Insider Newsletter 9: September 2022

We don’t like sharing doom and gloom, but this is a rough newsletter. Broad economic challenges will likely continue putting pressure on crypto. Odds are we have another year-plus of choppy, difficult markets ahead.

How do you navigate this while also positioning yourself in case a surprise bull run happens?

This Insider Newsletter will detail the reasons for this “doom and gloom” claim and also give you insight into the decisions we’re making with our portfolios. A measured approach during these turbulent times can put you in a great position once the markets do recover.

As always, we pull our information from many paid resources to help provide you with premium data in a summarized, clean format.

Summary

Crypto is an early-stage, high-risk investment. Regulation, real-world use cases, and institutional adoption are all question marks.

But, if you think certain cryptocurrencies are here to stay and you have a longer time horizon, it’s a good time to take advantage of uncertainty and fear.

- Macro factors are in the driver’s seat and may cause stagnant, volatile markets for the next 1-2 years. Bear markets are long and exhausting. Recessions nearly all last 2 years.

- $19,000 Bitcoin is a critical level. A significant weekly drop below will break many models and may cause heavy panic selling with a target of $11,000.

- If your time horizon is greater than 2 years, you should consider measured accumulation every month. A bull market can come at any time. Don’t try to time the bottom. Buy at many prices.

- If your time horizon is less, buckle up for heavy volatility. This will be a difficult market to trade.

On the bright side:

- Bitcoin and certain cryptocurrencies have not been killed by this storm. They are once again proving they are here for the long run.

- If you have a multi-year time horizon, there is a high likelihood of significant upside when the broader economic issues resolve.

Crypto-ML Data

Summary: growth models, including our logistic regressions Price Channels, are breaking. Watch $19,000 on the weekly charts.

