Insider Newsletter 17: May 2023

Overall, it appears the markets are taking a breather before heading into the next leg of a rally. This is natural profit-taking behavior and part of a healthy, sustainable market. This picture can be seen across our AI, crypto news, economic picture, technical analysis and on-chain data.

But there is also some concern that the rally may be fading entirely.

So how do you play indecisive markets?

Actions We’re Taking

Going back through our newsletters, you can now see the actions we’ve taken since January 2022. Whether profit-taking during greed, reallocation into crypto during extreme fear, or dollar-cost-averaging during times like this, you can see how our strategy opposes the general market sentiment.

Our AI tools are built to help us measure this sentiment from different angles.

With indecision in the air, it’s good to remember your long-term goals. We’re in it for the long haul and are taking counter-market measures to invest during times of fear and take profit during times of greed. Times like now are ideal for measured dollar-cost-averaging.

If you’ve been following us for months, it will be no surprise that we’re still dollar-cost-averaging in at these prices.

Here’s the same update from last month(s):

- Continuing to dollar-cost-average into BTC.

- Staying prepared to invest lump sums into BTC if the market takes another leg down.

- Keeping all funds off exchanges.

We bought continuously and aggressively during the second half of 2022, so we’re also ready to sit back and enjoy the ride-up if the market does go on a run. Our Market Index helped us invest while others were fearful.

If the market stagnates or drops, we’ll continue to buy more. In the meantime, we’re dollar-cost averaging into Bitcoin at a moderate pace.

Automated Dollar-Cost-Averaging

This is not meant to be a pitch for Swan Bitcoin, but it has become our primary method for dollar-cost-averaging into Bitcoin during the markets over the last 7 months. The main advantage is it offers full automation into your own wallet.

Prior to October 2022, we were following the Market Index and manually purchasing Bitcoin each month.

In October, we switched over to using the DCA automation in Swan Bitcoin. We’ll shut it off when the Market Index moves us into greed territory.

With Swan, you can setup:

- Automated purchases of Bitcoin each week (0.99% fee)

- Automated withdrawals to self-custody wallets (no fee)

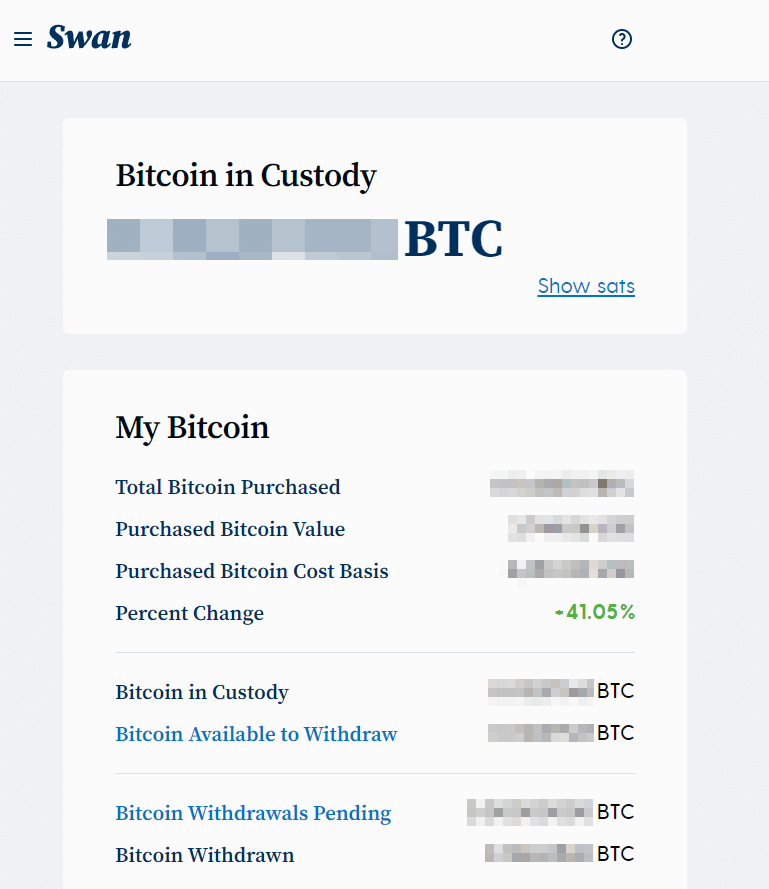

That means we’ve had automated DCA over this period:

Which has resulted in a nice +41.05% return on our investments so far. That’s with zero effort and thought. Automation removes any mental hoops you might normally have to jump through.

