Insider Newsletter 14: February 2023

Is the macro bottom forming?

About 1.5 years into this market slide, we’re seeing a wide variety of data points painting the picture of a broad market bottom. In this newsletter, we’ll dive into this question from multiple perspectives.

Here’s a summary:

| Section | Summary | Mid-Term |

|---|---|---|

| Crypto-ML Data | The market is taking a brief consolidation pause but is predicted to head up to $29K in the next 30 days. | Bullish |

| Economic | While not fully out of the woods yet, we are finally flipping to a bullish view of the macroeconomic picture. | Bullish |

| On-Chain | On-chain behavior shows long-term buying action from large accounts. | Bullish |

| Technical Analysis | Numerous, disparate measures of market psychology support a significant reversal is underway. | Bullish |

Of course, none of this guarantees the rest of 2023 will go straight up. Even experts who dedicate their lives and careers to understanding the economy don’t have a consensus view (barrons.com).

So if anyone shows you a single chart and says they know exactly what’s going to happen, skeptically back away.

Alright, let’s dig in.

Actions We’re Taking Now

Since actions speak louder than words:

- Not trying to time the bottom! Continuing to dollar-cost-average into BTC. From a macro perspective, we may have another 6 months of challenges.

- Prepared to invest lump sums into BTC if the market takes another leg down.

We bought continuously and aggressively during the second half of 2022, so we’re also ready to sit back and enjoy the ride-up if the market does go on a run. Our Market Index helped us invest while others were fearful.

If the market stagnates or drops, we’ll continue to buy more.

Crypto-ML Data

Our indicators show bullish momentum and a run to $29,000 over the next 30 days is probable.

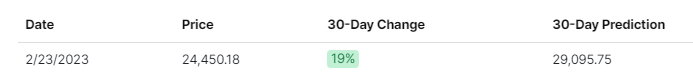

30-Day Price Prediction

Prior to this bull run, the Price Predictions began putting out negative predictions. Unfortunately, this was caused by a data error from one of our providers in reporting the all-critical 2-year bond rate. Since that has been addressed, we’re seeing a strong positive outlook for the next 30 days.

While a 19%-20% jump seems high at first, a push to $29K seems reasonable. The $30K level is a big psychological point with a lot of resistance.

As a reminder, these predictions use over 55 data points, covering the economy, sentiment, technical factors, and more. This is a very sophisticated analysis that humans would struggle to do.

Because of this, we favor this measure more than any other measure on Crypto-ML or in this post. It seeks to consolidate all of this information and analyze it in only a way a machine can.

