and Gensler launching a massive assault on the crypto space. More on this below. But ultimately, the fundamentals of Bitcoin and the economy prevail over short-term disruptions.

Perhaps we need to add a “Gary Gensler Mood Index.”

Looking at the predictions for next month, it appears we’ll have another failed rally but ultimately stay flat. This makes sense as the economy appears even (see below) and some of the more positive news may take a few months to unfold.

In the meantime, you’ll see measured accumulation (the run-up) and profit-taking (the move back down).

| Date | Predicted BTCUSD Price |

|---|---|

| 7/1/2023 | $33,076.02 |

| 7/2/2023 | $30,232.60 |

| 7/3/2023 | $31,253.54 |

| 7/4/2023 | $33,169.39 |

| 7/5/2023 | $32,772.06 |

| 7/6/2023 | $31,930.27 |

| 7/7/2023 | $29,780.54 |

| 7/8/2023 | $32,419.18 |

| 7/9/2023 | $31,508.22 |

| 7/10/2023 | $31,322.41 |

| 7/11/2023 | $31,135.57 |

| 7/12/2023 | $31,444.56 |

| 7/13/2023 | $31,005.91 |

| 7/14/2023 | $30,610.54 |

| 7/15/2023 | $30,474.00 |

| 7/16/2023 | $30,621.26 |

| 7/17/2023 | $31,150.26 |

| 7/18/2023 | $31,359.64 |

| 7/19/2023 | $31,605.95 |

| 7/20/2023 | $30,918.57 |

| 7/21/2023 | $32,371.65 |

| 7/22/2023 | $33,053.31 |

| 7/23/2023 | $34,179.05 |

| 7/24/2023 | $32,386.73 |

| 7/25/2023 | $32,932.09 |

| 7/26/2023 | $29,789.28 |

| 7/27/2023 | $31,011.67 |

| 7/28/2023 | $31,221.50 |

| 7/29/2023 | $31,931.79 |

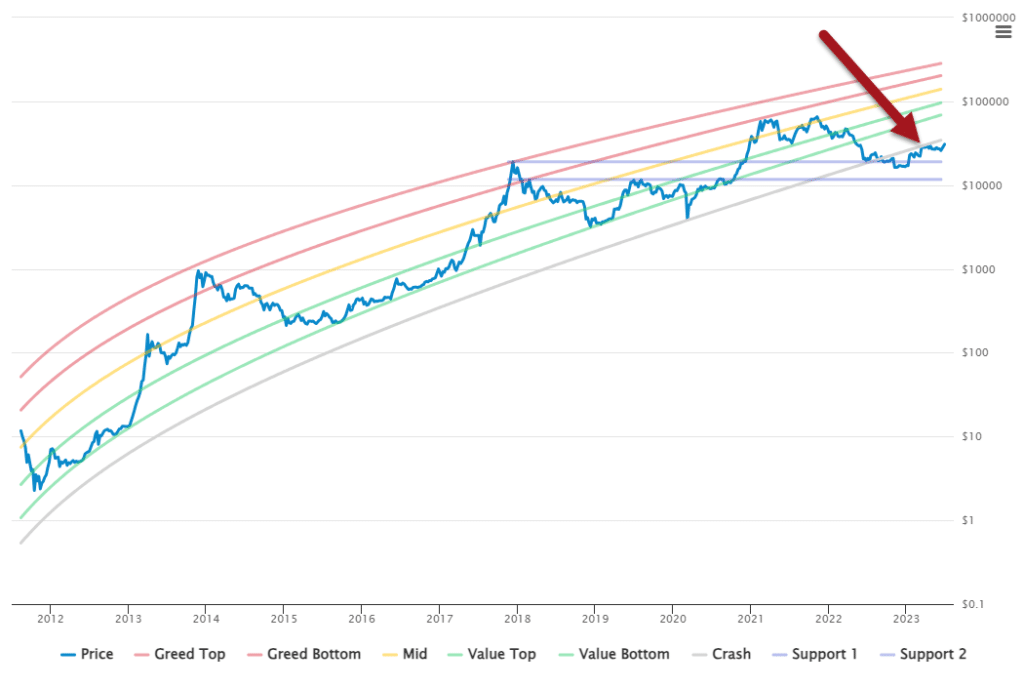

Price Channels

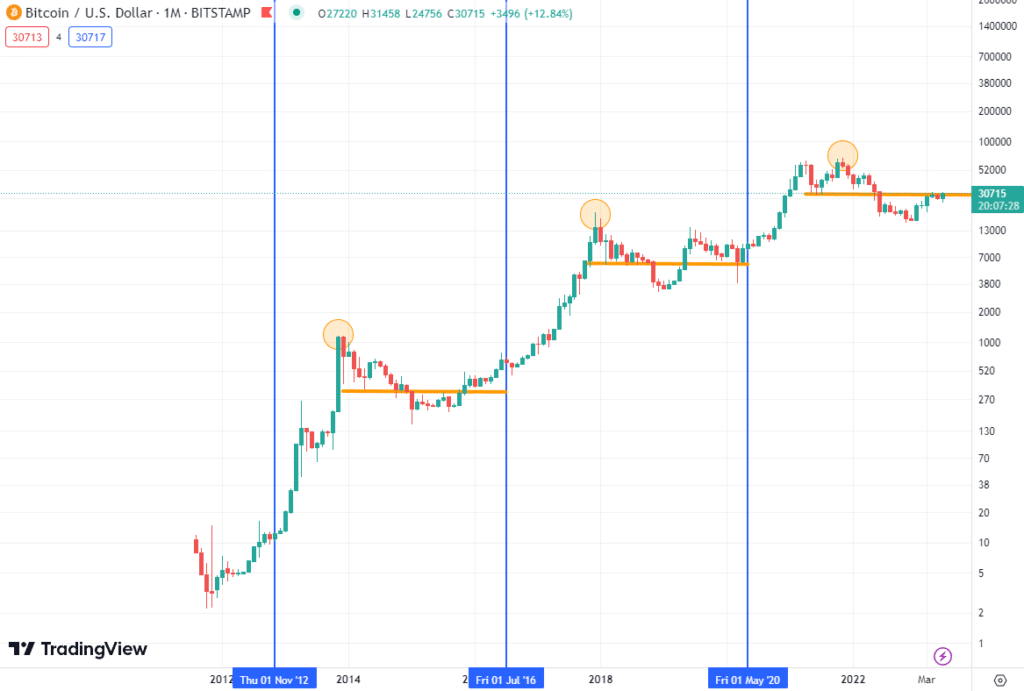

The Price Channels look at logarithmic regression channels.

Here still, we see the crash line acting as resistance.

The good news is that assuming this growth model holds into the future, Bitcoin is still in a strong buy zone.