If the market drops, we’ll do heavier manual purchases.

If the market starts becoming overheated (based on the types of items we’ll discuss below), we’ll switch and begin taking some profit off the table for future reinvestment once greed leaves and fear returns.

If you’re interested in trying Bitcoin for your investing automation, here are a couple of links:

- Affiliate link (you and Crypto-ML get a $10 deposit): https://www.swanbitcoin.com/crypto-ml/

- General link: https://www.swanbitcoin.com/

Crypto-ML Data

Positive sentiment in the market has dropped, but it is good to have a pause in healthy rallies. Our AI shows an upcoming test of $35K before retreating back down to current levels.

30-Day Price Prediction

Our AI is showing June will see a pop above the $30K Bitcoin mark with a failed break of $35K.

Last month, our 30-day price predictions called for a failed battle at the $30K level, which is what happened. Our AI is now indicating this battle will move up to the $35K level in mid-June and then come back down below $30K by the end of June.

| Date of Prediction | Price at Time | Prediction Price |

| 5/1/2023 | $28,066.53 | $34,573.62 on 5/31/23 |

| 5/2/2023 | $28,651.40 | $33,144.81 on 6/1/23 |

| 5/3/2023 | $29,054.03 | $33,454.66 on 6/2/23 |

| 5/4/2023 | $28,873.38 | $33,929.41 on 6/3/23 |

| 5/5/2023 | $29,573.75 | $33,437.57 on 6/4/23 |

| 5/6/2023 | $28,870.10 | $33,482.37 on 6/5/23 |

| 5/7/2023 | $28,643.19 | $33,736.54 on 6/6/23 |

