Insider Newsletter 5: May 2022

Bitcoin and the broader crypto market has been dropping since November of 2021. That’s effectively five months of bearish movement, yet fear hasn’t settled in until now. Both sentiment and technical measures are registering an extreme state. Does this mean the bottom is in?

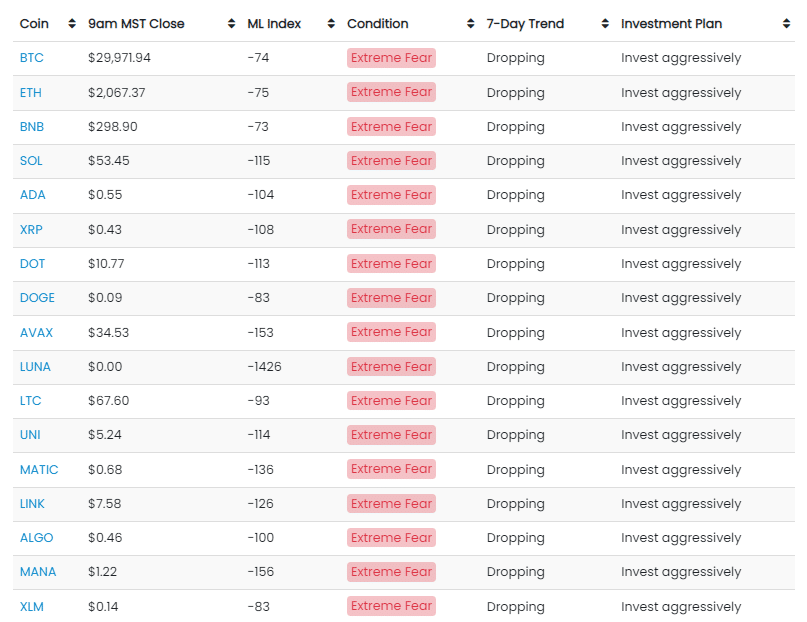

Crypto-ML Data

Our indicators couldn’t be more clear. Markets are in a state of extreme fear.

This is a quantification of it feeling foolish and scary to buy cryptocurrency.

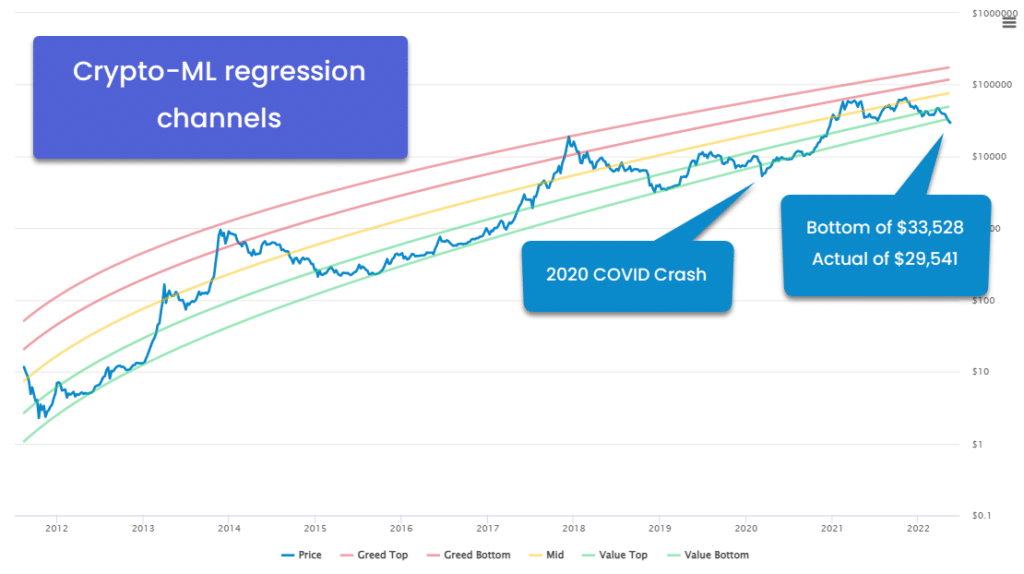

Price Channels

Bitcoin has exceeded our Price Channels regression models for the second time ever. However, you’ll see how this drop is a residual of the initial COVID crash.

- Price is currently exceeding the model by -12%.

- During the COVID crash, price exceeded the model by -30%.

Historically speaking, this means Bitcoin is a great value right now.

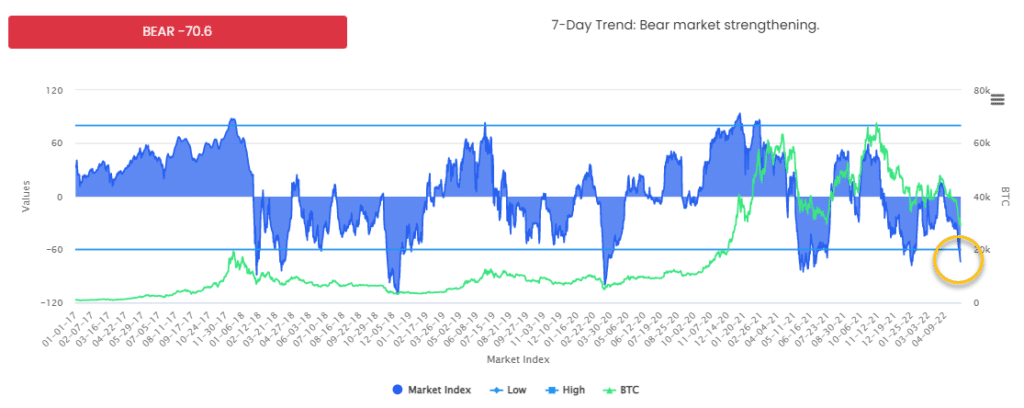

Fear and Greed Index

Similarly, the Fear and Greed Index is moving into an extreme zone (below -60). This signals Bitcoin is entering a local bottom.