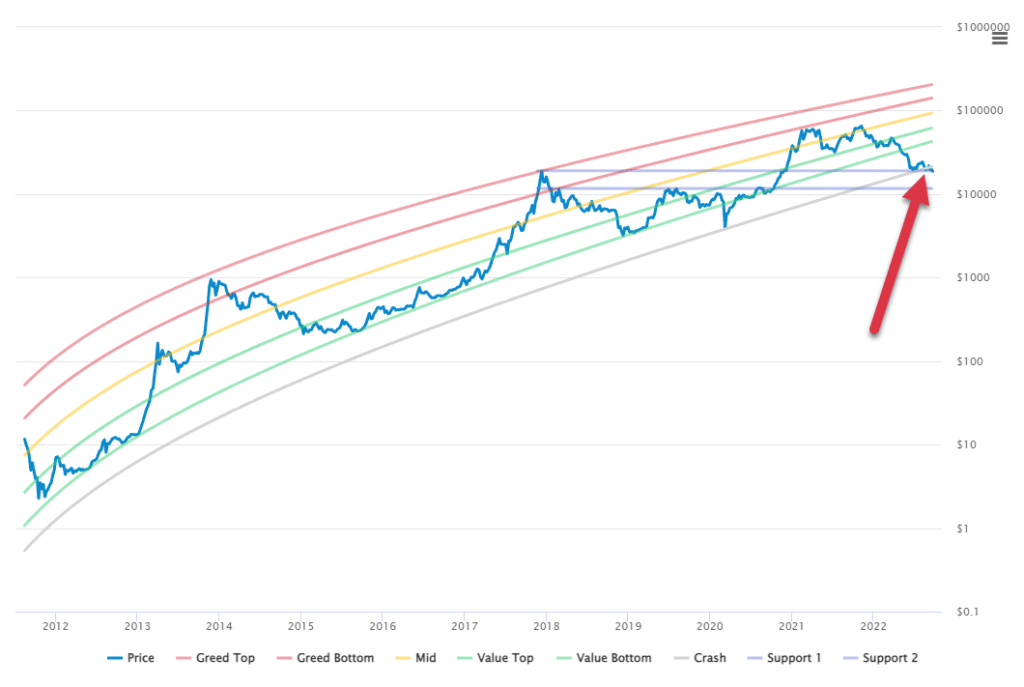

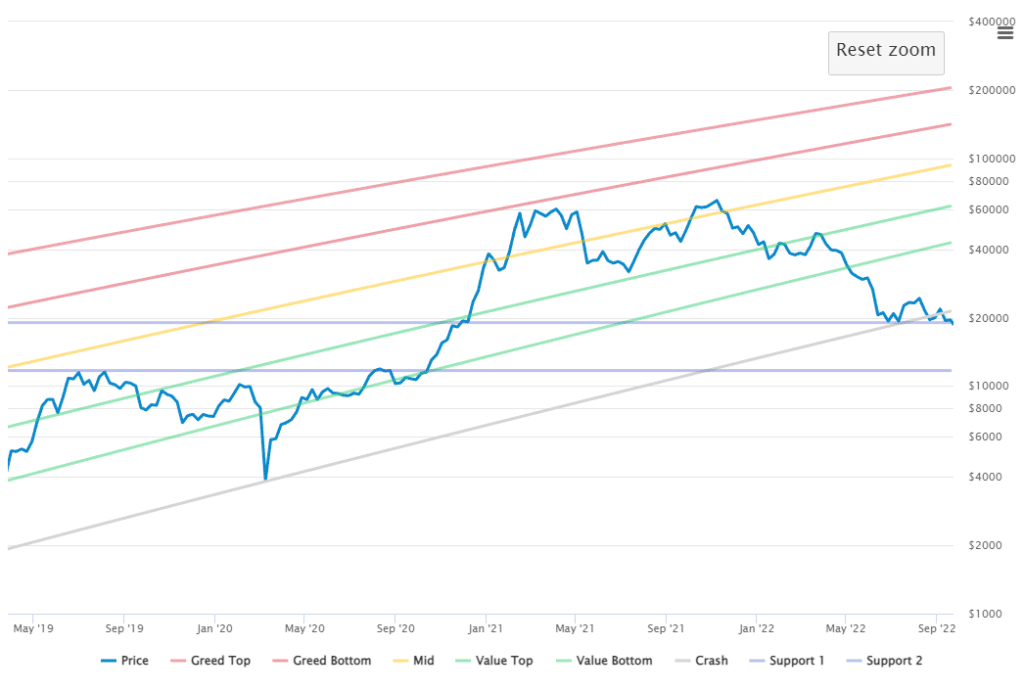

Price Channels

It appears the logarithmic regression growth trajectory of Bitcoin may be coming to an end. Bitcoin is decidedly closing below the bottom “crash” line.

Other growth models are also breaking, which we’ll discuss below in Technical Analysis.

The $19,000 level is critical support, as will also be shown later. This week will likely close under that level, opening the possibility of a larger scale drop to $11,000. That is the next point of long-term support.

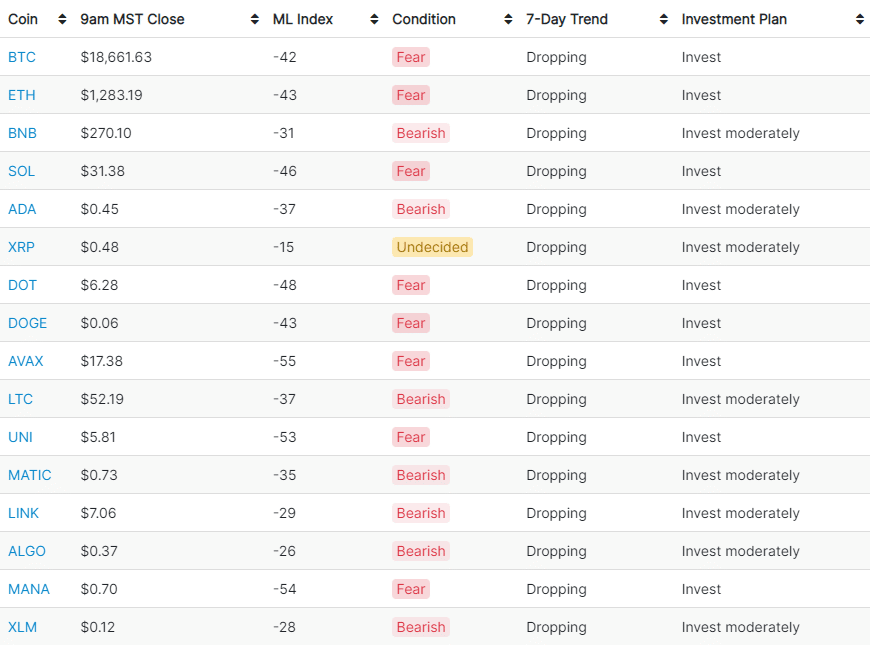

Market Index

While we experienced a brief bit of hope, Fear is back. If Bitcoin closes substantially below $19,000, expect market sentiment to quickly turn to Extreme Fear.

Just don’t forget, Extreme Fear is an opportunity for long-term investors.

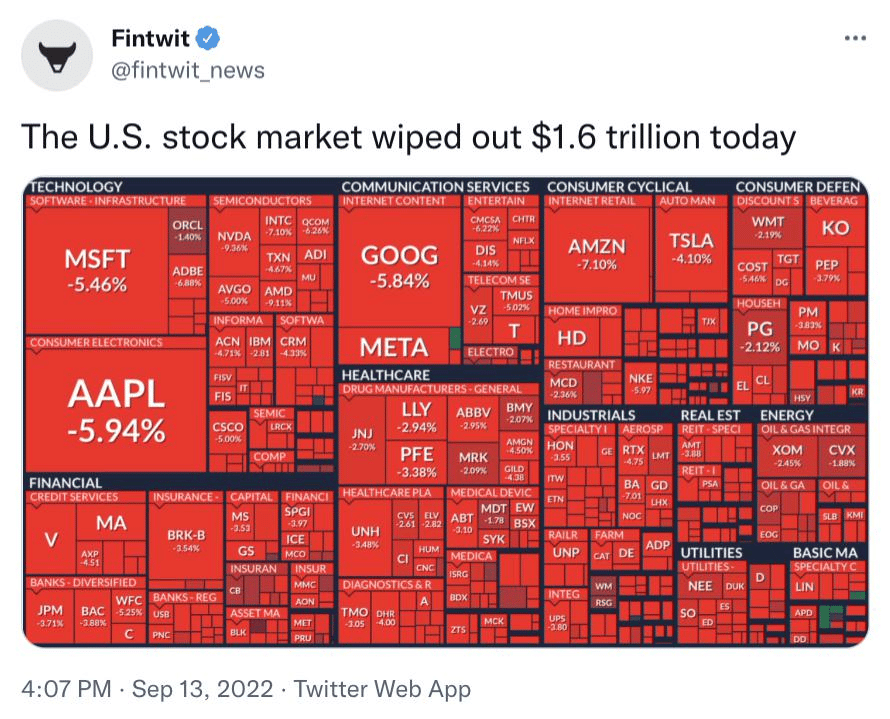

The Macro Picture Needs Time

Summary: the macroeconomic picture is worsening. Markets do not like uncertainty. Expect it to take 1-2 years for these issues to resolve.