| 5/8/2023 | $27,630.78 | $33,377.62 on 6/7/23 |

| 5/9/2023 | $27,668.00 | $32,352.71 on 6/8/23 |

| 5/10/2023 | $27,622.00 | $32,810.40 on 6/9/23 |

| 5/11/2023 | $27,016.00 | $32,048.93 on 6/10/23 |

| 5/12/2023 | $26,818.00 | $31,151.08 on 6/11/23 |

| 5/13/2023 | $26,790.00 | $34,045.61 on 6/12/23 |

| 5/14/2023 | $26,937.00 | $34,019.23 on 6/13/23 |

| 5/15/2023 | $27,190.00 | $31,717.37 on 6/14/23 |

| 5/16/2023 | $26,987.58 | $30,405.18 on 6/15/23 |

| 5/17/2023 | $27,363.62 | $31,322.69 on 6/16/23 |

| 5/18/2023 | $26,885.06 | $32,750.68 on 6/17/23 |

| 5/19/2023 | $26893.19 | $32,037.52 on 6/18/23 |

| 5/20/2023 | $27,095.69 | $32,106.10 on 6/19/23 |

| 5/21/2023 | $26,724.33 | $31,834.82 on 6/20/23 |

| 5/22/2023 | $26,868.43 | $30,562.36 on 6/21/23 |

| 5/23/2023 | $27,213.63 | $28,424.80 on 6/22/23 |

| 5/24/2023 | $26,276.26 | $29,941.02 on 6/23/23 |

| 5/25/2023 | $26,490.40 | $29,210.00 on 6/24/23 |

| 5/26/2023 | $26,668.01 | $29,622.46 on 6/25/23 |

| 5/27/2023 | $26,827.08 | $29,827.87 on 6/26/23 |

| 5/28/2023 | $28,343.42 | $28,787.92 on 6/27/23 |

| 5/29/2023 | $27,707.58 | $29,673.84 on 6/28/23 |

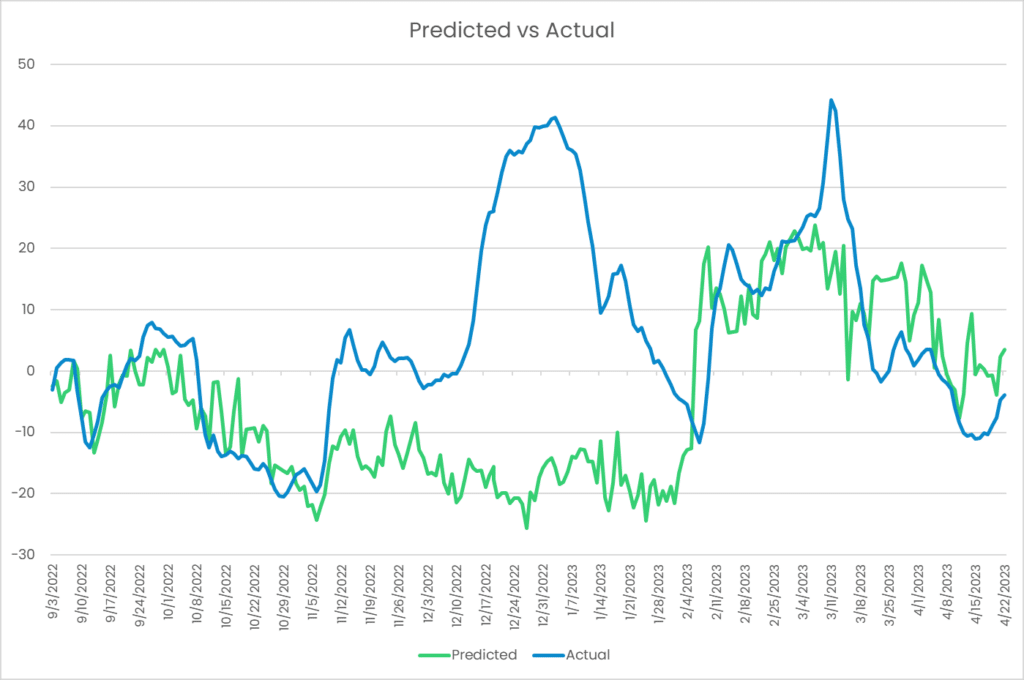

The chart below covers the prediction-versus-actual performance of Bitcoin. Apart from the break in November through January, which was caused by misreported 2-year bond rates (we’ve since changed providers), the predictions have generally matched market direction and have even predicted direction changes.