Whereas the Price Channels are simply regression models of price behavior, the Fear and Greed Index pulls in many different data sources to come up with an overall quantification of market sentiment. Being lower than -60 means negative news is dominating and the “end of Bitcoin” is all but assured.

Bitcoin has died 449 times now (99bitcoins.com Bitcoin Obituaries).

The last two drops below -60 still saw Bitcoin staying above $30,000, which has not held this time. Additionally, the Fear and Greed Index can stay below -60 for an extended period of time but historically speaking, it’s a good zone to dollar-cost-average into Bitcoin.

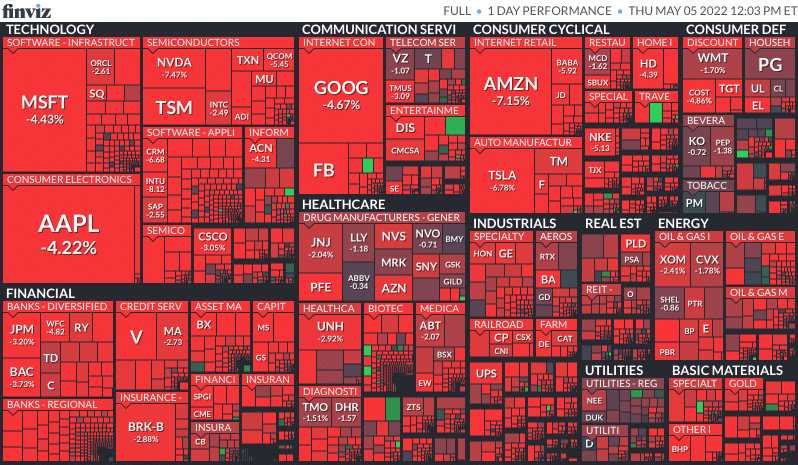

Macro-Economic View

Strong headwinds exist for the economy as a whole. This will hold Bitcoin back.

The good news is Bitcoin isn’t the only item falling. This shows broader macroeconomic issues are at play. Nothing fundamental has changed about Bitcoin and most other cryptocurrencies.

Said another way, if you believed in the future of Bitcoin at $65K, you should be delighted by the current pricing.

S&P 500 reflects economic policy

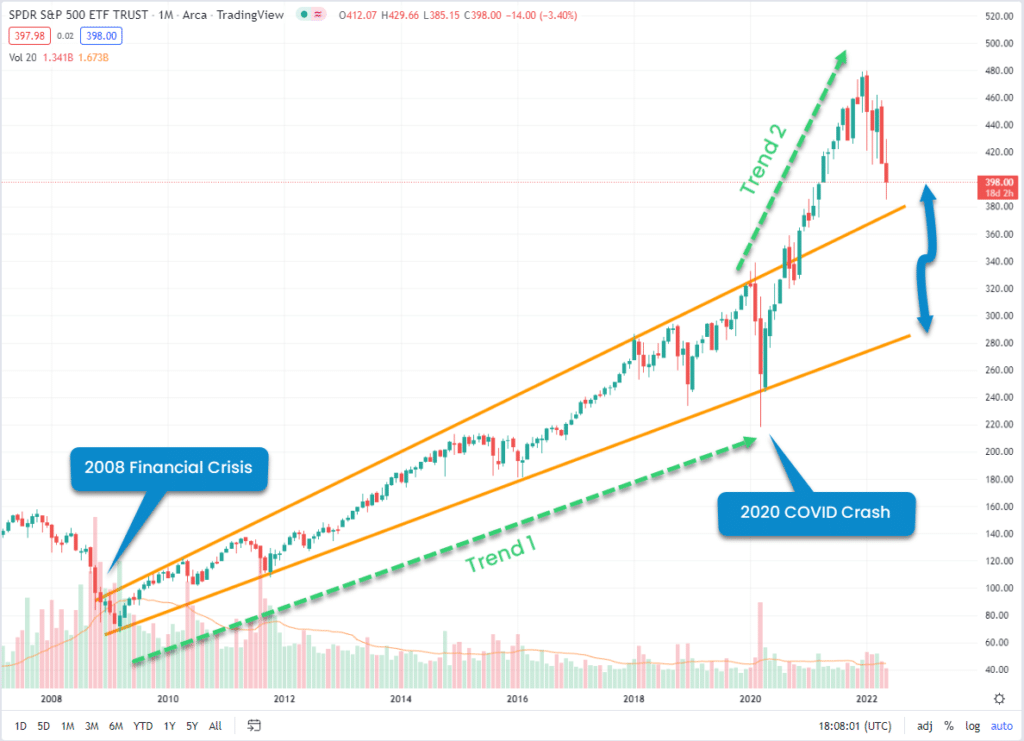

Looking at the S&P 500 as a reflection of overall economic policy, you can see a specific trend that began in 2009 after the 2008 financial crisis (Trend 1 below). This was the result of economic policies put in place at the time to recover the economy.

