Insider Newsletter 8: August 2022

Are the markets setting up for a dramatic plunge or have we already seen the bottom?

In this month’s Insider Newsletter, we’ll break down Crypto-ML’s indicators, the macroeconomic picture, on-chain data, and technical indicators to help you tackle this market based on your risk tolerance.

Crypto-ML Data

Summary: Market sentiment is bearish, struggling to turn bullish. Prices are at a strong floor, but a break below $20,000 will rapidly transition sentiment back to extreme fear and break many Bitcoin growth-cycle models.

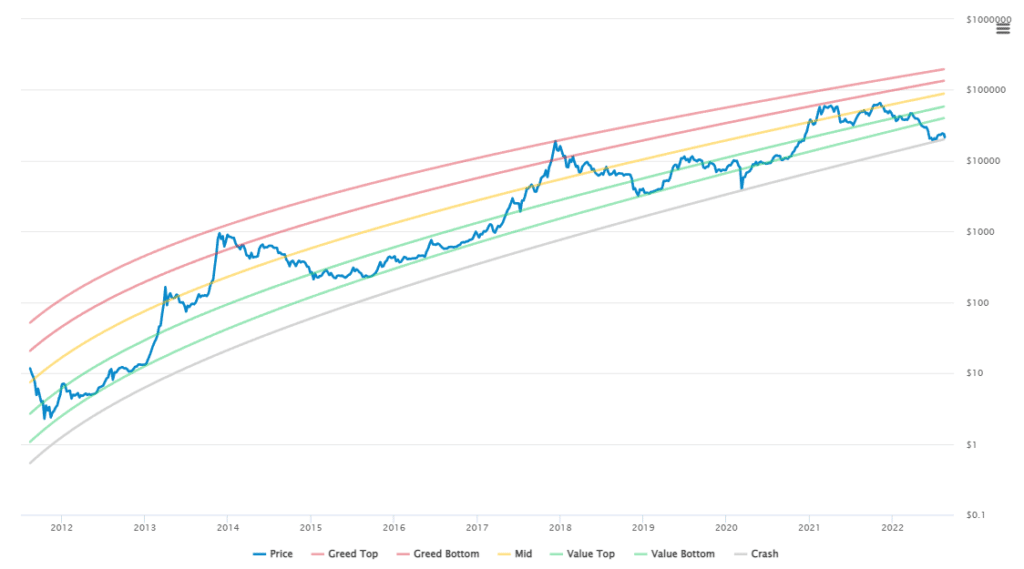

Price Channels

Bitcoin has remained in the crash zone since May. We are now seeing yet another test of this line.

This makes sense as the economy is in a mild recession and there has been endless bad news in the crypto sphere (such as LUNA, Voyager, Celsius, and Three Arrows Capital).

If Bitcoin is able to successfully recover, we can expect it to hop back into previous channels, with $40,000 as a floor.

If Bitcoin drops below the grey line, many of the “Bitcoin Cycle” and generalized “Asset Growth Lifecycle” models will break. But given historical patterns, expect $20,000 to be a solid floor.

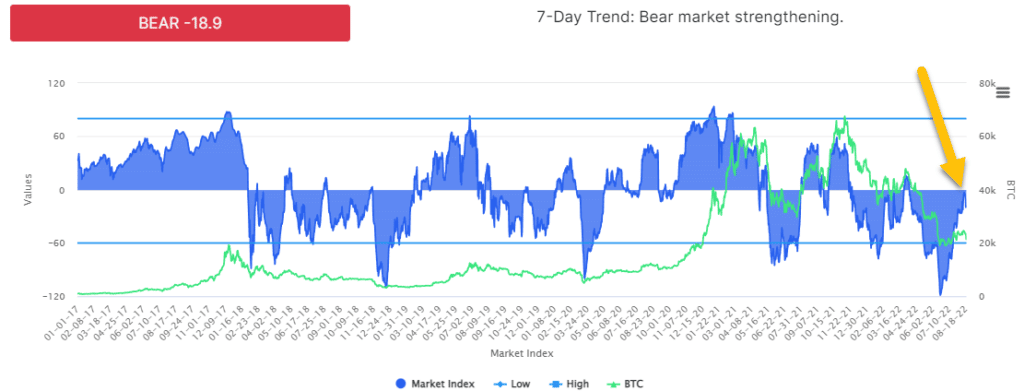

Fear and Greed Index

Sentiment began reversing in late June, heading rapidly toward a bullish stance. However, we still have not seen bullish sentiment.