Not yet convinced the macroeconomic picture rules all?

The reason we start these newsletters with the macro economy is it is the overall driver.

There will, of course, be performance variance between assets. But the general trend is driven by common forces.

Bitcoin and crypto will be stagnant and volatile until the macro picture improves. This could take one to two years.

Why does the broad economy affect crypto so directly?

Bitcoin has largely been discussed as a hedge against inflation and monetary policy. Perhaps it will eventually become this ideal, but for now, institutional investors dominate the percentage of money in crypto. They see crypto as a speculative, risky asset. During volatile times, they will choose traditionally conservative assets. We covered the data behind this in our April Newsletter.

Once macro factors improve, crypto could slingshot back up.

We’ve mentioned in our recent newsletters that recessions almost always take two years to pan out. That means we could still have 1.5 years of choppy, challenging markets ahead. If anything, recent events reinforce this message and still have us potentially not recovering until late 2023.

Russia is preparing for a long war of attrition, with its September 21 announcement of troop mobilization and commitment to using nuclear retaliation (theguardian.com). The war in Ukraine will not resolve any time soon. This means there will be a continued strain on global politics, food, energy, and economic growth.

As evidenced by the consistent interest rate hikes, inflation is also here to stay. It is not transitory.

Here are some insights directly from Federal Reserve Chair Jerome Powell:

- “The chances of a soft landing are likely to diminish.”

- “We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t.”

- “Pain is required to get consumer prices under control over the next year and asset prices will need to fall to achieve that goal” (fortune.com).

Higher interest rates will have a severe impact on businesses. Business loans generally have a variable rate and short terms.

Bankers say the trouble looms when loan terms reach their end stages and so-called balloon principal payments come due. Those big numbers begin next year when more than $200 billion in leveraged loans will need refinancing, and will rise yearly by multiples until around $1 trillion is due in 2028.

nypost.com

This means it’s likely a deep recession and unemployment are coming (fortune.com).

Here’s a look at what pros said in September:

- The Chief Economist at Goldman Sachs says to brace for a lengthy period of slow economic growth (finance.yahoo.com).

- The legendary hedge fund manager, Stanley Druckenmiller, warns of a high probability of a flat stock market for the next decade (fortune.com).

- The bond market will likely need to recover before stocks can (cnbc.com). This matches our assessment of the bond market in last month’s newsletter.

- Alphabet’s (Google) CEO is rapidly taking measures to prepare for economic uncertainty by making Google 20% more efficient, including job cuts. Based on their extensive data and analysis, he stated on September 6 that “The more we try to understand the macroeconomy, we feel very uncertain about it” (thestreet.com).

- Bank of America revised its “mild recession” prediction. Instead of coming in late 2022, they now believe it will begin in the first half of 2023 (fortune.com).

- Larry Fink, the CEO of BlackRock, the world’s largest investment firm, also highlights complex economic challenges ahead, saying a soft landing is nearly impossible and that there’s an “irreconcilable disconnect” between the While House and the Fed (nypost.com). This means governments are continuing to spend (create inflation), which forces the Fed to continue painful deflationary measures.

- Last, we have a brilliant post from Ray Dalio, the Founder and Co-Chief Investment Officer of Bridgewater, detailing a “significant economic contraction” as interest rates goes up and other markets go down (linkedin.com). Though a specific timeframe isn’t outlined, the issues he covers are complex and will likely take years to play out.

All of those messages are consistent.

And as we’ve said before, watching the actions of big companies is telling. Microsoft, Google, and Amazon have an unprecedented amount of data and analytics capabilities. If they are taking action to prepare for an economic slowdown, perhaps you should as well.

In recent months, Google and Meta have drastically slowed down hiring, cut back on perks like employee travel and laundry service, and begun reorganizing departments. Employees fear deeper staff cuts are ahead. Some economists say these moves are a sign that we’re heading into a “white-collar recession,” or a decline in job growth and security for professional workers, not just in tech, but also in other high-skilled industries.

The boom days are fading in Big Tech (vox.com)

Crypto News

Summary: regulatory and technology actions happening now are setting crypto up for a successful, mainstream future.

The major news focused purely on crypto centers on two items: regulation and the Ethereum Merge.

Regulation

Regulation is the wildcard that will make or break crypto’s future. This is an unknown and depends on the perceptions and actions of governments across the world.

If you believe governments will create a framework that allows for safe, broad adoption of crypto while also not hindering innovation, then you have a chance to invest early in the lifecycle of this industry.