Price Channels

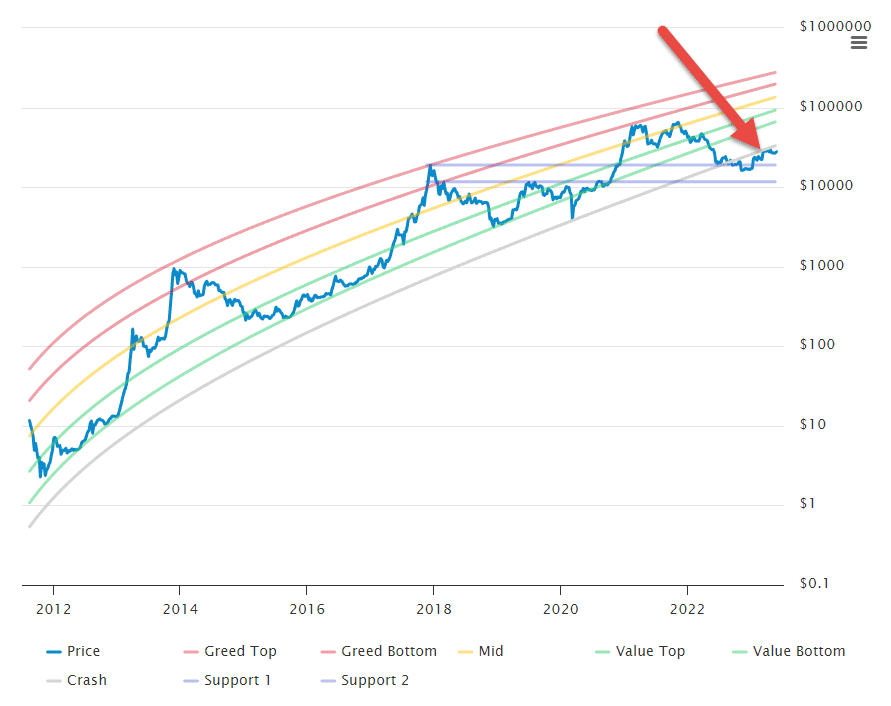

Bitcoin is struggling to reenter its growth regression model that defined its movement for years up until it broke in August of 2022.

The Price Channels look at logarithmic regression channels. Even in that view, you see clear resistance that Bitcoin is hitting against.

The crash line now appears to be acting as resistance.

The good news is that assuming this growth model holds into the future, Bitcoin is still in a strong buy zone.

As noted last month, this may go down in history as the time Bitcoin was suppressed due to recession, war, hasty crypto regulation, and broader financial system turmoil.

Market Index

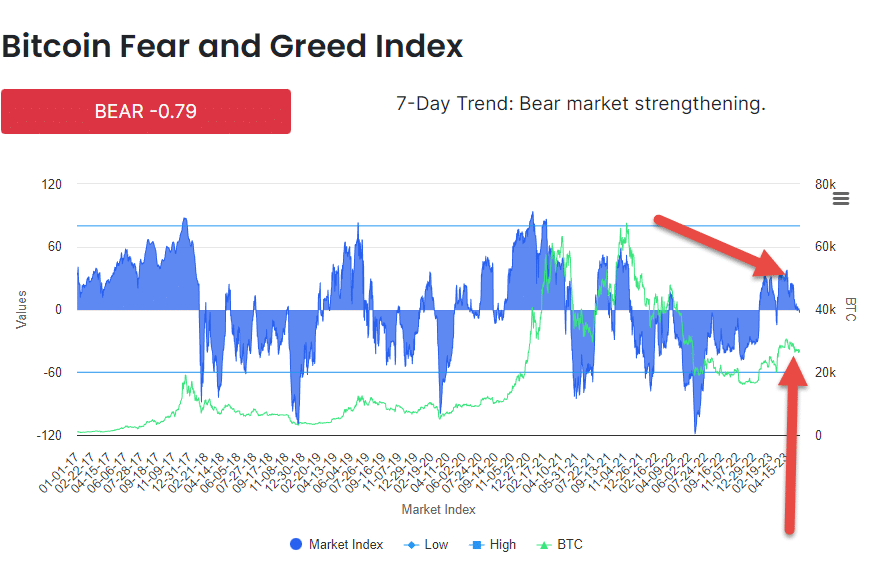

Since mid-April, Bitcoin price has been relatively flat. However, the Market Index has been dropping sharply.

The Market Index is telling us there is less greed in the market. This is measured by social & search sentiment, technical analysis, and Bitcoin dominance.

We’re not in a fearful market yet, but it shows indecision as people wait for the next move.

Commentary

While the rally has taken a pause, there are potential catalysts on the horizon. We see these across news, fundamentals, and technical charts.

Crypto news

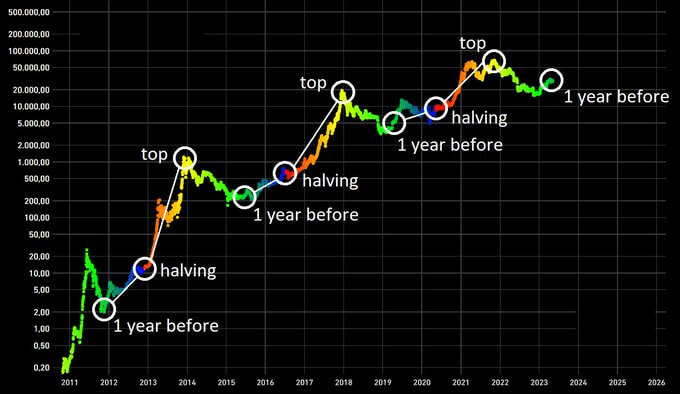

1. Bitcoin Halving Excitement: Each time we hit a halving, the mining block reward size reduces by 50%, effectively making the flow of Bitcoin slower and therefore reducing the supply side of the equation. Reduced supply equals higher prices, all things equal.