This trend continued until the 2020 COVID crash, which triggered a new pattern (Trend 2 below). This again happened because of economic policies put in place at that time. Global economies enacted easy money policies and injected massive amounts into the system to avoid a recession. This propelled the markets upward at an exceptional rate.

But we are now seeing the cost of this, as the markets are coming down at a similar speed.

It’s possible the markets will stay above the top yellow line and, despite the recent crash, we’ll still be better off overall.

It’s also possible the markets will trickle back down to something like a worst case of the S&P 500 hitting $3,000 (corresponding to $300 in the above chart). That’s another 25% drop.

Why is this important for cryptocurrency?

We have been reiterating throughout these posts that crypto is dominated by large investors. Their behavior will drive price. That is, there is more speculative money in crypto than there is utility money. As such, you need to weigh its relationship to macroeconomic changes.

This is important because Bitcoin is often touted as a hedge against traditional markets and inflation. In its purest form, it absolutely is. In fact, that’s why Bitcoin has the value it does. However, it is currently a store of value for some and a speculative tool for many.

The more speculative an asset, the faster it both goes both up and down.

- During downturns, investors move to assets that are low risk and low reward.

- During upturns, investors look for assets that have high risk and high reward.

With this concept in mind, it’s easy to understand the price dynamics. The “high risk and high reward” assets go up and down faster than the market. The greater the risk and reward, the more exaggerated the movements.

Overall asset performance

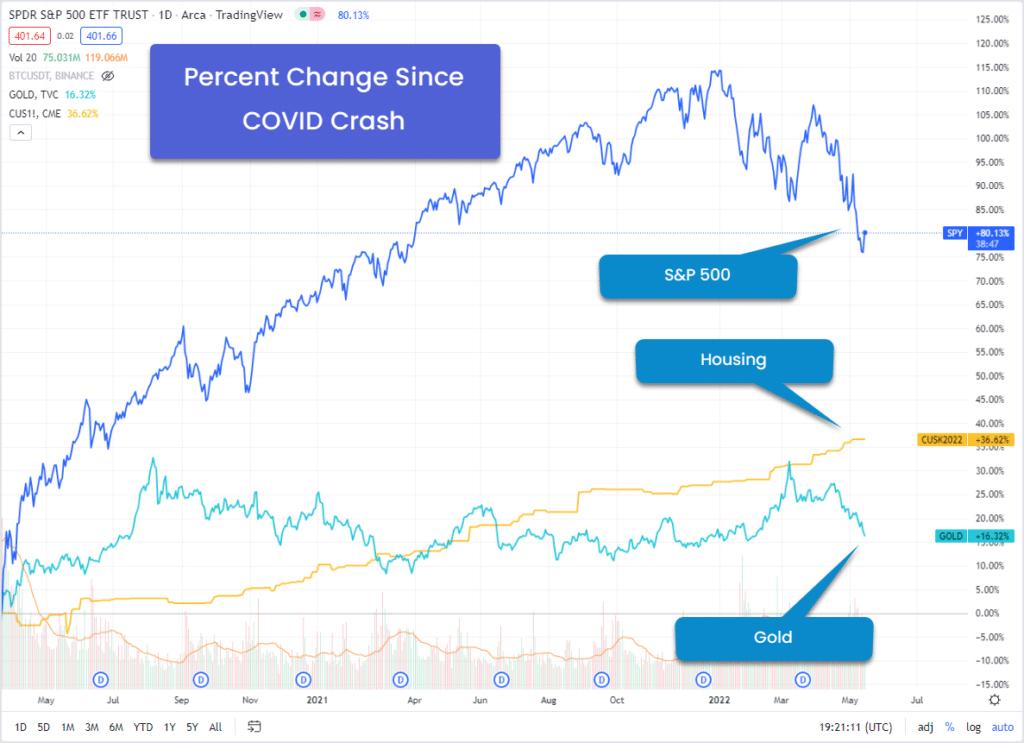

To illustrate this dynamic, here’s a view of what has happened since the COVID crash.

- S&P 500 is up 80%

- Housing is up 37%

- Gold is up 16%

Despite the recent crash, everything has inflated.

- Gold is considered stable (low risk and low reward), so it has stayed relatively flat.

- Housing is slow to respond but will likely slow down as well.