We believe this will be the case, albeit with speedbumps along the way. Like any early-stage investment, you need to realize it is high risk and will be full of ups and downs.

If you believe governments will not get crypto right and will instead slowly squash it, you should not invest in crypto.

Directionally, we expect governments have more to gain by enabling a future with crypto. The core argument for this is if many countries excessively restrict crypto, there will always be one country that opens itself to it. This will cause innovators and dollars to flow to that country. Fundamentally, countries don’t want to get left behind and miss this revolution.

“The adults in the room recognize that regulation is a good thing. Right now, we have 1% engaging in crypto. You’re not going to get the other 99% until they have clarity on what the rules of the road are.

“We’re seeing new rules coming out from the Treasury, IRS, FINRA and from the Fed,” he said. “And from the SEC and CFTC. We’ve got over 50 bills in Congress right now. And all of this is very healthy.”

Turning point for the crypto community (cnbc.com)

Unfortunately, governments likely will not always get things right along the way.

Case in point: the SEC in the United States is taking jurisdiction over all of Ethereum since the majority of nodes are in the US (finance.yahoo.com).

Ether sent to Balina in 2018 was “validated by a network of nodes on the Ethereum blockchain, which are clustered more densely in the United States than in any other country and as a result, those transactions took place in the United States.”

Formal SEC Complaint

However, our core belief remains that thoughtful regulation will attract a broader set of participants and help avoid scams and massive drawdowns. This sentiment is shared by many of the top crypto companies, who actively participate with regulatory bodies to help shape the future.

FTX CEO Sam Bankman-Fried Says Regulation Could Prevent Next Crypto Contagion (dailyhodl.com)

Ethereum Merge

Regarding the Ethereum Merge, we saw a successful technological deployment. This moves Ethereum into proof-of-stake and gives us all a direct way to earn off our Eth holdings. This is very positive.

It also allows more people to participate in earning with Ethereum. Staking is much simpler than mining.

Earning is key to our Crypto Investing Approach.

However, Ethereum has sold off about 26% in the few days after the Merge. So what gives?

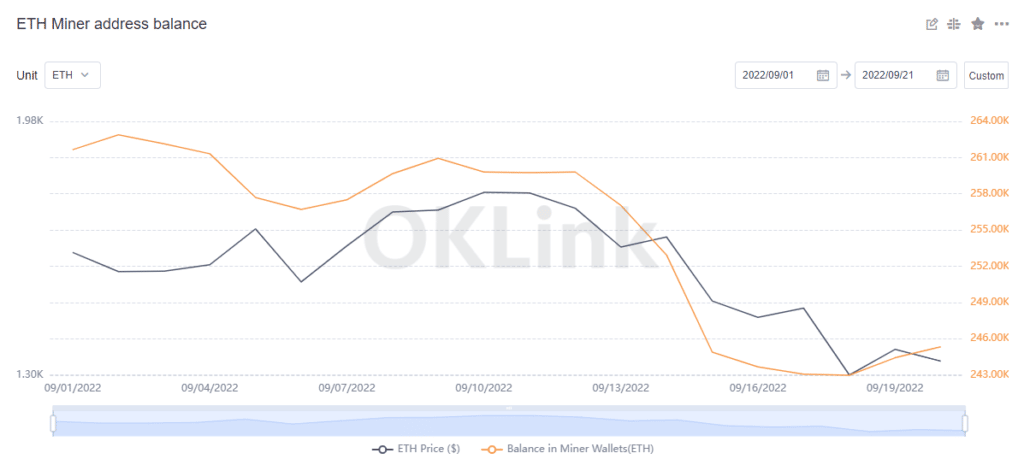

The selloff is largely based on miners selling their positions to prepare for new ventures. In September, so far, miners have net sold over 18,000 Eth. This is a break in a multi-year-long pattern of accumulation.

Traders anticipating a run after the Merge were also disappointed and exited.

On-Chain Metrics

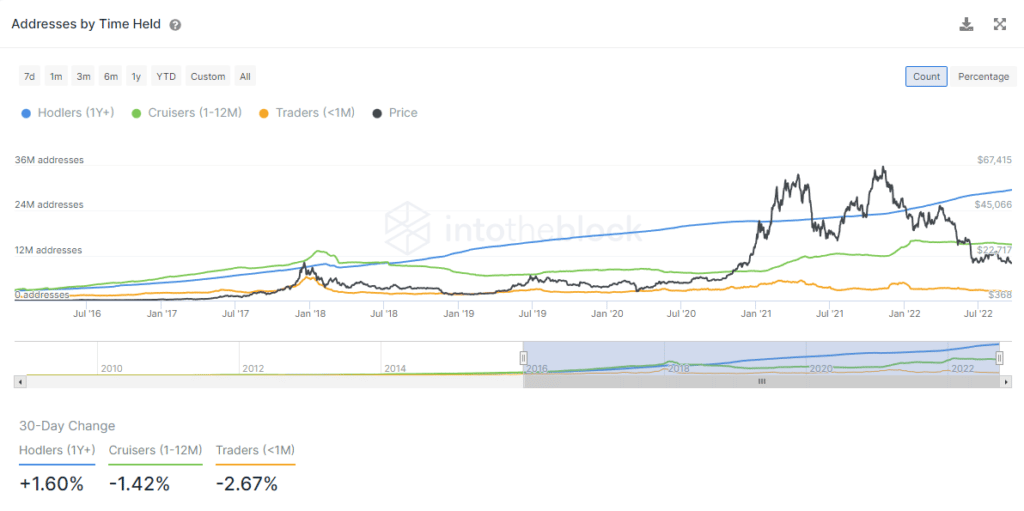

Summary: on-chain metrics are mixed, as usual. Many people show “the bottom is in.” But many patterns are also breaking. What we can say is core holders are continuing to build positions.