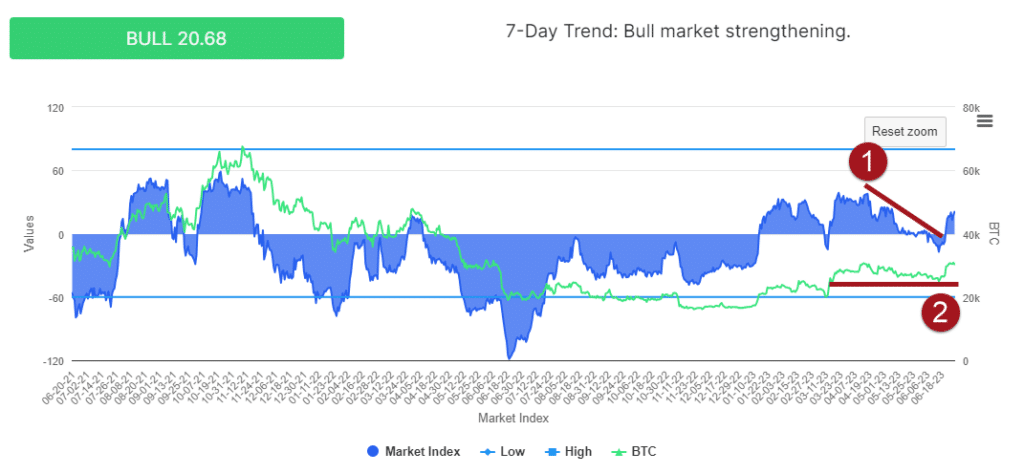

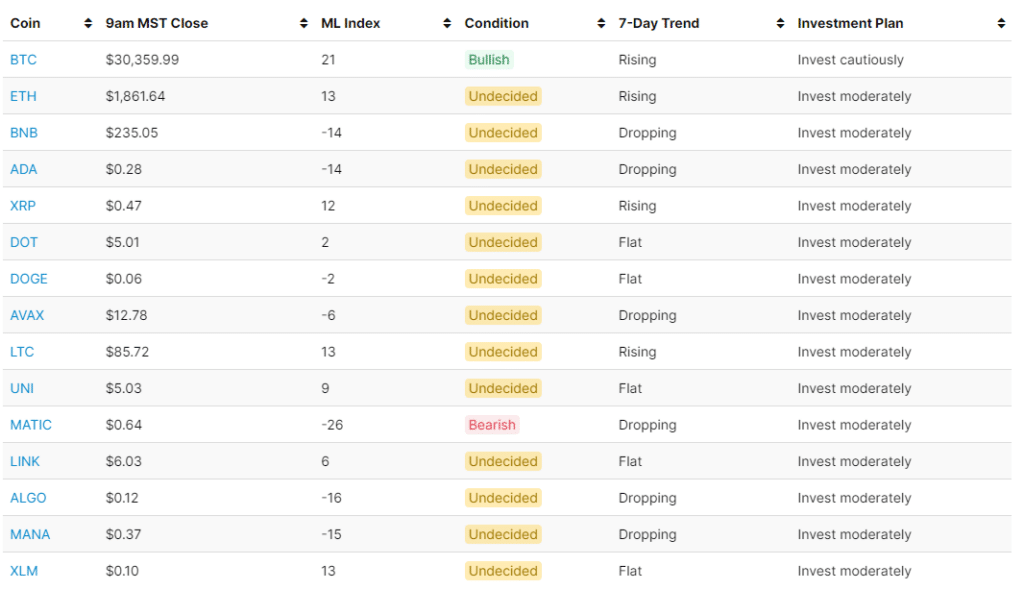

Market Index

The Market Index is telling us the general sentiment is moving bullish. This is measured by social & search sentiment, technical analysis, and Bitcoin dominance.

As Bitcoin price stagnated over the last three months (2), sentiment dropped (1). This can be explained as hope being lost. However, you now see sentiment moving up as price has captured $30K convincingly.

Altcoins do not share the same positive sentiment as Bitcoin. This can be explained by the SEC’s classifying them as securities, which will be discussed below.

Commentary

The perfect setup is in place for that bullish catalyst. Headlines are screaming fear, but numerous long-term fundamental building blocks are coming together to ignite significant Bitcoin adoption.

Crypto News

Whether those in the crypto space like it or not, most cryptocurrencies are, in fact, securities and will almost certainly be regulated as such. Just because they use blockchain technology does not mean they can skirt investor protection laws and regulations.

The Howey Test is simple. If something meets the following 4 prongs, it’s a security:

- An investment of capital

- In a common enterprise

- With the expectation of profit

- Driven by the efforts of others

The SEC has stated Bitcoin and Ether fall outside of this definition and are indeed not securities (nasdaq.com). This is good and accurate.

However, you can see most other crypto projects are securities. Prong #4, in particular, is telling.

As commentary, while the SEC may be technically right about many cryptocurrency projects, it’s unfortunate that it is leading with enforcement (penalties and lawsuits) rather than creating clear regulations and working with legitimate companies to cooperatively build an environment that protects investors while also encouraging innovation.

So what does this mean for investors?

Exchanges may not be able to list most altcoins. If you have many altcoins, it’s possible those will become difficult to exchange and sell. This may cause negative pressure on altcoin prices, which we’re already seeing.

Exchanges will face higher regulatory costs and overhead. This may cause them to increase prices, shut down, and minimize or eliminate operations in certain countries.

However, Bitcoin and Ethereum make up about 70% of the crypto markets. That means the majority of crypto is unaffected and may even be strengthened. While many altcoins have value and purpose, there are many altcoins that are just scams and quick cash grabs. Cleaning the low-quality coins and exchanges only stands to further legitimize crypto and drive broader adoption.

As painful and controversial as regulatory moves have been, a balanced approach will likely be beneficial in the long run.

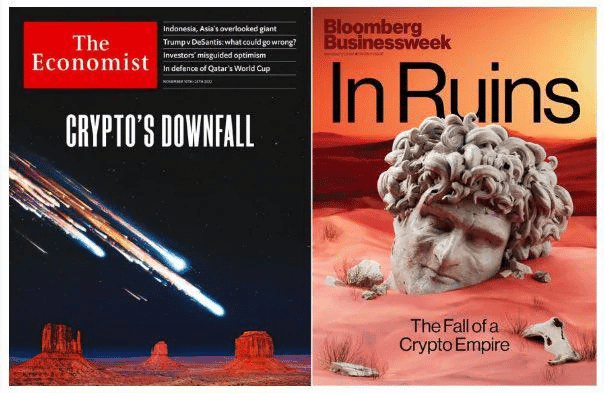

Fear in the headlines. Is crypto dead again?

