Stop Losses for Crypto-ML

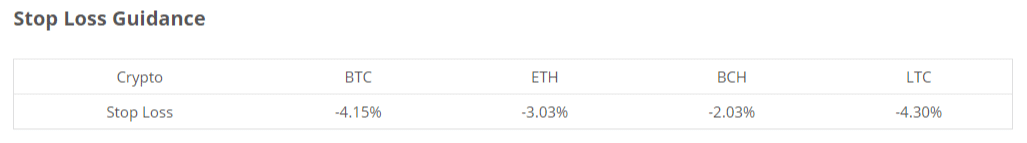

Crypto-ML provides trade alerts derived from machine learning that should identify ideal points to open and close positions. With Release 3.0 of Crypto-ML, a unique system identifies ideal stop loss points. This information is published on the Member Dashboard.

Please note that no system is flawless and individual traders have unique risk tolerance and goals. As such, you’ll find a deeper discussion on stop losses in this post that you can apply back to your trading system and usage of Crypto-ML Trade Alerts.

Crypto-ML and Losses

Crypto-ML holds a strong trade history of issuing trade alerts that successfully increase a trader’s account balance. This trade history is based on actual trade alerts delivered to Crypto-ML customers. In reality, though, the machine learning models continue to learn, evolve, and improve. In backtesting and hypothetical (non-production) scenarios, the modern models provide substantially better results than are seen on our public trade alert history.

As of this writing, during the period Crypto-ML has been live, it has delivered a 236% gain compared to a -4% return for the benchmark of “buy-and-hold.”

These results are achieved primarily by allowing winning trades to run and losing trades to be cut short. Said another way, losses do occur.

Even with advanced machine learning, the market can and will move against trade alerts. Also, there are particular risks associated with the cryptocurrency market, which means market moves can be sudden and dramatic. Regardless of the technology and tools you use, you will face significant risk from many factors.

Stop Losses Minimize Risk

In standard trading education, it is generally taught that you should have three items planned before executing any trade:

- Your entry point (the point or better at which you’ll buy)

- Your exit point (your max acceptable loss)

- Your target point (the profit point at which you’ll close)

In classroom settings, you will typically be unable to enter a trade unless all three points are entered at the same time. This means you enter:

- Buy limit

- Stop loss (followed by a trailing stop)

- Sell limit

In this way, you are following a predetermined plan and minimizing your risk if the trade moves against you. See our article on The Surprising Cost of Trading Losses.

Stopping Out of a Good Trade

As traders initially begin experimenting with stop losses, they inevitably find Murphy’s Law applies in earnest.

Upon opening a trade, it is common the trade will move against you and then go in the direction you want (profit). Traders inevitably find that when the trade has the initial downward move, it goes just far enough to hit their stop loss and close them out of the trade. This is followed by an immediate reversal and phenomenal run.

Because of this, many traders become frustrated with stop losses or struggle to develop an effective strategy for determining where the stop loss should be.

Being “stopped out” of a trade is a real concern, especially in the cryptocurrency markets where it could mean missing out on a long-term, rapid upswing.

However, the opposite is also a possibility. In crypto, in particular, it’s possible a quick dip down will become a much larger bear market. In this case, a stop loss could help tremendously.

Limitations of Stop Losses

The primary limitations of stop losses are as follows:

- Price is not guaranteed: A stop loss is a trigger that activates a market order when a certain price hits. This means your order will not be filled at exactly your given stop loss price. Given the extremely fast moves in the crypto markets, price may blow through your 2% stop loss (trigger) but execute your position at a 10% loss. While stop limit orders exist, they don’t solve this problem.

- No clear set point: Risk tolerance needs to be determined on a person-by-person basis. As such, it can be very difficult to determine the best stop loss approach for you or a specific trade. Backtesting can help, but markets change.

- Price fluctuation: As noted above, being “stopped out” is a common occurrence, specifically in volatile markets such as crypto.

The nature of the crypto markets exaggerates nearly all traditional trading and investing risks, and stop losses are no exception.

Crypto-ML Stop Losses

Crypto-ML 3.0 added an independent, dynamic stop loss mechanism to exit positions before they move too far against the traders.

While 1.0 was initially envisioned to have “all of the answers,” it’s proven best to separate out the machine learning into three separate decision makers:

- When to open (Model 1.0)

- When to take profit (Model 2.0)

- When to cut losses (Model 3.0)

Specifically, 3.0 adds these two primary features:

- Adaptive stop loss: Models will close positions based on a programmatic mechanism designed to seek optimal stop loss levels.

- Stop loss guidance: While positions will be closed based on the adaptive stop loss, the new machine learning feature will also be able to provide guidance as to how to set your stop losses in case you manually open and close your positions. This is what you’ll see on the Member Dashboard.

Stop Loss Feature FAQ

1. Why are stop losses set at different levels and why do they change?

It is common that immediately after a trade is opened, it will move into a negative position before turning positive. This is where stop losses need to be carefully managed. If the stop loss is too tight, you may be stopped out of a trade before it turns positive. As such, finding the right point for a stop loss is challenging. This is where we can let the power of machine learning help guide us, especially as market conditions evolve.

2. Will there be trading losses?

Yes. Crypto-ML (and probably any other system) has and will issue losses. As long as profits run and losses are managed, results will be positive. Crypto-ML has a solid trade history of capturing big runs. But there are also losses. With 3.0, these losses will be further minimized.

3. Will the stop loss levels be published?

Yes. Stop losses are now published on the Member Dashboard and the Daily Updates. You can use these numbers as guidance for setting your stop losses but you should consider your own personal risk tolerance when opening any trade.