Price Channels

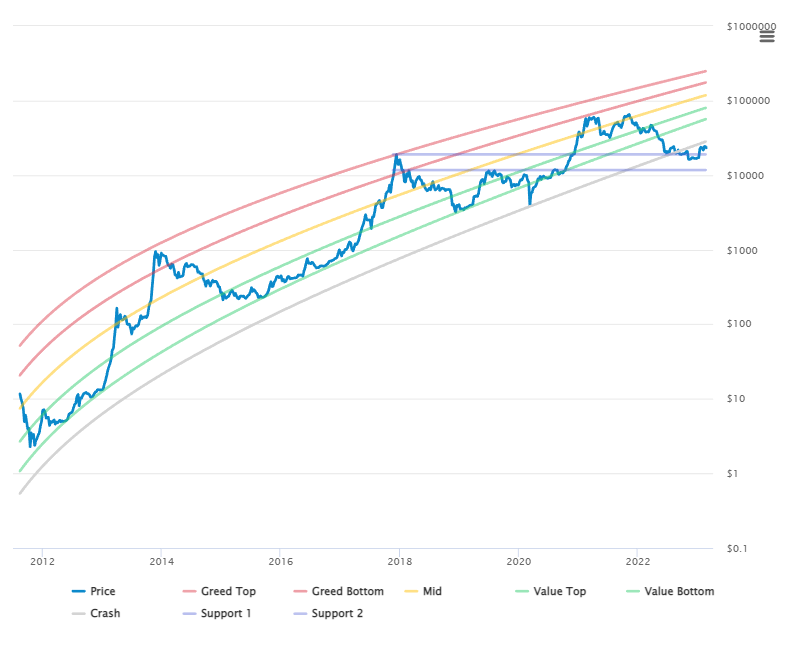

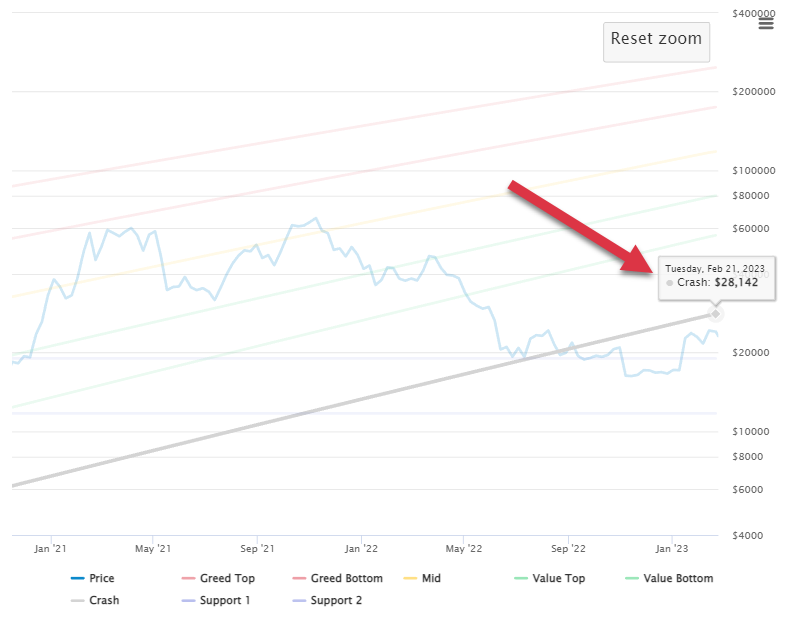

The Crypto-ML Price Channels use a regression model to plot the long-term growth pattern of Bitcoin.

We’re finally seeing the possibility of entering back into the model. If that happens, we’ll look back at 2022 as a historic buying opportunity.

To enter the model, Bitcoin price will need to cross $28,000, which is inline with the predictions.

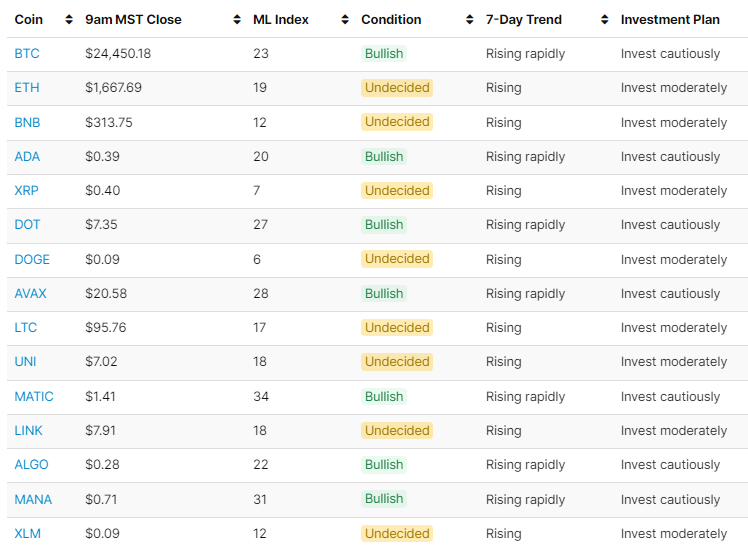

Market Index

Our Market Index looks at technical indicators and also social and search sentiment in order to determine overbought and oversold zones.

It helps you invest when others are fearful and then take profit when others are greedy.

Currently, it is showing the market is a tad overheated but upward momentum is taking a bit of a pause. While it was better to go in during Bearish periods, it is not overheated yet. This measure is better for understanding short-term waves and needs to be considered against other measures for long-term investing.

Macroeconomy

The macro picture is incredibly complex even for career experts to understand. However, we are seeing traditional signs of a reversal agreeing with typical downturn metrics.

When more money comes into the stock market, people, and more importantly, institutions, are leaving cash and instead investing in all types of assets, including cryptocurrency.

That is why the macro picture matters.

Recession analysis

The S&P 500 has been in a downward trend since January 2022.

