Increase Your Bitcoin Quantity by Trading the USDBTC Pair

In crypto trading, different individuals have different goals. Some may want to trade in and out of Bitcoin to maximize their US Dollar (or other fiat) account value. Others may want to trade in and out of USD to maximize their Bitcoin holdings. While these two goals sound similar, they actually require different strategies and tactics. To address this, Crypto-ML now has a new USD/BTC trading pair in addition to the existing BTC/USD trading pair.

This post covers the differences from both the trader’s perspective and the machine learning perspective.

BTC/USD Compared to USD/BTC

If you are familiar with Forex, you’ll be familiar with this convention of quoting.

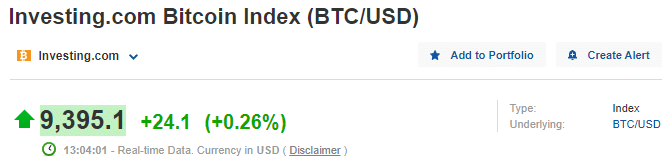

If we consider BTC/USD:

- BTC is the base currency.

- USD is the quote currency.

As a result, you’ll see how many US Dollars it takes to buy one Bitcoin. Here’s how it looks on Investing.com:

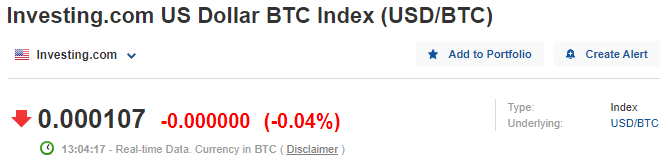

Likewise, we can have USD/BTC:

- USD is the base currency.

- BTC is the quote currency.

As a result, you’ll see how many Bitcoin it takes to buy one Dollar. Here’s how it looks on Investing.com:

You’ll notice the differences in price, direction, and change percentage.

Determine Your Goal Before Choosing a Model

At a high level, our signals will break down into the following categories:

| Trading Pair Model | Goal |

| BTC/USD | Maximize fiat holdings by trading in and out of Bitcoin. |

| USD/BTC | Maximize Bitcoin holdings by trading in and out of US Dollar. |

| ETH/USD | Maximize fiat holdings by trading in and out of Ethereum. |

| BCH/USD | Maximize fiat holdings by trading in and out of Bitcoin Cash. |

At first glance, these may seem similar. But, there are important differences.

Determining your goal:

- If your personal goal is to have as many Bitcoin as possible in the future, you would follow our USD/BTC model.

- If your personal goal is to have as much US Dollar as possible in the future, you would follow our BTC/USD model. Likewise, if you trade for regular income, this is also the model you would follow.

Machine learning implications:

Just as these models can be aligned to your goals, it’s critical to also align the machine learning goals. Machine learning always has a goal. It must have something it is optimizing toward so that it can create a model to achieve that goal as frequently as possible. Learn more about how to predict Bitcoin price with machine learning.

As such, if our models have the goal of maximizing USD, but your goal is to maximize BTC, you will not necessarily be happy with the results.

Due to this, the USD/BTC model will have an entirely different backend than the BTC/USD model. It will look for different patterns and make different recommendations.

USD/BTC vs BTC/USD in Practice

Our current BTC/USD model has some key characteristics:

- At rest, your balance is in USD (or comparable fiat or stablecoin).

- When our Neural Networks predict an increase in Bitcoin price, your balance will be traded into BTC. As soon as the run is done, your balance will be moved back to USD.

- Over time, your USD balance should go up.

This means the majority of the time (say 90% of the time), your balance is kept in USD. The other 10% of the time, you are in BTC to capitalize on a quick movement.

Our Trade History for BTC/USD is expressed in USD. That is the key metric our machine learning is working toward.

With the alternate USD/BTC model:

- At rest, your balance is in BTC.

- When our Neural Networks predict a relative increase in US Dollar price, your balance will be traded into USD. As soon as this is done, your balance moves back to BTC.

- Over time, the quantity of BTC you own should go up.

By comparison, in this situation, perhaps 90% of the time, your balance is in BTC. The other 10% of the time, your balance is in USD.

For this model, the Trade History will be expressed in BTC. That is the key metric our machine learning is working toward.

Trade Result Example

To show why this is important and how it may play out in the real world, consider this example:

- Use USD to buy 1 BTC at $5,000.

- BTC goes to $10,000. Sell 1 BTC to USD.

You have a 100% gain in USD, doubling your money.

- Now, BTC price moves up to $12,000 and you buy back in.

- BTC goes to $13,000 so you sell back to USD.

So while your USD value doubled, your BTC has dropped from 1 to 0.83:

| Holdings | Result |

| USD | +108% |

| BTC | -17% |

Here’s how the trades play out:

| USD | BTC | |

| Beginning Balance | $5,000 | 1.00 |

| Trade 1 | $10,000 | 0.83 |

| Trade 2 | $10,833 |

Now, if you open another trade and BTC is once again higher, you will have an even smaller quantity of BTC that you can buy.

This example shows how your USD quantity can go up while your BTC quantity goes down.

Of course, in the real world, you will see bull markets, bear markets, and considerable fluctuation in between. Regardless, the principles you see in this example will apply. And over enough time, if your personal goal isn’t aligned with the machine learning model’s goal, you will not be happy with the results.

Getting Started

This new trading pair is now available on Crypto-ML along with some additional changes:

- Updates to the Member Dashboard, namely for the trade alerts, showing more information on open and closed positions, such as current profit, targets, and stop-loss points.

- BTC-Conservative was retired and replaced with USD/BTC. Due to the recent risk management features added to all of our models, the need for a Conservative-specific model is diminished.

Questions or Comments?

Let us know in the comment below, discuss on our Community Forums, or join us on Telegram.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

6 thoughts on “Increase Your Bitcoin Quantity by Trading the USDBTC Pair”

Leave a Comment

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.

This is great. I have been looking for a model for this trading. Great job.

Great. Glad to hear.

When would this be available for auto trading?

Hello and thank you for the question. It is currently available for Auto Trade.

I know you don’t give advice…. but would it make sense to divide one’s account in half between the USD/BTC and the BTC/USD strategies?

Hey Crypter, I’ll take this question. That is absolutely an approach you can take. You’d need to split your funds into two different portfolios (if on Coinbase Pro) or into two subaccounts (in on Binance) so they can trade independently.

In general, it’s good to have a portion of your funds in a trading account, which would be the BTC/USD.

And if you believe in the long-term vision of Bitcoin, you’d have a portion of your funds in a longer-term account (aka HODL). In that account, you could use our USD/BTC model to attempt to maximize the quantity of your Bitcoin.