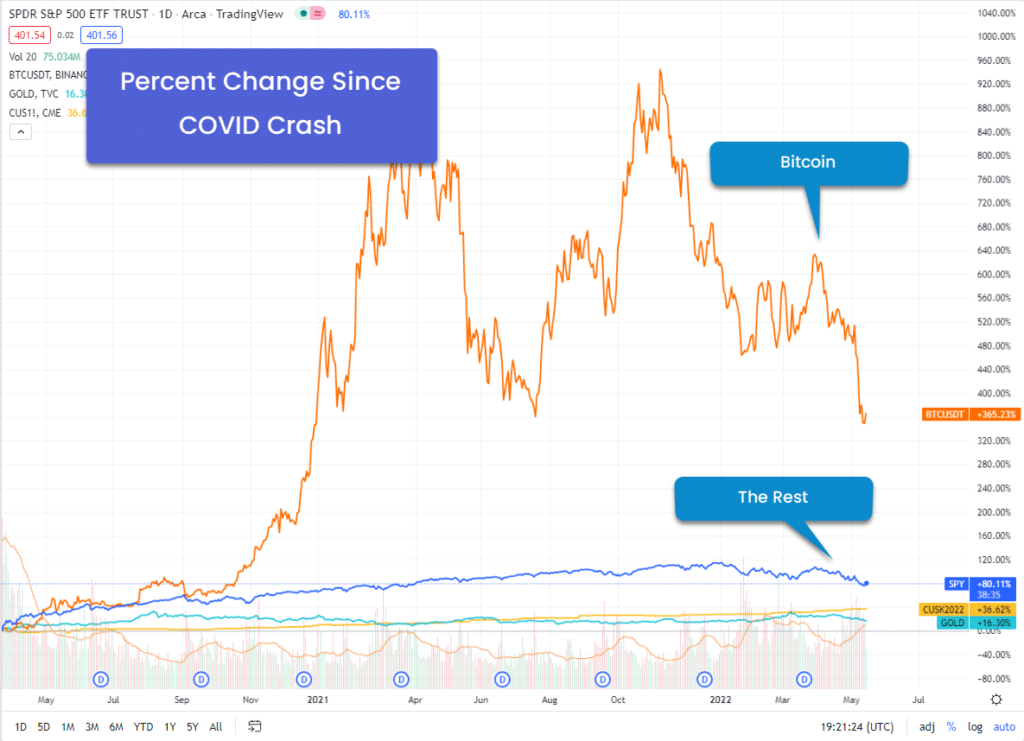

If we add Bitcoin to the same chart, the other lines practically disappear.

- Bitcoin is up 365% < that includes the recent massive drop

- S&P 500 is up 80%

- Housing is up 37%

- Gold is up 16%

Bitcoin has performed tremendously. But as a result, it has much more speculative money to shed.

Bitcoin is the best hedge against #Inflation.

Michael Saylor via Twitter on May 12, 2022

Since $MSTR announced its first BTC purchase August 11, 2020, bitcoin has appreciated 149%, outperforming Silver (-17%), Gold (-9%) Nasdaq (5%), S&P (18%), CPI (11.2%), M2 (19%), US Homes (28%), & PPI (33%).

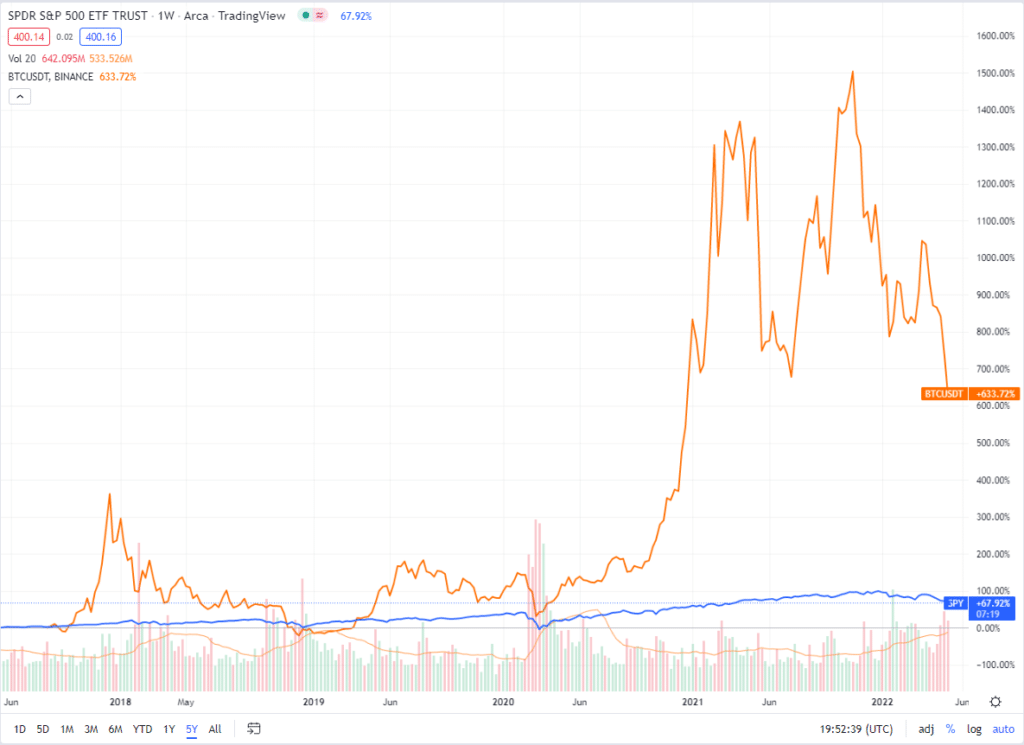

Here are the same lines on a 5-year view showcasing:

- Extraordinary performance

- Bitcoin is still highly valued

Cause of the economic downturn

This current drop is driven by a massive reduction in capital availability.