Historically, this has driven large bull markets. The next halving is targeted at around April 22, 2024, which means we’re just under a year out. As you can see in the chart below, a familiar pattern plays out with each halving.

Is it guaranteed to happen again?

Definitely not. There have only been a few samples in the past. But there are technical and psychological reasons for this to occur again. We may see earlier selling this next wave though as people attempt to pre-empt losing out after the top.

2. Bitcoin’s Blockchain Boom: Daily transactions have skyrocketed to an all-time high of 682,000 this month, primarily driven by the creation of BRC-20 tokens, the first class of crypto tokens built on the Bitcoin blockchain (reuters.com).

The BRC-20 frenzy saw the total value of these tokens surpass $1 billion in early May, highlighting the increasing interest in the use of Bitcoin’s blockchain for developing new coins and applications. However, this rapid creation of tokens has also led to increased transaction costs and network congestion.

3. Investor Sentiment: Crypto investment products have been witnessing outflows for the past five weeks, with trading volumes hitting their lowest level since late 2020. Bitcoin has been struggling to break above $30,000, even dropping below $27,000. This negative sentiment is largely concentrated in Bitcoin, with $32.7 million in outflows reported in the week ending May 19.

Analysts predict continued sideways trading in the current range until a new catalyst comes along (cnbc.com).

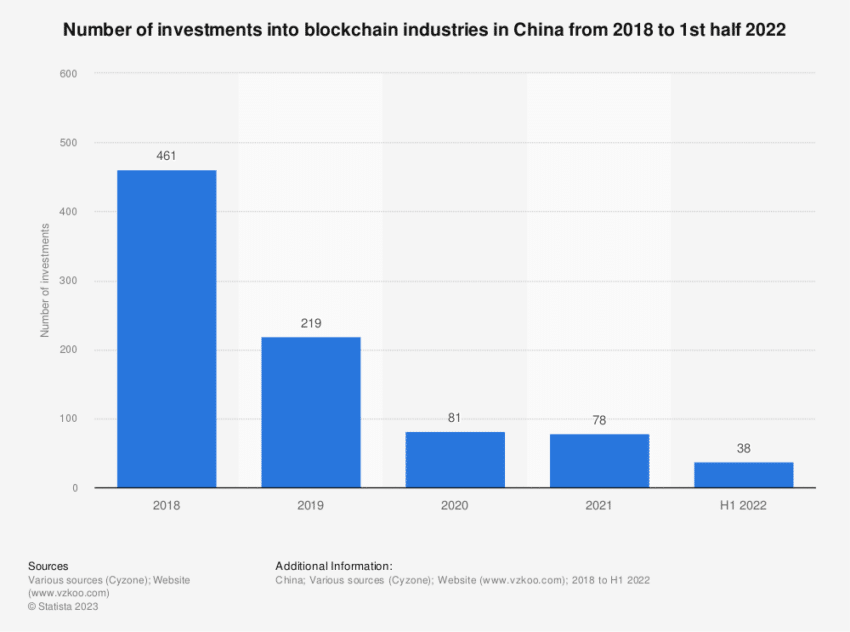

4. China Potential Lift of Crypto Ban: China has banned and sanctioned crypto in various forms back to 2013. However, there are indications China is seeing blockchain and crypto as a space for innovation and investment as China calls for a re-evaluation (beincrypto.com) to avoid missed opportunities. This is huge as China has the 2nd largest GDP and 2nd largest population.