That said, we are no longer in Fear or Extreme Fear. Though, with bad news, we may certainly drop back down. If price drops below the gray line in the Price Channels, expect fear to return quickly. As noted, that will signify the breakdown of many models, not just ours.

Earlier this week (August 14 through 16), our Fear and Greed Index flirted with crossing into bullish territory but instead began retreating on the 17th. The markets followed, dropping significantly on the 19th.

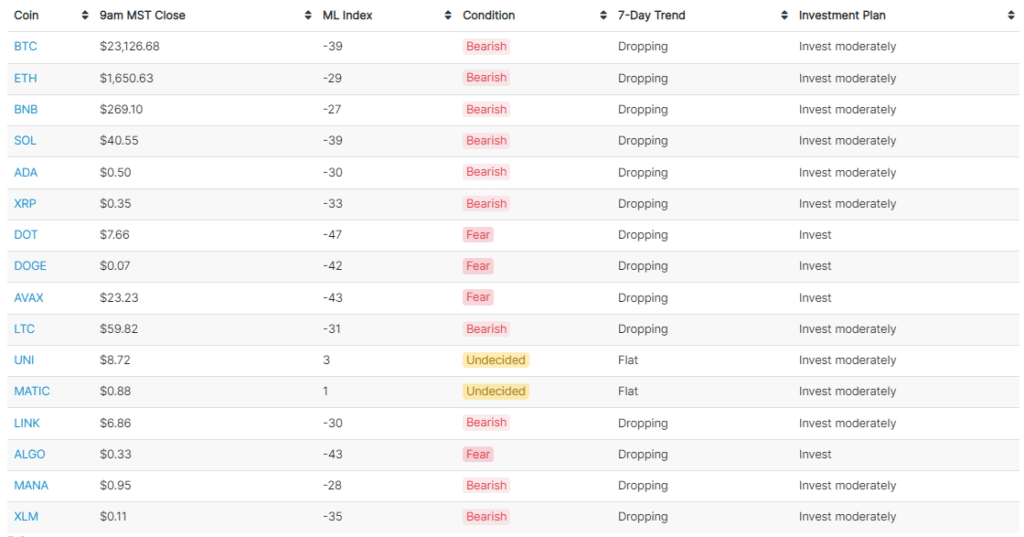

Outside of Bitcoin, some altcoins have dropped back down into Fear, including DOT, DOGE, AVAX, and ALGO. If you’re building positions, these may be good coins to shortlist for further review.

If you’re a long-term investor, remember that Fear and Extreme Fear represent historically-excellent buying opportunities.

Macro-Economic View

Summary: Economic indicators are mixed. Big companies are demonstrating defensive behavior. Markets approve of recovery plans, but any bad news could drop us into a severe recession. Recessions, even mild ones, tend to last 1.5 to 2 years, meaning we likely won’t fully recover until later 2023.

In previous newsletters, we’ve spent a lot of time diving into specific details about the economy that will drive institutional investor behavior and therefore Bitcoin price.

This month, that data is extremely mixed.

There are good news items:

- Unemployment rates in the UK, US, and elsewhere are excellent, hovering around historical lows (theguardian.com).

- US inflation flattened out month-over-month (tradingeconomics.com).

- Commodity prices (raw materials) have dropped significantly, which is a start to reduced inflation.

- 453 of the 500 companies in the S&P 500 have reported earnings, with 75% of them showing improvement over the prior quarter (npr.org). This beat analyst expectations.

But there are also bad news items:

- UK inflation hit double-digits at 10.1% outpacing expectations (theguardian.com).

- Those same companies that are posting better earnings are still worried about the economy over the next year. To combat this, they are cutting advertising and jobs (npr.org). It’s very valuable to see the behavior (not rhetoric) of big companies.

- The Chinese real estate market is in a crisis (cnn.com) and their companies are being delisted from US exchanges (washingtontimes.com).

People will debate the economy endlessly. But the truth is, no one knows what will happen next with certainty. Governments are executing recovery plans but there are also significant systemic risks.

So rather than further analyzing the minutia, this month, we’ll look at how the markets are reacting.

How the markets are reacting

Let’s look at what are people doing rather than what they’re saying.