After COVID, there was an unprecedented injection of money into the system. Much of this money was invested, driving many asset classes up.

Now we are seeing the cost of this. The COVID economic policies were not sustainable.

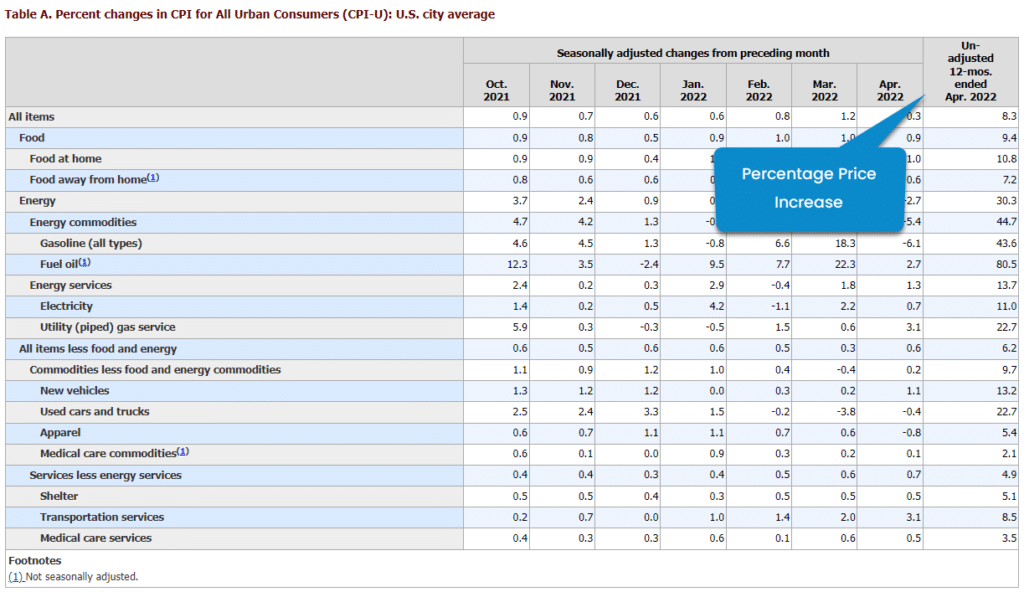

In addition to more restrictive money, expenses are going up across the board. Consumer prices have risen between 2% and 80% depending on the type of good.

Between less money and higher prices, people ultimately have less discretionary money to spend. When people spend less money on consumer goods, those consumer companies then spend less themselves, impacting business-to-business companies.

With less money across companies, hiring freezes and layoffs follow. In fact, we’re already seeing this. The hot tech job market cooled off nearly instantly.

Why the Fed wants corporate America to have a hiring freeze (yahoo.com).

Ultimately, money becomes less available across the entire ecosystem. People invest less. People shy away from speculative assets.

These are complex economic problems and, unfortunately, governments have few tools available. This may just be a necessary adjustment period.

As a final note, it took 2 years to see the results of COVID policy. We have yet to see the true impact of the war in Ukraine.

An extended recession is certainly a possibility.

Altcoin perspective: LUNA and UST collapse

Altcoins are risky. Most altcoins are companies in extremely early stages that have little regulatory oversight.

Unfortunately, to the general public, Bitcoin and all altcoins tend to be lumped together. A black eye for one is a black eye for all. Trust in the entire system can be easily broken.

This type of event is a natural target for detractors. It, unfortunately, also causes broad panic.

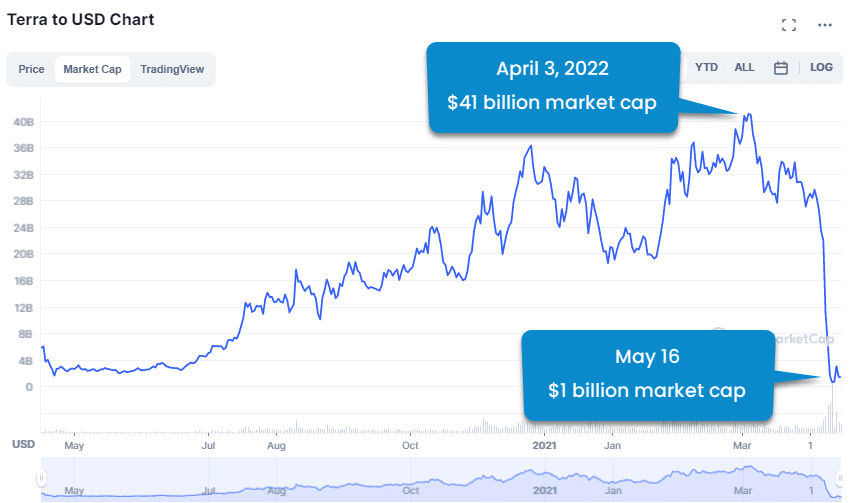

As the markets began dropping, the stablecoin UST lost its peg with the US dollar. This caused LUNA to drop 99%.