This excellent article dives into many additional details: https://beincrypto.com/what-happens-if-china-lifts-crypto-ban/.

Technical and on-chain view

Short-term, there is not much exciting happening with Bitcoin charts. Price has been stagnant.

However, we are seeing interesting patterns on the long-term and log scales.

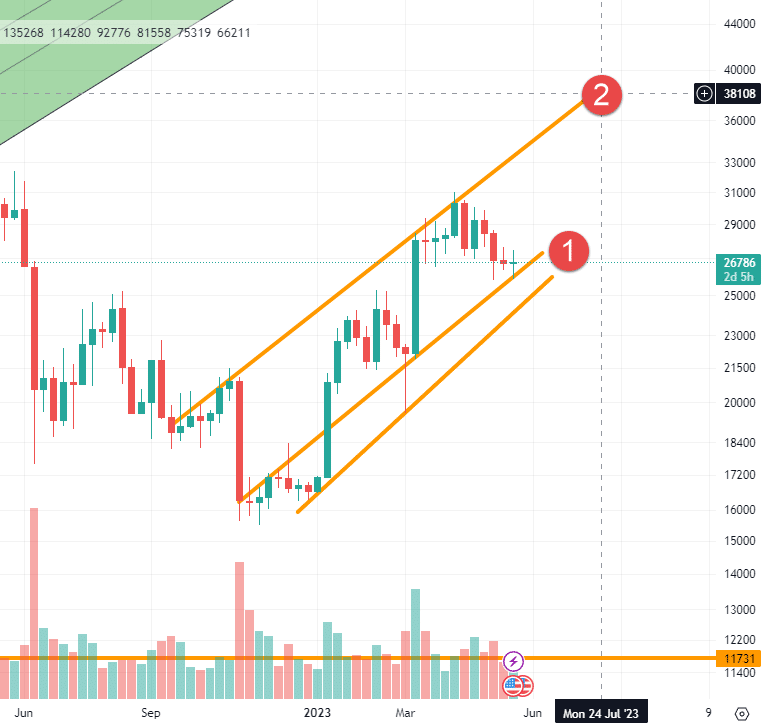

Going back to the start of 2022, we can see a massive triangle pattern. This pattern will need to break by June 23 (1) as the two lines connect. As our AI noted, the break may occur mid-June.

Zooming out further to look at this pattern from a monthly perspective, a giant bullish flag emerges with the mast (1) and flag (2).

From a support and resistance perspective, a strong channel has been in place on the log-scale chart since September of 2022. These log patterns can play out for a year or more.

We see a bottom may be forming now that will likely solidify in mid-June (1). From there, the next target would be $38K in late July (2).

That said, $25K is the critical line to watch. That is a psychological point as well as the near-future bottom of the lower channel.

On top of that, $25K is currently the weekly SMA200 line. Apart from the break in mid-2022, Bitcoin has always stayed above this line. It has acted as support through very tough periods, including COVID (2), the crash of 2018 (3), and markets before (4).

If that breaks, we will enter a new regime and may see a fast drop to $20K.

Exchange inflows are near historic lows and have been on a consistent decline since mid-2022. This might indicate people are following the “not your keys, not your coins strategy,” but generally this means people are not trading Bitcoin now. It can mean they are holding balances off-exchange for the long term, despite what CNBC said above.

Glassnode noted we’ve recently seen $400 million in Bitcoin withdrawn from exchanges in a single day. This follows $800 million leaving exchanges just 11 days prior.

This paints a more bearish picture, showing interest in trading Bitcoin is dropping, which typically happens during bear markets. It may also mean more people are waiting in their own wallets and trying to avoid problems with exchanges.