In our previous Insider Newsletters, we’ve stated that all recessions last between 1.5 to 2 years. See Insider Newsletter #6 for a full list of recessions.

The definition of a recession is now subjective, but these numbers are based on the traditional definition of a recession being two-quarters of negative GDP growth.

This puts the recession end in mid-to-late 2023. And the bottom will be in before quarterly growth is confirmed.

Another way of looking at recessions is inverted yield, which we also previously covered in our newsletters. In recent history, every time there is an inverted yield (comparing 2-year to 10-year bonds), a recession follows.

This also holds from 1940 to the present (govinfo.gov), though you need to look at different spreads as bond offerings change over time.

Based on this metric, we’re also looking at a similar timeframe for recovery.

This is all to say there is some reason to believe the bottom may be in for the broader economy. Perhaps the Fed did pull off a soft landing.

Mid-term economy view

Looking at the mid-term charts for the S&P 500, this story is reinforced.

The following factors appear to show bullish market behavior:

- Break of the 1.25-year downward trend line

- Golden cross of the 50 SMA over the 200 SMA

- Support from the upward trend line, the 50 SMA, and the 200 SMA

This does not mean the economy will rocket up from here. We still may have mixed, sideways, choppy action.

- Inflation is at 6.4%, which is above the 2% target (nytimes.com). This means more tightening from the Fed.

- Spending and debt are still rising, despite countermeasures (npr.org). This also means more tightening ahead.

- There is still a war in Ukraine. This adds massive uncertainty and global debt.

Inflation will take time to get under control. We will most likely continue to have choppy waters ahead for the remainder of 2023.

But, if you’re buying for the long term, this is great! Heavily dollar-cost averaging into great investments during down markets is one of the best ways to wealth.

We never try to time the bottom and there may very well be another leg down in the economy, but this downturn has produced some excellent buying opportunities.

Bitcoin strength vs stocks

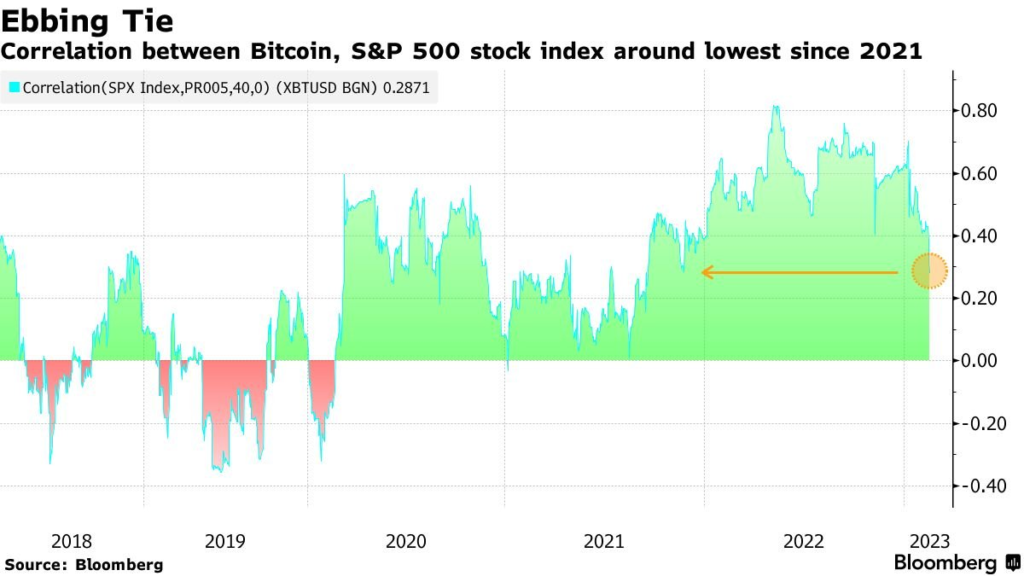

While the stock market may be turning around, stocks and Bitcoin have hit their lowest correlation in 2 years. Bitcoin is holding levels stronger than stocks.

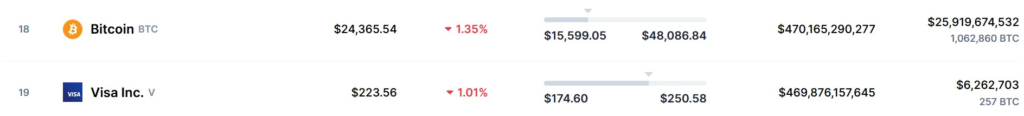

In a similar fashion, Bitcoin has flipped Visa, exceeding its market cap, for now, the third time.