Binance.us halted withdrawals and warned users this will happen again. Or it will convert their dollars. Binance.us even officially suggested users withdraw or spend their dollars.

Is crypto dead? The Atlantic published a high-quality piece on the state of crypto, effectively positioning it as a haven for white-collar crime and scams. It talks to industry insiders, who genuinely want to see crypto succeed, and examines whether the right regulatory framework can help crypto recover.

It is definitely down, written off by thousands of individual and institutional investors. The most obvious issue: scams. In the world of crypto, big firms are scams. Little firms are scams. Stable coins are scams; exchanges are scams; NFT schemes are scams; initial coin offerings are scams; tokens are scams. Firms run by self-proclaimed altruists are scams. Firms run by the shadiest dudes you can possibly imagine are scams. “There have been a lot of putatively decentralized Web3 companies that were really just three guys and a pair of servers in a pump-and-dump coin scheme,” Will Wilkinson, the head of policy at TBD, a bitcoin-focused subsidiary of the fintech giant Block, told me.

Is crypto dead? (theatlantic.com)

While the article from The Atlantic was balanced, these headlines hit hard. The Economist and Bloomberg are following suit.

Vox ran a piece titled Now might be a good time to consider quitting crypto (vox.com).

Finbold reported: Former US SEC attorney: ‘Get out of crypto platforms now’ (finbold.com).

“Get out of crypto platforms now, I can’t say it any plainer. <…> I believe that we now know for certain that crypto trading platforms are under a U.S. regulatory/law enforcement siege that has only just begun.”

John Reed Stark, a former Securities Exchange Commission attorney with extensive experience in the Enforcement Division spanning nearly two decades

Most crypto insiders have been worried about Tether for years. If Tether has faults or is exposed as a scam, that could cause a systematic collapse of the entire crypto ecosystem. While true crypto experts might shrug off mainstream media headlines, it’s harder to ignore Tether losing its peg (cnbc.com).

Positive news for Bitcoin

While fear is dominating the crypto headlines, Bitcoin took a brief hit but shook off the news and then some.

The reason? Bitcoin is separating from the scams that have overshadowed the broader crypto landscape. On the heels of the SEC statements, traditional finance and Wall Street pushing forward with their own Bitcoin products and services.

- Charles Schwab, Fidelity, Citadel Securities, and Deutsche Bank are live with Bitcoin and Ether (finance.yahoo.com and cnbc.com).

- BlackRock, the #1 global money manager, is moving forward with a Bitcoin ETF (finbold.com). Their track record with ETF approvals is 575-to-1.

The importance of the BlackRock deal cannot be understated. An ETF will give nearly every investor an easy way to gain exposure to Bitcoin as part of their investment and retirement portfolios. It will ensure professionalism and compliance in the handling.

BlackRock has over $8 trillion in assets under management. Their actions are closely followed by investors and analysts. This ETF lends a huge amount of credibility and legitimacy to Bitcoin as an asset.

For those of us who have been in Bitcoin for years, this means demand may be about to increase dramatically as BlackRock buys Bitcoin to back their ETF.

Is the BlackRock ETF here to short crypto?

Since the crypto community loves a good conspiracy, you’ll see plenty of chats talking about how this is a fiat scheme to short crypto and destroy the ecosystem.

That is false. The ETF will buy the underlying asset (actual Bitcoin) to maintain value. You can cut past the nonsense yourself and read the actual filing here: https://listingcenter.nasdaq.com/assets/rulebook/NASDAQ/filings/SR-NASDAQ-2023-016.pdf.

It’s not a short ETF designed to increase in value as Bitcoin goes down. That may come separately in the future, but that is not this.

We here have many high-net-worth individuals in our network and can confirm they generally want some exposure to Bitcoin (not crypto) in their portfolios. However, with traditional bankers, Bitcoin does not typically count as an asset on their balance sheets. This limits access to certain types of loans and investments.

A Bitcoin ETF fixes this problem. It will be a huge money maker for BlackRock and should create significant long-term demand for Bitcoin.