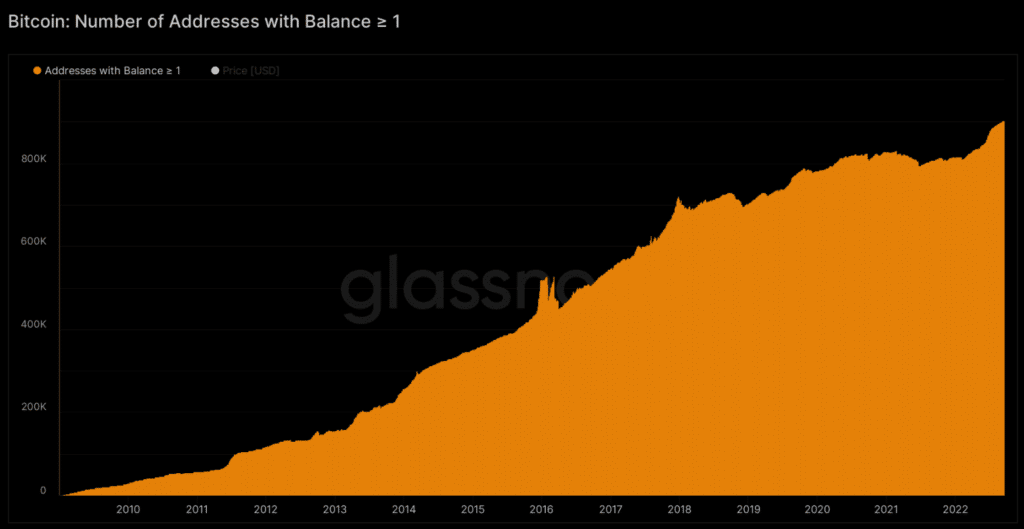

Believers keep buying! We just hit a record number of wallets that hold one or more Bitcoin.

In fact, despite most addresses now being at a loss, holders are not selling.

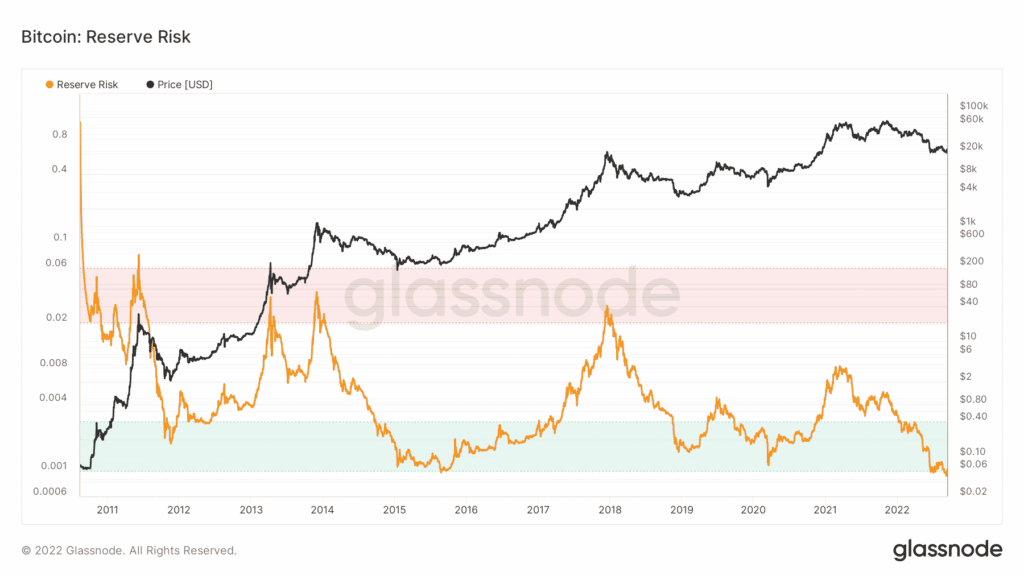

On the downside, similar to growth model charts, certain long-term on-chain metrics are going to never-before-seen levels. Normally when reserve risk dips into green, a rally ensues. However, we’re now seeing reserve risk drop below the green channel.

On-chain metrics paint a mixed picture. They do show Bitcoin is here to stay. But they also show we’re at a historically unusual point.

Technical Analysis

Summary: technical indicators are extremely bearish and generally show considerable downside ahead.