Bitcoin is also now at a level not seen in 6 months.

What does this all mean?

As money is flowing back into the financial markets, it seems to be finding a proportionally high home in Bitcoin. If stocks do take a major leg up, Bitcoin seems posed to hop on and even outperform.

Crypto news

Focusing on the crypto markets specifically, all eyes continue to be on Binance, which by some measures now dominates some 98% of all spot trading volume (cryptoslate.com). Other measures show an 80%+ dominance of the crypto trading market. Regardless, Binance is a behemoth. If issues are exposed, that could be catastrophic for the crypto industry.

Because of this, it is likely the US and other governments will take a measured approach to address compliance issues with Binance.

Binance inappropriately handled funds between Binance.com and Binance.us (reuters.com), including moving around $400 million in funds without Binance.us executives being aware. Binance.us is supposed to operate entirely independently of Binance.com.

“Something fishy is going on here that clearly doesn’t pass the smell test. Congress needs answers, and Binance.US and Silvergate are obligated to give them to us.”

U.S. Senator Roger Marshall

Additionally, Paxos has received notice from the SEC about Binance USD, considering it the sale of an unregistered security.

Paxos has since ceased its relationship with Bitcoin (reuters.com) and stopped minting BUSD starting February 21 (businessinsider.com).

This consolidates additional power to Tether, which gained around $1 billion in market cap from BUSD during just the first week following the Paxos announcement. Tether still remains somewhat of a black box with an unknown risk profile.

Simultaneously, the SEC is bringing stricter enforcement of securities regulation to the majority of the crypto market. This is a big deal, as the majority of the crypto market and token offerings do not comply with securities laws.

“Other than bitcoin, where is there not a group of entrepreneurs in the middle?”

SEC Chairman Gary Gensler

This is actually a good take and we have argued a similar position throughout the life of this site. Nearly all tokens and altcoins are run by people, just like a company.

Additionally, exchanges will also face stricter custody rules, including better disclosures and reporting (fintechnews.ch). While this is all intended to help protect consumers and prevent exchange meltdowns, it will cause speed bumps and measured growth in the crypto market.

On-Chain Metrics

The big, long-term buyers have been back and investing heavily in Bitcoin. This has been true for the last 6 months and is still currently true.

Stock-to-flow

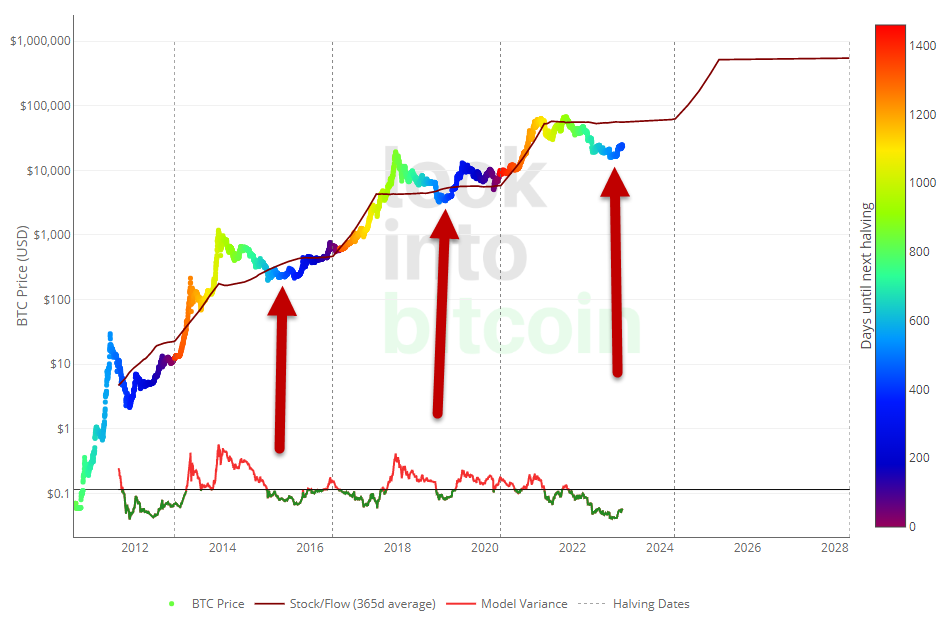

The Bitcoin stock-to-flow model also paints a bottom is here picture. This is based on being lower than the model and also the number of days until halving.