Market manipulation is a real thing, but this ETF very clearly makes BlackRock money when Bitcoin goes up in value.

Is there a downside to new ETFs?

Yes. Apart from the conspiracies, these new breed ETFs will make the Grayscale Bitcoin Trust obsolete. It needs to either evolve or fold. If it does fail, that means $18B of Bitcoin will hit the markets (cointelegraph.com). That’s enormous selling pressure.

The Grayscale Bitcoin Trust will become obsolete in its current because it has failed to track Bitcoin’s price and is currently trading 30% below Bitcoin price. It’s reached as low as 49% below. It also has significant management fees, at 2%. It’s one of the only traditional methods for getting exposure to Bitcoin, but it simply won’t stand up to the competition.

Ideally, Grayscale will be able to convert this fund into an ETF and make a graceful transition that does not impact the markets.

Macroeconomic

The 30-day prediction algorithm relies heavily on macroeconomic data, namely interest rates and international stock markets. It’s predicting we stay above $30K for the next 30 days but remain relatively flat. That aligns with macro news.

- Fundstrat analysts say we’re in a “buy the dip” moment as cash on the sidelines remains at a “monstrous” $5.5 trillion (finance.yahoo.com). That’s cash waiting to be deployed and propel the market upwards. This aligns with our actions over the last year.

- The Fed skipped a rate hike, is holding its target, and guides that two additional rate hikes will come later this year (cnbc.com). This slows the aggressive interest rate hikes and indicates recovery may be underway.

- The Fed expects core inflation to drop to 2.6% in March of 2024, which will be down from 3.9% in March of 2023. It is targeting 2%, which means inflation will be back under control in 2024.

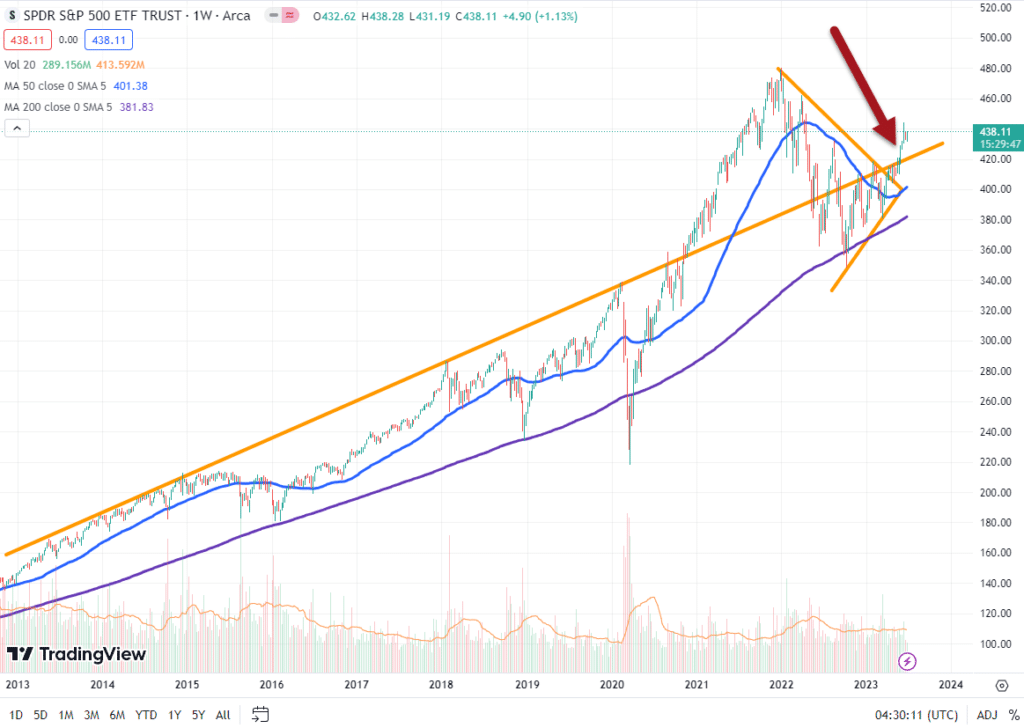

Looking at the S&P500, the market appears almost over-exuberant with this news. It has broken the shorter-term triangle but also the 10-year trend line. May really put an exclamation point on the recovery that has been taking place since October of 2022.