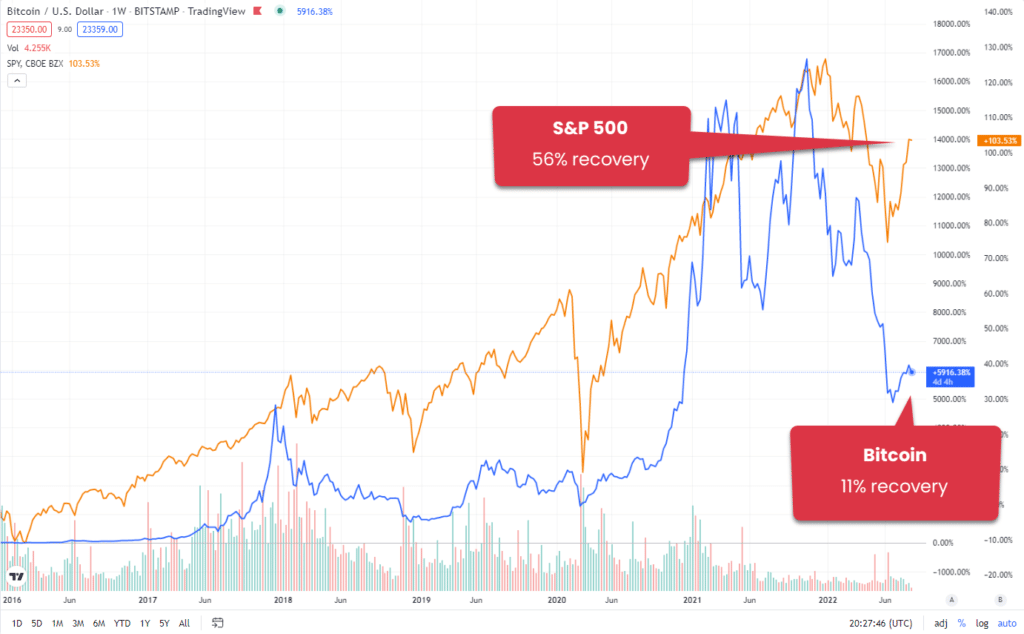

Measured here by the S&P 500, you can see there is a nice recovery in play. In fact, the general markets have moved more than halfway back up to previous highs.

This means participants believe the Fed is executing a plan that will get the economy under control.

Bitcoin, however, is not recovering as quickly. It has only regained 11% of its ground. As you can see in the chart above, Bitcoin has a history of trailing recovery.

This makes sense since it is a speculative asset for institutional investors. Money will begin piling back in only after the stability of traditional markets is established.

But watch out, once it does recover, it abruptly takes off. To be clear, this spread between the S&P 500 and Bitcoin paints a bullish case for Bitcoin long term.

Big warning: bond market

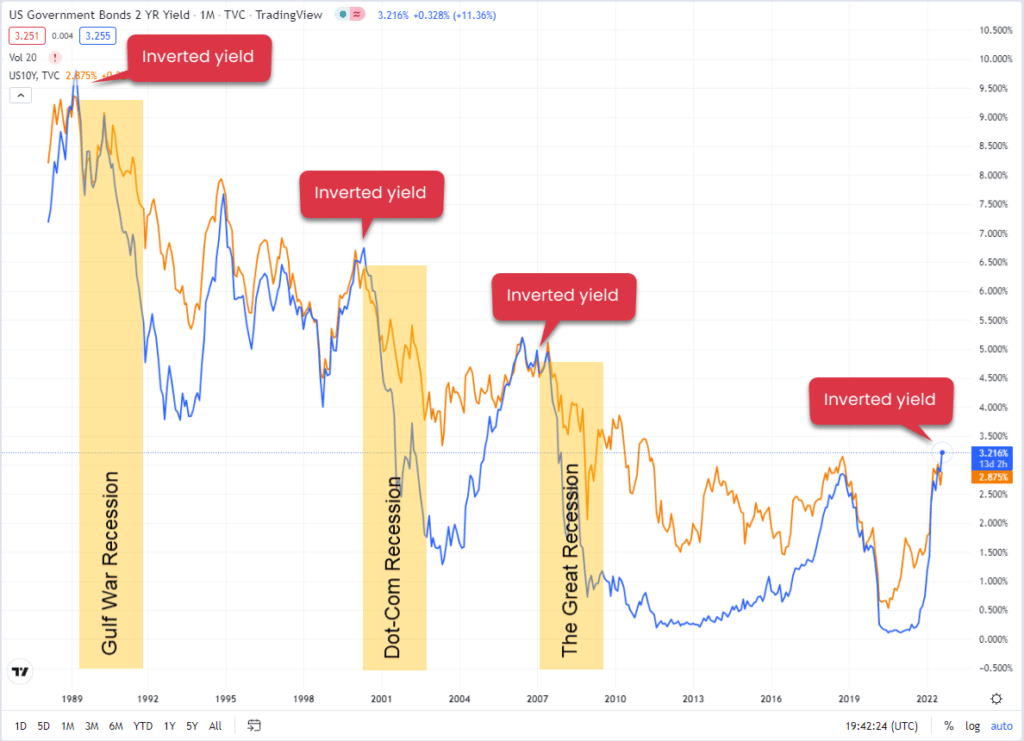

On the other hand, there is a serious warning on the bond market: the inverted yield curve.