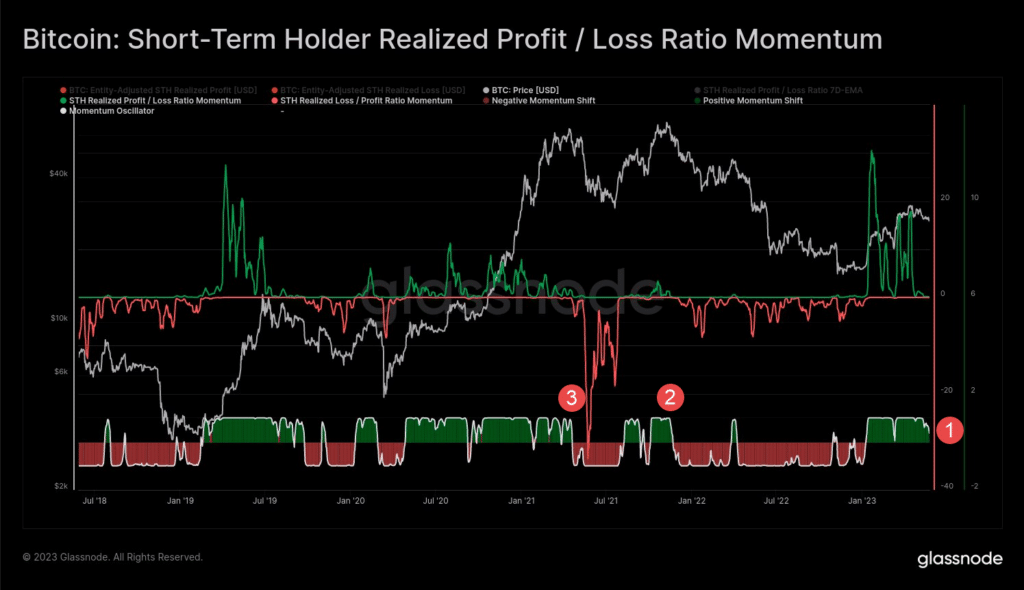

This view of “short-term holder realized profit/loss ratio momentum” is yet another way Glassnode slices the behavior of different types of accounts. Regardless of the convoluted name, it’s meant to show how short-term holders are behaving. They may be a leading indicator of overall market momentum.

In the momentum indicator along the bottom, you see momentum in the bull market is waning (1). While not a perfect indicator, this has happened before ahead of bearish movements, such as (2) and (3). Though it’s not confirmed red and it’s also not a perfect indicator. We’ll keep an eye on it though. In many ways, this is the same pattern you’re seeing on our Market Index.