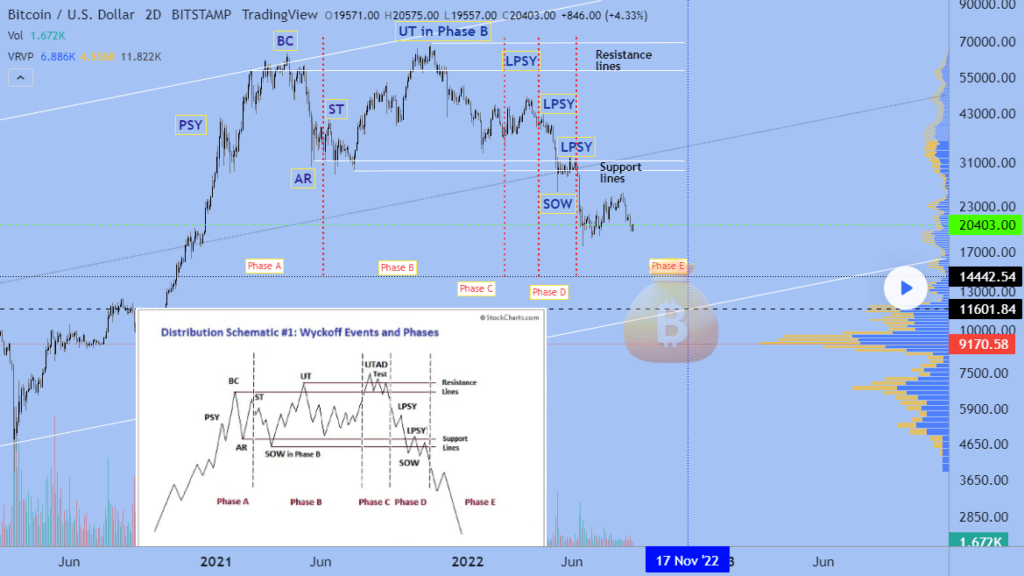

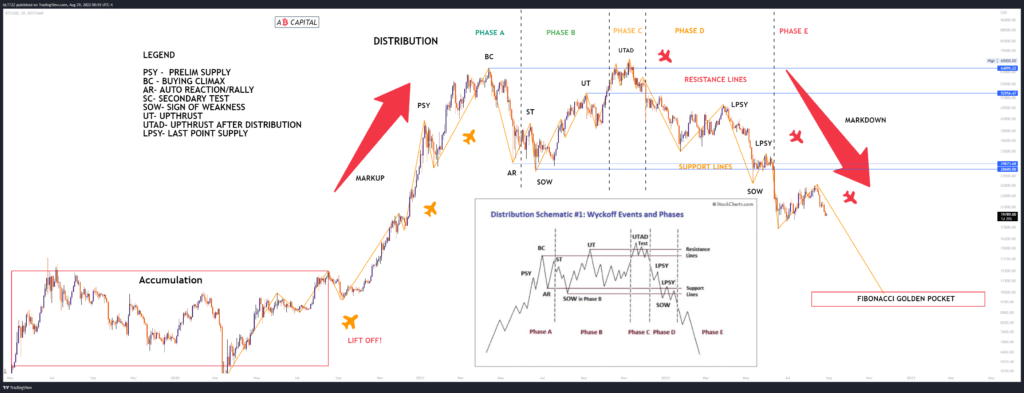

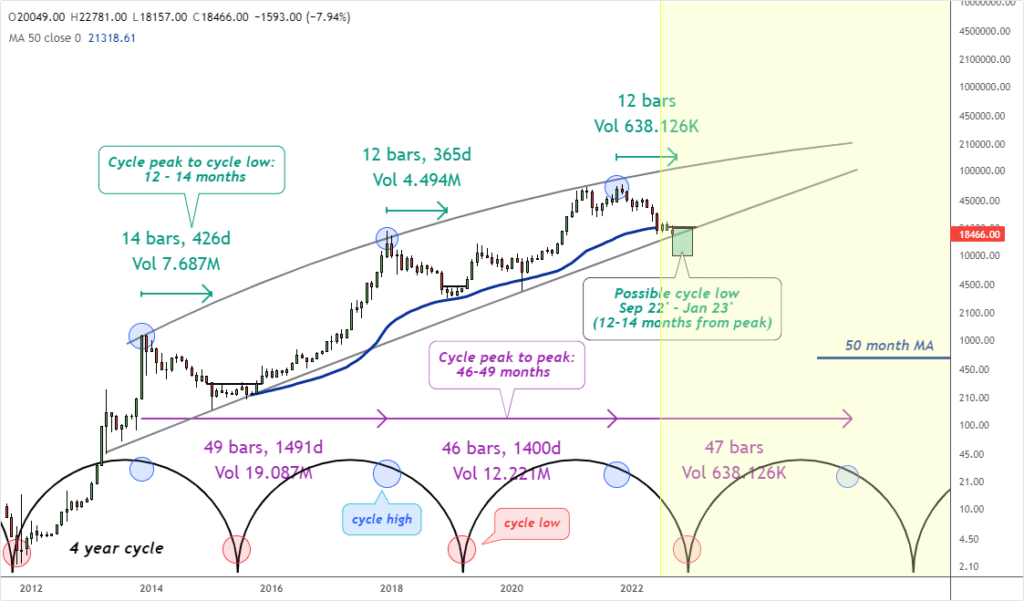

Technical indicators are interesting in that they capture recurring patterns in human behavior. The Wyckoff Method is designed to provide insights into how humans behave in longer-term cycles.