This inversion happens when long-term bonds are paying less than short-term ones. This situation does not make rational sense. The longer you invest your money, the more interest you expect to earn.

In recent history, every time there is inverted yield (comparing 2-year to 10-year bonds), a recession follows.

This also holds from 1940 to the present (govinfo.gov), though you need to look at different spreads as bond offerings change over time.

See Insider Newsletter #6 for a full list of recessions.

Given this overall uncertainty and the fact that big companies are moving into defensive positions, it’s safe to say a bull market is not imminent. Inflation will take time to get under control. We will most likely continue to have choppy waters ahead for the next year or so.

Until there is more certainty, don’t expect big players to pile into speculative assets, such as cryptocurrencies.

- If you’re an aggressive investor, it may be worth taking the risk now, avoiding missing out if the market does recover successfully.

- If you’re nearing retirement or have a low-risk tolerance, the downside potential may simply be too great. In this case, don’t worry about missing out. Consider focusing on asset preservation and conservative positions for the next 1 to 1.5 years.

Regardless, be cautious and assume bad news could drop us into a severe recession rather quickly.

On-Chain Metrics

Summary: On-chain metrics are fairly positive, despite the questionable economy. Big accounts are buying heavily at current levels. This indicates a belief we’re near the bottom.

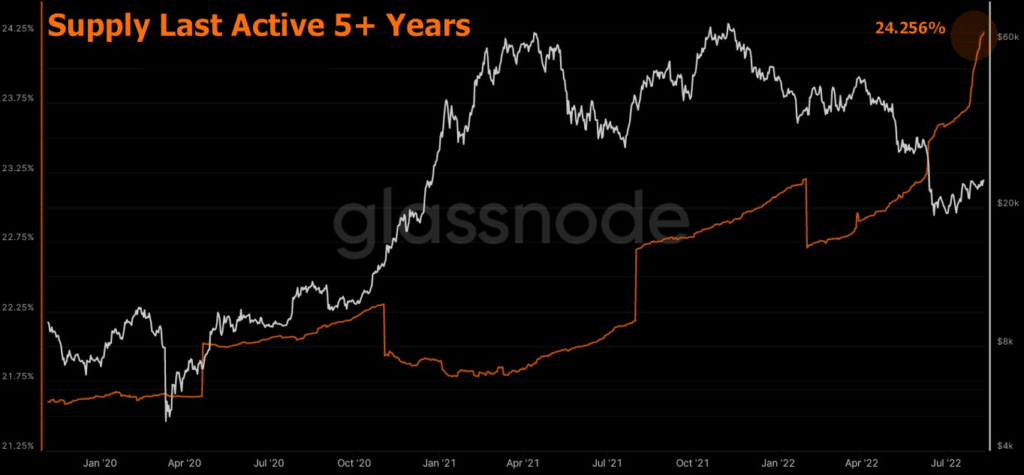

Holders are holding more than ever.

The orange line in this chart shows the percentage of Bitcoin supply that hasn’t moved in 5+ years. Now, nearly 25% of Bitcoin is officially in it for the long-term and has conviction about the future.