Whale buying

This view shows us where the large accounts are buying Bitcoin. The blue bubbles indicate large account buying.

They avoided buying in mid-2022 but started accumulating again in late 2022 and now.

Stablecoin exit

One of the most interesting metrics is stablecoin holdings. This gives a sense of the ebb and flow from stablecoins (consider as safe cash) to altcoins and Bitcoin (considered risk-laden investments). In other words, funds moving from stablecoins is traditionally bullish.

In this case, though, we’re also seeing the fallout from exchange collapses and BUSD news. This makes the stablecoin balance data a little less clear.

From a Glassnode analysis:

- Roughly $3.8 billion of stablecoins have left exchanges in the past 30 days, moving heavily into Bitcoin.

- Since the FTX collapse in November 2022, almost $11 billion worth of stablecoins has left exchanges.

Overall, on-chain metrics lean toward a positive outlook.

Technical Analysis

Numerous indicators are lining up to support the idea of a mid-term bottom formation.

Looking at patterns leading up to halving events, we see yet another indicator that we may be forming a bottom.

It also provides a price target of between $35,000 to $42,500 in March of 2024. That’s a solid bump of +46% to +77%.

After that, you typically see the real bull run kick in.

The risk with these types of charts is you’re only considering a couple of past pattern examples. Just because something has happened twice in the past, doesn’t mean it’ll happen a third time.

That said, the patterns do line up very well.

The Elliott Wave theory states market trends occur in five waves, three are the primary trend and two are partial retracements.

This gaussian channel view shows a more detailed view of the patterns unfolding. This lends a little more strength to the bullish arguments above. It shows multiple patterns lining up in a similar fashion to previous bottoms.

Overall, mid-to-long-term views are matching with other methods of analysis.

Current Crypto-ML Portfolio

Here’s the monthly view of our portfolio.

- During earlier periods of Extreme Greed, we slowly exited about 30% of our crypto positions to stablecoins.

- During Extreme Fear, we deployed out of stablecoins fully into crypto.

- We are actively dollar-cost-averaging into crypto every month.

- We have lump sums ready to deploy in case this is a bull trap and the market drops again.

- We are continuously working to ensure each position earns interest.

That last point is important. We are not relying on appreciation alone. Earning interest also means our investments are buying back in like-kind each month. Even if we don’t explicitly invest, these positions are growing and cost-averaging on their own.

Stablecoins: 0% (flat)

- This balance has been completely phased out during “Extreme Fear.” It originally consisted of profits that were booked during “Extreme Greed.”

BTC: 71% (flat)

- Long-term hold

- Investing bi-weekly

ETH: 24% (flat)

- Earning interest through staking

- Long-term hold

Other: 5%

- This group consists of 17 altcoins.

As always, ensure your crypto portfolio is an appropriate percentage of your overall savings and investment plan. You need to determine your goals, risk tolerance, and ideal allocations.

Putting It All Together

The bottom may be forming. But that doesn’t mean we’ll rocket up for the rest of 2023. We should anticipate chop and slow growth. If there is another leg down, take it as a long-term buying opportunity.

Our recommendations from last month still apply:

- Move your crypto to your own non-custodial wallet at least while the industry dust settles.

- Minimize expenses.

- Don’t try to time the bottom or go all in.

- Determine a budget and diversified savings and investing plan. Bitcoin is a subset of this plan.

- Automate monthly Bitcoin investing so that you stick to your plan.

We are currently using Swan Bitcoin to automate regular purchases of Bitcoin and automate transferring it to our non-custodial wallets.

Learn more about Swan Bitcoin.

Questions and Comments

Do you have thoughts, comments, or criticisms of this analysis? Let us know in the comments below!

Subscribe to the Newsletter

Join 7k+ working professionals to "The Five-Year Plan". Every Saturday morning, you'll receive one actionable tip to create life-changing wealth in crypto.