UST is an “algorithmic” stablecoin. The concept of maintaining a perfect peg with the US Dollar in an algorithmic manner is an extremely technical and conceptual challenge. There are intelligent people leading and contributing to UST, but ultimately, this was a $41 billion experiment that failed.

Learn more about the Terra, UST, and LUNA relationship (qicapital.org).

This doesn’t mean there was a scam or manipulation. Rather, it highlights the risk of ventures that are early in their lifecycles. Startups fail all the time. Outsized reward comes with outsized risk.

Expect regulatory requirements to follow this event. Companies and projects in this space will need to disclose risks in more of a standardized manner. Ideally, regulation will not hinder innovation.

SEC’s Hester Peirce says new stablecoin regs need to allow room for failure (investing.com)

Tether and Luna’s Plunge Could End the Crypto Free-for-All (gizmodo.com)

Regardless of regulation, if you invest in altcoins (or really anything), you must perform due diligence and attempt to understand the risks.

Given these projects aren’t required to disclose information, it is much more difficult to gauge their likelihood of success. If you’re a sophisticated investor, you may be able to cut through the clutter effectively. If you aren’t, study up and adhere to the term “never invest more than you’re willing to lose.”

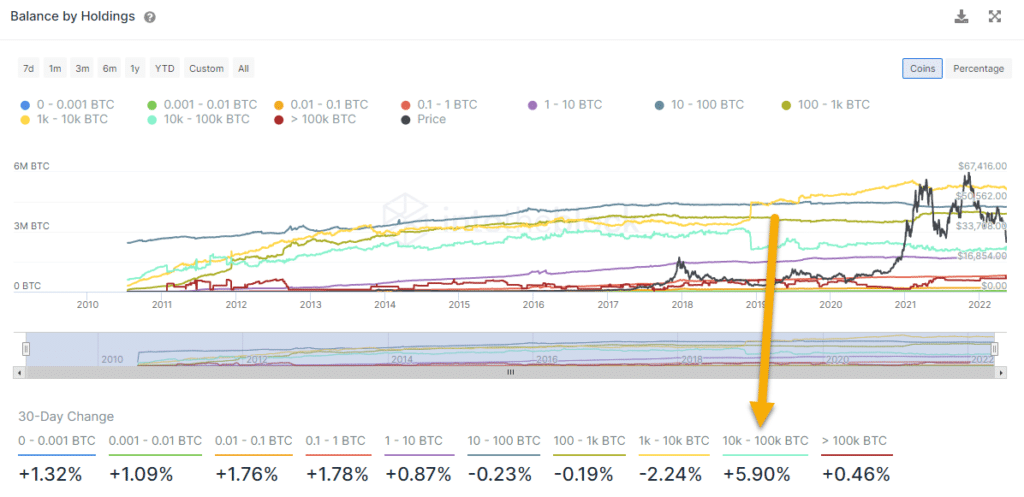

On-Chain Metrics

On-chain metrics paint a bullish picture with considerable support from large holders.

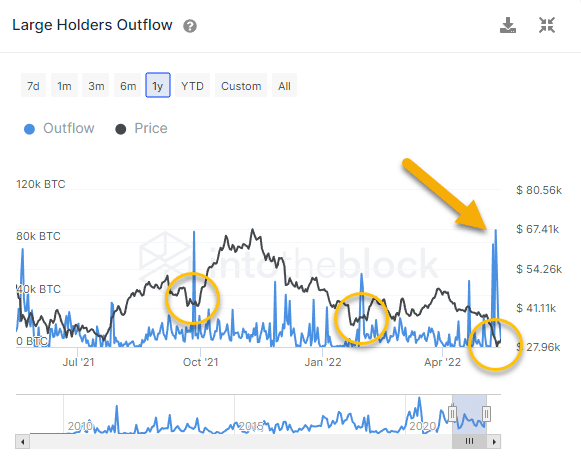

The “outlfows” metric shows Bitcoin moving off exchanges to private wallets. This is generally considered bullish as it indicates people are moving their funds to long-term holding accounts.

Since May 9, there have been some of the highest outflows in years.

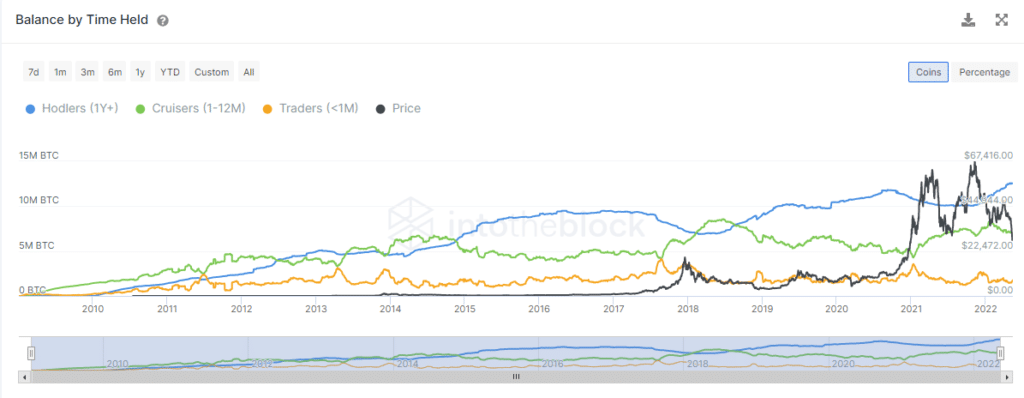

This view shows who is buying the dip, broken down by their length in the market:

- People who have held Bitcoin for more than a year are buying.