Macroeconomic view

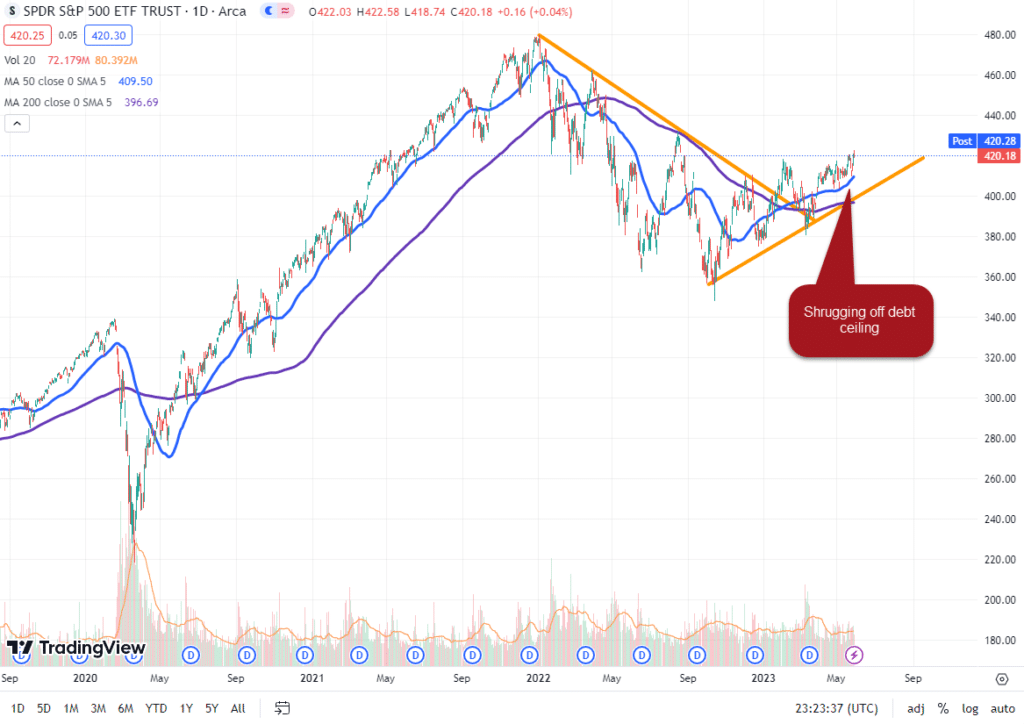

Short-term noise is keeping markets indecisive.

The debt ceiling tends to be dominating headlines and Twitter. Fundamentally, this means US debt is about to exceed the approved limit.

Here’s why this is a non-event though. Events such as the debt ceiling and federal budgets are regulars in the news cycle. These topics are divisive and act as scare tactics to get you to consume the news.

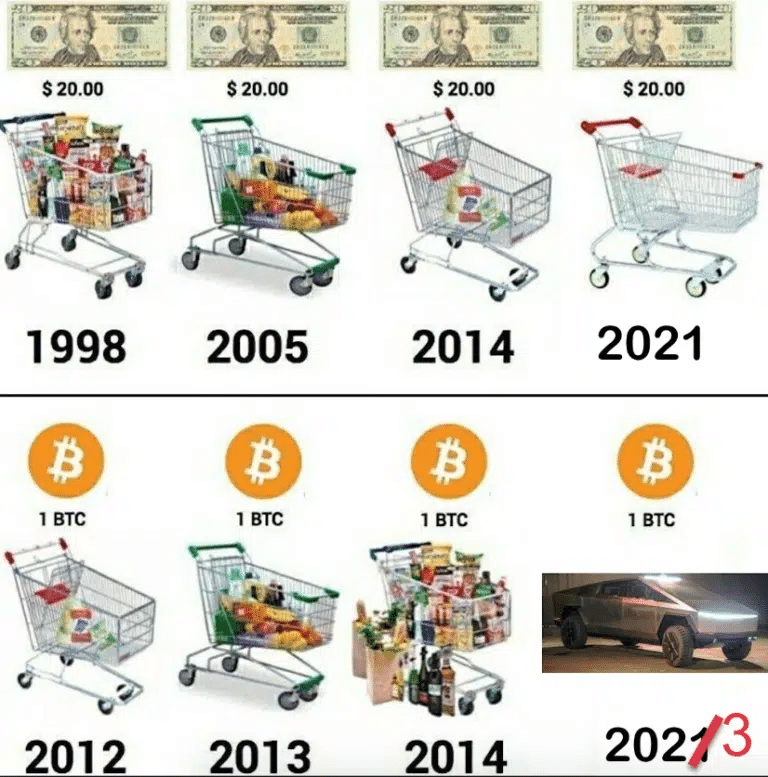

The US will not default. The government may marginally cut expenses and juggle around the budget. But more than likely, we’ll see more money flow into the system, debt limits get raised, debt terms be extended, or some other set of actions that ultimately devalue the dollar and economy over the long run, reinforcing this:

If fact, a tentative agreement has been reached days before “default” (abcnews.com).

Since markets respond to the news, any significant updates regarding these negotiations could serve as a potential catalyst for crypto markets because an agreement could improve risk appetite across stock and crypto markets (cnbc.com).

Putting It All Together

In summary, we’re seeing mixed appetite for investing across the board. Across multiple measures, odds appear to favor a moderate rally in the next month. Regardless, here’s a timeless approach for handling indecisive markets (same as last month):

- Move your crypto to your own non-custodial wallet at least while the industry dust settles.

- Minimize expenses.

- Determine a budget and diversified savings and investing plan. Bitcoin is a subset of this plan.

- Automate monthly Bitcoin investing so that you stick to your plan.

Questions and Comments

Do you have thoughts, comments, or criticisms of this analysis? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.