Technical analysis and human patterns

Bitcoin’s price chart looks surprisingly close to a standard Wyckoff schematic.

A broader view:

This Wyckoff approach predicts Bitcoin may be entering the final phase, which could drop us to the $11,000 level in late 2022 before moving to a new accumulation phase.

Other analysts use this same pattern to show Bitcoin has already completed the Markdown phase and has instead begun the next phase of accumulation. However, these analysts are in the minority.

Ugly triangle

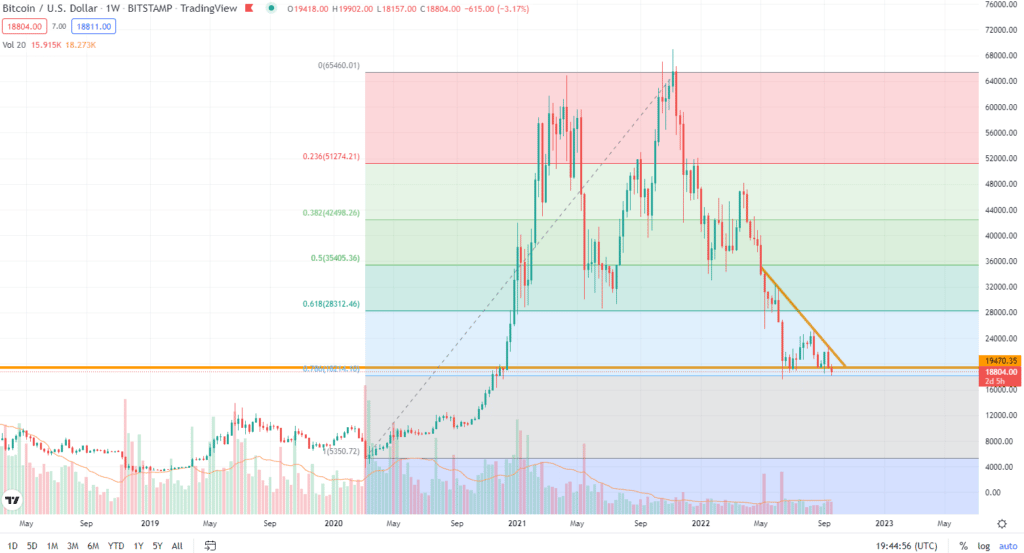

If we step back from the complexity of Wyckoff and instead look at simple patterns and levels, we still see a similar view.

A large bearish triangle closes in mid-October. This includes lower highs and diminishing volume. With this pattern, the probabilities are price will break to the downside.

The triangle’s support line is also very close to a major Fibonacci level.

No matter how we look at this, we’re at a make-or-break point for Bitcoin. Everything is focused around the $19,000 level, which is in the process of breaking now.

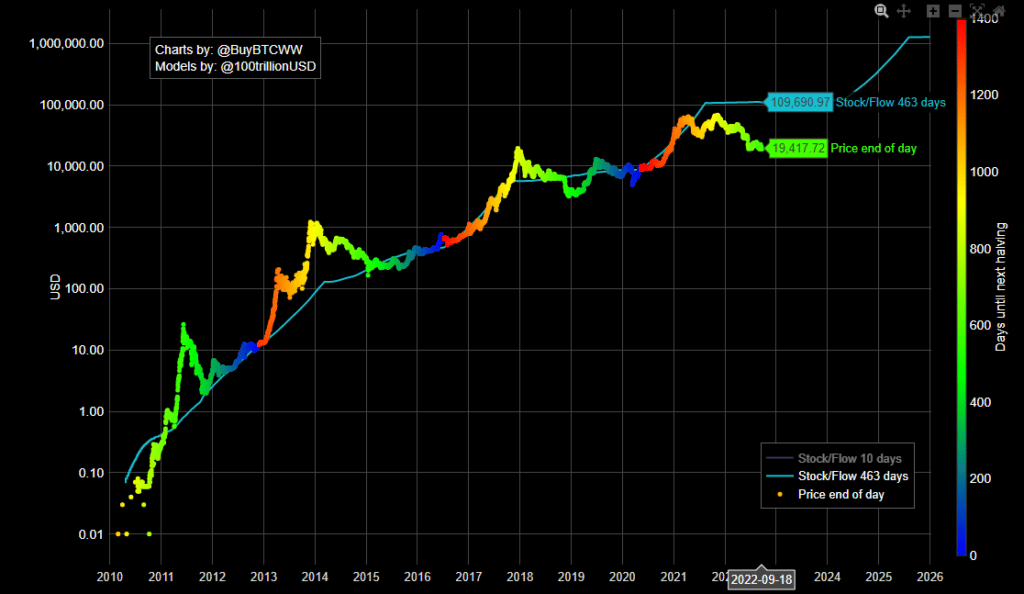

Have Bitcoin growth models broken?