- Newer accounts are selling.

- Traders are remaining fairly active.

Broken down by wallet size, we can see wallets that hold between 10K to 100K have increased their holdings most. This is another good sign.

Put together, these show big, long-term wallets are buying at these prices. This provides support.

Additionally, there has not been much selling from the mining community.

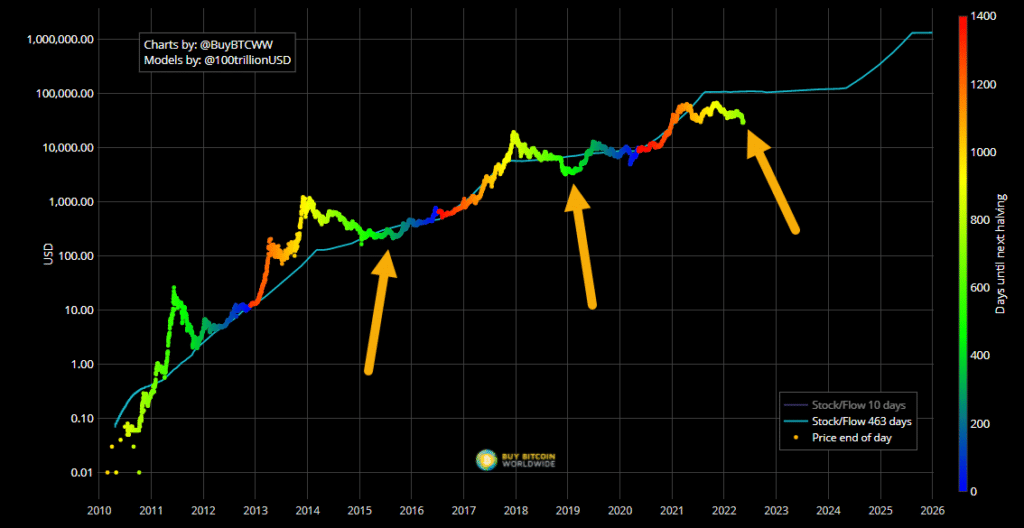

Last, Bitcoin stock-to-flow shows we’re also at a common low point in the market. This is based both on the time until the next halving (green) and the distance below the model.

While not “on chain,” the derivatives market shows low levels of leveraged short sellers (cointelegraph.com) for both Bitcoin and Ethereum. This indicates low expectations of further downside.