Putting interest rates aside, Bitcoin has added a major partner in Mexico. Grupo Salinas owns many of the major companies in Mexico, is owned by the 3rd richest person in Mexico, and will bring millions of Mexicans onto the Lighting network (cointelegraph.com).

Country-scale use cases continue to emerge and are critical to the long-term value of Bitcoin. Remember, Bitcoin has a fixed supply. If there’s widespread adoption, not many people will be able to own 1 full Bitcoin in the future.

Technical and on-chain

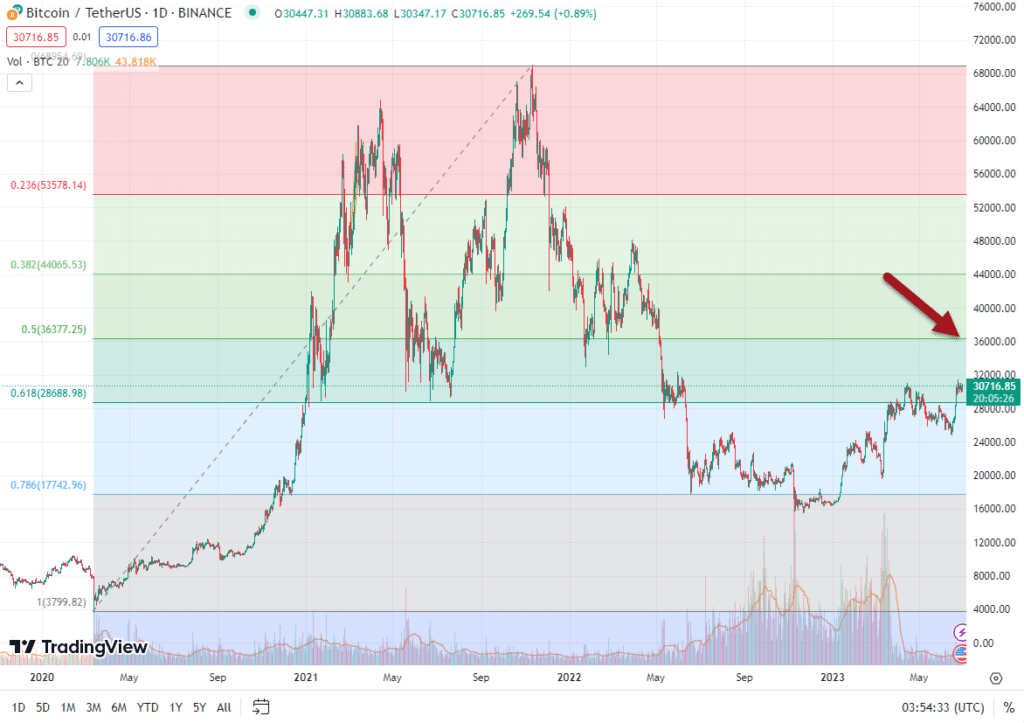

The current $30K level is a support and resistance zone. The next major stop is all the way up at $37.5K. If $30K is convincingly broken, expect a fast jump up.

Also of note, both $30K and $37.5K have been catalysts for major moves.

Looking at a log chart and notating the halving events, we see a hugely bullish picture and another argument for a $30K break being a major catalyst.

Applying Fibonacci levels, we get another indication there’s a large gap up to around the $37K level.