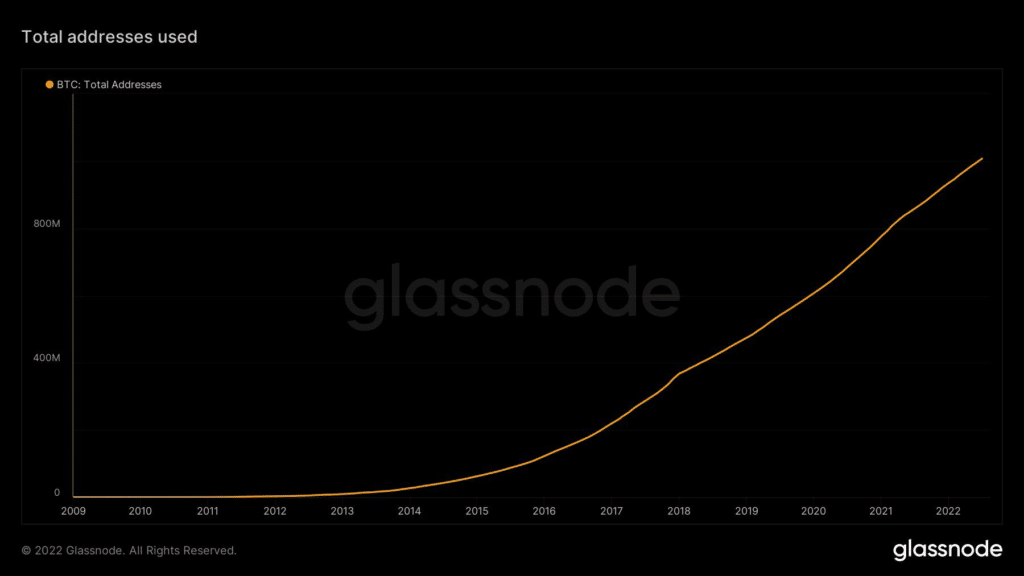

Bitcoin has also hit a huge milestone, crossing 1 billion addresses.

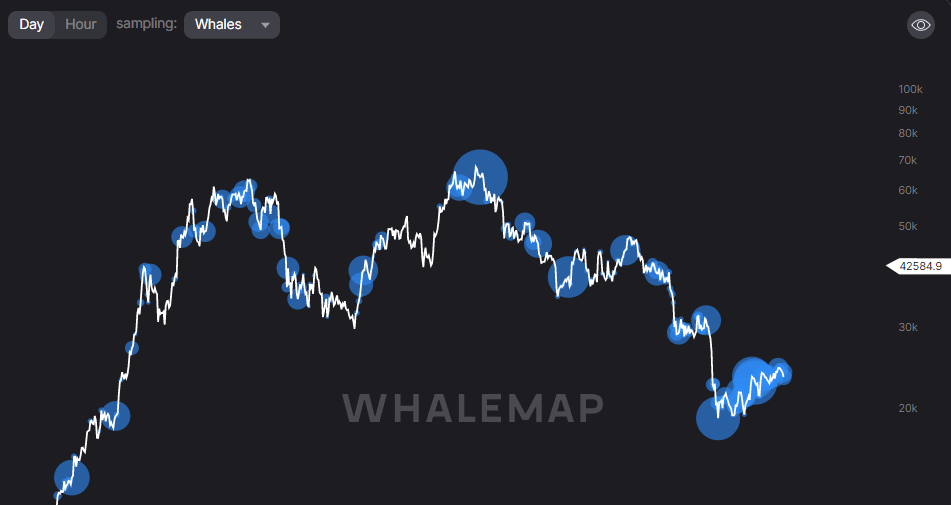

Whales have been buying and holding heavily since June, as indicated by the blue bubbles below. If you’re buying now, you’re in good company.

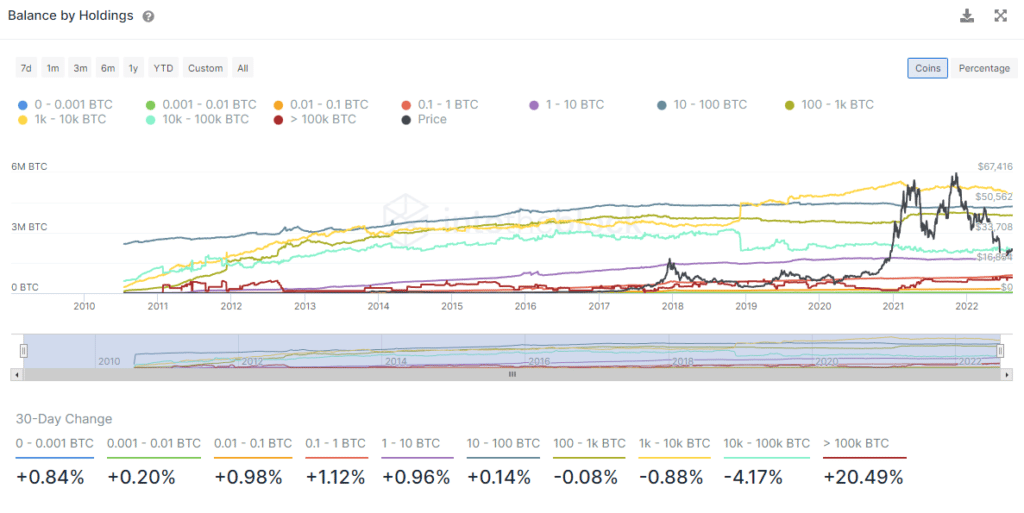

This can also be seen in balance by holdings, which shows the largest holders of Bitcoin (>100K) added a new member. This has caused the balance in that tier to grow by over 20%. There is also nice growth in the middle tiers.