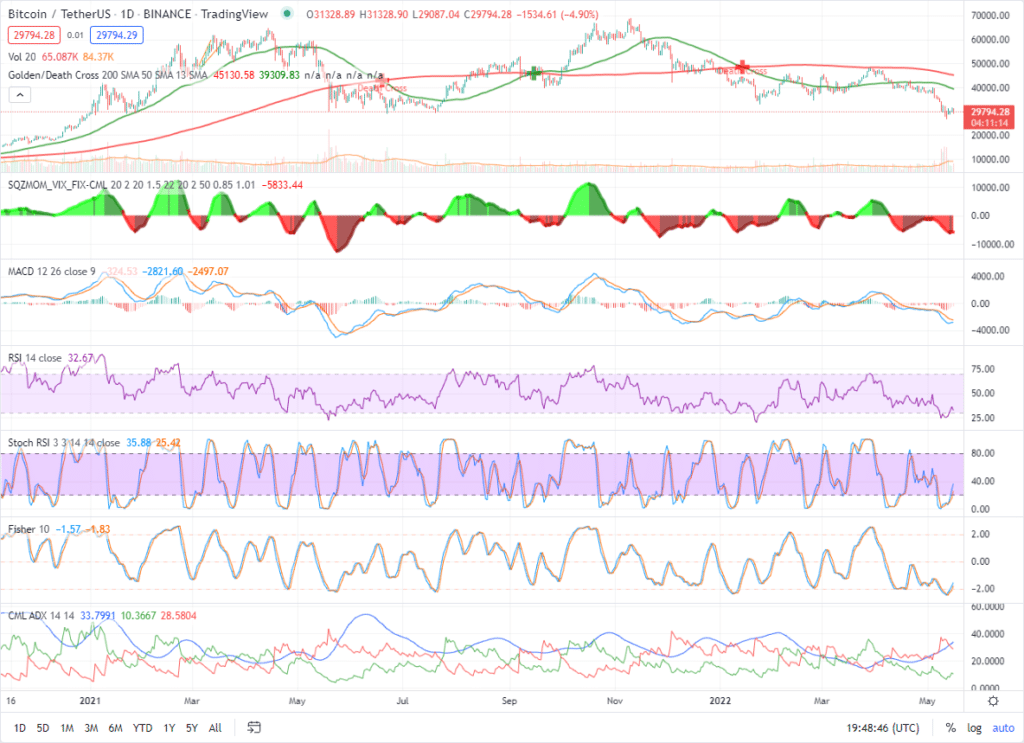

Technical Analysis

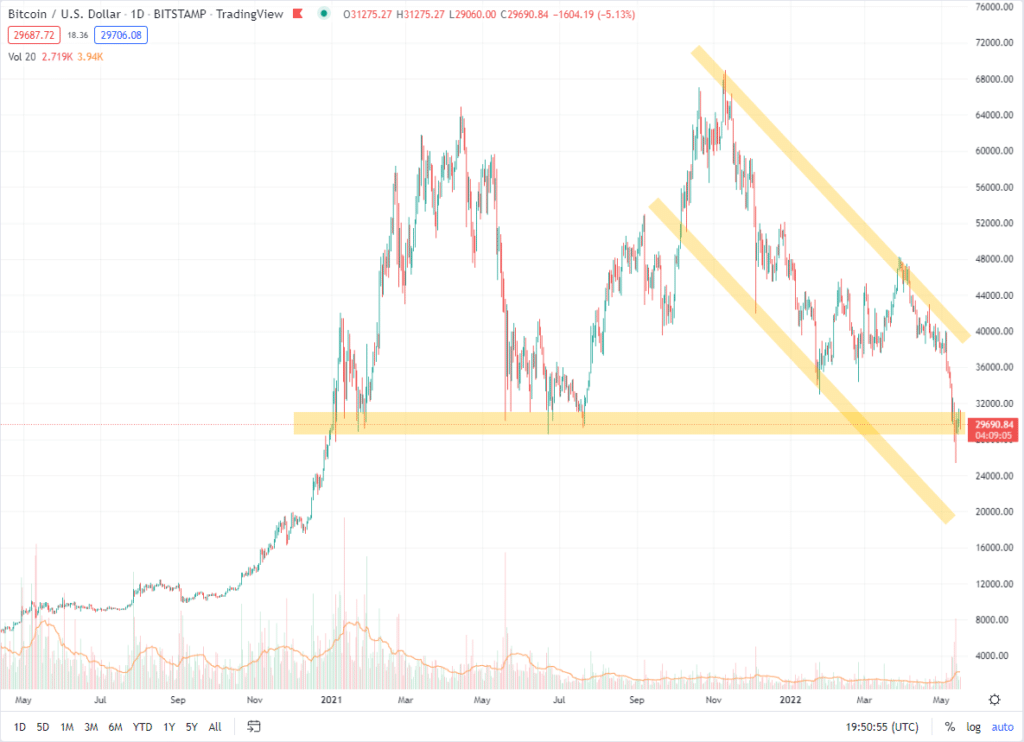

A critical support level for Bitcoin to hold is $30,000.

From a big picture perspective, $30,000 is a critical level for Bitcoin. If this level fails to hold, we may be in for another fast drop down to $20,000.

Nearly all technical indicators are pointed to a turnaround, but they tend to be unreliable in extreme market conditions. As such, it’s best not to put too much weight on indicators this month.

Putting It All Together

Invest at regular intervals, especially during fear. Don’t try to time the bottom.

The crypto markets have dropped considerably, but this is mostly due to broader economic issues. Nothing has fundamentally changed with Bitcoin.

There are bullish indications, particularly in on-chain data and in Crypto-ML’s measures. However, there are big economic headwinds that may take months or a year to resolve. No matter how strong Bitcoin is, macroeconomics will hold it back. Unexpected bad news could easily drop the stock market another 25% and crypto another 50%.

- Though this may be a market bottom, it’s safest and most prudent to not go “all in.” Don’t try to catch the falling knife.

- Rather, on a regular basis, consistently invest an amount you can afford. Don’t try to time the bottom, but do be a long-term buyer during times of fear.

- Ensure whatever you invest also earns income, such as interest.

Current Crypto-ML Portfolio

This is a snapshot of our portfolio, provided to give you insights into our real-life decision-making.

You’ll notice another significant shift as we have moved the majority of stablecoin funds to cryptocurrencies.

It is also important to note that nearly all of this money is working for us to generate interest. We are not relying on appreciation alone.

This is a critical point: these investments are automatically buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

If you’re investing for the long term, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

BNB: 40% (+17%)

- This position became outsized due holdings acquired prior to BNB’s rapid rise in early 2021.

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023. Some portion of BNB will likely stay as a long-term holding. Though not decentralized, Binance will still have a major role to play in the crypto space in the foreseeable future. The deflationary monetary policy is also attractive.

- Still not earning interest, which is a problem not yet addressed.

Stablecoins: 3% (-81%)

- Earning interest

- This month, nearly the rest of this balance was moved from stablecoins to crypto. That is phasing in during the “Fear” and “Extreme Fear.”

- This balance was initially held because we phased out of positions during “Greed” and “Extreme Greed.” This booked profit and provided a pool of funds to reinvest at a later point.

BTC: 35% (+24%)

- Earning interest through various means

- Long-term hold

ETH: 18% (+15%)

- Earning interest through various means

- Long-term hold

LINK: 1%

- Earning interest through various means

- Long-term hold

DOT: 1%

- Earning interest through various means

- Long-term hold

Other: 2%

- This group consists of 35 altcoins (+6).

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.