4. Should I manually set stop losses?

In general, yes. When you open a new position, you should set a stop loss. You can either set your stop lossbased on your own risk tolerance or you can follow guidance published by Crypto-ML 3.0 on the Member Dashboard.

If you are on the Auto Trade membership, Crypto-ML will automatically close your position after the stop loss is hit.

5. Will stop loss guidance change?

Yes, but not while a position is opened. Crypto-ML stop losses are dynamic, but they are created in a way that they will be fixed while a position is open. So you can set your open and stop orders simultaneously.

The dynamic stop loss guidance will only update if the position is closed. In this way, it issues an optimal stop loss before the next trade open.

6. What memberships gain the 3.0 benefit?

Since stop losses are related to trading, these memberships will see stop loss information:

- Crypto-ML Trader Membership (30-day free trial)

- Crypto-ML Auto Trader Membership

7. Will profit-taking guidance (Crypto-ML 2.0) be published?

No. Unlike stop losses, profit taking is continuously updated while positions are open. This is critical because positions need to be allowed to run. If the models preemptively call a profit taking point, there is a good chance extreme runs will be missed.

8. What are the risks of stop losses?

There are two key risks associated with stop losses. First, trades may close for a greater loss than your stop point. And given the strong volatility of cryptocurrency, there is a particular risk related to exceeding stops.

Second, you may be stopped out of a trade that ultimately goes positive. That means after the trade opens, it may dip a bit and then begin moving in your favor. If the stop is too tight, it will trigger and close your trade giving you a loss rather than a win.

Crypto-ML Stop Loss Evaluation

Important: this information is from the evaluation that led to the creation of 3.0 models. Since stop losses are now part of the models, different results are expected. However, this is kept here because it illustrates how minor tweaks to stop losses can create huge changes in results.

Since Crypto-ML is not a standard trading tool, it was envisioned as a platform that issued all buy and sell alerts dynamically. Determining a stop loss point when the initial trade alert was generated did not make sense in this model. The goal was (and still is) to have the model completely optimize entry and exit points on the fly as market conditions evolve in real time.

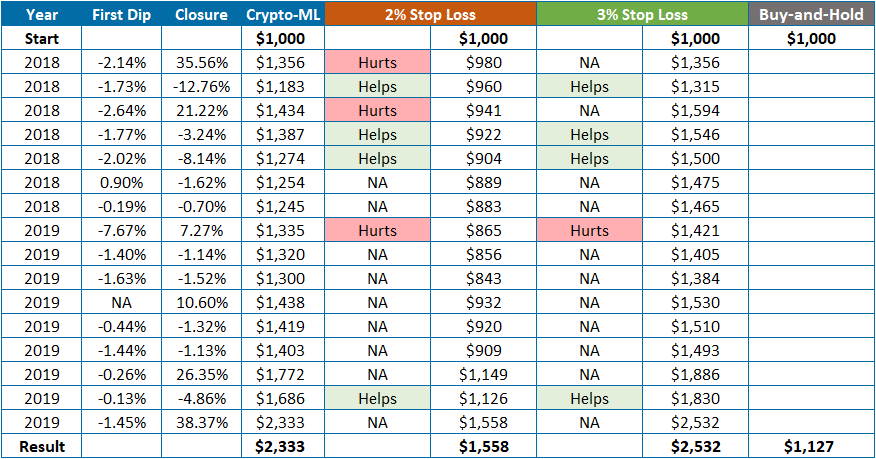

To test this, here is an evaluation of Bitcoin April 2018 forward (with the 2.x model):

Notes:

- The “First Dip” column refers to the initial slide that occurs after a trade alert is issued. This means price began moving against the trade before it moved up. This is where you risk getting stopped out.

- The “Closure” column refers to where the trade closed.

- 2018 was a bear market, as defined by the Crypto-ML Fear and Greed Index. It is our recommendation to be cautious of taking long trades during bear markets. It’s is favorable to swim with the current. There is a greater risk during this period.

- While the model tends to cut losses, there are in fact instances of larger losses, especially during 2018 when we saw drastic flash price drops. Stop losses are no guarantee but some protection would have helped during this time.

- 2% stop loss: This level would stop you out of two very significant trades and ultimately do more negative than positive.

- 3% stop loss: Assuming the stop loss price could be achieved, a 3% stop loss provides historically better results. There is only one positive trade that was “stopped out” of.

Keep in mind this analysis is looking at the situation from a backward-looking perspective and past performance is no guarantee of future performance.

Conclusion:

It appears a 3% stop loss performs better than the machine learning model alone, particularly in a bear market.

However, it also shows a drastic performance difference between a single percentage point (2% and 3%). As the markets evolve, there’s no guarantee 3% will remain optimal.

Stop Loss Recommendation for Crypto-ML Customers

Trading and risk tolerance are highly individualized. Further, the crypto markets are extremely volatile and will stop people out and cause sudden, significant losses.

To control your losses, a stop loss is recommended. If you focus on a particular cryptocurrency, review our Trade History and establish your strategy in accordance with past performance and your personal strategy. Our machine learning guidance will further aid in your decisions.

Your Personal Risk Tolerance

Whether you follow recommendations or trade alerts, only you understand your personal financial situation and trading expertise. We urge you to spend the time evaluating your goals and establishing your own approach to integrating trading advice and alerts into your strategy.

And if you’d like to learn more, The Balance provides a detailed look at stop losses.

About Crypto-ML

Whether you want to own 1, 10, or hundreds of bitcoins, we strive to help you realize your goal faster. Learn more and join for free.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.