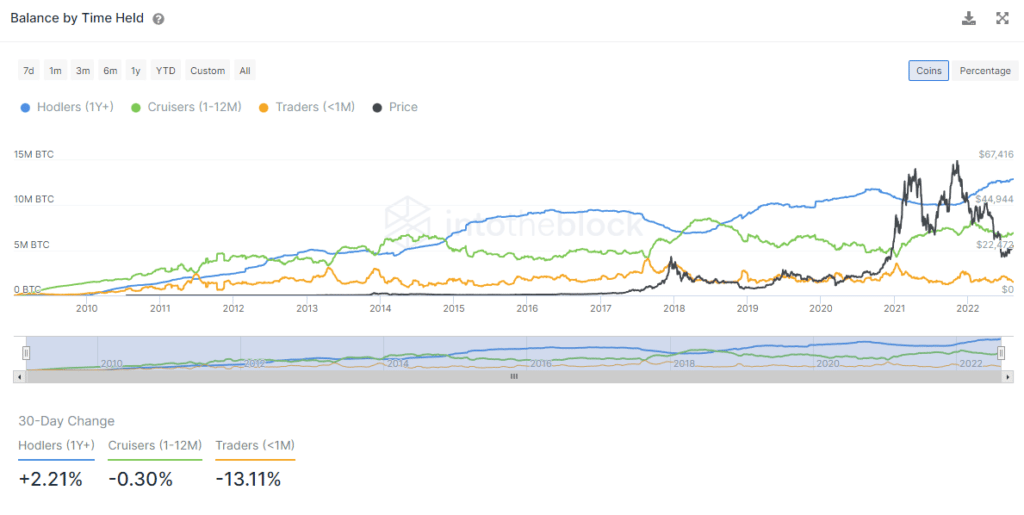

Looking at balances by time held, we can see long-term holders continue to grow and stay in Bitcoin. If you’re holding, you’re also in good company.

On the other hand, traders are participating less in the market. This indicates the perceived risk-to-reward ratio is not attractive and that traders expect more choppy, sideways action in the near term.

Technical Analysis

Summary: Technical analysis also shows a bottom may be in but recovery will likely not happen until later next year. This lines up well with the macroeconomic picture.

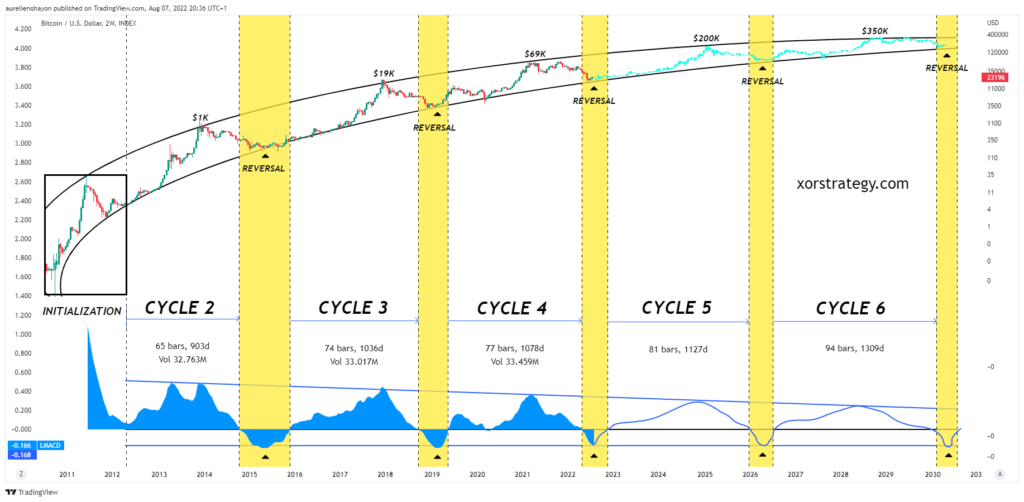

Many technical analysists have started posting long-term growth-cycle charts. These are actually similar to our Price Channels.

These charts tend to show:

- We’ll see a bottom sometime in 2022.

- Markets will stay fairly sideways through the first part of 2023.

- Toward the end of 2023, the next parabolic run will kick off.

This is similar to the macroeconomic picture and recession pattern.

Here’s a sample growth-cycle chart.