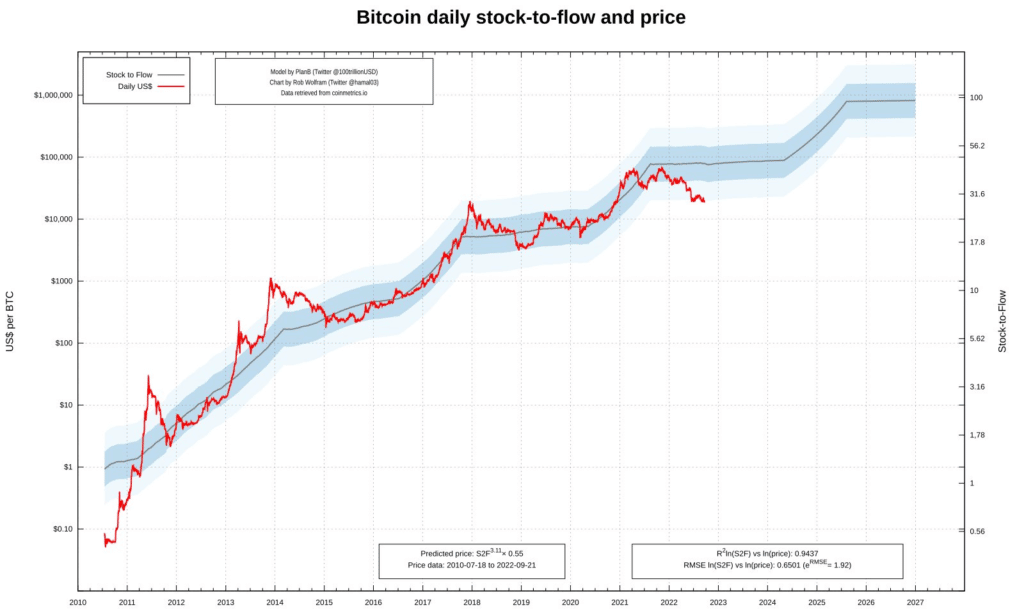

Numerous mathematical approaches to Bitcoin pricing, including our Crypto-ML Price Channels, fall under the “growth model” category. This is a category that seeks to utilize technology adoption and economic patterns as frameworks for understanding the growth of Bitcoin. Some of these models have accurately predicted Bitcoin behavior for over 10 years of price action.

The most famous is the stock-to-flow model, which is based on sound economic theory and generally applies to scarce resources.

Currently, the numbers are:

- Stock-to-flow predicted Bitcoin price: $109,691

- Actual Bitcoin price: $19,418

Bitcoin has underperformed the model for over a year, breaking below in May of 2021. The predicted value is now 5.6x actual.

While this may be a “temporary glitch” in the long arc of Bitcoin, it’s concerning the model is this far off.

Even the extremes of 2017 (3x) and COVID crash in March of 2020 (1.5x) fail to compare.

Here’s another view of the same data:

In this view, you can see Bitcoin price has never before left the dark blue zone. We’re now at the bottom of the light blue zone. This is similar to our Price Channels. The $19,000 level is a critical breaking point.

We covered other cyclical growth models extensively in the August Newsletter, which use similar logarithmic concepts. These models have largely been exceeded or also have a breaking point at about $19,000.

This is all to say a substantial break below $19,000 could be seen as disastrous and cause mass selling.

However, we also have many different approaches lining up to say we are near the bottom. If the macro picture strengthens, Bitcoin and other cryptos could rapidly recover to the mean of these growth models, which puts Bitcoin around $100K.

Putting It All Together

The data is conflicted but many factors point to a challenging 1-2 years ahead. Given the extreme state of many indicators, it’s possible a bottom is in. Or it’s possible we’re about to hit a new level of panic.

Regardless, Bitcoin and other quality crypto assets are proving they are here to stay. When the macro issues resolve and the markets rebound, they will likely recover fast and achieve new highs.

So how are we navigating this?

- Not trying to time the bottom.

- Continuing to invest a reasonable amount every month at a variety of prices. This is protection against an unexpected bull rally.

- If Bitcoin drops down to $11K, that’s fine. We’ll add to our portfolio more aggressively at even better prices.

- Earning yield (via staking or similar) on as many holdings as possible.

Current Crypto-ML Portfolio

Here’s a view of our portfolio.

- During earlier periods of Extreme Greed, we slowly exited about 30% of our crypto positions to stablecoins.

- Over the last few months (June through July mainly) during Extreme Fear, we deployed out of stablecoins fully into crypto.

- We are actively dollar-cost-averaging into crypto every month.

- We are continuously working to ensure each position earns interest.

That last point is important. We are not relying on appreciation alone. Earning interest also means our investments are buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

If you’re investing for the long term, be sure to see our guide Simple Ways to Earn Interest on Your Crypto Holdings.

Stablecoins: 0% (flat)

- This balance has been completely phased out during “Extreme Fear.” It originally consisted of profits that were booked during “Extreme Greed.”

BTC: 40% (flat)

- Long-term hold

BNB: 43% (+8%)

- This position continues to be a strong earner through staking

- Monitoring for optimal time to “right size” this position, considering macro environment and tax consequences. This probably won’t happen until early 2023.

ETH: 15% (flat)

- Earning interest through staking

- Long-term hold

ADA: 1%

- Earning interest through various means

- Long-term hold

DOT: 1%

- Earning interest through various means

- Long-term hold

Other: <1% (flat)

- This group consists of 15 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Questions and Comments

Do you have thoughts, comments, or criticisms of this analysis? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.