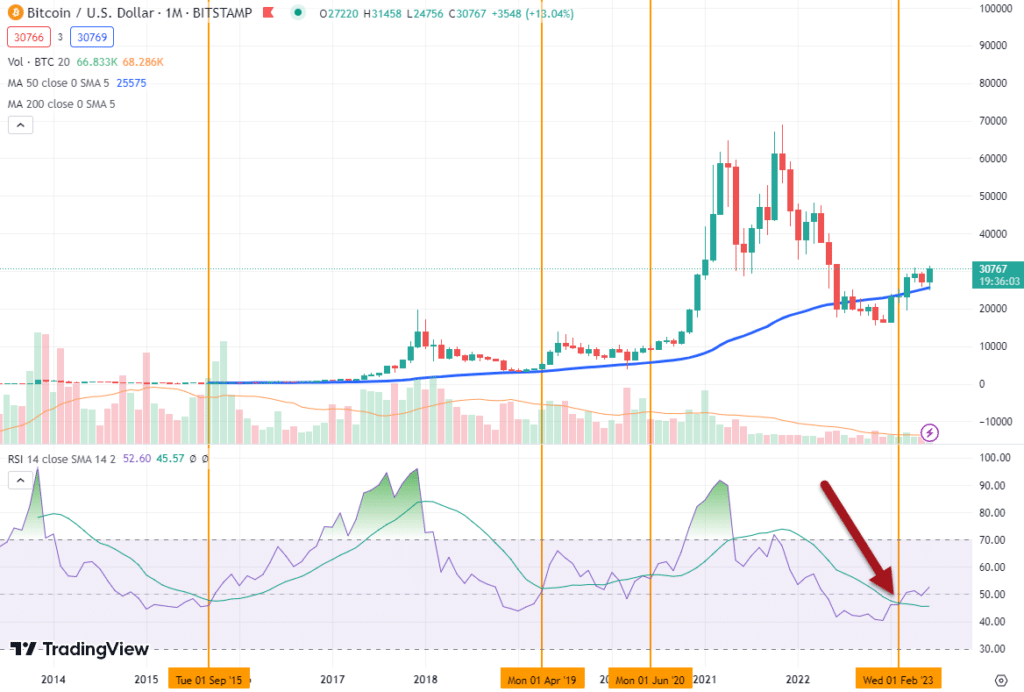

We don’t normally look at indicators, but the monthly RSI paints an interesting bullish picture in a pattern that has historically preceded major bull runs.

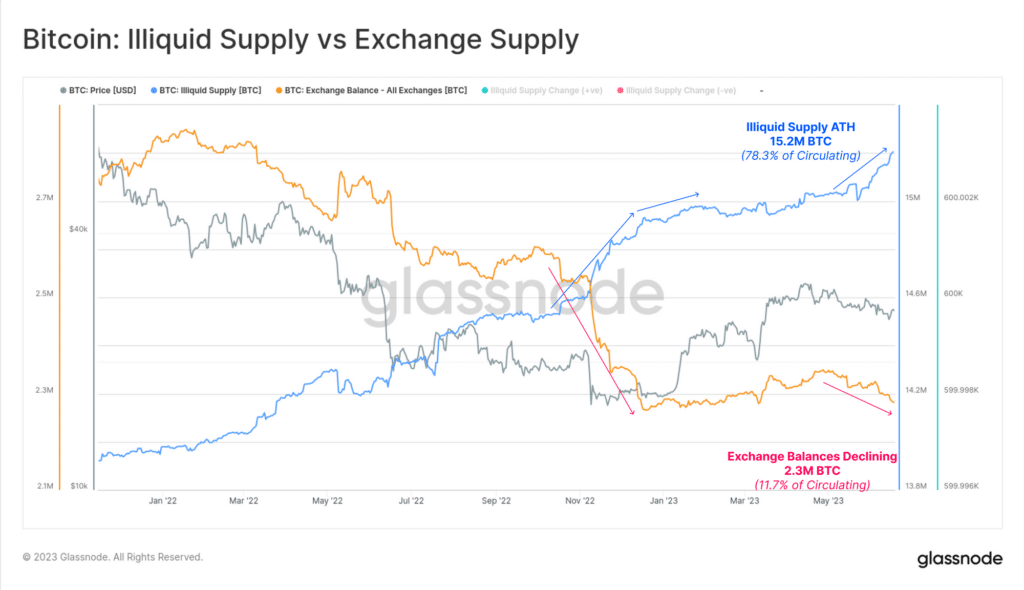

From an on-chain perspective, Bitcoin continues to flee off exchanges into long-term wallets (glassnode.com). Given the recent SEC actions, this isn’t surprising. But rather than flowing to Bitcoin wallets, the funds could have been exchanged into fiat and then withdrawn. So this is a bullish vote too.

Putting It All Together

In summary, Bitcoin has major potential ahead as buying pressure may go mainstream thanks to Wall Street, continued large-scale global adoption, and general credibility as it separates from other crypto projects and scams.

Additionally, there are traits of a classic “fear” market which are historic buy zones.

Here’s the timeless approach for handling markets in this state (same as last month):

- Move your crypto to your own non-custodial wallet at least while the industry dust settles.

- Minimize expenses.

- Determine a budget and diversified savings and investing plan. Bitcoin is a subset of this plan.

- Automate monthly Bitcoin investing so that you stick to your plan.

Questions and Comments

Do you have thoughts, comments, or criticisms of this analysis? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.