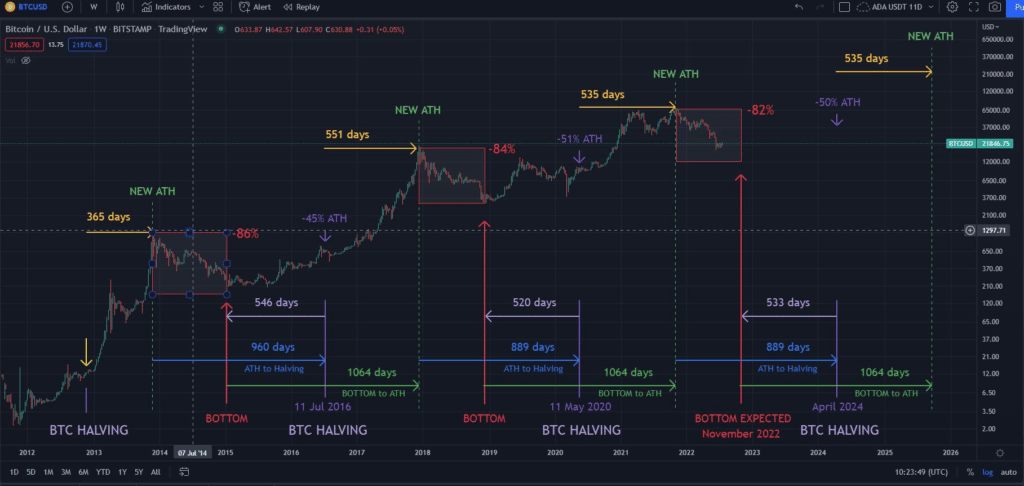

This chart looks at the two prior cycles but brings in halvings and a bit more detail. It puts the bottom in a little later, but ultimately paints a similar picture.

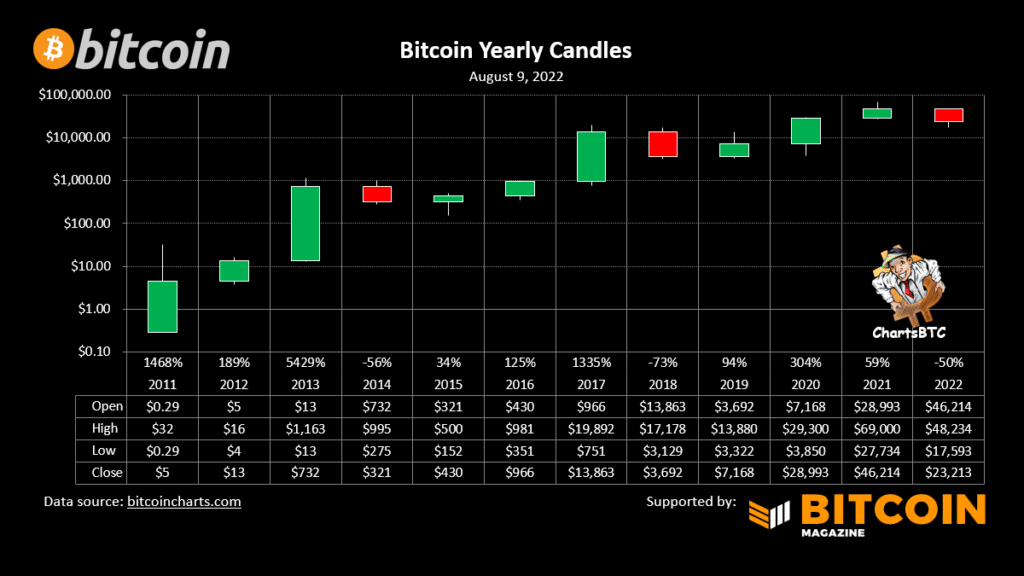

This cyclical pattern can also be seen in yearly candles, which show a 3 green, 1 red pattern. This suggests 2022 will close in the red but gains will follow.

You may notice the bottom of each green candle following the red is actually lower than the bottom of the red. This suggests 2023 will put in a low below or near 2022’s but will recover by the end of 2023. That matches all other data pointing to recovery starting later in 2023.

Looking at traditional technical indicators, we see:

- Trading volume growing significantly since May, biased toward buyers.

- The 13-period SMA has turned up, but price just dipped back down below. Bitcoin may quickly pop back above $22,000 to continue the recovery.

- Though not at extreme levels, overbought conditions in RSI, Squeeze, or other similar indicators have appeared. This indicates minor exhaustion in the rally.

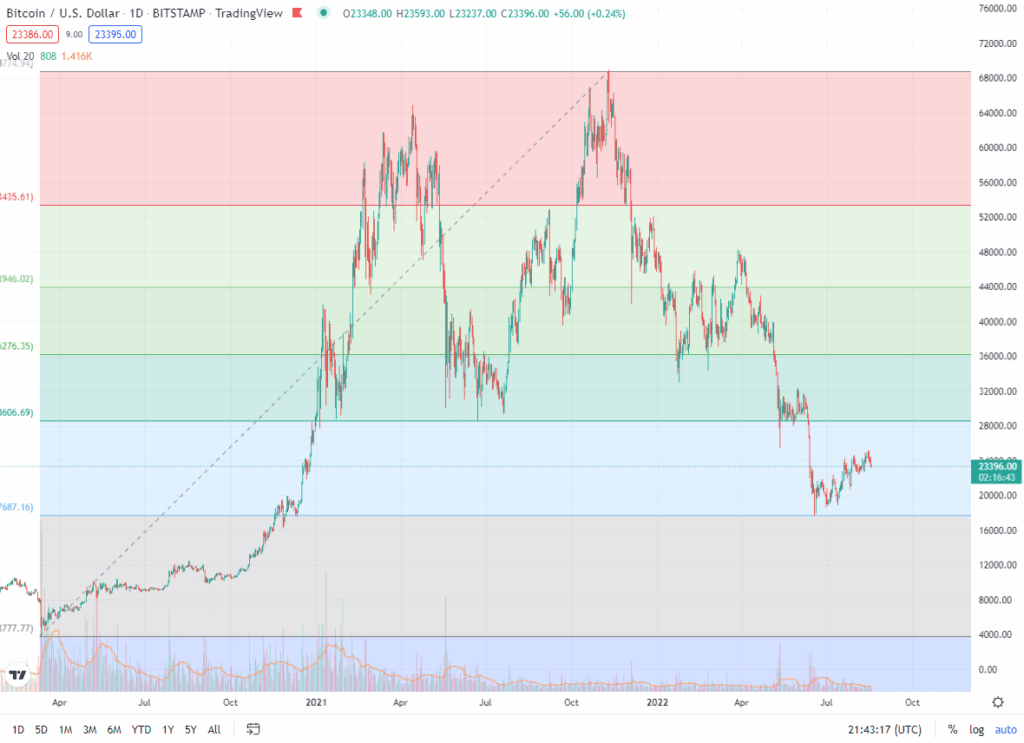

Support and resistance lines are holding up nicely, as can be seen by the Fibonacci levels stretching from the COVID 2020 low to the 2021 peak.

Based on this, we can expect significant resistance at the $28,500 level. This area has been a heavy battleground over the last couple of years.

It also means we could see a retest of the $17,500 level in a severe downside scenario.

Today’s drop makes for the formation of a rising wedge, which is generally bearish. This is reinforced by declining volume during this recovery. If price goes below $21,000, that would indicate a confirmation and likely breakout to the downside.

Putting It All Together

We are in a mild recession with the possibility of a severe recession. Big companies with access to vast data and professional analysts are taking defensive measures.

It is, however, possible that governments will navigate the global economy out of trouble successfully. Numerous indicators do show we are near the bottom.

- If you are willing to take risk and have a longer-term time horizon, dollar-cost-averaging into crypto assets now will help you avoid missing out, especially if we are indeed at a bottom. This is the approach big Bitcoin players are actively taking.

- If you are more risk-averse or are nearing retirement, consider sitting out until the data becomes less mixed. That may mean you sit on the sidelines until mid-2023.

Bitcoin has weathered tough news and a tough economy. It has proven itself as a valuable asset. But we should expect chop and emotion to dominate over the next 1.5 years.

Current Crypto-ML Portfolio

Actions speak louder than words, so here is how we’re handling our portfolios.

Specifically:

- Over the last few months during Extreme Fear, we deployed out of stablecoins fully into crypto. The stablecoin balance was built up during earlier periods of Extreme Greed.

- We are actively dollar-cost-averaging into crypto every month.

- We are continuously working to ensure each position earns interest.

That last point is important. We are not relying on appreciation alone. Earning interest also means our investments are buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

If you’re investing for the long term, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

Stablecoins: 0% (0%)

- This balance has been completely phased out during “Extreme Fear.” It originally consisted of profits that were booked during “Extreme Greed.”

BTC: 41% (-7%)

- Long-term hold

BNB: 40% (+3%)

- Earning interest through staking

- This position became outsized due holdings acquired prior to BNB’s rapid rise in early 2021.

- Though not decentralized, Binance will still have a major role to play in the crypto space in the foreseeable future. The deflationary monetary policy is also attractive.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023. Some portion of BNB will likely stay as a long-term holding.

ETH: 15% (+7%)

- Earning interest through staking

- Long-term hold

ADA: 1%

- Earning interest through various means

- Long-term hold

DOT: 1%

- Earning interest through various means

- Long-term hold

Other: 2% (+100%)

- This group consists of 15 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Questions and Comments

Have comments or questions? Please let us know in the comments below. For private matters, Contact Support.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.